ExxonMobil Supplemental Savings Plan (SSP) and Pension Plan (SPP)

How High-Earners Are Able To Accumulate Additional Assets For Retirement

The Internal Revenue Service (IRS) has put in place several restrictions on company retirement benefits. This is to ensure fairness between high earning individuals and regular employees. As an Executive at ExxonMobil, these limitations can significantly reduce the benefits you are entitled to in your ExxonMobil Savings Plan (EMSP) and your ExxonMobil Pension Plan (EMPP).

Fortunately, ExxonMobil has recognized the limitation enforced by the IRS and has established supplemental retirement benefits to help offset the shortfall. These benefits are accumulated through the Supplemental Savings Plan (SSP) and Supplemental Pension Plan (SPP).

High income earners at ExxonMobil are eligible to receive the benefits of the SPP and SSP. To receive these benefits, the ExxonMobil employee must retire. Terminating employment before reaching this status will eliminate your eligibility to receive benefits from both the SSP and SPP.

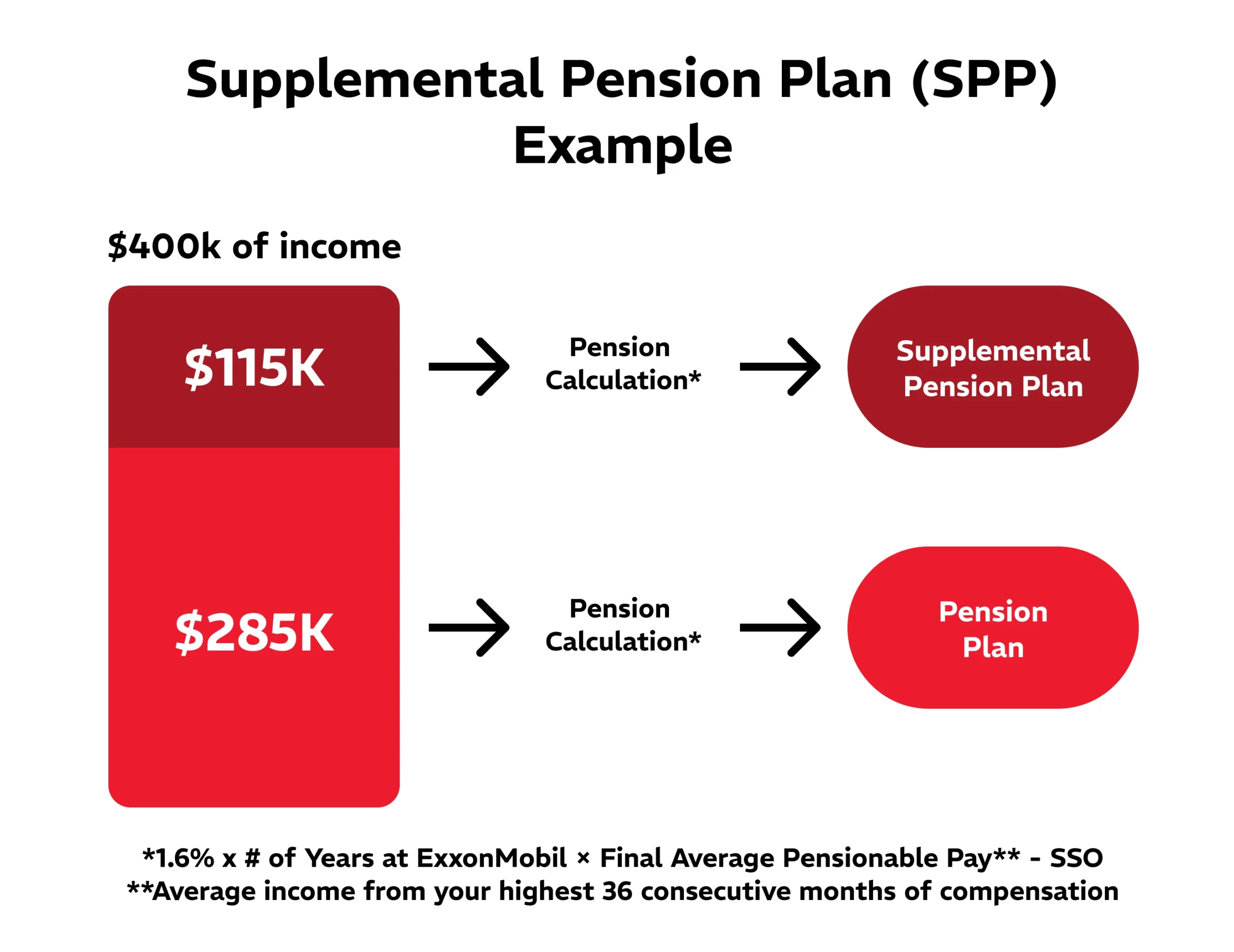

ExxonMobil Supplemental Pension Plan (SPP)

There are two required IRS limits that apply to the EMPP, the compensation limit and the benefits limit. The compensation limit restricts the amount of compensation that can be considered for your Pension Benefit (for 2025 this limit is $285,000) and the benefits limit restricts the amount of monthly payment you are entitled to in retirement. The SPP accounts for the benefits you are entitled to over the IRS-prescribed limits, and invests them in a fund very similarly to how assets are treated within the EMPP.

These funds are not combined with the EMPP funds, but can be viewed on the same Pension statement as the EMPP.

ExxonMobil runs a benefit formula. This formula calculates your normal pension benefit without any IRS limits. Then, ExxonMobil calculates your pension benefit with the IRS limits.

The difference between the two calculations is the amount that is deposited into the SPP. This formula is something that ExxonMobil automatically does on their end if your benefit exceeds the IRS limits.

This can cause individuals to be unaware that they have SPP benefits when they retire. These benefits are paid out in a different way than the EMPP and should be planned for accordingly.

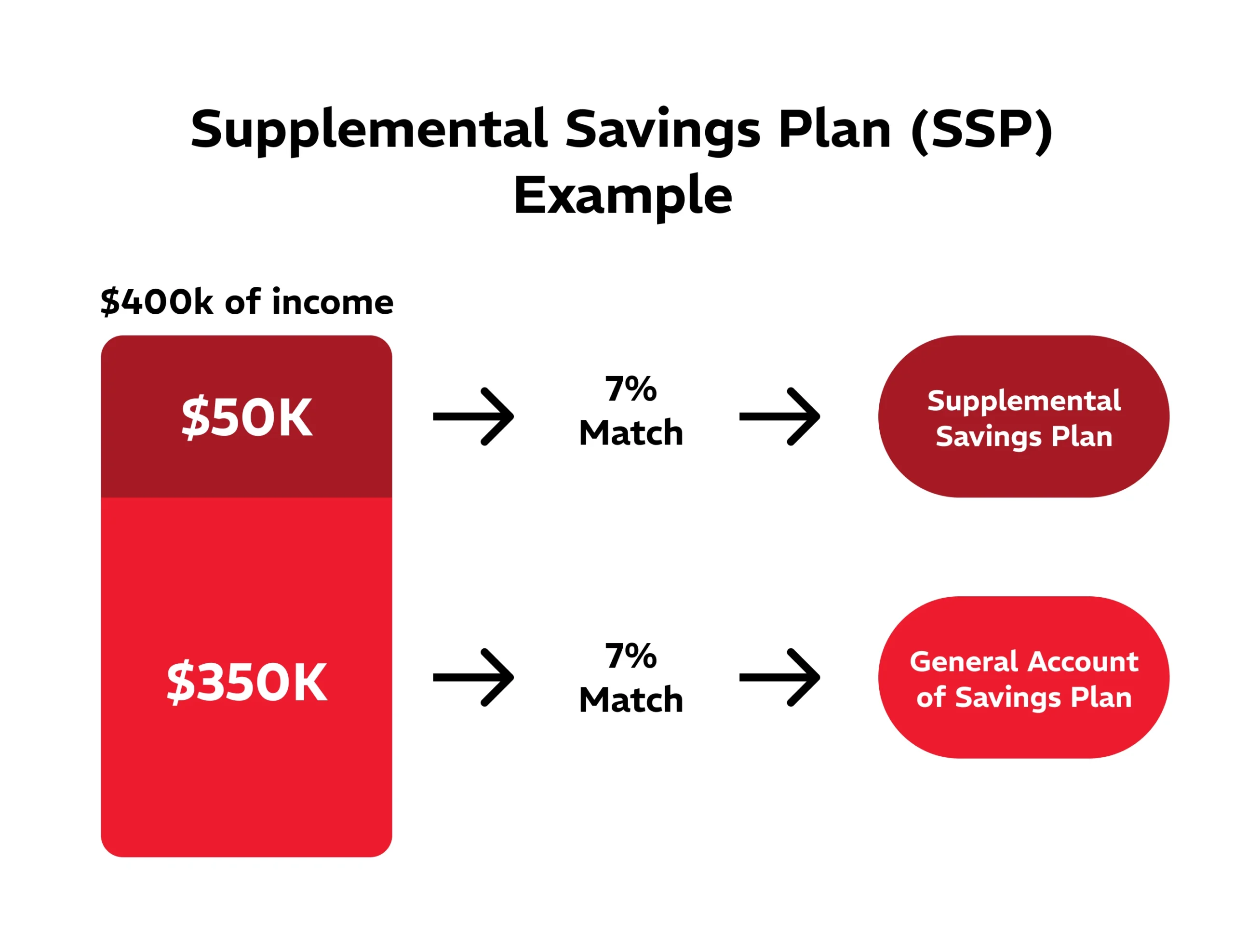

ExxonMobil Supplemental Savings Plan (SSP)

The IRS also limits the amount of compensation that is used to calculate savings plan matching contributions on an annual basis. After an ExxonMobil employee’s year-to-date pay reaches the IRS limit (for 2025 it is $350,000), any additional compensation does not receive the 7% match into your Savings Plan. instead, this match is deposited into the Supplemental Savings Plan (SSP) account.

The IRS also limits total 401(k) contributions ($70,000 for 2025). After total contributions to the plan have reached $70,000, neither ExxonMobil nor the employee are allowed to deposit additional funds. ExxonMobil will accumulate any excess employer matching contributions above the IRS limit in the SSP to compensate employees for the disallowed benefit under the IRS rules.

Unlike the traditional ExxonMobil Savings Plan and Pension Plan, the Supplemental plans are not eligible for a tax-free rollover into an IRA at separation of service. Instead, the accumulated benefits are paid out as a lump sum at retirement and taxable on an ordinary income basis. Depending on the benefits accumulated, this could be a significant tax burden to a new ExxonMobil retiree.

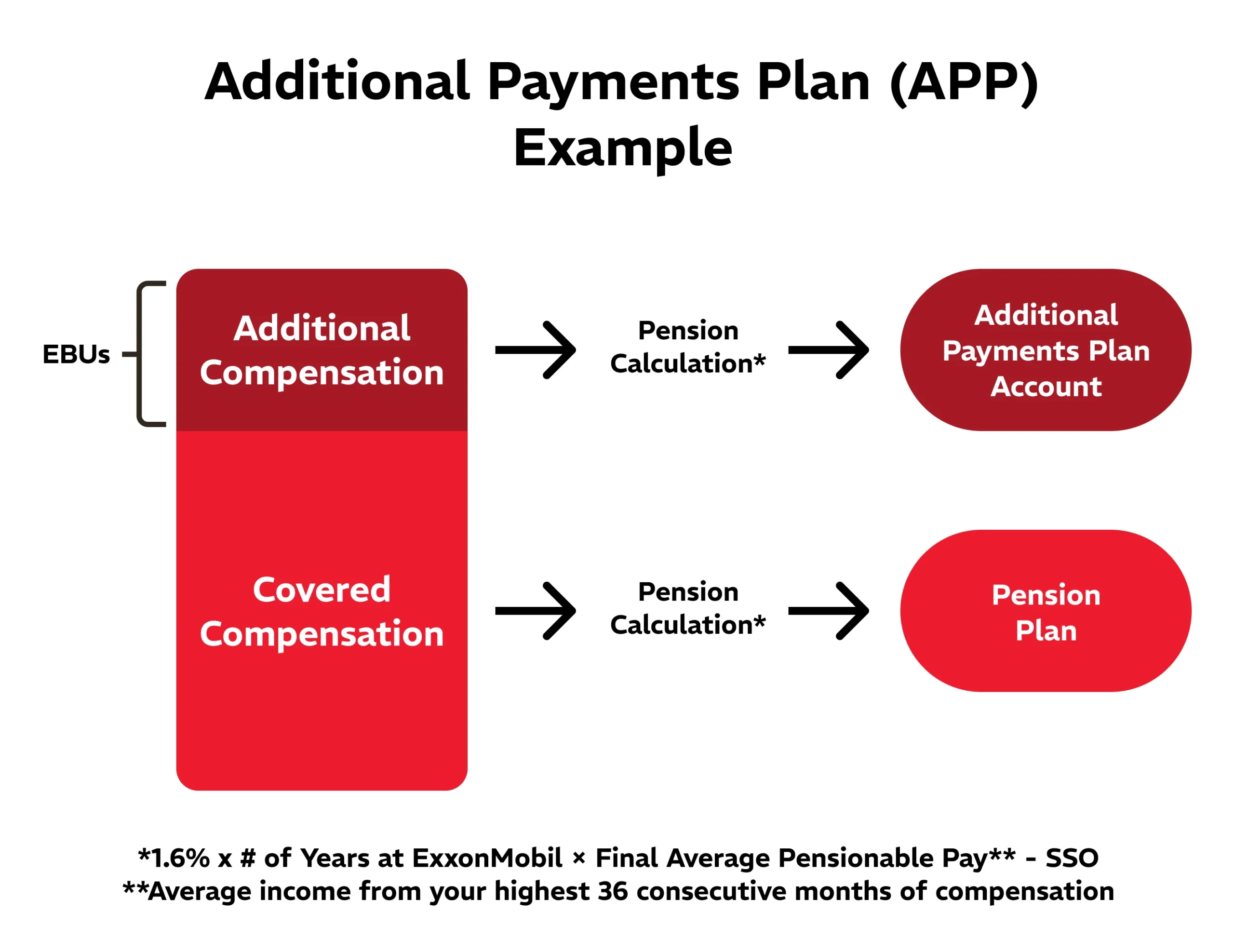

Additional Payments Plan (APP)

ExxonMobil also compensates employees with a contribution to the Additional Payments Plan account. This calculation is the same as the pension formula and based on Earnings Bonus Units (EBUs).

It is important to note that ExxonMobil discontinued the use of EBUs as a form of compensation. However, individuals who are at or near retirement might have an existing APP balance.

Supplemental Plan Example

To help illustrate how the SSP and SPP work, let’s walk through an example. Say there is a woman named Margery who is an ExxonMobil employee. Margery makes an annual salary of $550,000. Based on the IRS limits, only $285,000 of her wages could be used in calculating her employer match for her savings plan and in the calculation of her pension plan benefits. This means that she is missing out on $14,000 of Savings Plan benefits (7% * ($550,000 – $350,000)) and has $265,000 left out of her pension plan benefit calculation ($550,000 – $285,000).

ExxonMobil recognizes that Margery is missing out on the full retirement benefits she should be entitled to due to the IRS limits. To remediate this, ExxonMobil will contribute to her SSP and SPP. The accumulated benefits in both of these accounts will be paid to Margery once she retires from ExxonMobil.

Supplemental Plan Pitfalls

There are two major pitfalls that ExxonMobil employees need to be aware of when discussing the SSP and SPP. The first is something that we mentioned at the start of this article, in that if you leave ExxonMobil before attaining retiree status, you will forfeit any accumulated benefits within the SSP and SPP. This is an important consideration when deciding later in your career to either stay with ExxonMobil until retirement, or leave to pursue other endeavors.

The second pitfall faced by many ExxonMobil employees is a lack of preparation for the tax bill they might face when they retire. Because the SSP and SPP benefits accumulated are fully taxable to the employee in the year they retire, many ExxonMobil retirees can get stuck with a large tax liability when they file after retirement.

One of the ways to mitigate this would be shifting other income items into the year after they retire. Another would be making accurate projections and estimated tax payments in preparation of this bill. Consulting with an advisor is recommended in order to minimize your tax liability and maximize your retirement assets.

For additional information regarding retirement strategies and what you should be doing during your career at ExxonMobil, please check out our ExxonMobil Retirement Timeline.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.