The Backdoor Roth IRA: Benefits, Rules, and How To Set One Up

Understanding One Of The Most Widely-Applicable Tax Strategies for 2024

The Backdoor Roth IRA is one of the most widely useful exploitations of current tax law for high earners to receive additional tax deferral. From 2020-2022, multiple items of legislation attempted to limit or remove this functionality from the IRA landscape. Despite multiple attempts, all failed to succeed and the final language for these pieces of legislation.

In what appears to be a significant change, the SECURE Act 2.0 enacted in December 2022 did not have language eliminating the Backdoor Roth strategy in the drafting phase or final legislation. We believe this bodes well for the ongoing availability of the strategy. As of 2025, the Backdoor Roth IRA is still allowed. We will explore this strategy in depth below.

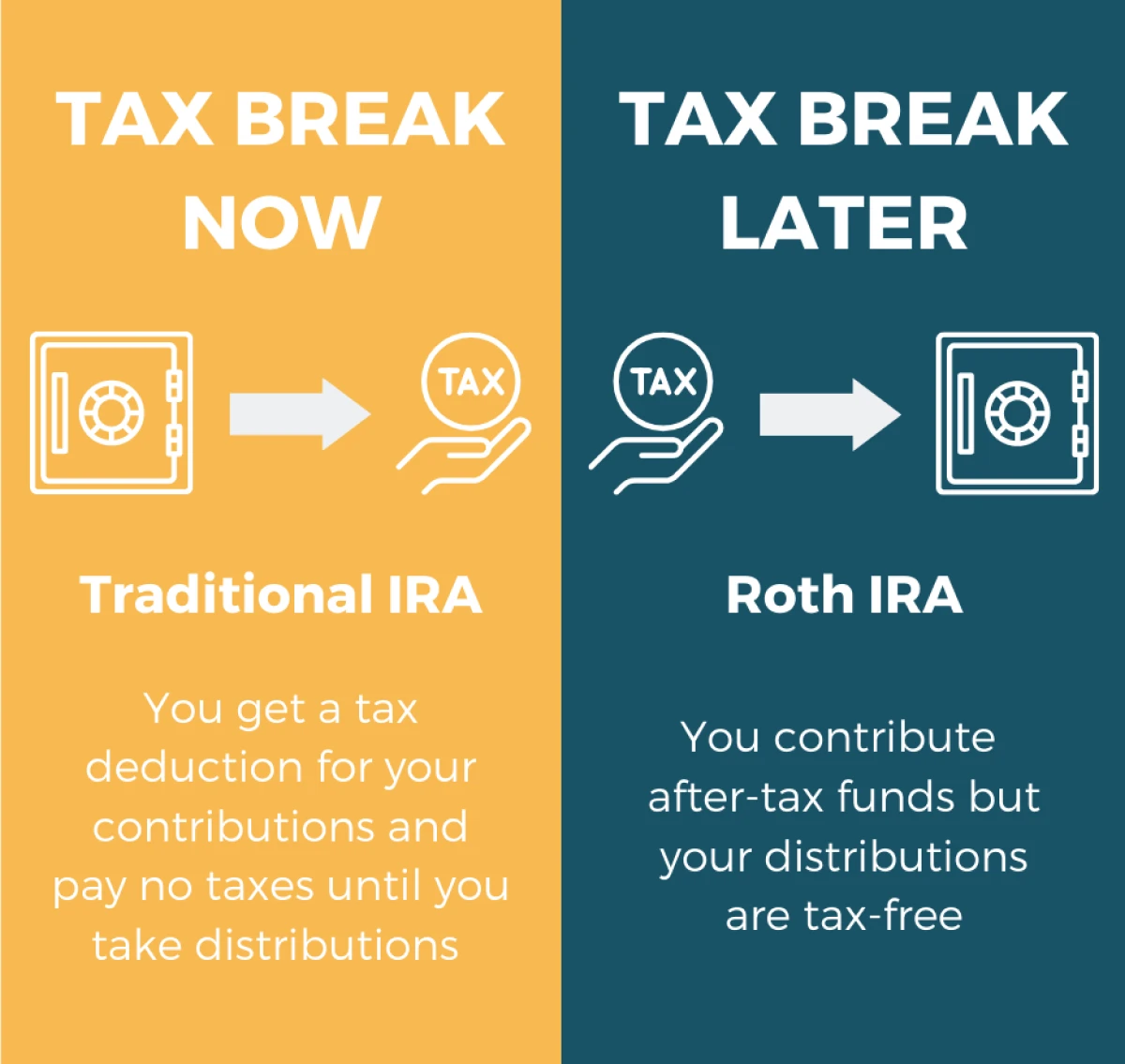

Traditional vs. Roth IRA

The Individual Retirement Arrangement (IRA) is an investment account with tax advantages that individuals can use to save and invest for retirement. There are two primary types of IRA: Traditional and Roth. For 2025, both accounts allow up to $7,000 of contributions per year ($8,000 for age 50 and over).

A working individual is also allowed to make contributions on behalf of a non-working spouse by utilizing a Spousal IRA. This allows for a total of $14,000 in contributions ($16,000 if both are over the age of 50).

In a typical Traditional IRA, a taxpayer makes tax deductible contributions (i.e., pre-tax contributions). The investment growth is tax deferred and the money is subject to ordinary income tax when withdrawn. In a Roth, it’s the opposite. Contributions are non-deductible but the growth is generally tax-free upon withdrawal. For an in-depth breakdown of how these accounts differ, please see our Traditional vs. Roth IRA article.

IRA Contribution Phase-Outs

High-income earners are disallowed from making pre-tax contributions to a Traditional IRA if:

- Their modified adjusted gross income exceeds certain thresholds, and

- They are covered by an employer sponsored retirement plan.

Taxpayers who are ineligible to make pre-tax contributions to a Traditional IRA can still make contributions, but these contributions are treated as non-deductible contributions.

High-income earners can also be phased-out from making direct contributions to a Roth IRA. This occurs when their modified adjusted gross income exceeds certain thresholds. See the chart below for the 2025 limits:

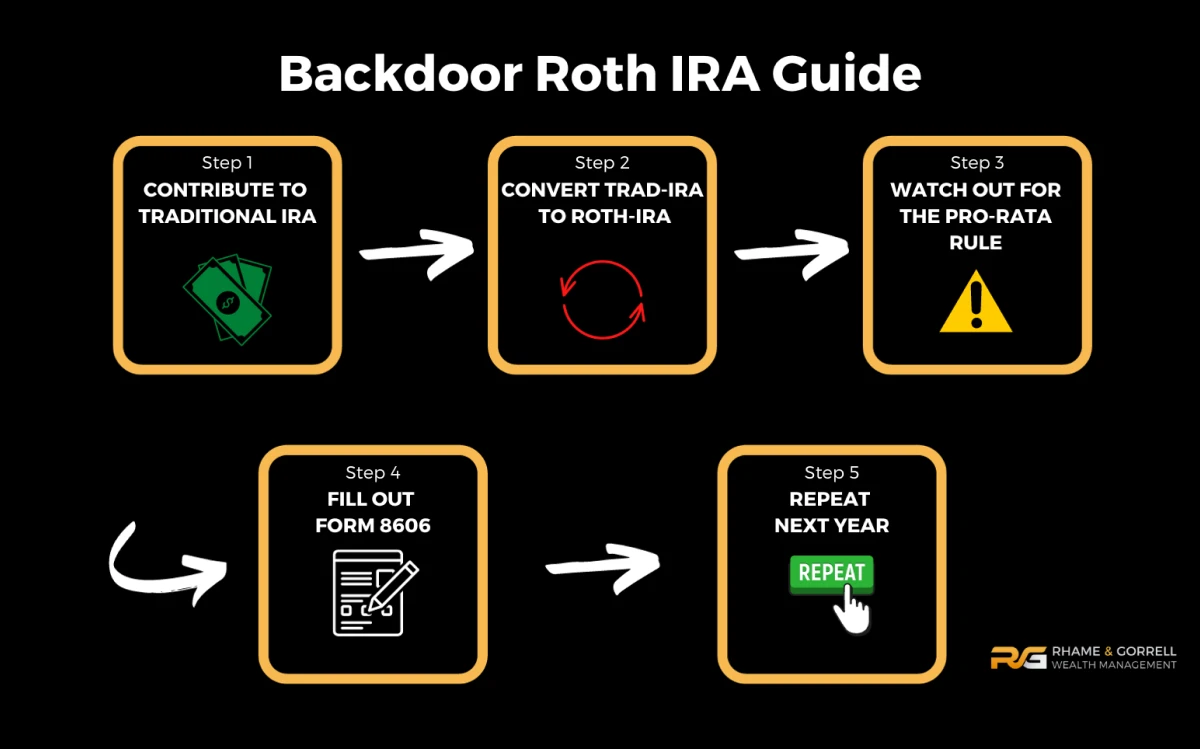

How Does a Backdoor Roth IRA Work?

In 2010 Congress changed the rules governing the conversion of a Traditional IRA to a Roth IRA. This change eliminated the income restrictions and allowed all taxpayers, regardless of income, the ability to convert their Traditional IRA to a Roth IRA.

High-income earners who are not eligible to make direct Roth IRA contributions, can still accrue Roth IRA savings. This is accomplished by making non-deductible contributions to a Traditional IRA, and then converting those contributions to a Roth IRA. This process is oftentimes referred to as The Backdoor Roth IRA.

While this is not a taxable event, there may still be some taxes owed. If the individual has a combination of both deductible pre-tax dollars and non-deductible after tax dollars within the Traditional IRA, they will have to pay ordinary income taxes on the amount of the conversion that consists of the pre-tax dollars. The taxable amount is a percentage of each dollar converted. This is referred to as the Pro-Rata Rule. We cover this rule extensively and how to avoid it in our article on the topic.

The process only makes sense for those individuals who have income that precludes them from directly contributing to a Roth or deducting their Traditional IRA contribution. For 2024, this means:

-

- If tax status = Single and MAGI > $150k

- If tax status = Married and MAGI > $236k

Potential Issues To Keep In Mind

The Backdoor Roth IRA is a complex strategy and there are a number of potential pitfalls that come along with it. Below, we have listed out and explained a few of the most common.

The Aggregation Rule

In the eyes of the IRS, all Traditional IRA accounts owned by an individual are viewed as one account for tax purposes. This means if the taxpayer has other pre-tax Traditional IRA money in a different account than the one being converted, they will have to pay tax on the converted IRA on a pro-rata basis.

To be clear, this doesn’t include different types and differently titled IRA accounts. You wouldn’t include your Roth IRA, your spouse’s IRA, or an inherited IRA.

For example, if a taxpayer has a Traditional IRA with $95,000 of money from a 401(k) rollover (the $95,000 contributions were made on a pre-tax basis), and the taxpayer makes a $5,000 non-deductible contribution to a new Traditional IRA, the conversion would be 95% taxable. This can be avoided by rolling the $95,000 Traditional IRA into the taxpayer’s employer sponsored retirement plan. Not all custodians allow this type of rollover.

For more information, please see our article on avoiding the Pro-Rata Rule.

Form 8606

Taxpayers who make non-deductible contributions to a Traditional IRA and/or convert a Traditional IRA to a Roth IRA must file Form 8606. Form 8606 is how you communicate to the IRS that a conversion took place, and what amount of this conversion consists of non-deductible dollars. The calculation that takes place on this form shows what amount of the conversion is taxable.

The Step-Transaction Doctrine

This is the legal principle that a series of related steps in a transaction should be combined to one single step and taxed based on the overall economic nature of the transaction, not taxed based on the separate individual steps. The concern is that the IRS would treat the converted amount as a direct contribution to the Roth IRA.

The IRS’s informal position is that the Backdoor Roth IRA strategy is not a problem. However, taxpayers may wish to wait some time between the contribution to the Traditional IRA and the conversion to the Roth IRA.

Conclusion

The Roth IRA is among the most tax advantageous investment vehicles allowed by the government. Amounts in the account grow tax-free and can be withdrawn tax-free. In addition, amounts withdrawn are not counted for purposes of calculating Medicare premiums, are not subject to RMDs, and do not affect the threshold for the new 3.8% Medicare contribution tax.

For individuals above the income phase-out for Roth IRA contributions, the Backdoor Roth IRA is a valuable strategy for accumulating additional Roth dollars. Prior to engaging in this strategy, a number of factors must be taken into account including, other Traditional IRA assets, state tax issues, and potential IRS scrutiny of the transaction. For help analyzing your current situation to see if this strategy is right for you, the Rhame & Gorrell team is here to help. Click below to schedule your complimentary consultation today!

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.