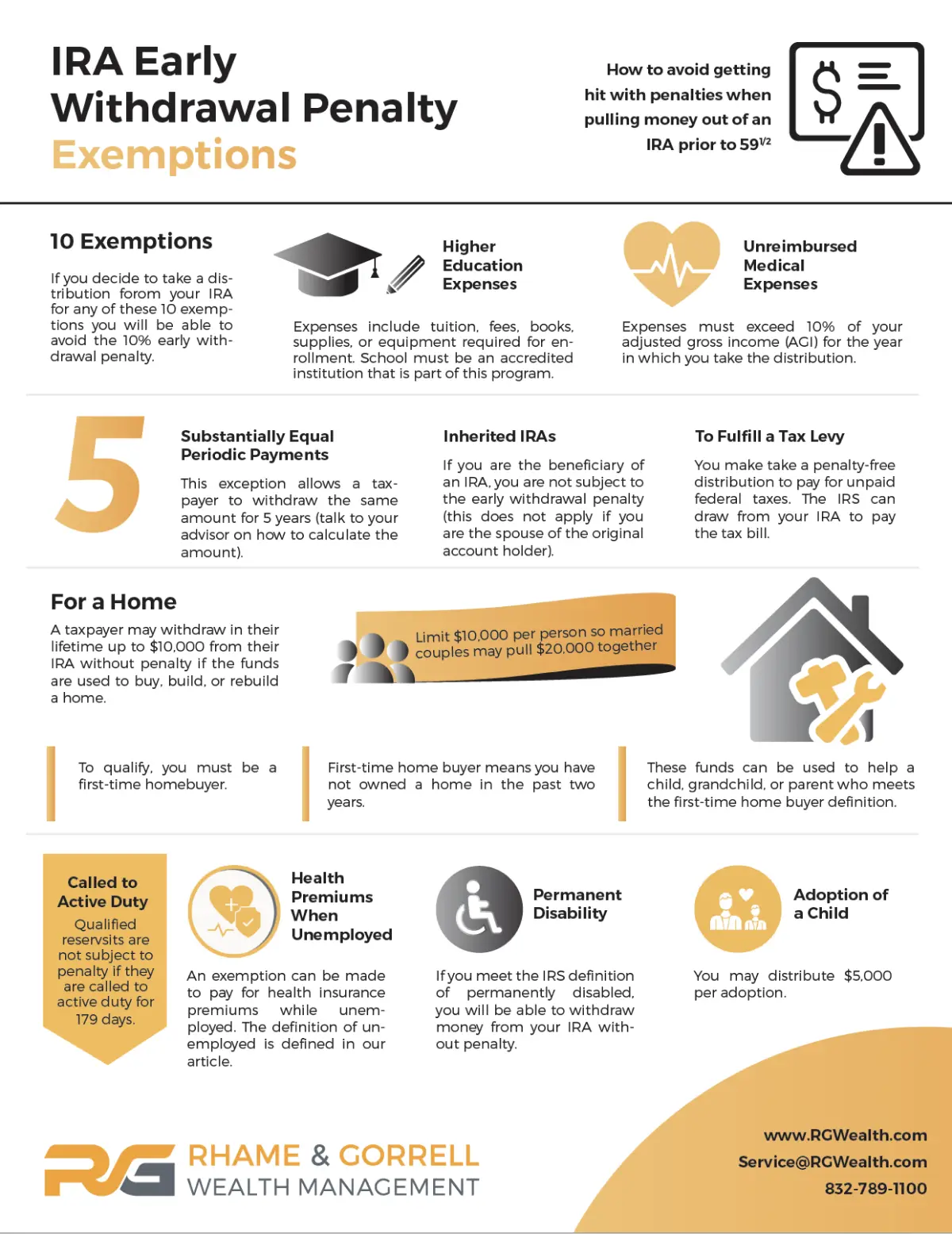

10 IRA Early Withdrawal Penalty Exemptions

How to avoid getting hit with penalties when pulling money out of an IRA prior to 59 ½

There are many different reasons that you might want to pull money out of an IRA prior to 59½. Maybe you have fallen on an unexpected hardship or have decided to retire early and need money to supplement your lifestyle until you reach social security age. If not planned appropriately, taking money out of your IRA prior to 59 ½ will not only be taxed at your normal ordinary income tax rate, but it will also land you a 10% penalty on any funds withdrawn. The good news is that there are several ways to avoid the 10% early withdrawal penalties. If you decide to take a distribution from your IRA for any of the ten exemptions below, you can avoid the 10% early withdrawal penalty.

- Substantially Equal Periodic Payments: This exception to the early distribution penalty allows you to bridge the gap between when you retire and 59 ½. This exception allows a taxpayer to withdraw the same amount (talk to your advisor on how to calculate the amount) for each of five years or until 59 ½, whichever is greater.

- Higher Education Expenses: You may be allowed to take a penalty-free distribution from your IRA to pay for qualified higher education expenses for you, your spouse, or your child. Higher education expenses include tuition, fees, books, supplies, or equipment required for enrollment. Room and board are also covered if the student is enrolled as at least a half-time student. Be sure that the school is an accredited institution that is part of this program.

- Unreimbursed Medical Expenses: If you must pay medical expenses out-of-pocket and are not reimbursed the funds by your insurance company, you will be eligible to take an early IRA distribution without incurring the penalty. Please note there is a floor to this exception. The unreimbursed medical expenses must exceed 10% of your adjusted gross income (AGI) for the year in which you take the distribution (i.e., if your AGI is $100,000 and you have $25,000 in medical expenses the most you can distribute penalty-free is $15,00).

- Inherited IRAs: If you are the beneficiary of an IRA, you are not subject to the early withdrawal penalty (this does not apply if you are the spouse of the original account holder who is the sole beneficiary of the IRA). The main reason for this exception is the IRA 10-year rule which states that beneficiaries must exhaust the funds within an inherited IRA within 10 years following the original owner’s death. If the person who inherits the IRA is a child or a grandchild, they would almost certainly have to pay the penalty on any funds required to be distributed if it were not for this exception.

- For a Home Purchase, Build, Rebuild: A taxpayer may withdraw in their lifetime up to $10,000 from their IRA without penalty if the funds are used to buy, build, or rebuild a home. To qualify for this exception, you must be a ‘first-time homebuyer.’ This means that you have not owned a home in the past two years (so you could have owned a home in the past and still be considered a first-time homebuyer). These funds can also be used to help a child, grandchild, or parent who meets the first-time homebuyer definition. The $10,000 limit is per person, so if you are married, you and your spouse together may pull $20,000 for this exception.

- Adoption of a Child: You may distribute up to $5,000 per adoption without penalty to pay for the legal adoption of a child. You can withdraw funds from your IRA within the first year after the date when the adoption was finalized.

- To Pay for Health Insurance Premiums While Unemployed: If you are unemployed, you may take a penalty-free distribution to pay for health insurance premiums. To meet the definition of unemployed, you must have lost your job, received unemployment compensation for 12 consecutive weeks, received the distribution no later than 60 days after returning to work, and taken the distribution during the year you received unemployment compensation or the succeeding year.

- Permanent Disability: If you meet the IRS definition of permanently disabled, you can withdraw money from your IRA without penalty. To meet this definition, you must have been disabled in a way that you cannot engage in any substantial gainful activity, and a physician has determined that the disability can be expected to last continuously or lead to death.

- To Fulfill a Tax Levy: You may take a penalty-free distribution to pay for unpaid federal taxes. The IRS can draw from your IRA to pay the tax bill. It is important to note that this distribution is not initiated by the taxpayer but by the IRS. Since it is a forced distribution to pay federal tax liabilities outstanding, the penalty does not apply.

- Called to Active Duty: Qualified reservists are not subject to the penalty if they are called to active duty for at least 179 days.

As always, our CPAs and CFP® professionals are happy to analyze your current and future situation to ensure you are not hit with any unwanted penalties associated with IRA distributions.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.