ExxonMobil Restricted Stock Units: What You Need to Know

A Guide to the Specifics and Tax Features of ExxonMobil Restricted Stock

ExxonMobil rewards employees with various forms of additional compensation beyond base salary. Among these, Restricted Stock Units (RSUs) are the most common form of bonus equity compensation. RSUs are stock awards granted to employees, which vest according to a predetermined schedule. This method of compensation offers both opportunities and complexities, particularly in tax planning.

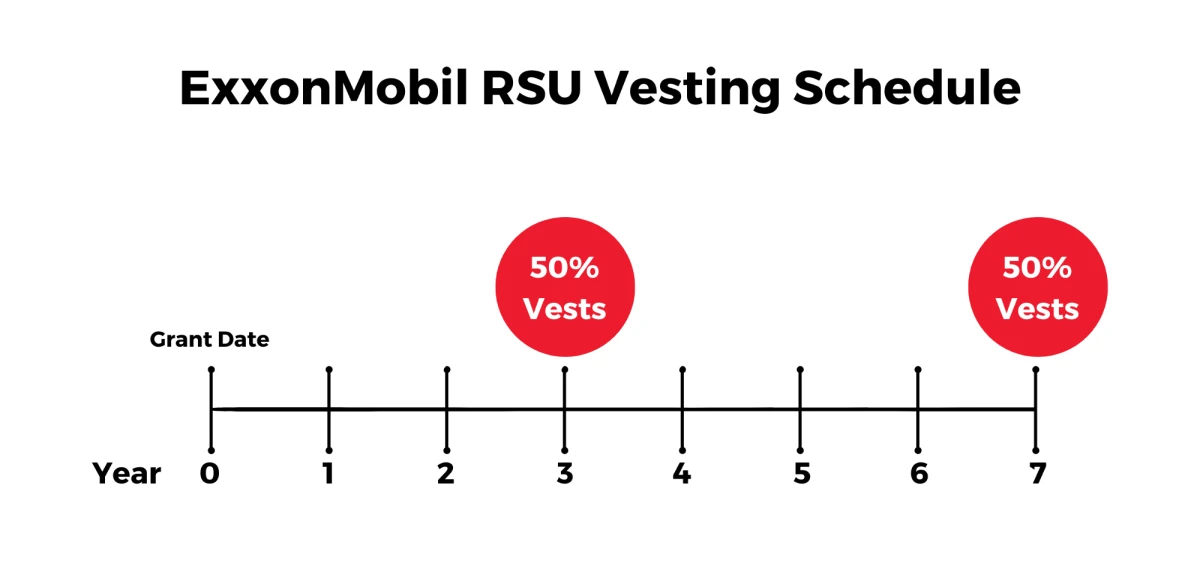

Vesting

The vesting schedule is perhaps the most crucial aspect of RSUs for employees to understand. When an employee is awarded RSUs, the first 50% of the shares vest three years after the grant date, and the remaining 50% vest seven years after the grant date. Of note – if an employee leaves the company before their RSUs vest, they generally forfeit these shares unless other arrangements have been negotiated.

If an ExxonMobil employee retires while still having unvested shares, the shares will continue to vest on the pre-determined schedule into retirement.

Taxation

Another aspect of effectively managing RSU compensation is a thorough understanding of the taxation of RSU receipt and disposition. Before we dive into this topic, it is important to understand some terms that relate to this form of compensation.

Grant Date

The date on which a company issues equity compensation to an employee

Vest Date

The date on which the restriction on the stock lapses and the employee receives the stock

Vesting Schedule

The schedule determined by the company over which the restriction on the RSUs ends

Cost Basis

The original value of an asset for tax purposes. For RSUs, it is determined by the valuation of ExxonMobil stock on the vest date

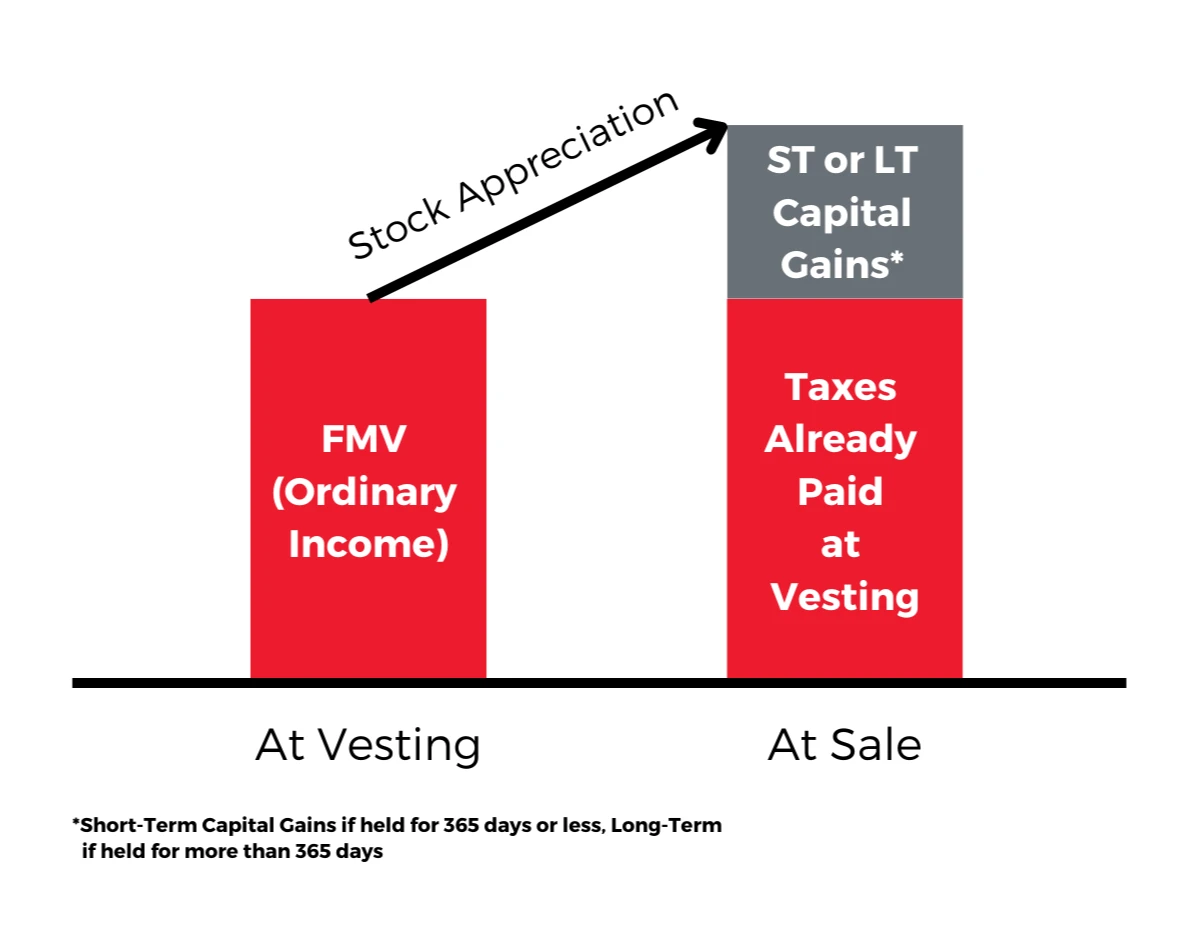

When an ExxonMobil employee is awarded RSUs, no taxes are due at the grant date. The first taxable event occurs at the first vest date (Year 3), when the fair market value of the vested shares must be included in the employee’s income for that year. This happens again on the second vest date (Year 7). This value becomes the employee’s cost basis for future tax purposes.

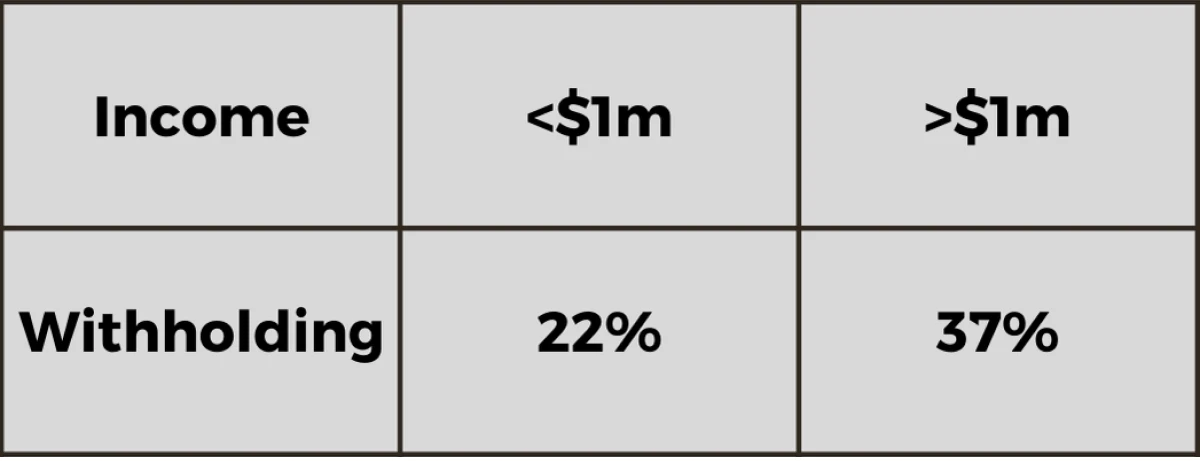

ExxonMobil automatically sells a portion of these shares to cover estimated tax payments: 22% for employees earning less than $1 million annually and 37% for those earning over $1 million. If your tax rate exceeds these percentages, it’s wise to make additional estimated tax payments to avoid an unexpected bill when the employee’s tax return is filed.

Many employees opt to sell their stock immediately upon vesting to diversify their portfolio. However, for those who choose to hold onto the shares, it’s important to note that if the shares are sold within 365 days of vesting, any appreciation in value will be subject to short-term capital gains tax rates. To benefit from the more favorable long-term capital gains rates, the shares must be held for more than one year before being sold.

Diversification

As discussed earlier, it can make sense to sell vested shares immediately to diversify into other investments. Many ExxonMobil employees already have a substantial portion of their wealth correlated to the fortune of the company via low-basis shares earmarked for Net Unrealized Appreciation treatment or the ExxonMobil Pension Plan.

For these individuals, selling the shares at their cost basis as soon as they vest can be a prudent move. However, for those who decide to hold onto their vested RSUs, it is wise to consider the 365 day holding period required to take advantage of the more favorable long-term capital gains rate on appreciation post-vest.

Conclusion

ExxonMobil RSUs can be a valuable part of your overall compensation, but they come with their own set of complexities. Understanding the vesting schedule and tax implications is a prerequisite to making good decisions regarding these benefits. Whether you decide to hold onto your shares or sell them to diversify your portfolio, any good financial plan will have a strategy for your RSUs in place that aligns with your financial goals.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.