Equity Portfolio Allocation: It’s Not a Simple Calculation

What Is The Best Allocation For Your Portfolio?

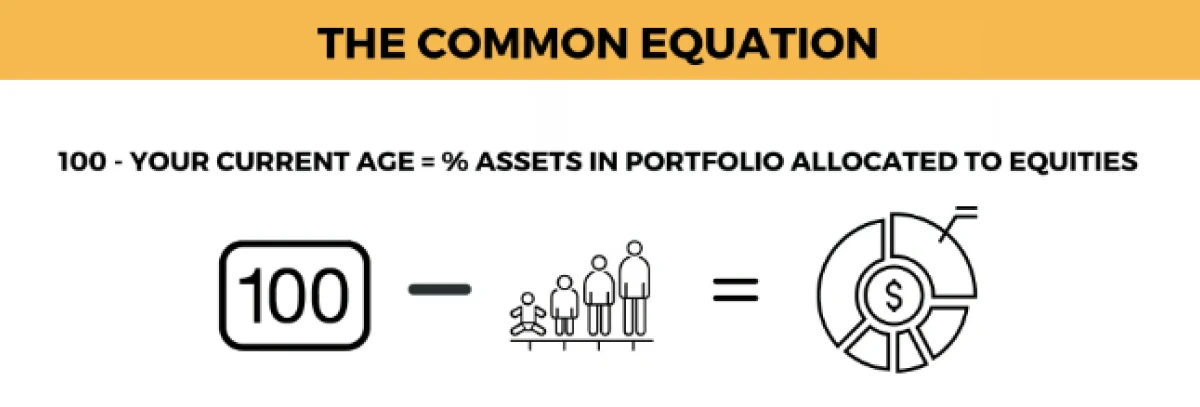

You might have been told at some point in your life that there is a simple calculation you may use to determine how you should allocate your assets between equity and fixed income assets. This formula is rudimentary and does not consider your personal retirement goals or risk appetite. This equation has misled investors for years and can cause you not to have sufficient assets to meet your goals or leave you awake at night, fearing that your accounts are too volatile or risky.

If someone in their 40s used this formula, it would tell them that their portfolio should contain only 60% equity investments. This formula is highly rudimentary and does not consider individual investors’ personal goals or feelings on risk.

Let’s look at another example. Say Johnny is 70. If he were to set his asset allocation based on this formula, he would invest 30% in equities and 70% in fixed-income assets. Let’s also say that Johnny has a significant risk appetite and is fine taking on a lot of risk. Further, Johnny would like to pay for his granddaughter to attend college in 5 years. The formula above would start to severely hurt Johnny in this situation as he would be alright if his assets were allocated 60% to equities and 40% to fixed income. This would give him a higher probability of reaching his investment goal of paying for his granddaughter’s college.

This formula could also hurt younger investors with very low-risk appetites. Let’s look at another example. Say Margaret is in her 30s and is very risk averse. She does not spend much money and is afraid of having any debt or seeing her investments have large swings based on market fluctuations. Based on the formula above, Margaret would be told to invest in a 70% equity portfolio and only have 30% fixed-income assets. This allocation keeps Margaret up at night, fearing her accounts could fall too far for them to recover and thinking she will never be able to retire.

As stated above, the main problem with the formula above is that it does not consider the individual’s risk appetite or financial goals. Here at Rhame and Gorrell Wealth Management, we do not look solely at your age to determine the most appropriate asset allocation. We work with you to determine the amount of investment risk you are comfortable taking while still achieving your unique investment goals. This will allow you to maximize the probability of achieving your financial goals and peace of mind.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.