Baker Hughes SRP: Enhancing Your Retirement Beyond the 401(k)

A Guide For Demystifying The Baker Hughes Supplemental Retirement Plan (SRP)

The Supplemental Retirement Plan (SRP) offers a unique opportunity for eligible Baker Hughes employees to enhance their retirement savings beyond the limits of a traditional 401(k). Designed for high-earning employees, the SRP allows for additional tax-deferred savings, providing a valuable tool in your retirement strategy. Understanding the eligibility criteria, deferral options, benefit calculation, investment choices, and available strategies can help you make informed decisions to maximize your retirement readiness.

Eligibility and Participation

Eligibility for the SRP is generally targeted towards higher-earning employees. This typically includes senior executives and other key personnel.

Enrollment

Employees are usually invited to participate in the SRP through an enrollment notice from the company. This notice outlines the steps required to enroll, including selecting your deferral options and choosing your investment preferences. Timely enrollment is crucial, as it impacts when your contributions can start accruing benefits.

When enrolling in the SRP, you will have to make important decisions regarding how much of your salary and bonuses you wish to defer. These decisions are integral to your overall retirement strategy and should be made after careful consideration of your long-term financial goals and current financial situation.

Typically, there is an annual enrollment period during which you can make changes to your deferral elections. It’s important to review your SRP contributions regularly, in conjunction with changes to your income, financial goals, and retirement plans. Outside of this period, changes to deferral elections may be restricted, so planning ahead is essential.

Vesting

Employees are always 100% vested in their contributions and company basic contributions (5%). After 3 years of service, employees will be fully vested in the company base contributions (4%).

Deferrals and Contributions

Navigating the deferral and contribution landscape of the Baker Hughes Supplemental Retirement Plan (SRP) is a critical step in maximizing your retirement savings. The SRP offers unique opportunities and considerations for higher-income earners seeking to augment their retirement nest egg.

Employee Contributions

Employees can defer between 1% and 60% of their eligible base salary each year into the SRP. Additionally, individuals can defer between 1% and 100% of eligible bonus compensation in the year that it is payable.

The employee contributions are removed from the employee’s taxable income in the year that they are contributed. This effectively defers the income until the funds are withdrawn from the SRP in retirement.

Company Contributions

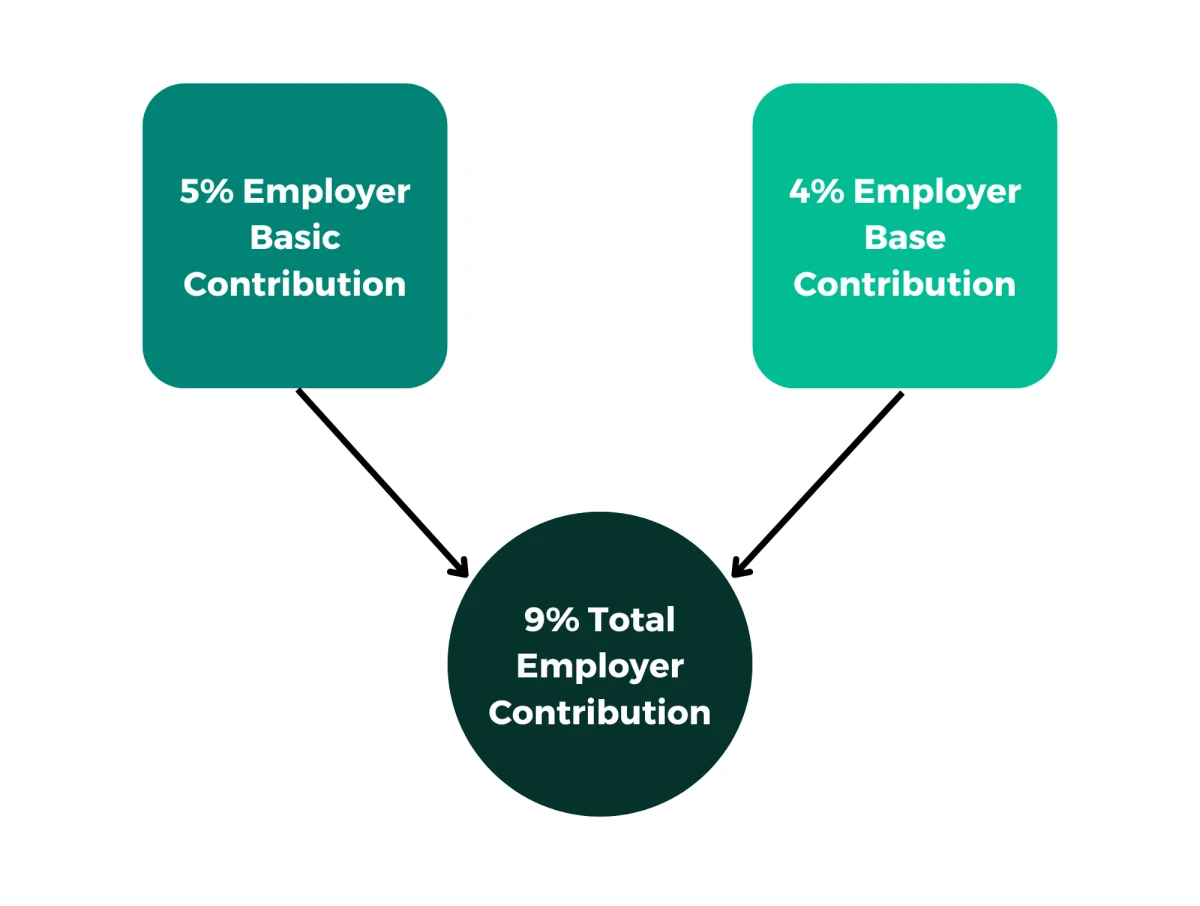

Baker Hughes provides two types of company contributions to the Supplemental Retirement Plan (SRP).

Basic Contribution

Baker Hughes contributes an amount equal to:

- 5% of the participant’s base salary deferrals and eligible bonus deferrals, and

- 5% of the participant’s base salary and eligible bonuses above the IRS compensation limit, after subtracting the base salary deferrals and eligible bonus deferrals.

Base Contribution

This contribution includes:

- 4% of the participant’s base salary deferrals and eligible bonus deferrals, and

- 4% of the participant’s eligible compensation above the IRS compensation limit, after subtracting the base salary deferrals and eligible bonus deferrals.

Essentially, the company matches 9% on any amount above the IRS limit for covered compensation ($350k for 2025). The company also matches 9% on any employee contribution, regardless of the IRS limit. However, the company does not match more than 9% on any dollar earned or contributed.

SRP Examples

The benefit calculation is relatively difficult to understand. In order to clarify, we have provided some examples and illustrations below.

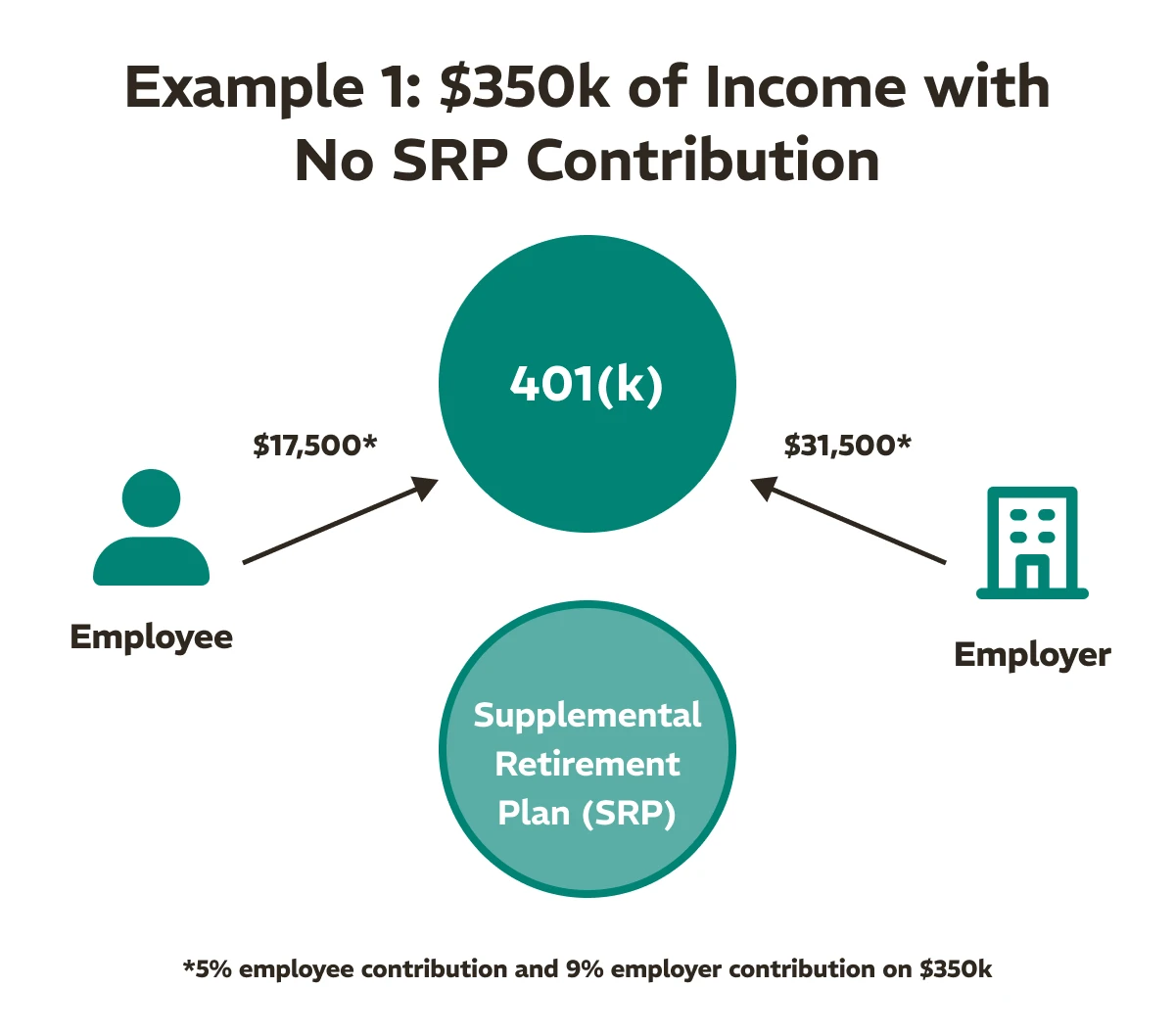

Example 1: No SRP Contribution, $350,000 Income

For the first example, we have an employee who makes $350,000 in total compensation. This employee does not elect to defer any of their compensation to the SRP.

- Employee’s Total Income (Base Salary and Bonus): $350,000

- Employee 401(k) Contribution: 5% of $350,000 = $17,500

- Company 401(k) Matching Contribution: 5% of $350,000 (IRS limit) = $17,500

- Company 401(k) Base Contribution: 4% of $350,000 (IRS limit) = $14,000

- Total 401(k) Contributions (Employee + Company): $17,500 (Employee) + $17,500 (Matching) + $14,000 (Base) = $49,000

- SRP Contribution: $0 (No contribution to SRP)

- Total Retirement Savings: $49,000 (All in 401(k))

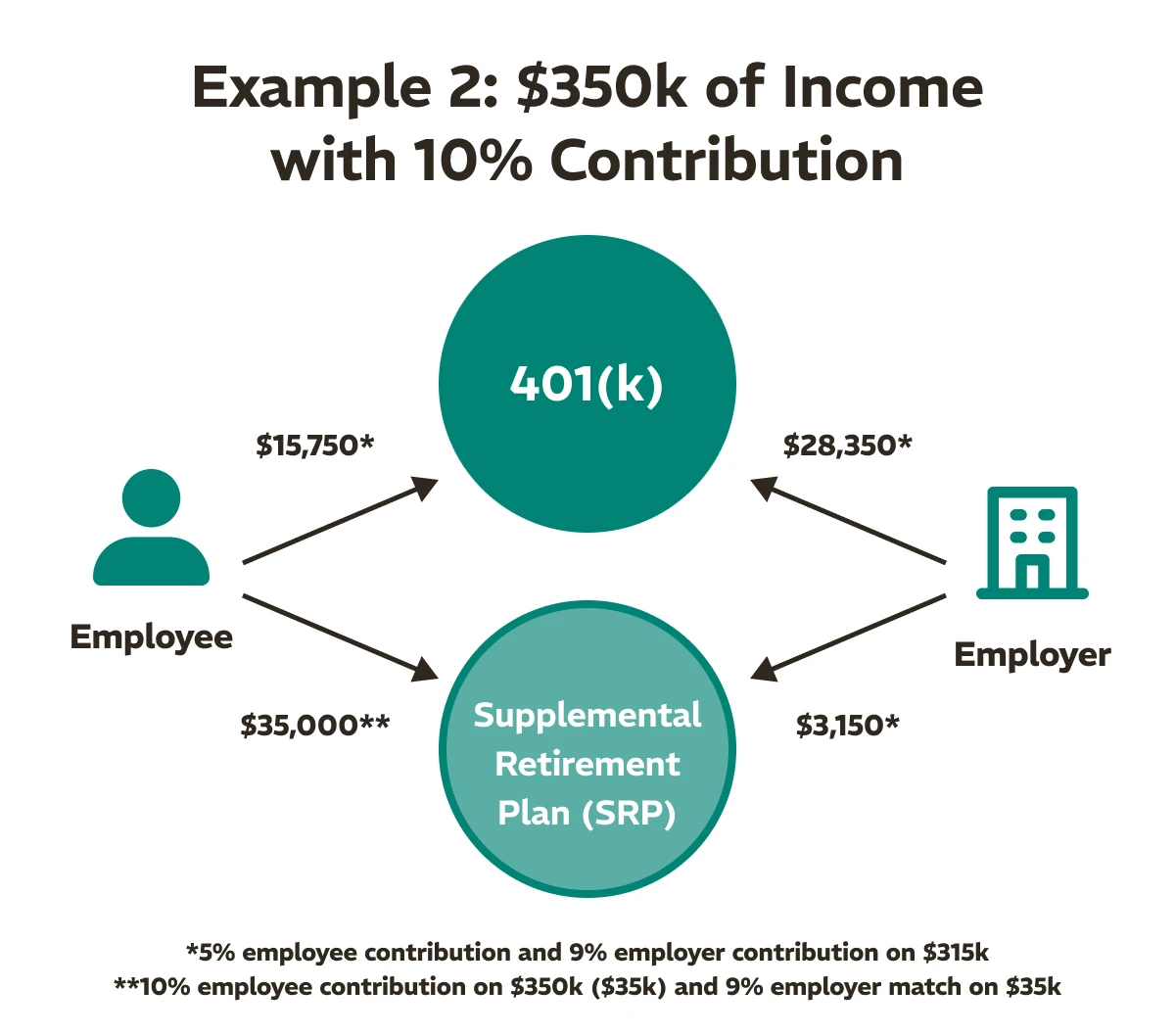

Example 2: 10% SRP Contribution, $350,000 Income

In the second example, we have the same employee from example 1 making $350,000 in total compensation. However, in this example, the employee elects to defer 10% of their compensation to the SRP.

- Employee’s Total Income (Base Salary and Bonus): $350,000

- Employee SRP Contribution: 10% of $350,000 = $35,000

- Remaining Income After SRP Contribution: $350,000 – $35,000 = $315,000

- Employee 401(k) Contribution: 5% of $315,000 = $15,750

- Company 401(k) Matching Contribution: 5% of $315,000 = $15,750

- Company 401(k) Base Contribution: 4% of $315,000 = $12,600

- Company SRP Basic Contribution: 5% of $35,000 = $1,750

- Company SRP Base Contribution: 4% of $35,000 = $1,400

- Total SRP Contributions (Employee + Company): $35,000 (Employee) + $1,750 (Basic) + $1,400 (Base) = $38,150

- Total Retirement Savings: $44,100 (401(k)) + $38,150 (SRP) = $82,250

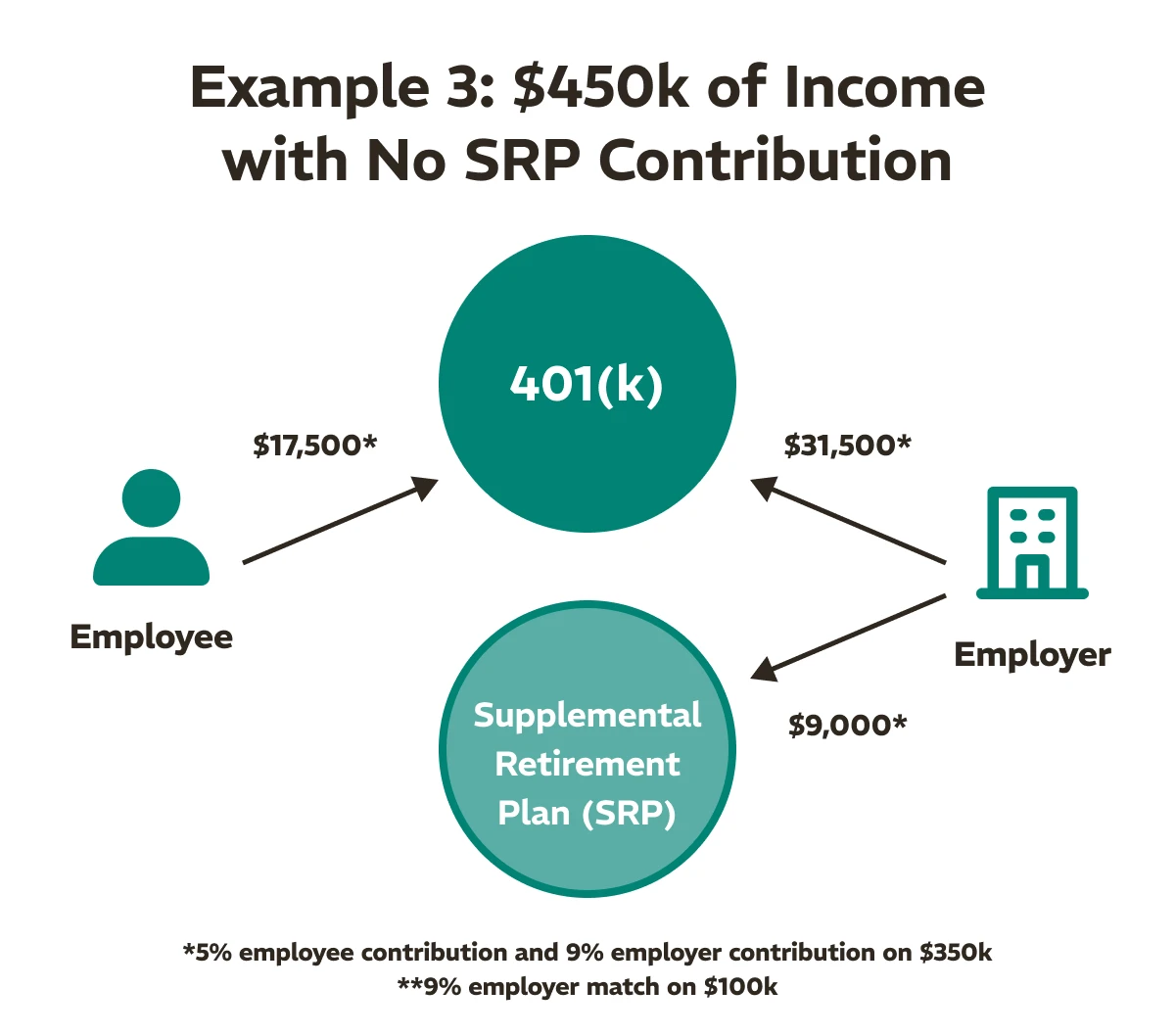

Example 3: No SRP Contribution, $450,000 Income

For this example, we have an employee who makes $450,000 in total compensation. This employee does not elect to defer any compensation to the SRP.

- Employee’s Total Income (Base Salary and Bonus): $450,000

- Employee 401(k) Contribution: 5% of $350,000 = $17,500

- Company 401(k) Matching Contribution: 5% of $350,000 (IRS limit) = $17,500

- Company 401(k) Base Contribution: 4% of $350,000 (IRS limit) = $14,000

- SRP Eligible Income (Excess over IRS limit): $450,000 – $350,000 = $100,000

- Company SRP Basic Contribution: 5% of $100,000 = $5,000

- Company SRP Base Contribution: 4% of $100,000 = $4,000

- Total SRP Contributions (Company Only): $5,000 (Basic) + $4,000 (Base) = $9,000

- Total Retirement Savings: $49,000 (401(k)) + $9,000 (SRP) = $58,000

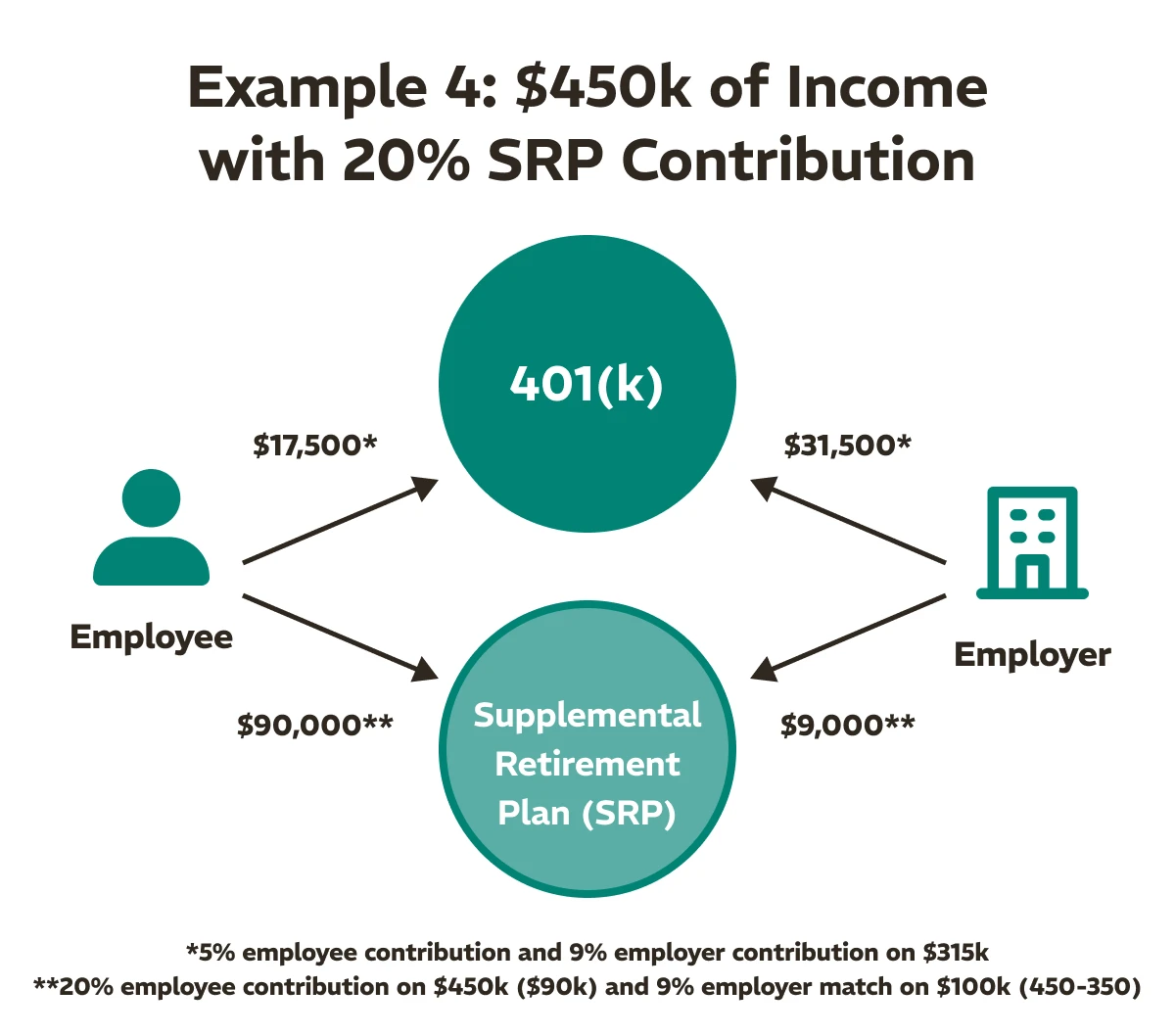

Example 4: 20% SRP Contribution, $450,000 Income

In the final example, we have the same employee from example 3 making $450,00 in total compensation. However, in this example, the employee elects to defer 20% of their compensation to the SRP.

- Employee’s Total Income (Base Salary and Bonus): $450,000

- Employee SRP Contribution: 20% of $450,000 = $90,000

- Remaining Income After SRP Contribution: $450,000 – $90,000 = $360,000

- Employee 401(k) Contribution: 5% of $350,000 = $17,500

- Company 401(k) Matching Contribution: 5% of $350,000 (IRS limit) = $17,500

- Company 401(k) Base Contribution: 4% of $350,000 (IRS limit) = $14,000

- SRP Eligible Income (Excess over IRS limit): $360,000 – $350,000 = $10,000

- Company SRP Basic Contribution on Deferral: 5% of $90,000 = $4,500

- Company SRP Base Contribution on Deferral: 4% of $90,000 = $3,600

- Company SRP Basic Contribution on Excess: 5% of $10,000 = $500

- Company SRP Base Contribution on Excess: 4% of $10,000 = $500

- Total SRP Contributions (Employee + Company): $90,000 (Employee) + $4,500 (Basic on Deferral) + $3,600 (Base on Deferral) + $500 (Basic on Excess) + $400 (Base on Excess) = $99,000

- Total Retirement Savings: $45,000 (401(k)) + $99,000 (SRP) = $144,000

Taxation of SRP

The Baker Hughes Supplemental Retirement Plan (SRP) is a non-qualified plan, meaning it follows different tax rules compared to a 401(k).

Contributions

The SRP, as a non-qualified plan, allows for tax-deferred contributions, similar to a 401(k). This means that taxes on contributions are deferred until withdrawal, potentially reducing your taxable income during your high-earning years.

However, unlike a 401(k), the SRP funds are subject to the claims of Baker Hughes’ creditors in the event of the company’s insolvency. This presents a distinct risk profile, as the funds in a 401(k) are protected by ERISA and are under the employee’s ownership, irrespective of the financial state of the company.

Distributions

SRP distributions can be received in two ways: lump sum or installment payments over 2 to 20 years. The taxation of these distributions depends on the chosen method:

- Lump Sum: The entire amount is taxed as ordinary income in the year it is received.

- Annual Installments: These are also taxed as ordinary income, but spreading the distribution over several years can potentially place the employee in a lower tax bracket each year, reducing the overall tax liability.

Tax Strategies for High Earners

For high-earning individuals, strategic deferral of funds into the SRP can be a smart move. By deferring a significant portion of income into the SRP, one’s taxable income can be reduced in years of high earnings. Then, opting for installment payments during retirement can potentially lower their overall tax liability. This strategy not only defers taxes but also can lower your total taxes paid, optimizing your retirement planning and tax efficiency. However, it is very important to be aware of the risks associated with SRP contributions mentioned above.

Investment Options

The Baker Hughes SRP offers more investment options than the 401(k). With the increased complexity, it is important to be strategic in your allocations in order to meet the appropriate level of risk. We will explore each of these fund options below:

Core Funds – Equity

- Emerging Markets Equity Fund (RREMX): Aims for long-term capital appreciation by investing in a broad and diverse group of securities from emerging markets, including small cap issuers and value securities. The goal is to outperform the MSCI Emerging Markets Index.

- International Growth Equity Fund (HNGFX): Focuses on long-term total return by investing primarily in foreign companies with potential for sustainable growth, aiming to outperform the MSCI EAFE Index.

- International Value Equity Fund (FMIYX): Seeks long-term capital growth by investing in foreign equity securities using a bottom-up, value-oriented approach, with the objective to outperform the MSCI EAFE Index.

- Non-U.S. Developed Markets Equity Index Fund (VTMGX): Strives to track the performance of the FTSE Developed All Cap ex US Index.

- U.S. Small Cap Growth Equity Fund (WSMRX): Targets long-term growth of capital by investing in small and mid-cap companies exhibiting growth characteristics, aiming to outperform the Russell Mid Cap Growth TR Index.

- U.S. Small Cap Value Equity Fund (FMIUX): Seeks long-term growth of capital by investing in small and mid-cap companies with a value approach, intending to outperform the Russell 2000 Value Index.

- U.S. Growth Equity Fund (TRLGX): Aims for long-term growth of capital by investing in a diversified equity portfolio, targeting to outperform the Russell 1000 Growth Index.

- U.S. Value Equity Fund (FMIQX): Focuses on long-term growth of capital by investing in mid- and large-cap companies using a value approach, with the goal to outperform the Russell 1000 Value Index.

- S&P 500 Index Fund (FXAIX): Seeks to approximate the risk and return characteristics of the S&P 500 Index.

Core Funds – Bond and Money Market Funds

- Opportunistic Bond Fund (BSIKX): Targets total return consistent with capital preservation, investing in a mix of fixed income securities to outperform the Bloomberg Barclays U.S. Universal Index.

- Inflation Protection Fund (VAIPX, PTTRX): Provides inflation protection and income by investing in inflation-indexed bonds, aiming to outperform the Barclays Capital U.S. Treasury Inflation Protected Securities Index.

- U.S. Bond Index Fund (FXNAX): Seeks to provide investment results corresponding to the Bloomberg Barclays U.S. Aggregate Bond Index.

- Money Market Fund (VMFXX): Focuses on current income consistent with capital preservation and liquidity, investing in high-quality money market instruments.

Style Funds

- Conservative Style Fund (JFLJX): Aims for income and capital appreciation, investing primarily in a diversified group of mutual funds with a 70% income securities and 30% equity securities allocation strategy.

- Moderate Style Fund (JFQUX): Seeks income and capital appreciation, investing primarily in a mix of fixed income and equity securities with a 50/50 allocation.

- Extended Style Fund (JFBUX): Targets income and capital appreciation, focusing on a diversified portfolio with a 30% income securities and 70% equity securities allocation.

- Maximum Style Fund (JFTUX): Aims for income and capital appreciation with a high equity exposure, investing primarily in a diversified group of mutual funds with a 10% income securities and 90% equity securities allocation

Conclusion

The Baker Hughes Supplemental Retirement Plan (SRP) offers a valuable opportunity for high-earning employees to enhance their retirement planning. By understanding the intricacies of this non-qualified plan, including its tax-deferred contributions, employer match, diverse investment options, and flexible distribution choices, employees can make informed decisions to maximize their retirement benefits.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by Baker Hughes. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealtha Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.