The Chevron ESIP: Mega Backdoor Roth Strategies

A Comprehensive Guide on Mega Backdoor Roth Conversions with the Chevron Employee Savings Investment Plan (ESIP)

The Mega Backdoor Roth is a powerful strategy for Chevron employees looking to maximize the retirement saving capabilities of the Employee Savings Investment Plan (ESIP). By converting after-tax contributions in your ESIP to a Roth account, this strategy enables you to exceed the standard limit for direct Roth contributions, allowing for greater tax-free growth potential.

Executing a Mega Backdoor Roth Conversion with the Chevron ESIP requires a nuanced understanding of the plan’s structure, particularly the distinction between Basic and Supplemental contributions, company matching rules, and the operational requirements to complete this transaction. In this guide, we’ll walk you through each step of the process to ensure you can fully leverage this opportunity to enhance your retirement strategy.

Mega Backdoor Roth Strategy

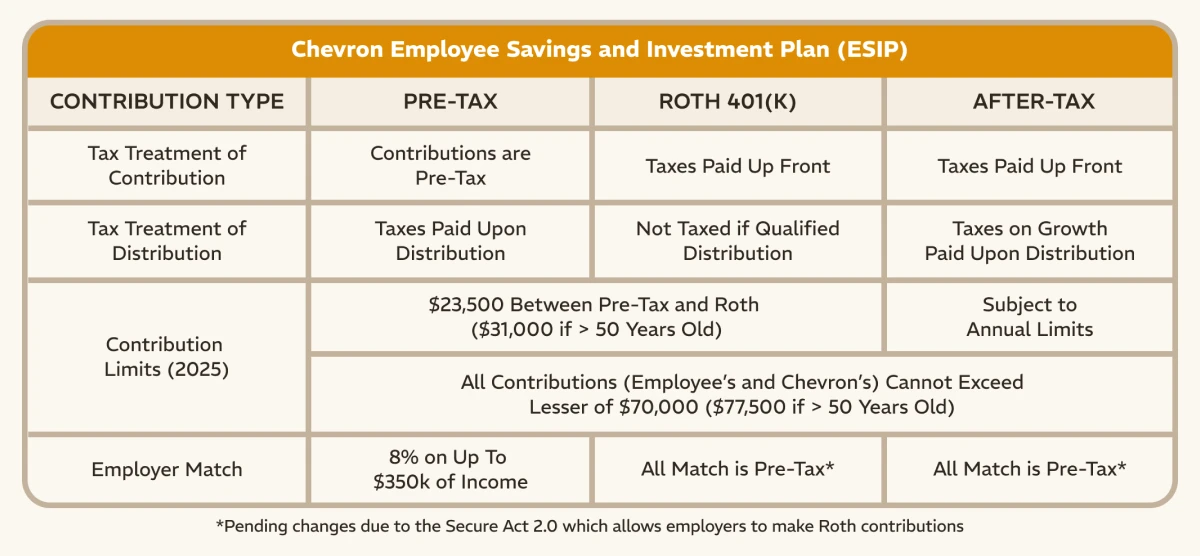

Most Chevron employees know they can contribute to their Chevron ESIP through pre-tax and Roth contributions. For 2025, employees can contribute up to $23,500 a year ($31,000 if age 50 or older) from their paycheck. It is less commonly known that the ESIP allows additional after-tax contributions beyond this limit. In order to fully understand this strategy, it is important to be aware of the key components involved.

Key Components of the Strategy

-

After-Tax Contributions:

- Employees can make after-tax contributions beyond the standard Pre-Tax and Roth 401(k) contribution limits, up to the combined annual limit of $70,000 (or $77,500 for those aged 50 or older in 2025). These after-tax contributions form the foundation of the Mega Backdoor Roth strategy.

-

The Role of Basic vs. Supplemental Contributions:

- In the Chevron ESIP, contributions are categorized as either Basic or Supplemental:

- Basic Contributions: These are the first 2% of an employee’s contributions made each pay period to any of the ESIP accounts (Pre-Tax, Roth, or After-Tax). Basic contributions are eligible for the company match, but attempting to convert Basic after-tax contributions into a Roth account results in suspension from the ESIP.

- Supplemental Contributions: These are contributions made beyond the Basic contributions. Supplemental contributions to the After-Tax account are not subject to the same restrictions, making them the preferred source for Roth conversions.

- In the Chevron ESIP, contributions are categorized as either Basic or Supplemental:

-

Company Match and No True-Up Clause:

- Chevron matches only Basic contributions and does not offer a true-up clause. This means employees must contribute at least 2% as Basic contributions each pay period throughout the year to receive the full company match. Missing even a single contribution could result in forfeiting part of the company match for the year.

Challenges and Planning Considerations

The division between Basic and Supplemental contributions creates additional challenges for Chevron employees pursuing the Mega Backdoor Roth strategy. Careful planning is required to balance the need for maximizing the company match with the goal of optimizing after-tax contributions for Roth conversions. This often involves calculating total contributions at the beginning of the year and setting contribution percentages to meet both objectives.

Chevron ESIP: Mega Backdoor Roth Conversion Example

To illustrate how Chevron employees can navigate the complexities of the Chevron ESIP: Mega Backdoor Roth Conversion strategy, let’s consider an example:

Employee Salary

- Annual Salary: $235,000

- Retirement Savings Goals: Maximize deductible contributions, secure the full company match, and utilize after-tax contributions for Roth conversions.

-

Step 1: Allocating Contributions to Maximize Deductible Contributions and Company Match:

- The employee contributes a total of 10% to the Pre-Tax account, split as follows

- 2% Basic Pre-Tax Contributions: Ensures eligibility for Chevron’s company match

- 8% Supplemental Pre-Tax Contributions: Fully leverages the deductible contribution limit.

- Chevron matches 8% of the employee’s compensation if the 2% Basic Pre-Tax contribution is made. For this individual, the match totals $18,800 annually.

- The employee contributes a total of 10% to the Pre-Tax account, split as follows

-

Step 2: Using After-Tax Supplemental Contributions for Roth Conversions

- The employee allocates an additional 10% of their salary to Supplemental After-Tax contributions, totaling $23,500 annually. These contributions are directed to the After-Tax 401(k) account and will be used for Roth conversions.

-

Step 3: Converting After-Tax Contributions to Roth

- In order to complete a Mega Backdoor Roth Conversion at Chevron, the After-Tax funds must be rolled to outside IRAs. This is beneficial because it allows employees to avoid the Pro-Rata Rule, which can cause potential tax issues for in-plan conversions. By rolling funds outside of the plan, After-Tax contributions can be separated cleanly from their growth, maximizing tax efficiency. Let’s say the $23,500 of After-Tax contributions grow to $25,500.

-

Roll After-Tax Contributions to a Roth IRA:

- Roll the $23,500 of After-Tax contributions to a Roth IRA.

- This allows for future tax-free growth and tax-free withdrawals in retirement

-

Roll the Growth to a Traditional IRA:

- Roll the $2,000 of growth into a Traditional IRA

- This amount remains tax-deferred and will only be taxed when withdrawals are made in retirement.

-

Final Contribution Breakdown:

- Basic Pre-Tax Contributions: $4,700 (2% of salary)

- Supplemental Pre-Tax Contributions: $18,800 (8% of salary)

- Supplemental After-Tax Contributions: $23,500 (10% of salary)

- Company Match: $18,800 (8% of salary)

- Total Contributions: $65,800, including $23,500 in after-tax contributions converted to Roth.

-

- In order to complete a Mega Backdoor Roth Conversion at Chevron, the After-Tax funds must be rolled to outside IRAs. This is beneficial because it allows employees to avoid the Pro-Rata Rule, which can cause potential tax issues for in-plan conversions. By rolling funds outside of the plan, After-Tax contributions can be separated cleanly from their growth, maximizing tax efficiency. Let’s say the $23,500 of After-Tax contributions grow to $25,500.

Conclusion

The Mega Backdoor Roth Conversion offers Chevron employees a unique and powerful way to maximize their retirement savings and achieve tax-free growth. However, successfully implementing this strategy with the Chevron ESIP requires careful planning to navigate the complexities and potential pitfalls.

If you’re looking to make regular Roth conversions, the key to success is a thoughtful approach tailored to your specific financial situation. By understanding the nuances of the Chevron ESIP and working with experienced financial professionals, you can unlock the full potential of this strategy and build a more secure financial future.

At Rhame & Gorrell Wealth Management, we specialize in helping Chevron employees optimize their retirement benefits and implement advanced strategies like the Mega Backdoor Roth Conversion. Schedule a complimentary consultation today to explore how we can help you make the most of your retirement savings.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by Chevron. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealtha Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.