2023 Tax Code Update

Breaking Down the New IRS 2023 Tax Code Changes and How They Impact You

As 2022 comes to a close, many individuals will begin to plan for 2023 and what next year might hold for them financially. 2022 saw higher than normal inflation and turbulent markets. These conditions have caused the IRS to make significant adjustments to tax brackets, phase out ranges, and contribution limits. In order to get ahead of these changes and understand how they could impact your specific tax situation, please see our 2023 tax guide below.

Notable Changes for 2023 and Beyond

There are a couple of items we would like to highlight for the 2023 tax year. One of the most appreciated COVID-related tax benefits comes to an end. As it currently stands, the IRS will not extend the 100% deduction for business meals past the end of 2022. Originally intended to provide relief to the crippled restaurant industry during and after the pandemic, the deduction for business meals will revert to its pre-2020 levels allowing for a 50% deduction in 2023.

After the SECURE Act in 2019 reformed the way newly inherited IRA assets should be distributed, the IRS appears to make another altering change. Currently, the law does not call for Required Minimum Distributions (RMD) on non-spousal inherited IRA assets if the decedent passed away after January 1, 2020. Instead, the Inherited IRA is required to be depleted within 10 calendar years of the date of death. The proposed change would begin to enforce RMDs on these inherited assets. If passed in 2022, the IRS has confirmed it will not take effect until 2023. Most importantly, for 2023, the IRS has made significant increases to brackets, limits, and phase out ranges across the board, more discussion on this and its impact below.

One of the most advantageous TCJA policies, bonus depreciation will start its phase out process in 2023. Bonus depreciation was the policy that allowed businesses to take additional depreciation expense in the year an asset was purchased. Previously businesses were allowed to take 100% of the assets value as bonus depreciation but this will start to be phased out, dropping to only 80% in 2023. The percent of additional depreciation will continue to drop by 20% every year until 2027 when it completely expires.

The beneficial effects of the Tax Cuts and Jobs Act (TCJA) are set to expire in 2025. These favorable changes will revert to their pre-2017 totals including higher marginal tax rates, significantly decreased standard deduction amounts, and lower lifetime gift/estate tax exclusions. This looming reversion means that there is a window of time left to position your financial situation to be the most tax efficient before the TCJA rules expire. Some of the most beneficial strategies that can be implemented are backdoor and mega backdoor Roth conversions, distribution planning, and maximizing retirement plan contributions.

Tax Brackets see Significant Widening

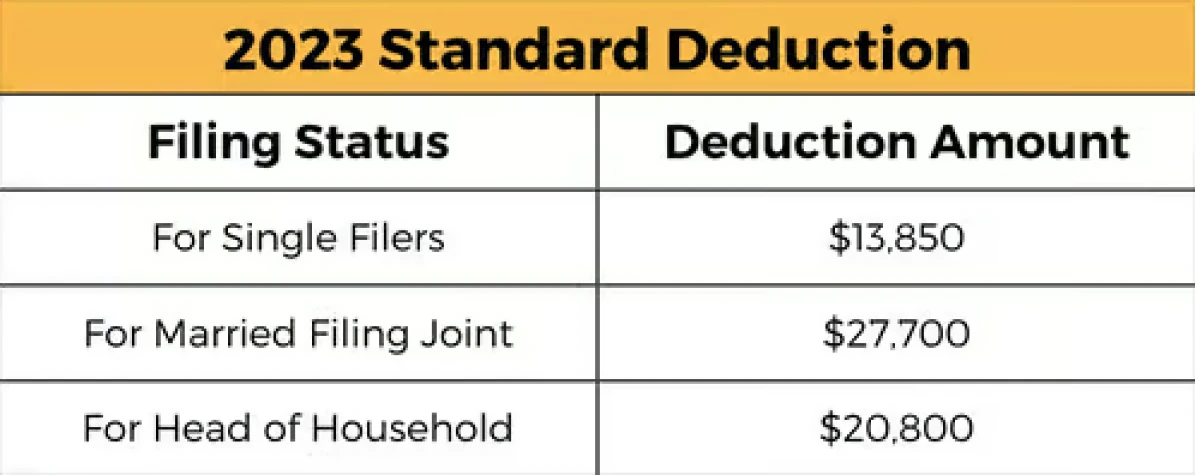

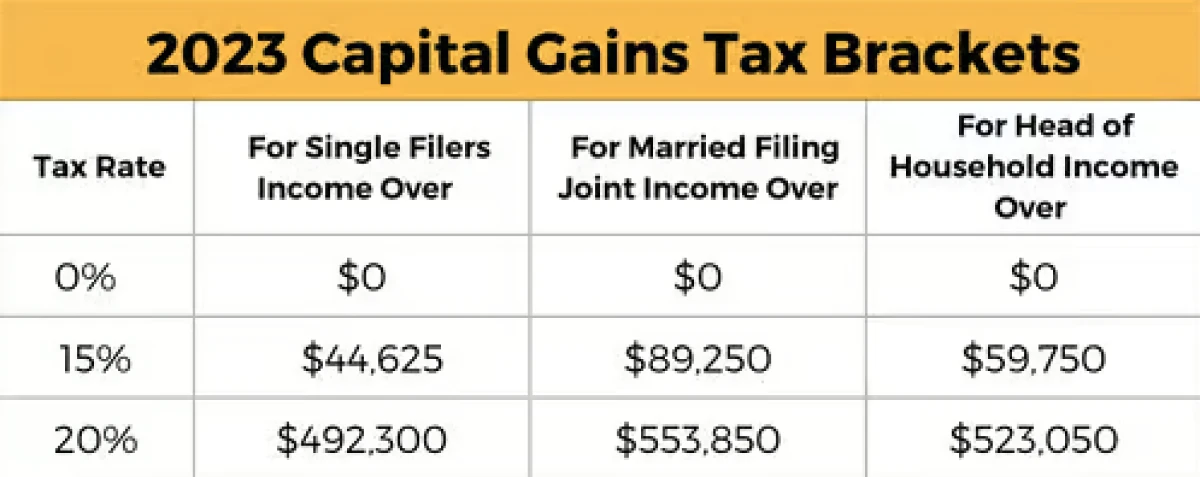

Typically, the IRS amends tax brackets and the standard deduction based on the prior year’s inflation reading. 2023 will prove to be no different as the IRS has increased marginal tax brackets by 7% on average. Please see the new updated 2023 tax brackets compared to the 2022 brackets below:

Takeaways

Utilizing proper tax planning could result in significantly reduced tax liabilities in 2023. These new brackets raise the starting point and range of the 15% capital gains tax. This means that for taxpayers who have moderate income could see some or all of the long-term capital gains and qualified dividends generated from these accounts taxed at 0%. Through proper distribution planning in taxable brokerage accounts, 0% Long-Term Capital Gain treatment should be easier to achieve in 2023 than ever before.

This year’s Standard Deduction increase is $900 for single filers and $1,800 for joint filers. These higher standard deduction limits will likely cause more people to use the standard deduction over itemizing. We see this reinforcing the trend since TCJA took effect where fewer people are able to itemize their deductions. Itemized deductions (such as state sales and property taxes, deductible medical expenses, mortgage interest expenses, and charitable giving) must cumulatively be greater than the standard deduction in order to be tax deductible.

Largest 401(k) Changes in History

In 2023 the IRS is implementing the largest increase to contribution limits for 401(K) accounts since the 401(K) was introduced in 1986. For 2023, the IRS has increased the amount an employee can save on a pre-tax or Roth basis from $20,500 to $22,500. The catch-up contributions for taxpayers over 50-year-old also rose from $6,500 to $7,500. This will allow those employees approaching retirement to put more funds into their 401(K) accounts in 2023. The total amount for 2023 that is allowed to be put into a qualified plan is $66,000 ($73,500 if over 50) up from $61,000. This increased total contribution limit substantially increases saving opportunities available based on your company-specific 401(k) plan design.

The eligible compensation limit for retirement plan contributions has been increased from $305,000 in 2022 to $330,000 in 2023. This benefits highly compensated employees and their ability to put funds into their retirement plans prior to using deferred compensation programs. For instance, a company matching 5% 401(k) match in 2022 could only provide a maximum match of $15,250 ($305k x 5%). In 2023, the maximum match would increase to $16,500 ($330k x 5%)

Traditional and Roth IRA Contributions

The IRS has slightly increased the IRA contribution limit for 2023. The IRA contribution limit increased from $6,000 to $6,500 and the catch-up contribution for individuals over 50 remains at $1,000. The phase out ranges for determining the eligibility for deductible traditional IRA contributions and direct Roth IRA contributions was increased by 7% on average for each income tax bracket. This will allow individuals and couples to put more into tax advantaged retirement accounts in 2023 and especially benefit those who chose to put these additional funds into a Roth IRA account as they are getting more funds into an account that has tax free growth and distributions. This increase might have more people looking at potential backdoor Roth conversions if their income is over the phase out ranges for direct Roth contributions and deductible traditional contributions.

SIMPLE IRA

Some good news for self-employed individuals and taxpayers that have small businesses is that the contribution limit for SIMPLE IRAs has increased to $15,500; a $1,500 increase from the previous $14,000. The increase helps to keep this retirement plan relevant and a potential option for small businesses looking to easily establish retirement accounts for employees.

Annual Gift Exclusion

For 2023 the annual gift tax exclusion has been increased from $16,000 to $17,000. This means that people who are married and elect gift splitting will be able to give up to $34,000 on a per-person basis in 2023. This allows taxpayers to transition more money to their heirs or family and decrease their taxable estate. For example, if a couple wanted to give their child who is married and has two children the maximum gift for 2023, they will be able to gift $34k to their child, $34k to the spouse, and $34k to each of the kids. This would remove a total of $136,000 from the estate in an individual year. If a taxpayer does end up exceeding this gift limit, they will then have to dip into their lifetime gift tax exclusion amount that is being increased to $12,920,000 for 2023.

With the impending reversion of the TCJA and lifetime exclusion amounts subjected to significant cut back in 2025, gift strategy and estate planning are more relevant than ever. In order to optimize your estate strategy, we always encourage you to contact a qualified financial and tax planner to determine the best individualized strategy for your situation.

If you have any questions with respect to changes in tax law in 2023 and how they may impact your financial situation, reach out to the Rhame & Gorrell Wealth Management team at the link below for a complementary tax and financial planning strategy session.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.