Baker Hughes 401(k): Mega Backdoor Roth Strategy

The Mega Backdoor Roth can be a powerful tool for Baker Hughes employees looking to maximize their 401(k) contributions. By making after-tax contributions and converting them into a Roth IRA, employees can exceed standard Roth contribution limits and benefit from long-term tax-free growth. A clear understanding of the Baker Hughes 401(k) Plan and the nuances of this strategy is essential for optimizing retirement savings and avoiding potential pitfalls.

How the Mega Backdoor Roth Works

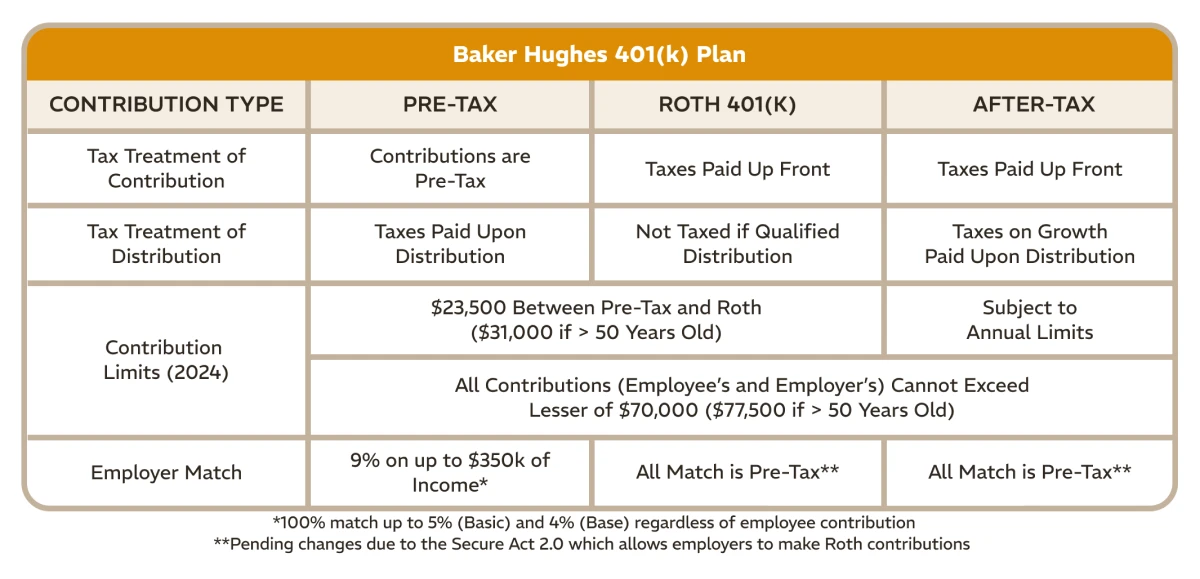

Most Baker Hughes employees know they can contribute to their 401(k) on a pre-tax or Roth basis up to the IRS annual limit—$23,500 for 2025 ($31,000 if age 50+). However, the plan also allows after-tax contributions beyond this limit, up to a total of $70,000 ($77,500 if age 50+), including employer contributions.

Company Contributions

Baker Hughes enhances employee retirement savings by offering two types of employer contributions:

- 4% Base Contribution: The company contributes 4% of eligible pay to the 401(k) automatically, regardless of whether an employee makes their own contributions.

- 5% Basic Contribution: Baker Hughes matches dollar-for-dollar on employee contributions up to 5% of salary.

To maximize these contributions, employees should contribute at least 5% of their salary each pay period.

After-Tax Contributions in the Baker Hughes 401(k)

After reaching the pre-tax/Roth contribution limit ($23.5k for 2025), employees can contribute additional after-tax dollars to the 401(k), up to the overall IRS limit. These contributions do not provide immediate tax benefits, but when converted to a Roth IRA, they become a source of tax-free growth. Importantly, Baker Hughes allows in-service rollovers, meaning employees can move after-tax contributions out of the 401(k) while still employed, a key feature that makes the Mega Backdoor Roth strategy possible.

Without in-service rollovers, employees would need to wait until leaving Baker Hughes to move after-tax contributions, potentially leading to significant taxable earnings. By rolling funds out regularly, employees can avoid excessive taxable growth while ensuring their retirement savings remain in tax-advantaged accounts.

Executing the Mega Backdoor Roth Conversion

Once after-tax contributions have been made, the next step is converting them to a Roth IRA to avoid taxation on future earnings. Employees can initiate an in-service rollover of their after-tax 401(k) contributions to a Roth IRA. Any growth in the after-tax account before conversion is taxable, so it’s important to roll funds over frequently, such as annually or semi-annually, to minimize the tax liability on earnings.

When rolling funds out of the 401(k), the IRS allows employees to separate after-tax contributions from their earnings. The after-tax portion is rolled into a Roth IRA, where it grows tax-free. The earnings portion is rolled into a Traditional IRA, preserving tax deferral until withdrawals are made in retirement. This method ensures that only pre-tax growth is taxed later while keeping all original after-tax contributions in a Roth account.

Example Scenario

David, a Baker Hughes employee earning $250,000 per year, wants to maximize his retirement savings. He first contributes $23,500 to his pre-tax 401(k) to take advantage of tax deductions and receives the full 5% employer match, adding $12,500 in matching contributions. Baker Hughes also deposits the 4% base contribution, adding another $10,000.

Having reached the pre-tax 401(k) contribution limit, David still has room to contribute more within the overall IRS cap of $70,000. To fully utilize this limit, he makes an additional $24,000 in after-tax contributions, increasing his total contributions to $47,500. Including Baker Hughes’ employer contributions, this brings his total 401(k) contributions for the year to the IRS limit of $70,000.

At the end of the year, David initiates an in-service rollover of his after-tax account. By this point, his $24,000 after-tax contributions have earned an additional $2,000. David rolls the $24,000 into his Roth IRA, where it will grow tax-free, and transfers the $2,000 in earnings into a Traditional IRA to defer taxes until retirement. This ensures his contributions are in the most tax-efficient accounts and that future growth remains untaxed in his Roth IRA.

By consistently following this strategy each year, David builds significant tax-free retirement savings while staying within IRS limits and taking full advantage of Baker Hughes’ employer contributions.

Things to Consider

While the Mega Backdoor Roth strategy provides significant tax advantages, there are several important factors to keep in mind before implementing it. Understanding how it interacts with other retirement strategies and tax rules will help you maximize tax benefits while avoiding potential pitfalls.

Impact on Backdoor Roth IRA Conversions

If you are also utilizing a Backdoor Roth IRA strategy, it’s important to be mindful of the pro-rata rule. This rule requires that when you convert pre-tax IRA balances to a Roth IRA, the IRS considers all your IRA funds (including pre-tax and after-tax amounts) as a single pool. If your Mega Backdoor Roth rollover includes earnings rolled into a Traditional IRA, it could impact the tax treatment of your Backdoor Roth IRA conversions. To avoid unexpected tax consequences, investors may wish to minimize pre-tax IRA balances before executing a Backdoor Roth IRA conversion.

Mega Backdoor Roth vs. Taxable Brokerage Accounts

Some employees may wonder whether it’s better to invest in a taxable brokerage account instead of executing a Mega Backdoor Roth conversion. While a brokerage account offers flexibility and access to a broader range of investments, a Roth IRA provides tax-free growth and withdrawals, making it a more efficient long-term savings vehicle. In a taxable account, investment gains are subject to capital gains tax, while qualified Roth IRA withdrawals remain tax-free in retirement. If your goal is long-term, tax-advantaged growth, the Mega Backdoor Roth is generally the superior option.

The Five-Year Rule for Roth Conversions

A crucial aspect of Roth conversions is the five-year rule. Each Roth conversion has its own five-year clock, meaning that funds converted from a 401(k) to a Roth IRA must remain in the account for at least five years before they can be withdrawn tax-free. If you access converted funds before meeting this requirement and are under age 59½, you may owe taxes and penalties on the withdrawal.

Conclusion

The Mega Backdoor Roth conversion offers Baker Hughes employees a unique opportunity to maximize their tax-advantaged 401(k) savings beyond traditional contribution limits. By leveraging after-tax contributions and rolling them into a Roth IRA, employees can significantly increase their tax-free retirement savings while taking full advantage of employer contributions.

While this strategy requires careful execution to avoid tax pitfalls, it provides an excellent way to accumulate substantial Roth assets over time. Regular rollovers prevent excessive taxable earnings from building up in the after-tax account, ensuring the strategy remains efficient from a tax perspective.

At Rhame & Gorrell Wealth Management, we have experience helping Baker Hughes employees navigate their 401(k) benefits and implement strategies like Mega Backdoor Roth conversions. Schedule a complimentary consultation today to make the most of your retirement savings with a plan tailored to your financial goals.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by Baker Hughes. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.