2022 Tax Information

A Reference Guide For The 2022 Tax Environment

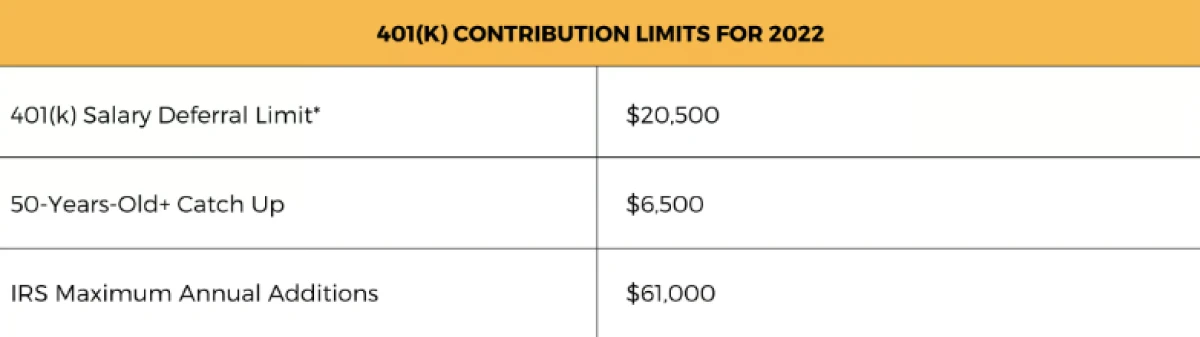

As we reach the end of the year, a tax topic that will be discussed more will be the IRS 401(k) contribution limits. This contribution limit has a significant impact on your retirement savings and the strategies that are available to you. The 401(k) contribution limits for 2022 are as follows:

The above 401(k) limits can help determine if you are maximizing your retirement savings potential. This is because most companies have some sort of 401(k) match. Because of this, every employee’s priority should be to contribute up to the 2022 $20,500 limit through their salary deferrals as they receive free money from their employer for doing so. If you are over 50, you will want to take full advantage of the catch-up contributions as they are meant to help you ramp up your retirement savings as you get closer to your retirement date. The maximum IRS limit of $61,000 ($67,500 if over 50). This limit considers the funds the employee and employer put into a 401(k). Contributions up to this limit benefit the employee to store away even more for retirement even if they are not getting any company match on the funds. The contributions up to this IRS limit are also a very useful tool in that they can be eligible for Mega Backdoor Roth Conversions. To read more about how Mega Backdoor Roth Conversions work, please read our article discussing this topic in depth.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.