How You Can Invest Your ExxonMobil Savings Plan

A Guide To The Different Options Available Within Your Voya Savings Plan

Most 401(k) plans have a wide array of investment options available to participants. Choosing the correct combination of investment options to create a diversified portfolio that will help reach your specific goals is often a very important decision.

We find that it looks very different for everyone depending on risk appetite, time horizon and other factors like cash flow needs. Many individuals are left feeling uninformed or out of touch with what their most efficient portfolio may look like. There are a multitude of investment combinations available, and we hope to provide some insight regarding how to best maximize your retirement.

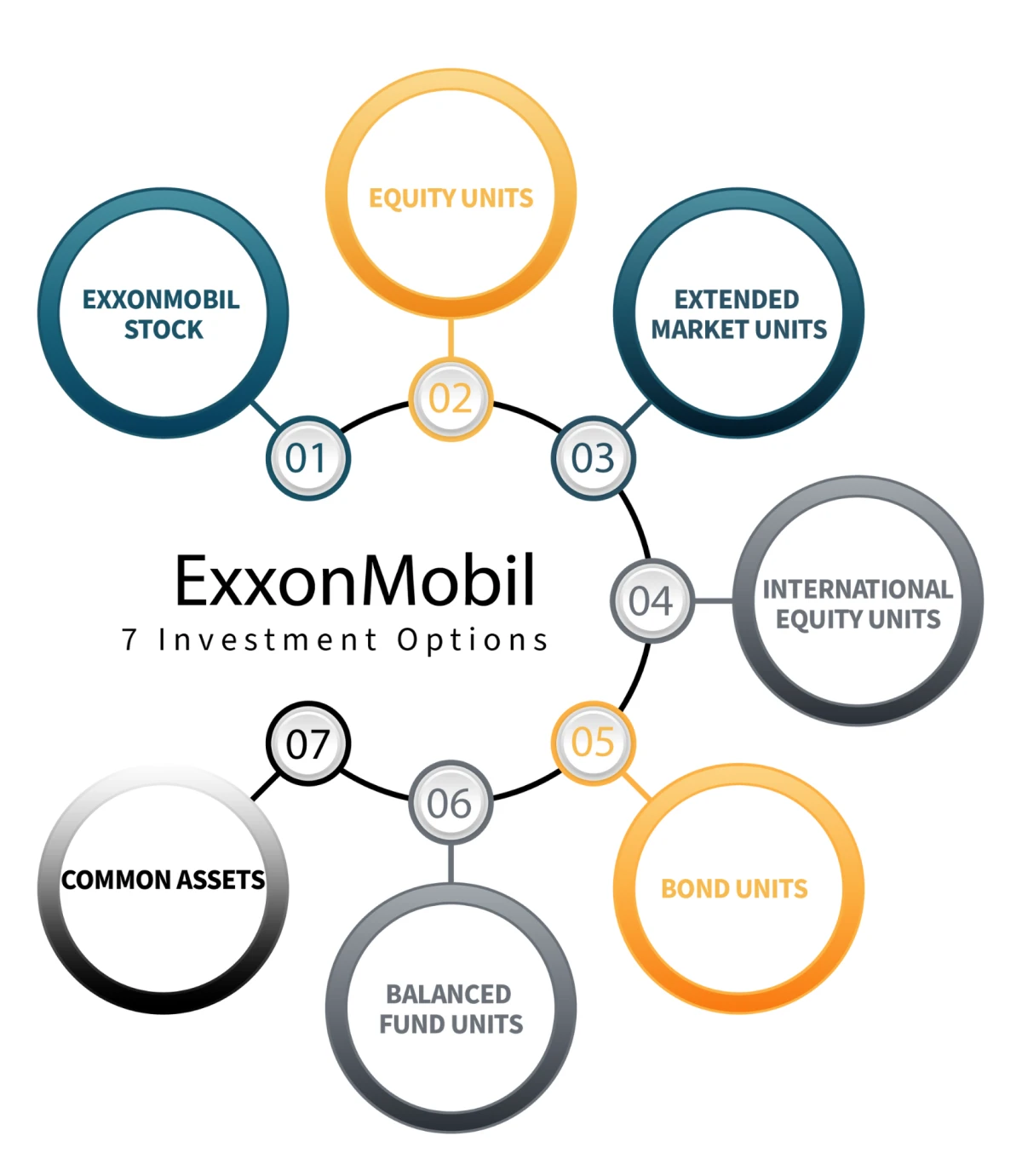

As an ExxonMobil employee, you have the ability to invest in seven different Investment options through your Voya Savings Plan. We have summarized these options below. Understand how they function and if they are worth utilizing in your portfolio in order to reach your retirement goals.

- ExxonMobil Stock: This option lets plan participants directly invest a portion of their portfolio in ExxonMobil stock. Participants receive dividends (which are automatically reinvested) and hold voting rights, just as they would if owning the stock in a personal investment account. It’s important to note that a high concentration to a singular stock can lead to a lack of diversification and inherently higher risk.

- Equity Units: This Index Fund intends to provide large cap U.S. equity market exposure and returns that approximate those of the S&P 500. It is comprised of a diversified portfolio of publicly traded U.S. common stocks.

- Extended Market Units: This Index Fund attempts to closely match the characteristics and returns of the Dow Jones Total Market Index. It’s composed of a broader array of stocks than those in the S&P 500 and Equity Units option. The fund primarily holds publicly traded small cap and mid cap U.S. common stocks.

- International Equity Units: Another Index Fund, this option provides access to the remaining global stock market. This fund invests in roughly 3,500 international equity securities and holds no U.S. stock exposure. These international securities are comprised of 22 developed market countries and closely approximate the total rate of return of the MSCI World Index (excluding the U.S.).

- Bond Units: This option invests in publicly traded, investment grade U.S. Bonds, with an average maturity that is longer than that of the investments held in the Common Asset Fund. The units represent interests in an Index Fund aiming to mirror the Bloomberg Barclays U.S. Aggregate Bond Index.

- Balanced Fund Units: This Index Fund is designed to generate income and growth for investors by diversifying in the various funds listed above. The Fund’s allocation to each security is as follows: 35% Equity Units, 15% Extended Market Units, 25% International Units, and 25% Bond Units. While it is called a “Balanced Fund,” it is not tailored to the needs of each ExxonMobil employee. We recommend meeting with a financial planner to determine the most appropriate investment allocation that fits your unique situation.

- Common Assets: This Fund is managed by an ExxonMobil subsidiary and holds short to medium-term fixed income securities. It invests in high-quality fixed income securities such as U.S. government issued Series I and Series EE Savings Bonds. A part of this Fund is used to invest in loans to participants. At the end of each quarter, any earnings this account generates are credited to participants’ Savings Plan Accounts. These earnings are then reinvested in Common Assets.

As mentioned in the Balanced Fund Unit description, the correct assortment of investments varies depending on each Exxon employee’s specific situation. It is crucial to fully understand these investment options and the purposes of each, in order to select the investment mix that matches your risk tolerance.

To make the most of your ExxonMobil Savings Plan and ensure you are on track to meet your retirement goals, it is best to meet with a qualified and knowledgeable financial planner who is well versed on the ins and outs of the ExxonMobil Savings Plan at Voya. Please refer to our article on maximizing your ExxonMobil retirement benefits for more information.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.