ConocoPhillips Retirement: Understanding Your Benefits

Everything You Need to Know as A ConocoPhillips Employee

Everyone wants to ensure they have saved enough to live the life they want in retirement. ConocoPhillips offers a robust benefits package to its employees and executives that can be an excellent tool for retirement savings if utilized correctly.

Below, we have put together an overview of the different retirement benefits available to ConocoPhillips employees. We will look to give you insight as to how each of the options work as well as how to maximize them for retirement.

ConocoPhillips 401(K)

The centerpiece of the ConocoPhillips retirement plan is the 401(K) also known as the ConocoPhillips Savings Plan (CPSP). It enables employees to save and invest a portion of their earnings for retirement on a tax-advantaged basis by contributing to either a pre-tax or Roth account. Contributions to the CPSP will be withheld according to a set percentage amount each pay period.

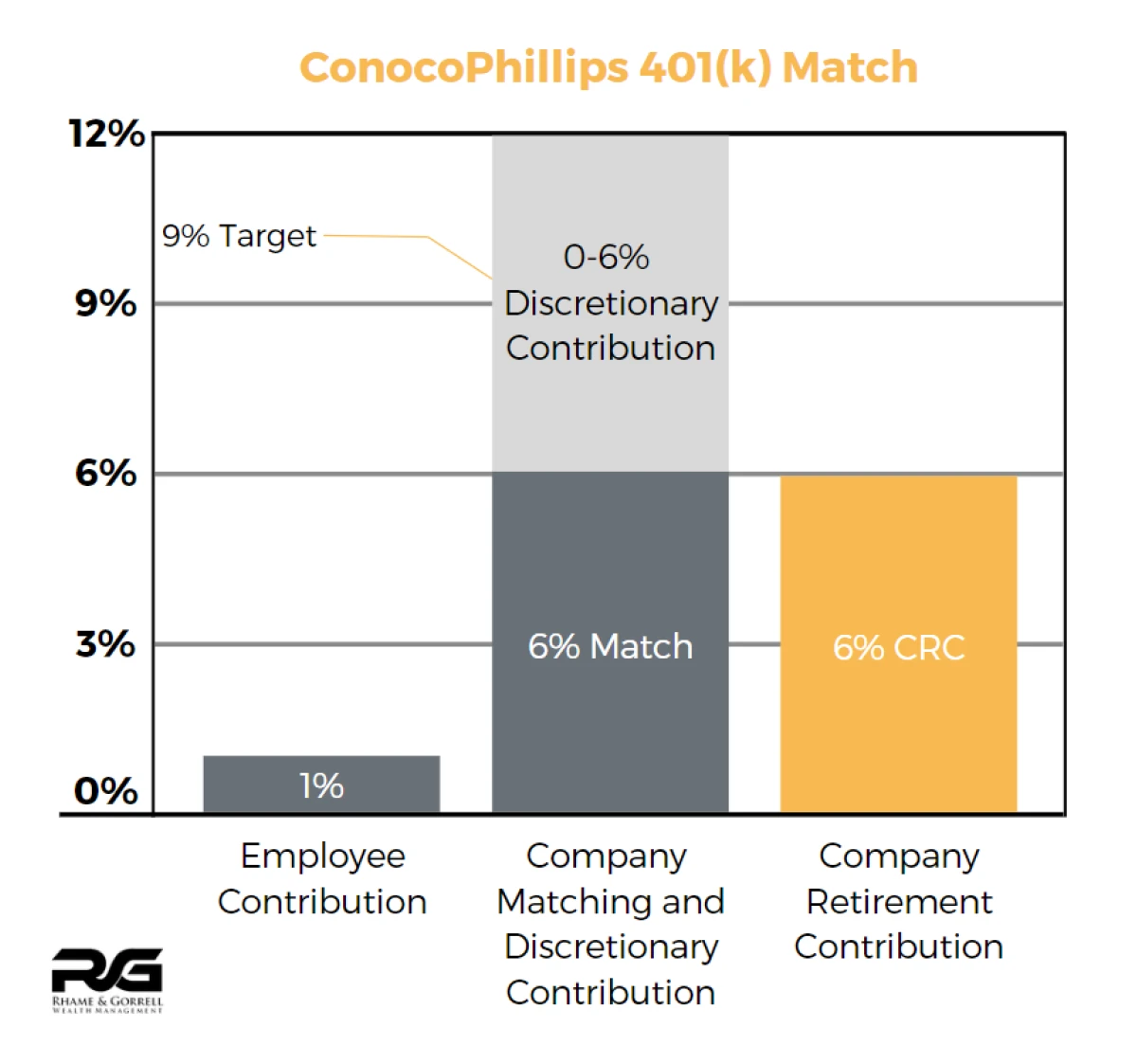

If a ConocoPhillips employee contributes at least 1% of their eligible pay each period to the CPSP, they will receive a 6% company match. On top of this, ConocoPhillips also has a discretionary contrition that can be up to 6% (but ConocoPhillips targets 3% annually).

This discretionary contribution paired with the employer match of 6% means that by a ConocoPhillips employee only contributing 1% of their eligible pay to CPSP, they will be matched 9% of their pay by ConocoPhillips through their company contribution. These benefits are vested immediately to the employee.

In addition to the employer match ConocoPhillips has company Retirement Contribution (CRC) of 6% of eligible pay each period. This 6% contribution requires no contribution by the employee and will vest after three years of service by a ConocoPhillips employee. All of these aspects of the CPSP help ConocoPhillips employees store large amounts away for retirement.

Once the funds are in the CPSP there are fixed options offed for employees to invest in. Employees are also able to invest in ConocoPhillips stock through this plan.

Employees that have been at ConocoPhillips for most of their employment could potentially have a large number of COP stock accumulated in their CPSP. If some of these shares were purchased when the stock price was lower than it is today, these employees might be able to benefit from a retirement tax savings strategy called Net Unrealized Appreciation or NUA. To read more about what NUA is and how it might benefit a ConocoPhillips employee, please see our NUA article for ConocoPhillips employees.

ConocoPhillips CPSP also allows high net worth employees supercharge their retirement through Mega Backdoor Roth Conversions. For more information on how this retirement planning tool works please see our Mega Roth article for ConocoPhillips employees.

ConocoPhillips Pension Plan

The next major part of the ConocoPhillips retirement plan is the ConocoPhillips Pension Plan (CPPP). This plan differs from the CPSP in that it is fully funded by ConocoPhillips.

The benefit received from the CPPP is determined by a formula that takes into account years of service, compensation, and social security benefits. This plan benefit will grow as the ConocoPhillips employee progresses through their career.

Once the employee reaches retirement, they will have a few different options on how to collect their accumulated pension benefits. The employee is allowed to take the money out as a lump sum that may be rolled into an Individual Retirement Account tax free. Here the employee has a great deal of flexibility in how the funds are invested as well as how and when the funds are distributed.

The other option at retirement would be to take the pension benefit as an annuity that will pay the employee a fixed income every month. This annuity can be for their life or for the joint life of the employee and a spouse.

The CPPP is one of the best benefits offered and is helpful in allowing ConocoPhillips employees to reach their retirement goals.

Stock Based Rewards, Options and Benefits

ConocoPhillips can offer a number of different stock rewards and incentives to employees. Through these programs, ConocoPhillips employees are granted shares of COP stock for reaching certain performance or service requirements.

Stock Rewards

Stock rewards are shares of stock that are usually given to an employee based on a vesting schedule. When the shares vest, they are given to the employee and the cost of the shares are included on the employee’s W-2 as taxable income for that year. Then, the employee may hold these shares as an investment and sell them at a later date.

Stock Options

Stock options on the other hand are a way for ConocoPhillips to incentivize employees to better the company and increase the COP stock price.

Essentially, ConocoPhillips gives the employee an option to buy a set number of COP shares at a certain price (price is established when options are granted). The hope is that the stock price will increase and by the time the employee can exercise the options, the current price of COP will be higher than the price on the options.

Employee Stock Purchase Program (ESPP)

Another benefit ConocoPhillips has is the ability for employees to join what is known as the Employee Stock Purchase Program or ESPP. This allows employees to have a portion of their paycheck withheld and used to purchase COP stock at a discounted price. These shares are not held in their CPSP but are instead held with a custodian called Computershare and can be sold at any time once they are purchased.

While employees have access to these shares of COP once they are vested or purchased, they are often not sold immediately and instead used to help fund employee retirement goals.

It is important for ConocoPhillips to keep an eye on how many shares of COP stock they have and what percentage of their overall investment portfolio they represent. If they start to become too large of a percentage of the employee’s overall investment portfolio, it could be beneficial to consider diversification into other investment assets to avoid their retirement goals being determined by the rise or fall of COP stock.

Conclusion

ConocoPhillips offers ample opportunities for employees to store away funds and investments for retirement. These different retirement vehicles can be an excellent source of retirement savings. It is important to fully understand the available benefits, and how to maximize them. Our advisory team is well-versed in these benefits and has helped many ConocoPhillips employees and executives retire successfully.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ConocoPhillips. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealtha Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.