Baker Hughes 401(k): Navigating Contributions and Investments

An inside Look at Accounts, Contributions, and Investment Choices in the Baker Hughes 401(k)

The Baker Hughes 401(k) Plan is an essential component of an employee’s retirement income strategy. This guide provides a detailed overview of the plan’s features, including contributions, company match, investment options, and other vital aspects, offering Baker Hughes employees a clear understanding of the benefits and opportunities available to them.

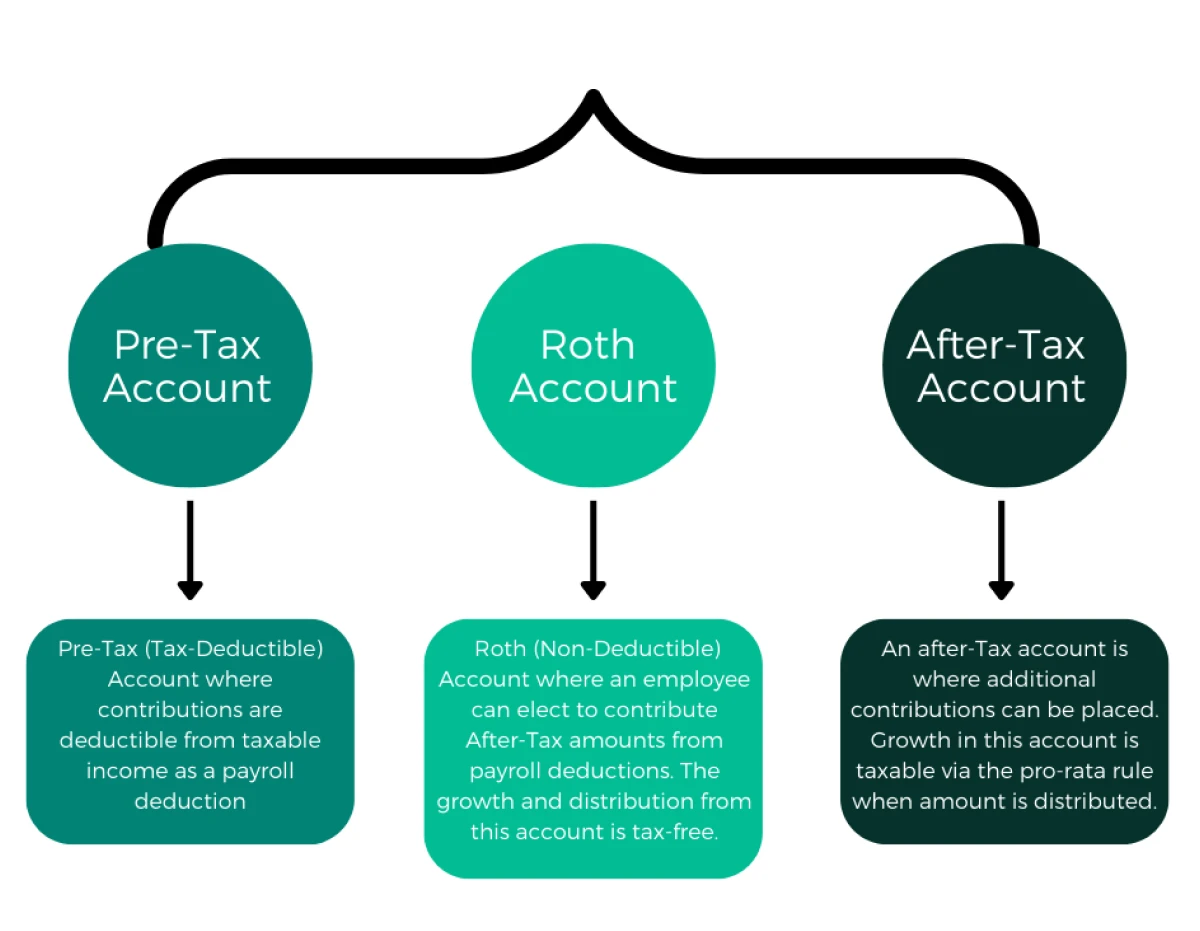

Accounts Within the 401(k)

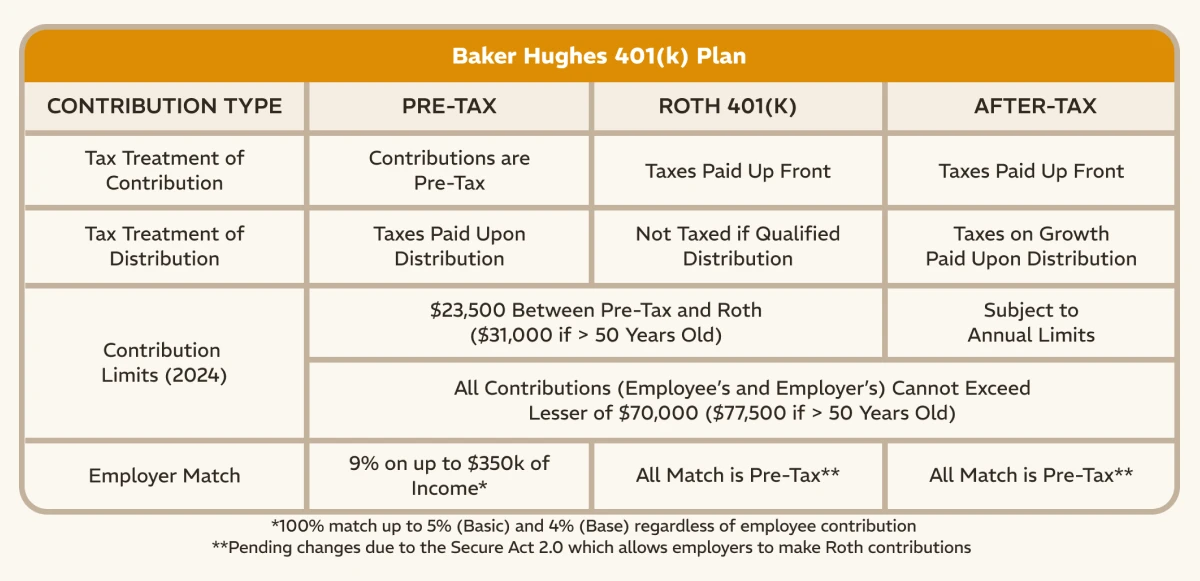

Within the Baker Hughes 401(k), there are three accounts that employees may contribute to. The Pre-Tax account, the Roth account, and the After-Tax account.

Pre-Tax

A pre-tax 401(k) account contribution is made before taxes are deducted. This means that the contributions consist of pre-tax dollars, thereby reducing the employee’s taxable income for that year.

The advantage of a pre-tax 401(k) account is that it allows individuals to lower their current taxable income while saving for retirement. The contributions and any investment earnings within the account are not taxed until they are withdrawn during retirement. It’s important to note that withdrawals from pre-tax 401(k) accounts are subject to ordinary income tax rates at the time of withdrawal.

Roth

Unlike a pre-tax 401(k) account, the contributions to a Roth 401(k) are made with after-tax dollars, meaning that the employee’s taxable income for the year is not reduced.

The advantage of a Roth 401(k) account is that it allows individuals to withdraw their contributions and earnings tax-free during retirement. Since the contributions have already been taxed, qualified distributions from a Roth 401(k) are not subject to income tax.

After-Tax

Similar to a Roth 401(k) account, contributions to an after-tax 401(k) are made with after-tax dollars. This means that the employee’s taxable income for the year is not reduced.

However, unlike a Roth 401(k), the earnings on the after-tax contributions are subject to income tax upon withdrawal. Despite this disadvantage, there are still some benefits from contributing to the After-Tax account.

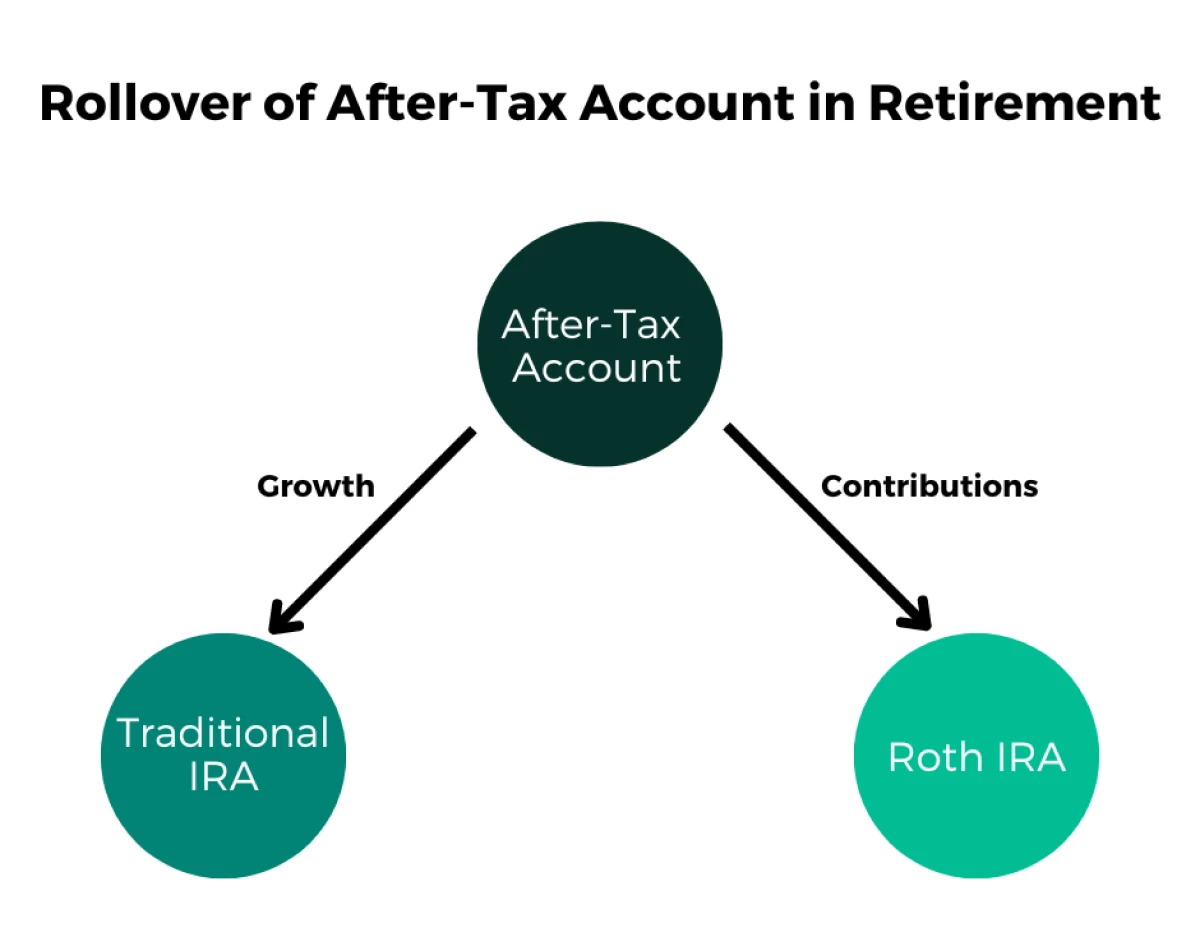

In retirement, employees can roll their contributions to the After-Tax account into a Roth IRA. The growth is still taxable, but this allows for additional accumulation of Roth savings. Baker Hughes has also noted that they are looking into adding in-plan Mega Backdoor Roth conversions. If this is made possible, the After-Tax balance could be converted to the Roth account while individuals are still employed.

Contribution Limits

There are various contribution limits that define the maximum that can be contributed to the plan. These limits are set by the IRS and vary depending on the account within the 401(k) and who is contributing.

Employee Contributions

Within the 401(k) Employees can contribute between 1% and 50% of their total eligible pay to the 401(k) Plan, up to the IRS limits. Eligible pay includes regular base pay, overtime, shift differentials, commissions, and eligible bonuses.

Contributions can be made on a Pre-Tax, Roth, or After-Tax basis, or a combination of these. For Pre-Tax and Roth, the combined IRS limit is $23,500 for 2025. For all three accounts, the combined limit is $70,000 for 2025.

Employees aged 50 or over can make additional catch-up contributions. For 2025, the catch-up limit is set at $7,500.

Company Matching Contributions

Baker Hughes enhances the value of this plan through company contributions, which include a base contribution of 4% of eligible pay each pay period, regardless of employee contributions. Additionally, the company provides a matching contribution dollar for dollar up to 5% of the employee’s eligible pay.

Matches on income over the $350,000 covered compensation limit are contributed to the Supplemental Retirement Plan (SRP).

Vesting

Employees are always fully vested in their contributions, the company’s matching contributions, and the investment earnings on those contributions. Vesting in company base contributions occurs upon completing one of the following:

- Three years of vesting service

- Retirement from the company

- Reaching age 65 while still an active employee

- Upon becoming permanently disabled or death while employed.

Investment Options

The 401(k) Plan offers two main types of investment funds: Target Date Funds and Core Funds. Target Date Funds are designed to simplify investment decisions with an asset allocation appropriate for the employee’s age, while Core Funds offer more involved investment choice and management. Baker Hughes employees that want to invest in company stock can utilize the Employee Stock Purchase Program (ESPP).

Target Date Funds

Target date funds are a type of investment fund offered in the Baker Hughes 401(k) Plan. These funds are designed to simplify investment decisions by automatically adjusting the asset allocation based on the employee’s age. The idea behind target date funds is that as an employee gets closer to their retirement date, the fund gradually shifts towards more conservative investments to protect against market volatility.

The downside is that target date funds typically have higher fees compared to other investment options. It’s important for Baker Hughes employees to carefully consider their investment objectives and compare the performance and fees of target date funds with other investment options available in the 401(k) Plan.

Core Funds

Baker Hughes employees have 7 different core funds to choose from. We will explore these below.

Stable Value Fund

This fund aims to achieve a stable rate of return, focusing on preserving the principal and allowing for consistent growth through the accumulation and reinvestment of interest income. It targets a return equal to or greater than the 5-Year Rolling Constant Maturity Treasury net of fees, maintaining an appropriate level of credit risk.

U.S. Bond Index Fund

The U.S. Bond Index Fund is designed to provide portfolio diversification and growth of income. It seeks to mirror the performance of the Bloomberg Barclays U.S. Aggregate Bond Index. This fund is ideal for investors looking for income growth and risk distribution.

Bond Fund

This fund also focuses on portfolio diversification and the growth of income. It aims to achieve returns equal to or greater than a blended benchmark comprising 80% Barclays Capital U.S. Aggregate Index and 20% Barclays Capital Global Aggregate ex-U.S. Index net of fees. This allows for international bond exposure which the U.S. Bond Index Fund is lacking.

S&P 500 Index Fund

Targeting growth of capital, this fund aims to provide investment results that reflect the risk and return characteristics of the S&P 500 Index. It is suitable for investors seeking exposure to large-cap U.S. equities.

U.S. Equity Fund

With a goal of capital growth, this fund seeks to achieve a return equal to or greater than the Russell 3000 Index net of fees. It is tailored for investors looking for broad exposure to the total U.S. equity market.

International Equity Index Fund

This fund’s primary objective is capital growth. It aims to provide investment results that approximate the risk and return profile of the MSCI Europe, Australasia, and Far East (EAFE) Index. It’s suitable for investors seeking international diversification.

International Equity Fund

Focused on capital growth, this fund aims for returns equal to or greater than the MSCI All Country World ex-U.S. Investable Market Index (MSCI ACWI-ex-U.S. IMI) net of fees. It’s designed for investors targeting global equity exposure outside of the U.S.

Conclusion

The Baker Hughes 401(k) plan is a valuable tool for saving for retirement. By understanding the basics of the plan, taking advantage of employer matching, and diversifying your investments, you can set yourself up for a comfortable retirement.

Be sure to regularly review and adjust your portfolio as needed, and don’t hesitate to seek guidance from our team if you want to optimize your situation. With the right strategies and investment options, you can make the most of your Baker Hughes 401(k) and achieve your retirement goals.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by Baker Hughes. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealtha Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.