A Guide To The Different IRS Tax Filing Penalties – What You Need To Know

Understanding the different penalties assessed on individuals for filing taxes incorrectly

Every year the IRS hits people with tax filing penalties and interest. This often leads to higher than anticipated amounts being owed to the IRS and confusion as to what individuals are being penalized for.

It is common for a person to file their tax return on time and have a refund coming to them but be assessed with a penalty from the IRS for failing to file their estimated tax payments on time. The three most common penalties individuals experience are Failure to File, Failure to Pay, and Failure to pay Estimated Tax Payments.

Failure to Pay Penalty

As mentioned above, extensions to file do not extend to payment of taxes. Tax payments have a strict April 15th deadline.

Any amount owed after April 15th will be hit with a failure to pay penalty. This penalty is 0.5% of what is owed per month (or part of the month) and has a cap that cannot exceed 25% of the tax due. This failure to pay penalty can also be decreased by applying for and following an installment agreement with the IRS.

There are several rules and regulations that surround the implementation of these types of agreements, and speaking with a CPA is recommended before attempting to implement one. Fortunately, this penalty does not have a minimum or floor that must be paid.

Failure to pay Estimated Tax Payments

The estimated tax payment penalty is assessed upon failure to pay quarterly taxes throughout the year which could result in a $1,000 penalty. The IRS likes to receive tax payments in the corresponding quarter where income is received. This follows the accounting principle of income matching.

For some sources of income, the IRS will deem the income as earned equally throughout the year, regardless of when it is actually earned. An example of this type of income is W-2. Regardless of whether a W-2 employee is paid equally over a 12-month period, or is paid a total sum in December, the IRS will recognize this income and subsequent tax payments as being made equally throughout the year.

There are also sources of income that the IRS only recognizes when received. An example of this would be 1099-R income from pulling from a qualified retirement account.

The estimated taxes of a 1099R income paid equally throughout the year must be paid quarterly in order to match the income received. In contrast, a large distribution from an IRA in the fourth quarter will only need to be paid in that quarter. The problem arises with these different types of income in that the IRS has no way of knowing when the funds are distributed as they only receive the 1099-R at the end of the year.

It is up to the taxpayer to clarify with the IRS when the income was realized and the quantity of the estimated tax payment due by submitting a Form 2210 with their tax return. This form shows how much income was realized in each quarter and the corresponding tax payment that needed to be submitted for that quarter. This form will then calculate the correct penalty, if any, that is due for a lack of estimated tax payments.

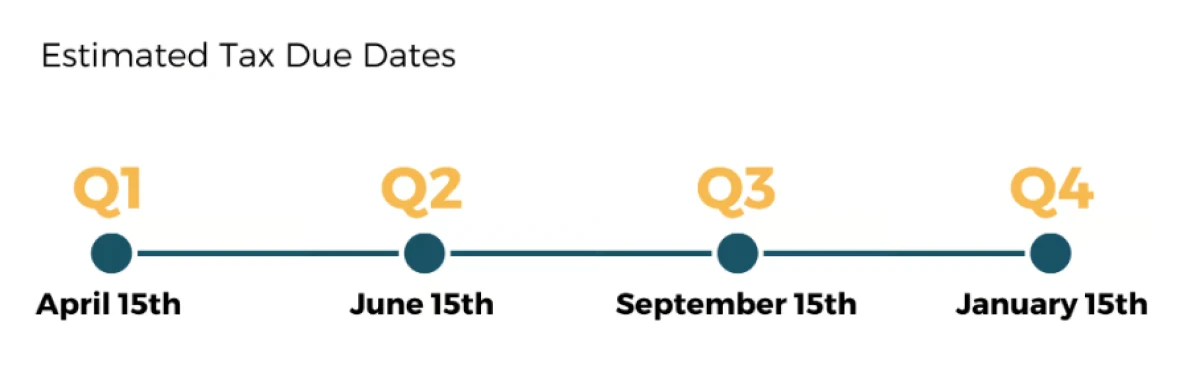

For clarification, estimated taxes are due the following dates:

Q1 = April 15th

Q2 = June 15th

Q3 = September 15th

Q4 = January 15th

If the 15th falls on a weekend or holiday, the deadline falls on the next business day.

The penalty for underpayment of estimated taxes is an annual rate of 8% (2024 number is adjusted based on interest rate environments). This can be calculated on Form 2210. It is calculated by taking the earned income for every quarter and the corresponding tax payments for that quarter. Then a shorthand tax calculation is made to see if the withholding covers the estimated taxes for the quarter.

If there is an underpayment, this amount is multiplied by number of days that the payment was late (as the underpayment might have been corrected in the next quarter or at an earlier date) and then multiplied by the penalty rate of 8% for every day the payment is late. So, while the penalty amount of 8% might seem high, it is very rare that a taxpayer will owe that amount as underpayments tend to correct themselves as the year progresses.

Multiple ways exist to reduce or eliminate this penalty. One way is to simply pay estimated taxes and remain vigilant of one’s own tax liability throughout the year.

Another way of reducing this penalty is by filing for the Safe Harbor rule. This means that if you are paid 90% of your current tax liability or 100% of your prior year liability (110% if you have earned income over $150,000 in a year), the IRS will not charge you an underpayment penalty.

The unfortunate aspect of the Safe Harbor Rule is that it will only consider taxes paid in tax withholdings (W-2 and 1099-R withholdings for example) and not estimated tax payments. This means that individuals who are self-employed, or in retirement, are more susceptible to exercising this penalty as their income could be generated from nontraditional sources.

Lastly, there is a way to remove the estimated tax payment penalty is by requesting a one-time tax abatement. This is a request that can be made if all tax returns are filed, outstanding balances are paid, an installment agreement with the IRS has been implemented, and there are no prior penalties in the past 3 tax years.

This penalty abatement must be requested and will eliminate the penalties and interest owed if an unusual tax penalty is incurred. Filing and submitting Form 843 is required to claim this penalty abatement.

It is worth noting that there are certain circumstances that can give some penalty relief. For example, areas that experience frequent disastrous weather will most likely receive relief from estimated tax payment penalty as part of being in the federally declared disaster area. There are also extenuating circumstances such as house fires, illnesses, and death that allow for penalty relief as well.

Conclusion

Taxes and their corresponding penalties can be challenging to understand when unfamiliar with the material. Here at Rhame and Gorrell we help clients think through their tax situation and make sure they are aware and in control of their tax filings and payments to give them the best chance of avoiding any of these penalties or interest. Knowing where you stand with Uncle Sam prior to tax filing season can also give peace of mind to know there are no tax surprises around the corner.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.