Understanding The BOI Form Requirement For Small Businesses – Common Questions

What You Need To Know About The New Beneficial Ownership Information Reporting Requirement Effective January 1, 2024

As of January 1, 2024, small businesses will be required to file a new form called the Beneficial Ownership Information Form or BOI. This new reporting requirement was enacted as part of the 2021 National Defense Authorization Act (NDAA) and as an amendment to the prior Bank Secrecy Act (BSA). This Corporate Transparency Act (CTA) is meant to close the information gap around small businesses’ involvement in money laundering and illicit acts such as hiding gains through the use of shell companies and other opaque ownership structures.

This reporting is being overseen by the Financial Crimes Enforcement Network (FinCEN) which is a part of the US Department of Treasury. In order to clarify this new reporting requirement, we have compiled a list of answers to the common questions surrounding these changes.

Who Must File a BOI?

Corporations, Limited Liability Companies (LLCs), or any business created by filing a formation document with a secretary of state are required to file a BOI form with FinCEN. Unfortunately, this definition is very inclusive and means that one of the most common entity types (single member LLCs) will need to file.

These businesses are referred to as “reporting companies”. There are certain companies that are exempt from filing the BOI despite meeting this requirement. This is due to other reporting requirements that are deemed as more stringent than the BOI form.

These exempt companies include banks, securities reporting issuers, government authorities, money services businesses, accounting firms, public utilities, tax-exempt entities, large operating companies, and financial companies. Sole proprietorships are not considered reporting companies unless the sole proprietorship was created in the US by filing documents with the secretary of state.

How Often Must I File a BOI?

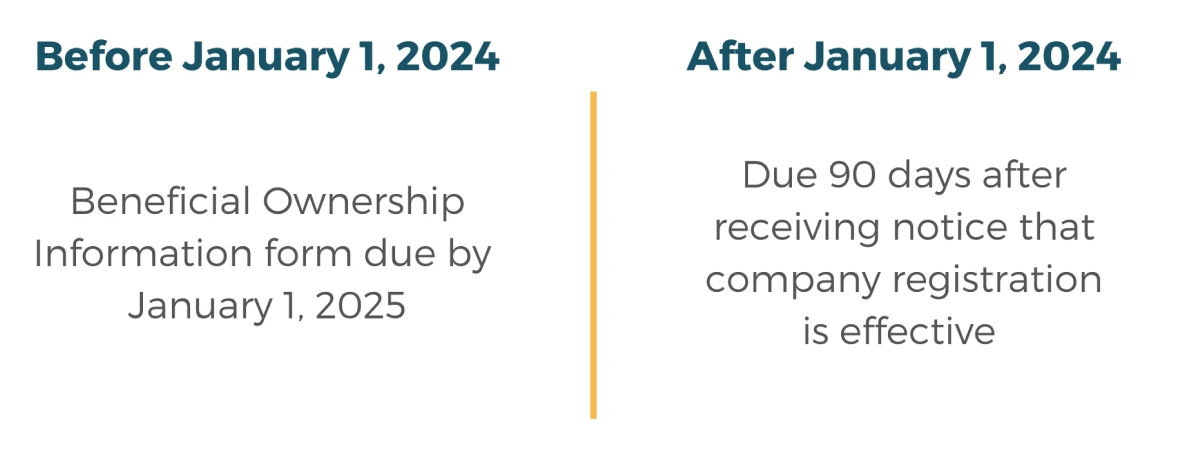

There are different requirements for companies created or registered before January 1, 2024, and those created or registered during 2024. For a reporting company created or registered to do business before January 1, 2024, the initial forms are due by January 1, 2025. A reporting company created or registered in 2024 has 90 calendar days to file after receiving notice that the registration is effective. While it isn’t relevant right now, it is worth noting that companies formed after January 1, 2025 will only have 30 days to file the BOI form.

The good news is that once this BOI form is filed, it is not necessary to correct it unless the ownership of your company or its location changes. Every subsequent form is due 30 days preceding a change in the reported information. As a result, this report does not need to be filed annually like a tax return. Instead, it only needs to be filed along with changes to a company’s structure or location.

How Do I File My BOI?

There are two ways you can file your BOI form. The first way is to download the FinCEN BOI PDF form and then upload the PDF to the FinCEN website. The second way is to complete the form directly on the FinCEN website: BOI E-FILING (fincen.gov)

There is no filing fee for this form, it is completely free. Please be sure to use the website listed above, as there might be fraudulent websites claiming they can file this form for a fee.

What Information Will I need to File My BOI?

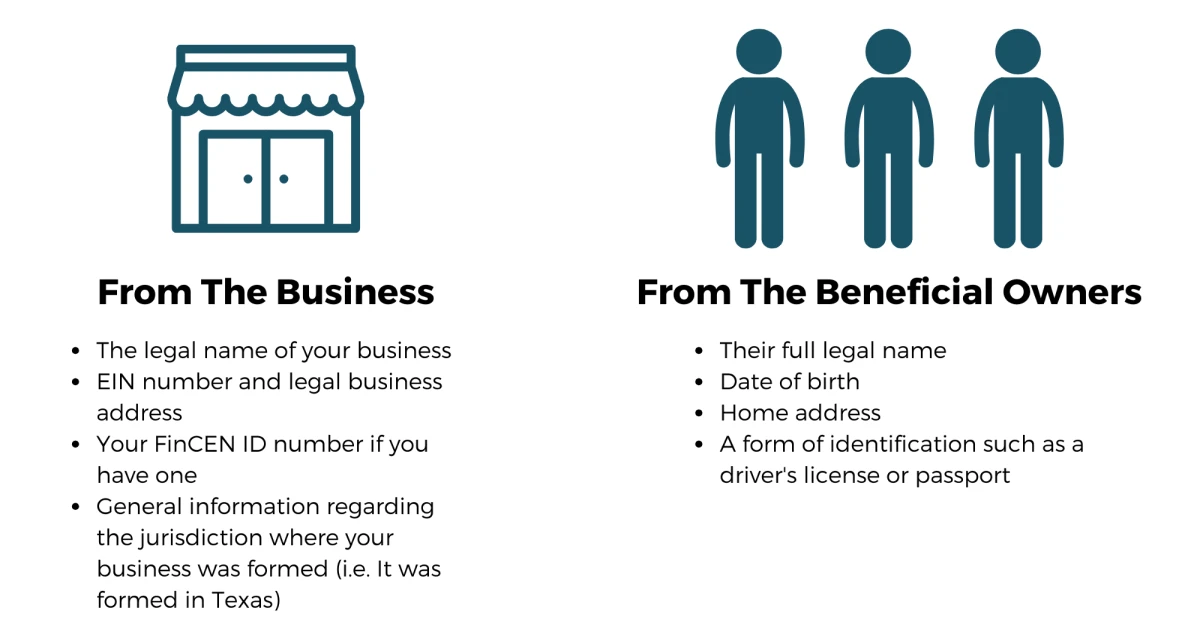

The BOI is purely an informational report and is therefore relatively straightforward to complete. You will need:

- The legal name of your business

- EIN number and legal business address

- Your FinCEN ID number if you have one (if not you are able to request one on your initial filing of the BOI)

- General information regarding the jurisdiction where your business was formed (i.e. It was formed in Texas).

You will also need to fill out some personal information on the owners and beneficial owners of the company. Beneficial owners are defined as those owners who can directly or indirectly exercise control over the reporting company or who owns or controls 25% or more of the reporting company’s ownership interest. Each person listed on the BOI will need to provide:

- Their full legal name

- Date of birth

- Home address

- A form of identification such as a driver’s license or passport.

FAQs

What specific criteria define a “beneficial owner” for the purposes of this requirement?

A “beneficial owner” is typically defined under such regulations as any individual who, directly or indirectly, owns 25% or more of the equity interests of the company or exercises significant control over the company. This can include individuals who have significant responsibility to control, manage, or direct a legal entity customer, including an executive officer or senior manager. The criteria aim to uncover the actual individuals who benefit from or have significant influence over the company, beyond just the named owners or managers.

Are there any penalties for non-compliance or submitting inaccurate information?

Regarding penalties for non-compliance or submitting inaccurate information, the regulations typically enforce strict penalties to ensure adherence. These can include substantial fines or even criminal charges, depending on the severity and intentionality of the non-compliance. The goal is to deter businesses from either neglecting their reporting obligations or attempting to obscure their true ownership.

How will the information submitted through the BOI form be used by FinCEN, and what measures are in place to protect this sensitive information?

As for the use and protection of the information submitted through the BOI form, FinCEN is tasked with using this data to aid in the prevention of financial crimes, such as money laundering and terrorism financing. The agency is expected to maintain stringent security measures to protect this sensitive information, including access controls, encryption, and other cybersecurity protocols. The information is used by law enforcement and regulatory agencies to investigate and prosecute financial crimes, but access is tightly regulated to prevent misuse or unauthorized disclosure.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.