ExxonMobil Savings Plan: Mega Roth Strategies – 2025 Update

How Mega Roth Conversions Can Optimize Your Tax Treatment In 2025

One of the most effective ways to prepare for retirement is to maximize the usage of tax-advantaged retirement savings vehicles like an IRA or 401(k). However, “Maxing Out” your plan means something different for employees of certain companies. The RGWM team wants to highlight a unique tax planning opportunity for ExxonMobil’s “Super Savers.” In general, many individuals we meet are frustrated by the low annual contribution limits for tax advantaged vehicles like their Traditional or Roth IRA or their 401(k).

At $7,000/year in an IRA and $23,500/year in a 401(k), most high-income savers wish there was a place to put their excess income above these limits but don’t know where.

Enter the Mega-Roth: a unique tax strategy with no upper limit on income for eligibility.

In what appears to be a significant change, the SECURE Act 2.0 enacted in December 2022 did not have language eliminating the Mega Roth strategy in the drafting phase or final legislation. We believe this bodes well for the ongoing availability of the strategy, which we will explore in depth below. Learn about ExxonMobil’s supplemental plan options.

Mega Backdoor Roth Strategy

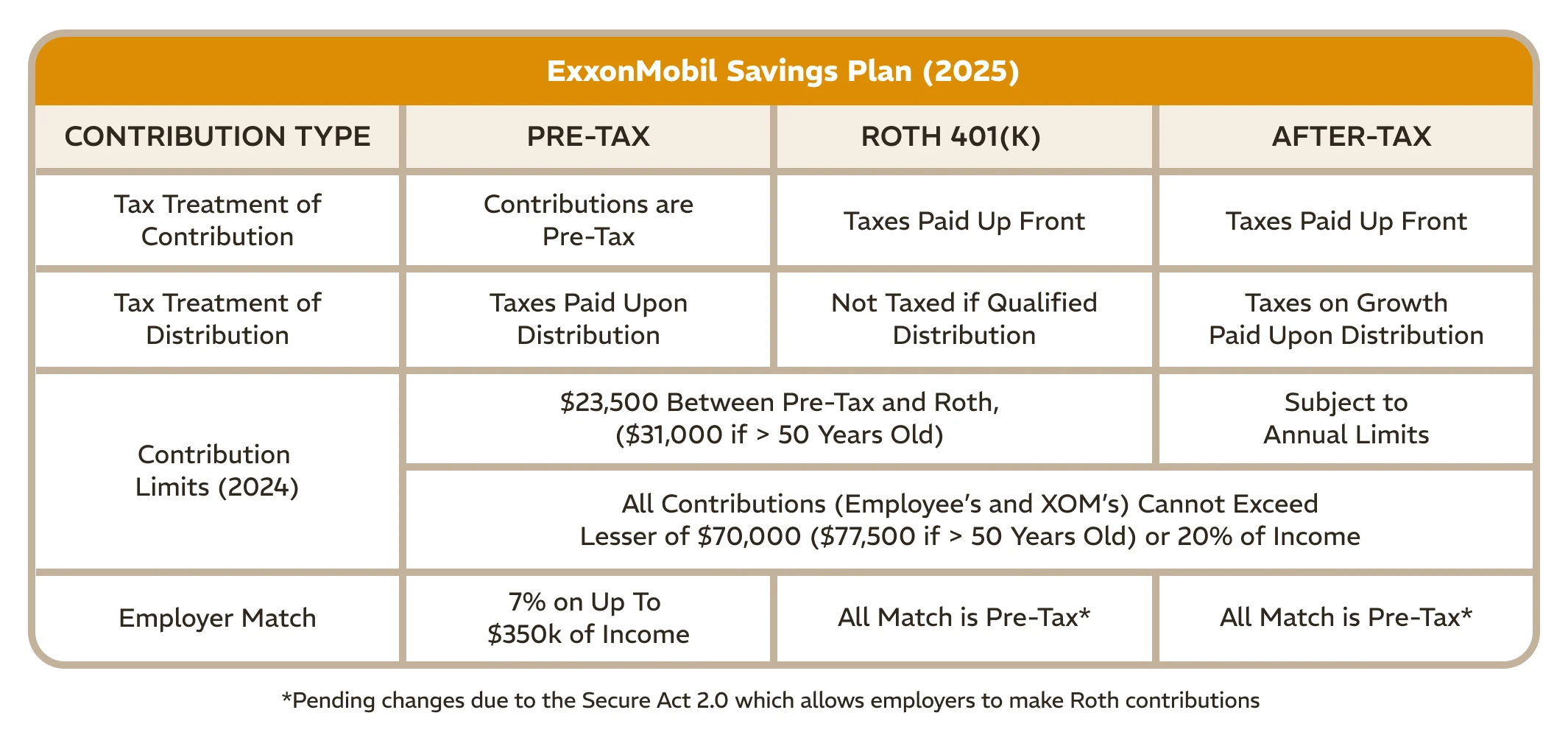

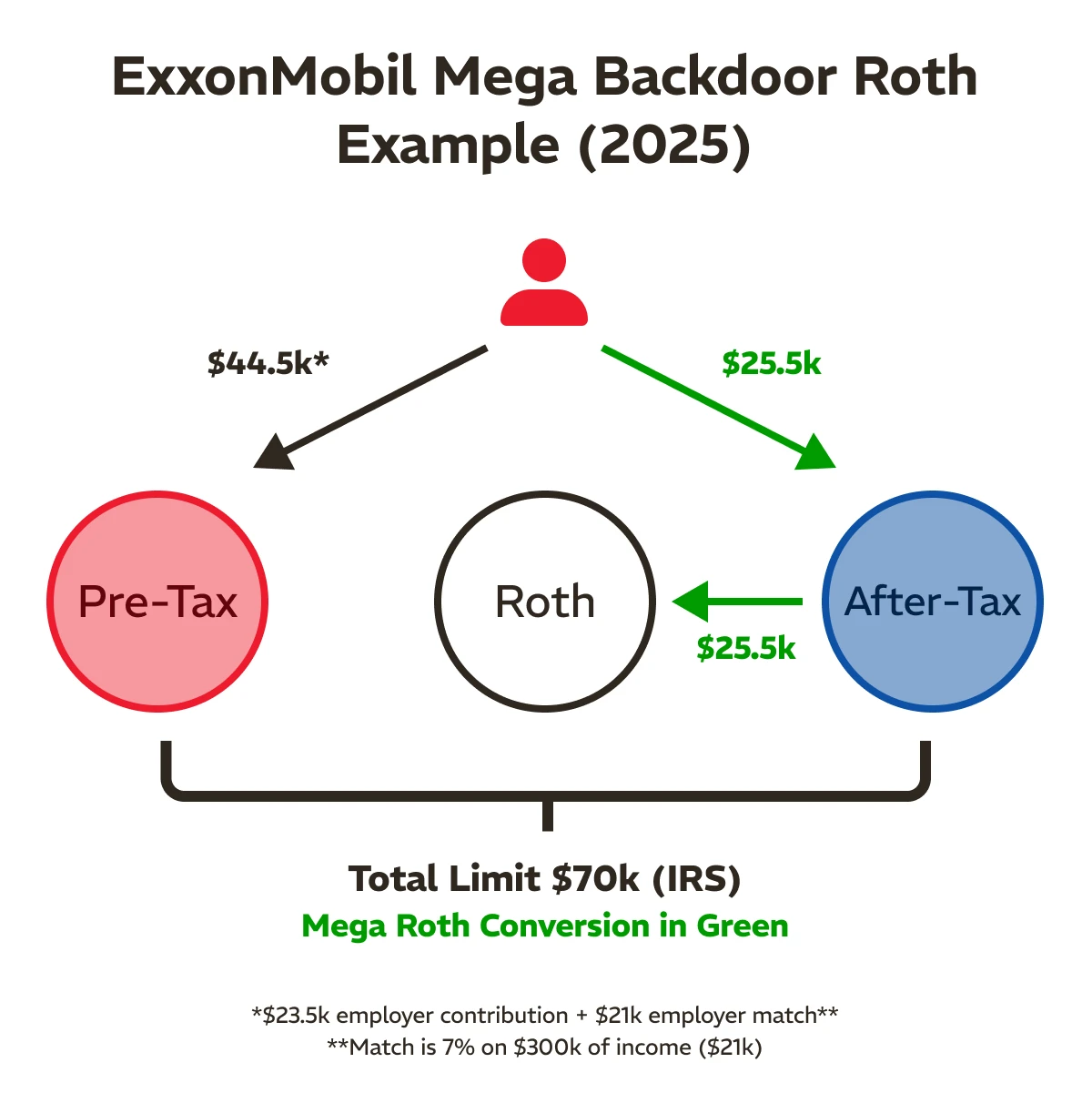

Most ExxonMobil employees know they can contribute to their Savings Plan through pre-tax and Roth contributions. Employees can generally contribute up to $23,500 a year ($31,000 if age 50 or older) from their paycheck. People are less aware that the Savings Plan allows for additional after-tax contributions beyond this limit. Sometimes, these after-tax funds can be converted tax-free to Roth at your convenience. The ExxonMobil Savings Plan, fortunately, is one of the retirement plans that allow for this capability. HERE’S HOW IT WORKS:

Consider this example: An ExxonMobil employee (let’s call him Bob) has a salary of $300,000. He contributes the pre-tax max of $23,500 to his Savings Plan for 2025 and receives a 7% match of $21,000 for a total of $44,500. This remains $25,500 below the IRS limit of $70,000. Let’s assume Bob then contributes $20,000 each year to the After-Tax account in the Savings Plan for five years – a total of $100,000. This money has grown over the five years to $150,000. Therefore, for conversion purposes, $100,000 is Bob’s contribution basis, and $50,000 is growth.

Tax Implications

Uncle Sam isn’t far away whenever a citizen receives a tax-advantage. He wants to get his share of this windfall! The IRS has instituted a Pro-Rata rule that mirrors the one associated with a traditional backdoor Roth IRA.

If Bob were to withdraw the $150k After-Tax amount from the Savings Plan, he would pay ordinary income tax on the portion of the withdrawal that represents the growth ($50k). The same goes for a conversion from the After-Tax account to the Roth account. One-third ($50k/$150k) of any conversion will be taxable because that is the proportion of the value that is represented as growth. Conversely, this strategy would be more attractive if Bob had completed annual conversions. If Bob were to make ongoing conversions before any growth occurred, these After-Tax assets would be placed into the Roth Account and compound tax-free permanently. As the chart above shows, qualified Roth withdrawals are always tax free. In essence, Bob can use this strategy to permanently eliminate the tax on the growth of After-Tax assets!

The Catch

If there is one, the catch is that many people already have a current after-tax balance in their Savings Plan. If you inadvertently contribute too much to the Pre-Tax or Roth accounts, the excess automatically rolls over to the After-Tax balance. While this does not prohibit you from taking advantage of this strategy, the After-Tax balance can grow over time and complicate conversion strategies. Before making conversion decisions, it’s crucial to look on Page 2 of your Savings Plan statement to identify your After-Tax account balance and compare that to your contribution basis (the sum of your Pre-1987 and Post-1986 contributions is usually on Page 3). This will give you an idea of how the Pro-Rata rule comes into play for the taxation of conversions. For more information on what benefits are available to you, please refer to our article on maximizing your ExxonMobil retirement benefits.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.