2024 Tax Code Changes: Everything You Need To Know

Breaking Down the New IRS 2024 Tax Code Changes and How They Impact You

Throughout 2023, there were numerous economic and legislative changes that impacted the tax code. On the legislative front, individuals are continuing to adjust to the changes brought about by the Secure Act 2.0 and the associated tax implications. Considering the ongoing deficit spending and wrangling over the debt ceiling in Washington, budget discussions are expected to intensify as we head into an election year.

We believe that following the 2024 election, tax code will be an object of legislative focus due to the approaching sunset of the 2016 Tax Cuts and Jobs Act (TCJA). While this is a more significant adjustment on the horizon, there are some normal and expected changes that are happening to the tax code in 2024 that we will cover below.

2024 Tax Brackets

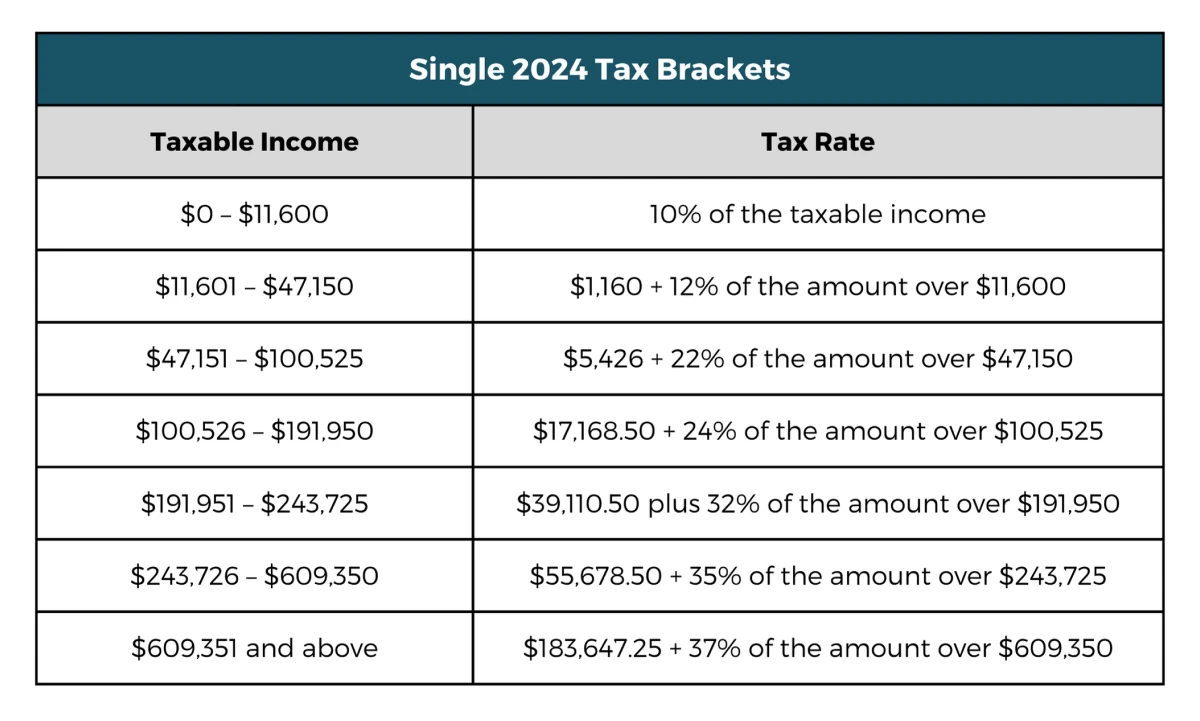

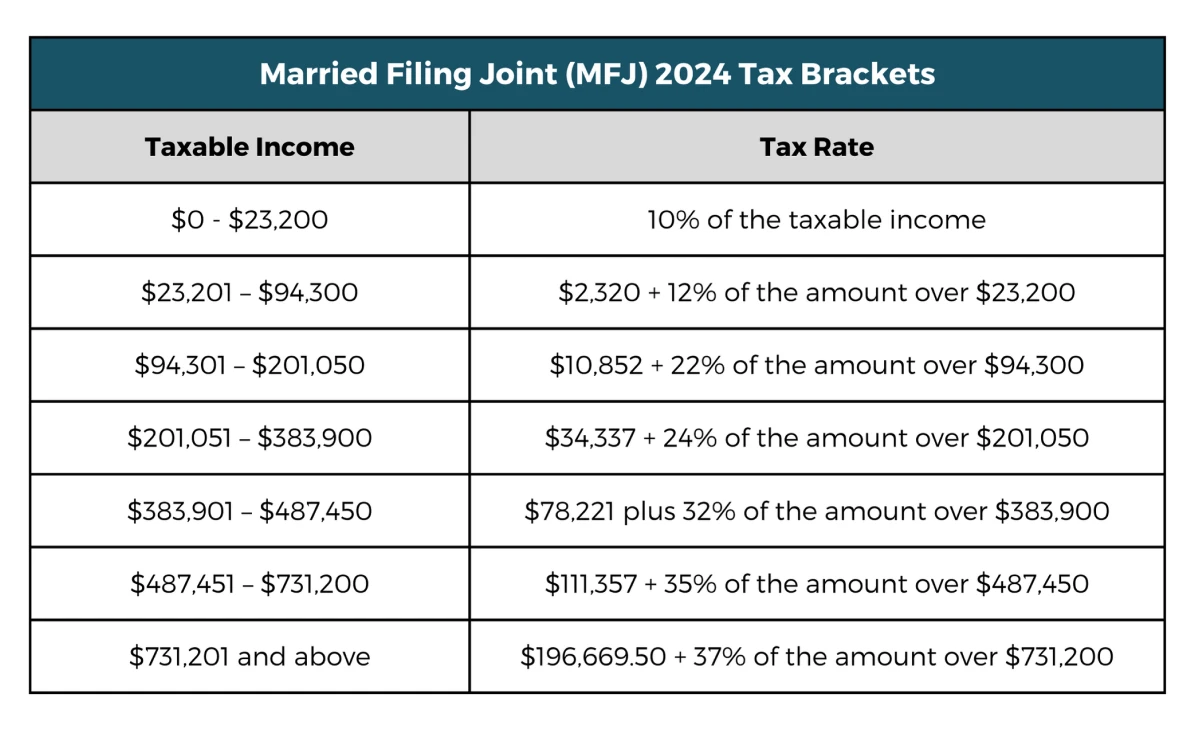

Each year, tax brackets increase in size to account for inflation. The adjustment for 2024 is a healthy 5.4%. Compared to the Social Security cost-of-living adjustment of 3.2%, this increase means that some Social Security recipients could see lower taxes in 2024. We have listed the new tax bracket sizes below:

Single Filers

Married Filing Joint (MFJ)

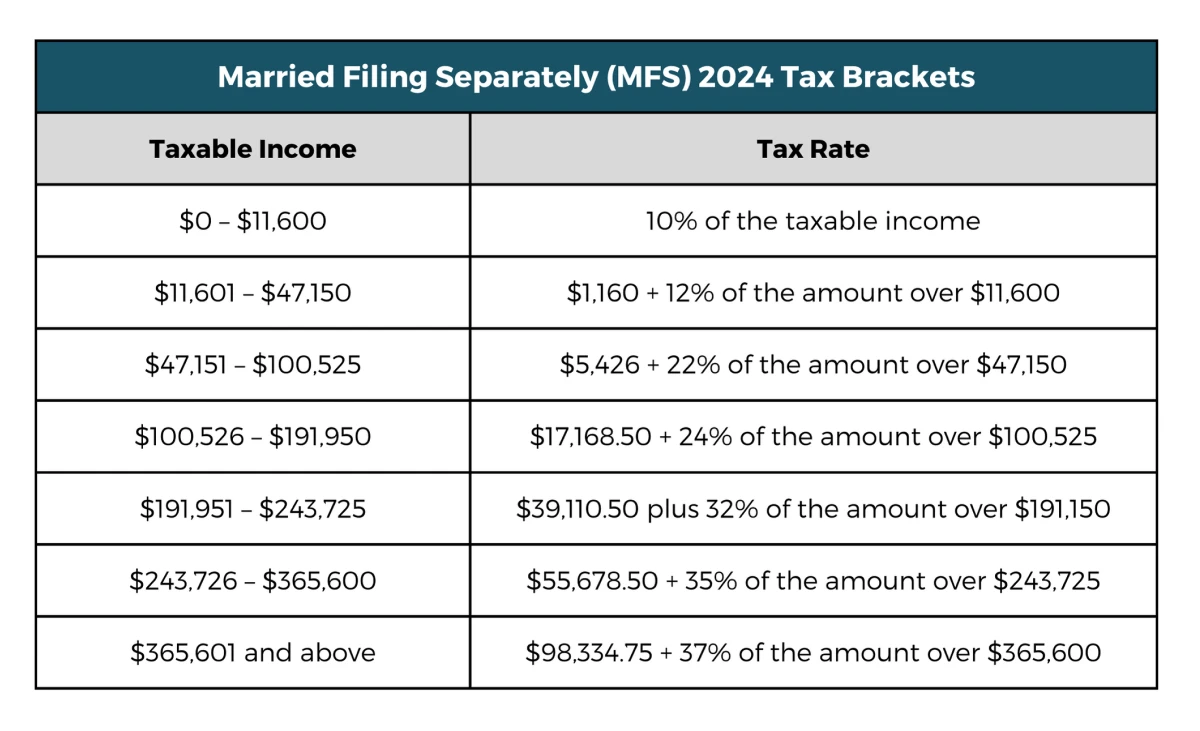

Married Filing Separately (MFS)

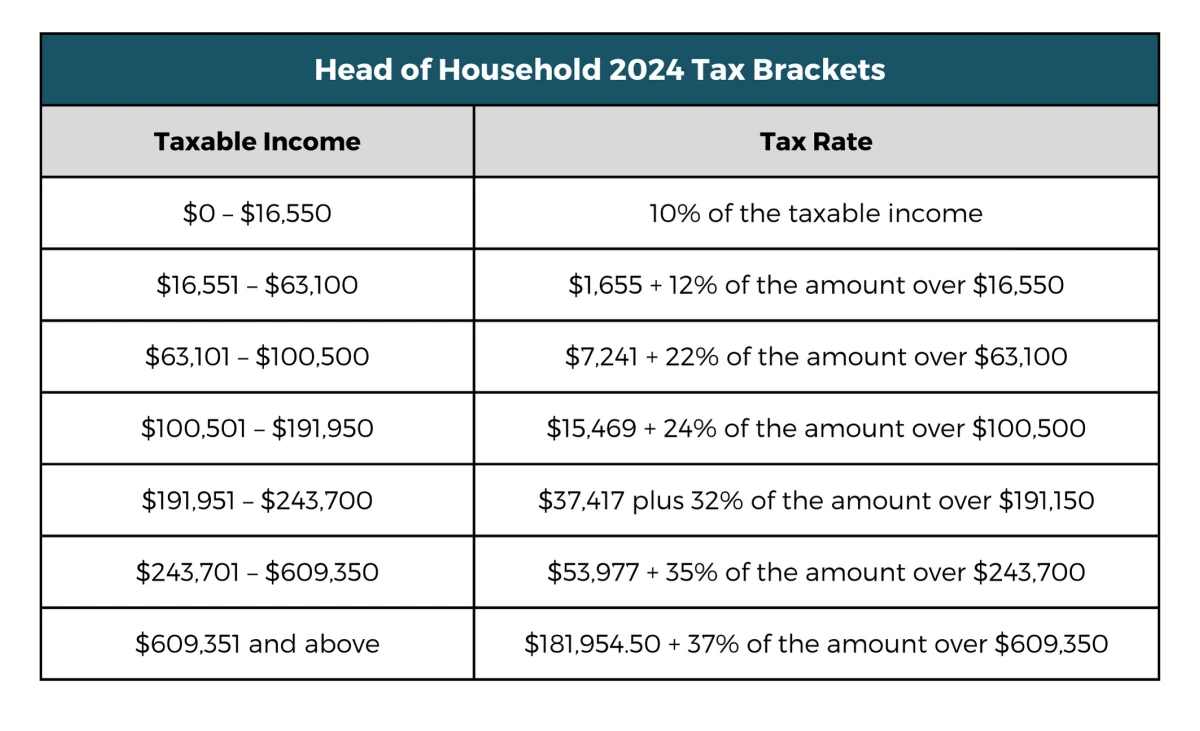

Head of Household

Standard Deduction

The standard deduction for taxpayers will get the same 5.4% bump that the tax brackets received. This means that the standard deduction for single taxpayers and married taxpayers filing separately will be $14,600, head of household will be $21,900, and married filing joint (MFJ) will be $29,200. This will continue the trend we have seen since 2018 where many people do not itemize their deductions as they are not able to surpass these high standard deduction numbers.

Retirement Contributions

The IRS retirement contribution limits for 2024 will be increased slightly from their 2023 limits. For company sponsored 401(k) plans, the maximum contribution limit from employee and employer will increase to $69,000. The maximum employee contribution on a pre-tax or Roth basis will increase to $23,000 and the catch-up contribution will remain the same at $7,500.

This IRS maximum of $69,000 and catch-up contribution of $7,500 is also applicable to SEP IRA contributions. SEP IRAs will continue to have the same income and wage calculation in years past at 20% of wages or self-employed income for owners and 25% for non-owner employees.

The maximum annual benefit in a defined benefit plan such as a pension plan will increase to $275,000. The maximum compensation consideration that can be considered for the company matching percentage on retirement plans (such as a 401(k) plan) will be $345,00, up from $330,000.

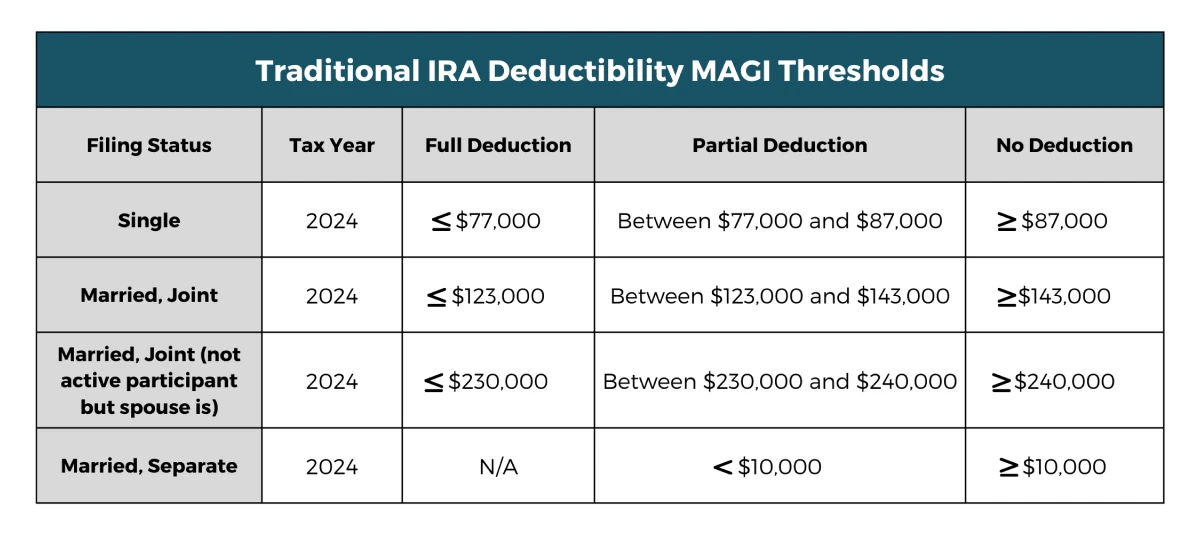

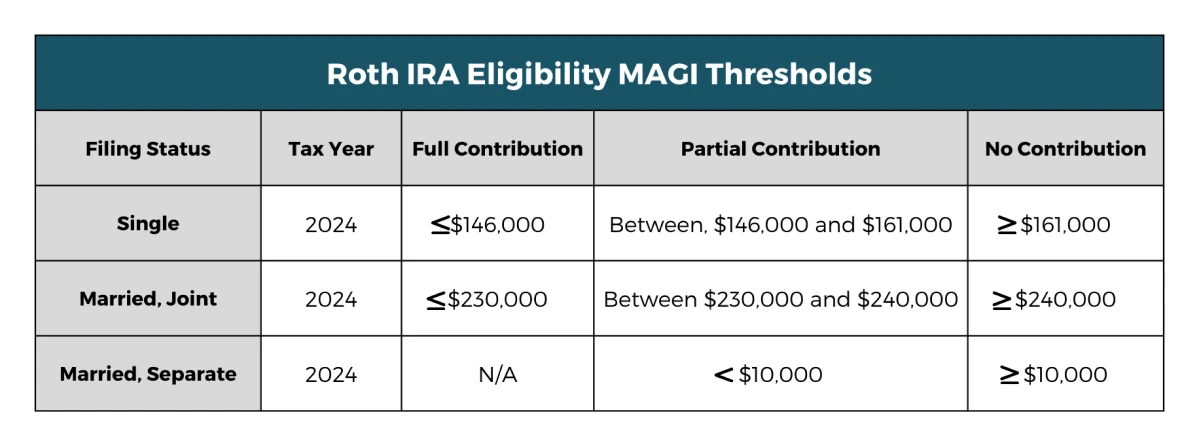

Traditional and Roth Individual Retirement Account (IRA) contributions will also see a slight bump. The annual contribution limit for these types of accounts will increase from $6,500 in 2023 to $7,000 in 2024. Despite the base contribution increase, the catch-up contribution for those ages 50+ will not receive any increase and remains at an additional $1,000. Please see the below tables for the phase-out ranges for tax deductible traditional IRA contributions as well as direct Roth IRA contributions.

SIMPLE IRAs will also receive a small bump in contributions limits from $15,500 to $16,000. Like traditional and Roth IRAs, the catch-up contribution for SIMPLE IRAs remains the same for 2024 at $3,500.

Health Savings Accounts (HSA)

Health Savings account contributions will see slight increases. Jumping from $3,850 for individuals in 2023 to $4,150 in 2024. The family coverage limit will jump from $7,750 in 2023 to $8,300 in 2024. The catch-up contribution will remain at $1,000 for people 55+.

Required Minimum Distributions (RMD)

As stated in the previously passed Secure Act 2.0, RMDs will be pushed back to age 73 for those born between 1951 – 1959. For those born in 1960 or later, the RMD age will be 75. Along with this increase, there will also be a change to inherited IRA distributions.

Going forward, for inherited IRAs where the decedent was RMD age, there is a requirement to pull an RMD from the inherited IRA annually. The entire account must also be depleted by the end of the 10th year. For inherited IRAs where the decedent had not reached RMD age, no annual distribution is required but the entire account must still be liquidated by the end of the 10th year.

Other 2024 Tax Considerations

As many individuals know, rates over the past year have skyrocketed. This has in turn led many individuals to invest in interest-bearing vehicles such as money market accounts and certificates of deposit (CDs). While these instruments are great for giving set rates of return with very little risk, they can generate substantial taxable income. This can lead to higher than anticipated tax bills and should be considered when going through tax projections and planning.

Secure ACT 2.0

It is also important to consider other changes the Secure Act 2.0 brought about. These items expand the use of 529 accounts and change where employer contributions in retirement plans are allowed to go. Please feel free to read our article covering all the changes brought about by this legislation in our article here.

Tax Cuts and Jobs Act (TCJA)

The sunsetting of the TCJA is a big topic that we believe will be discussed in 2024 as political candidates give their two cents on what should be kept or what should expire. We have already covered everything you need to know about the TCJA sunset provisions as they stand today and how they can impact you in a separate article here.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.