Mega Backdoor Roth Conversions: A Comprehensive Guide

Understand How Mega Roth Conversions Can Optimize The Tax Treatment Within Your 401(k)

One of the most effective ways to prepare for retirement is to maximize the usage of tax-advantaged retirement savings vehicles like an IRA or 401(k). However, “Maxing Out” your plan means something different for employees of certain companies.

Most are frustrated by the low annual contribution limits for tax-advantaged vehicles like their Traditional or Roth IRA or their 401(k). At $7,000/year in an IRA and $23,500/year in a 401(k), many individuals wish there was a place to put their excess income above these limits, but just don’t know where.

Enter the Mega Backdoor Roth: a unique tax strategy with no upper limit on income for eligibility.

In what appears to be a significant change, the SECURE Act 2.0 enacted in December 2022 did not have language eliminating the Mega Roth strategy in the drafting phase or final legislation. We believe this bodes well for the ongoing availability of the strategy, which we will explore in depth below. As of 2025, Mega Backdoor Roth Conversions are still allowed.

Mega Backdoor Roth Strategy

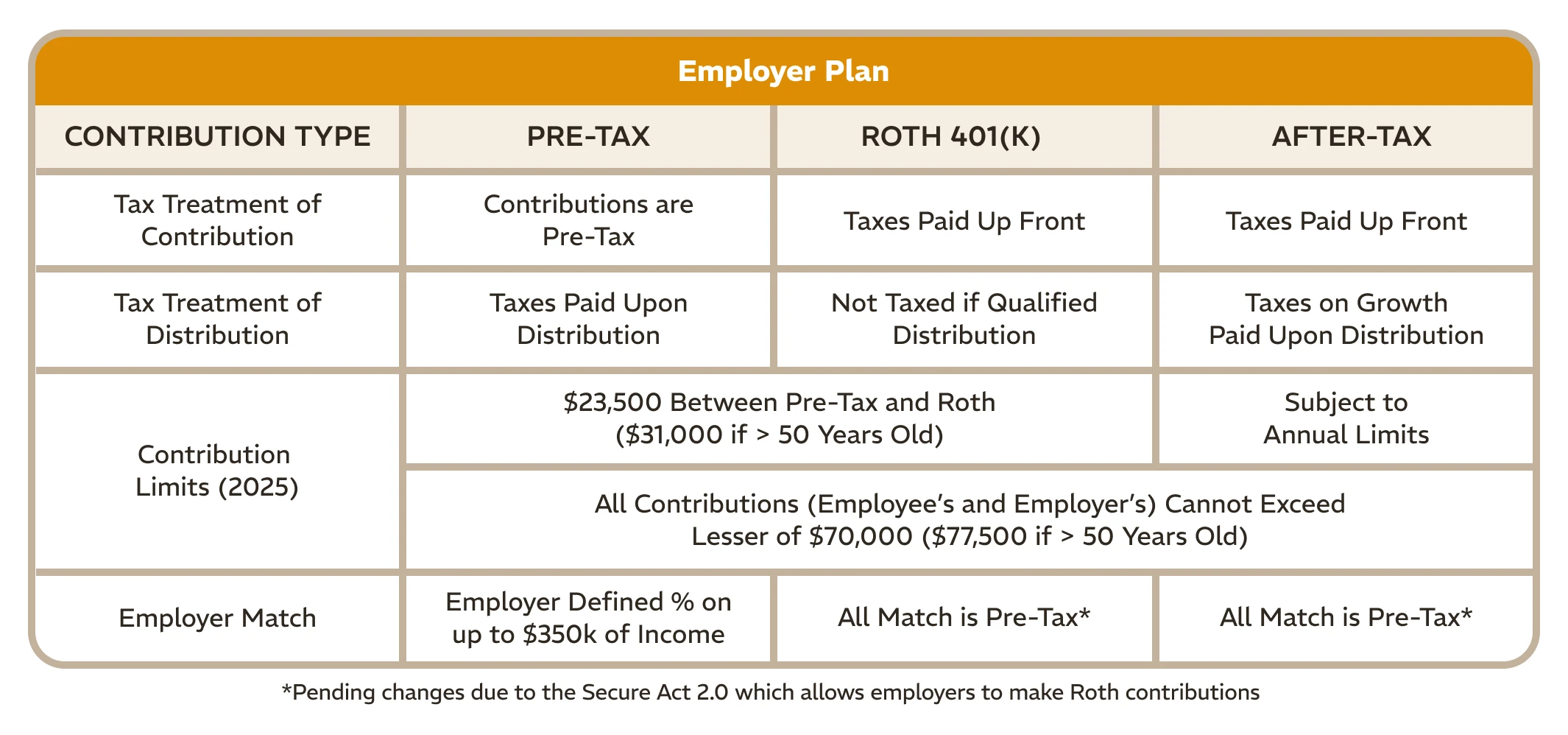

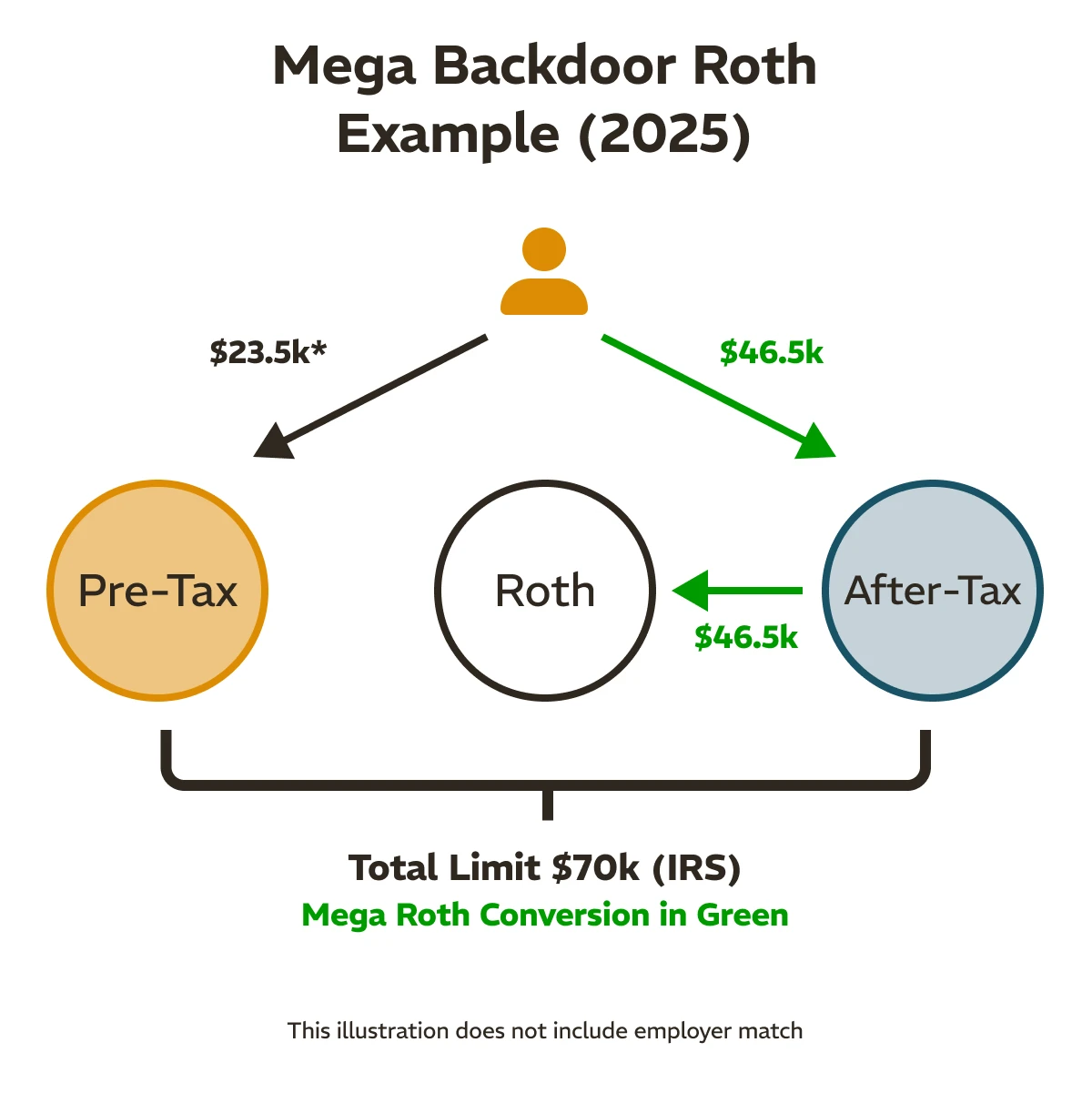

Most employees know they can contribute to their 401(k) through pre-tax and Roth contributions. Employees can generally contribute up to $23,500 a year ($31,000 if age 50 or older) from their paycheck. People are less aware that the 401(k) allows for additional after-tax contributions beyond this limit. Sometimes, these after-tax funds can be converted tax-free to Roth at your convenience.

HERE’S HOW IT WORKS:

Consider this example:

An employee (let’s call him Bob) has a salary of $250,000. He contributes the maximum pre-tax amount of $23,500 to his 401(k) for the year 2025. This remains $46,500 below the IRS limit of $70,000.

Let’s assume Bob then contributes $30,000 each year to the After-Tax account in the 401(k) for five years – a total of $150,000. Over the five years, this account balance has grown to $250,000. Therefore, for conversion purposes, $150,000 is Bob’s contribution basis, and $100,000 is growth.

Tax Implications of Mega Roth Conversions

Whenever a taxpayer gets a tax benefit, the government is close by, eager to receive their portion of the windfall. The IRS has instituted a Pro-Rata rule that mirrors the one associated with a traditional backdoor Roth IRA.

Conversely, this strategy would be more attractive if Bob had completed annual conversions. If Bob were to make ongoing conversions before any growth occurred, these After-Tax assets would be placed into the Roth Account and compound tax-free permanently. As the chart above shows, qualified Roth withdrawals are always tax free.

In essence, Bob can use this strategy to permanently eliminate the tax on the growth of After-Tax assets!

The Catch

If there is one, the catch is that many people already have a current after-tax balance in their 401(k). If you inadvertently contribute too much to the Pre-Tax or Roth accounts, the excess automatically rolls over to the After-Tax balance. While this does not prohibit you from taking advantage of this strategy, the After-Tax balance can grow over time and complicate conversion strategies.

Before making conversion decisions, it’s crucial identify your After-Tax account balance and compare that to your contribution basis (the sum of your Pre-1987 and Post-1986 contributions). This will give you an idea of how the Pro-Rata rule comes into play for the taxation of conversions.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.