Making The Most Of The Oxy Retirement Plan

A Guide For Maximizing The Oxy Money Purchase Pension Plan

Company sponsored retirement plans and robust benefits programs make building a healthy retirement portfolio an attainable feat. These are most commonly seen in the form of a 401(k) established by the employer. Oxy employees have access to a robust 401(k) Savings Plan with a robust selection of investment options and a generous company match. In addition to the 401(k) plan, Oxy also offers retirement savings through the company’s pension: the Oxy Retirement Plan.

For retirement plans such as 401(k)s, employees are generally required to contribute to the plan to receive a company matching contribution. Conversely, for pension plans like the Oxy Retirement Plan, employees receive a contribution without making a contribution of their own.

What is the Oxy Retirement Plan?

The Oxy Retirement Plan is a money purchase pension plan funded by the company to help provide additional financial security.

What is a Money Purchase Pension Plan?

A Money Purchase Pension Plan is a type of Defined Contribution plan that requires companies to make a specific contribution based on an employee’s income each year. Unlike certain other types of employer plans, a Money Purchase Pension Plan requires that the contributions are made regardless of the companies’ profitability. The contributions to the plan grow tax-deferred until the funds are distributed in retirement.

How Does a Money Purchase Pension Plan Work?

A Money Purchase Pension Plan appears similar to a 401(k), but differs in a few ways. Like 401(k) plans, the employee selects the investments for the funds, which can go up or down in value over time. After the contributions are made on the employee’s behalf, the employee is responsible for how the funds are invested. Although Money Purchase Pension Plans can in some cases allow employee contributions, they are typically made by the employer. The Oxy Retirement Plan does not allow employee contributions.

Contribution Limits for a Money Purchase Pension Plan

The contribution limits for a Money Purchase Pension Plan are very similar to those of a 401(k). The employer may contribute up to 25% of the employee’s covered compensation up to $70,000 for 2025. Additional contributions to other qualified 401(a) plans directly offset this contribution total.

For example, if an employee is maxing out their 401(k) at $23,500 and the employer has made a matching contribution to their 401(k) plan of $17,500, the total contributions to qualified 401(a) plans so far is $41,000. For this employee, the max contribution that could be made to a Money Purchase Pension Plan is an additional $29,000.

Oxy Retirement Plan Specifics

Although the Oxy Retirement Plan is a Money Purchase Pension Plan, just like any retirement plan, it has specific contribution percentages, investment and distribution options that are unique to it.

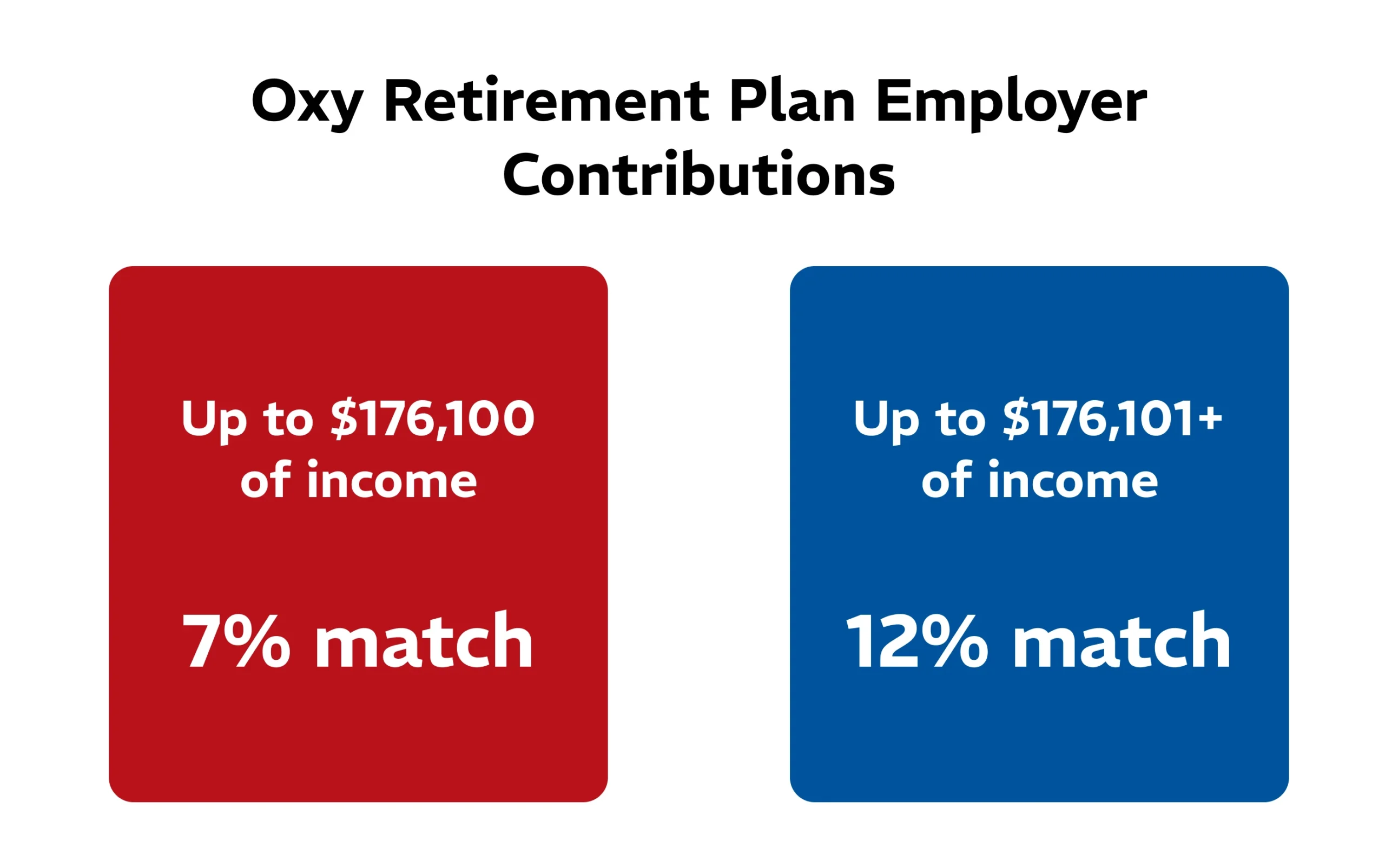

Oxy Contributions

The Oxy Retirement Plan contributions are made solely by the company. The contribution calculation can be complex depending on your level of income. First, the company makes a contribution of 7% of your salary, up to the Social Security Wage Base (SSWB). For 2025, this number is $176,100 and will increase each year based on inflation. Any cash compensation above the SSWB receives a 12% match from the company.

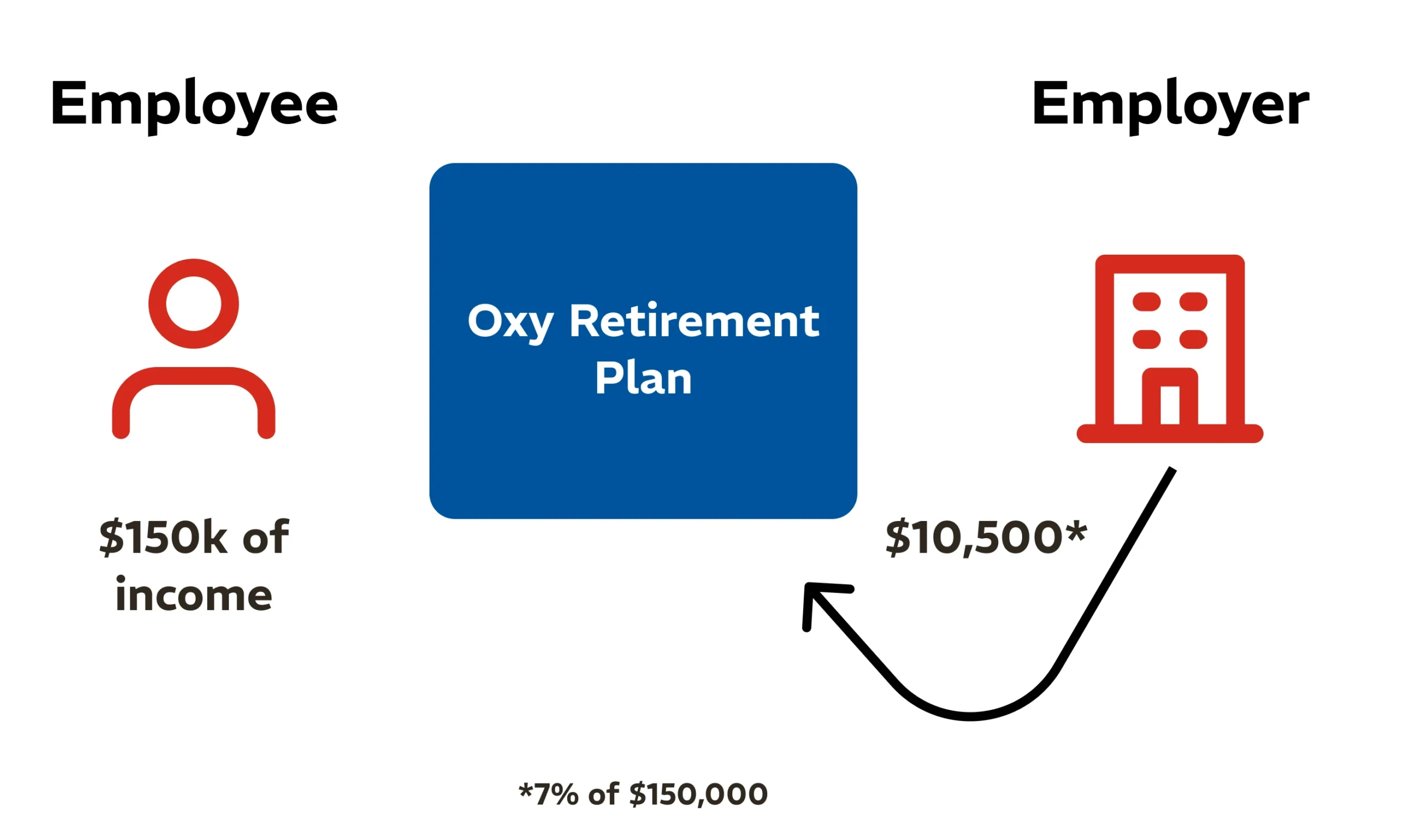

For example, an employee making $150,000 with the company would receive 7% of their compensation, or $10,500, deposited into their Oxy Retirement Plan throughout the year.

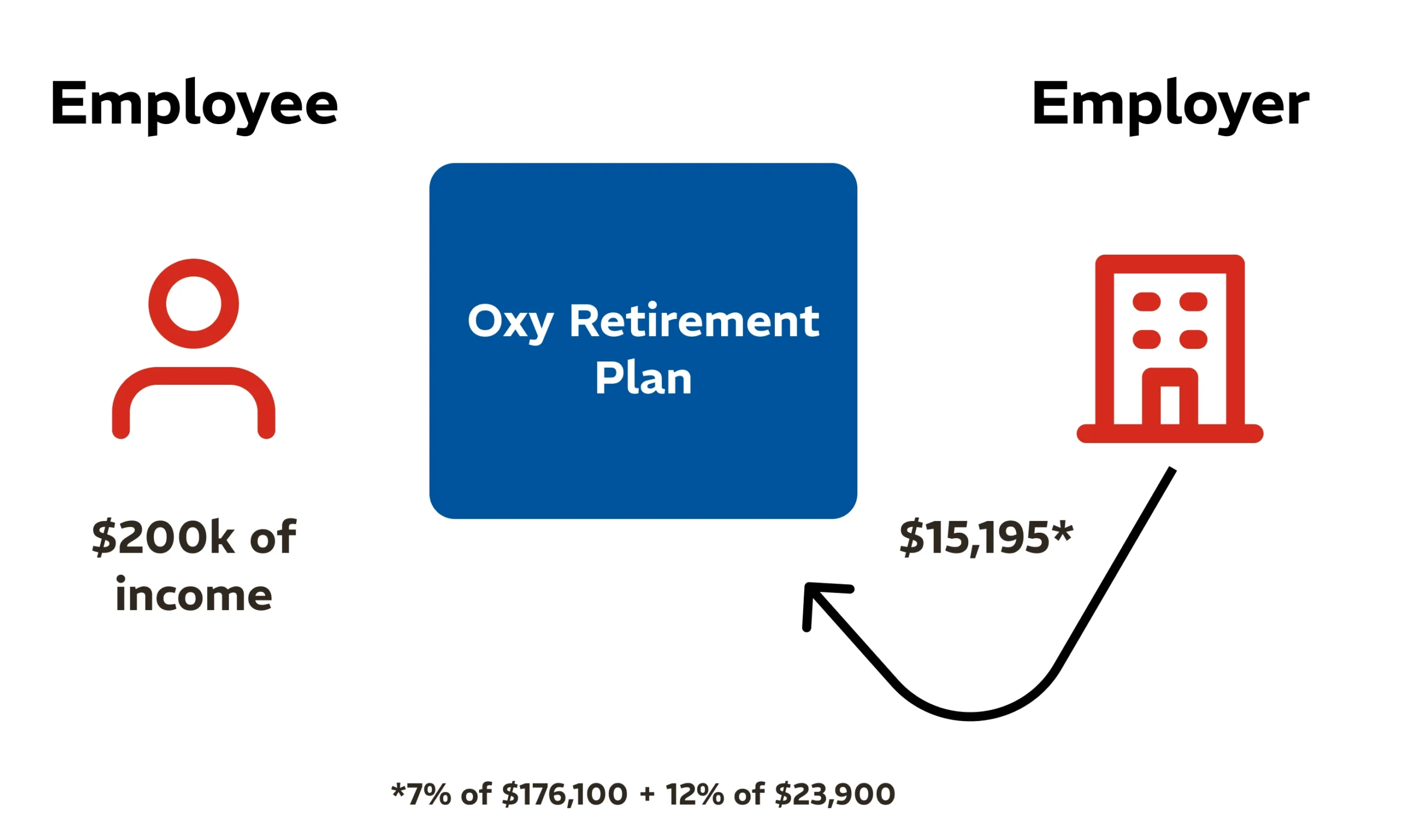

Whereas an employee making $200,000 with Oxy would first receive a 7% contribution on their first $176,100 of compensation. This would equal $12,327. The next $23,900 of compensation would receive a 12% contribution equaling $2,868 for a total contribution of $15,195.

Per the IRS, the maximum compensation that can be considered for the plan is $350,000. If your compensation is greater than $350,000, any excess contributions would be funneled to an additional plan called the Supplemental Retirement Plan (SRP). The SRP allows the company to ensure that highly compensated employees receive the benefit that they have earned.

Investment Options

As mentioned previously, in a Money Purchase Pension Plan, the investment decisions are up to the employee. Although the company makes the contributions to the plan, the employee must choose how these contributions are invested. Just like the Oxy 401(k) Savings Plan, the Oxy Retirement Plan offers a wide range of investment options. These options vary from very conservative investment assets to very aggressive options. See below:

Target Date Fund

A good solution for individuals looking for a turnkey portfolio. This fund takes into account your age and projected retirement date to build a portfolio. A target-date fund will invest in a higher risk allocation of assets when you are young and become more conservative over time as you approach retirement. These portfolios are typically very basic and do not provide strategic decisions based on your personal risk management and financial plan.

Bond Funds

The Oxy Retirement Plan has six different bond fund options giving you access to invest in different types of bonds.

- Stable Value Fund: gives employees an option to invest in ultra-short-term bonds.

- US Bond Index Fund: allows direct exposure to the Bloomberg Barclays US Aggregate Bond Index, an intermediate term index comprised of investment grade US Bonds.

- International Bond Index Fund: seeks to track the performance of the Bloomberg U.S. Aggregate Float Adjusted Index using global, public, investment grade bonds.

- Bond Fund: an instrument that seeks maximum return through the use of Fixed Income Instruments at different maturity levels. May invest within or outside the US.

- High-Yield Bond Fund: seeks a higher yield through the utilization of primarily junk bonds.

- Inflation Protected Securities: seeks to provide inflation protection and income by investing the majority of the fund in inflation-indexed bonds issued by the US government.

Equity Funds

- Total US Stock Market Index Fund: seeks to track the Russell 3000, which represents the 3000 largest companies in the US.

- S&P 500 Index Fund: seeks to approximate the risk and return characteristics of the S&P 500 Index. The 500 largest companies in the US.

- Large Cap Value Fund: Focuses on long-term growth of capital by investing in mid- and large-cap companies using a value approach, with the goal to outperform the Russell 1000 Value Index.

- Large Cap Growth Fund: Aims for long-term growth of capital by investing in a diversified equity portfolio, targeting to outperform the Russell 1000 Growth Index.

- Mid Cap Index Fund: Aims to track the performance of a blend of different mid cap indices such as the S&P MidCap 400.

- Small Cap Value Fund: Seeks long-term growth of capital by investing in small cap companies with a value approach, intending to outperform the Russell 2000 Value Index.

- Small Cap Growth Fund: Targets long-term growth of capital by investing in small cap companies exhibiting growth characteristics, aiming to outperform the Russell 2000 Index.

- Total International Stock Market Index Fund: Seeks to track the MSCI ACWI Ex US Index. This index represents companies from 22 of the 23 developed nations (excluding the US).

- International Large Cap Value Fund: allows individuals to invest in international markets by investing half the fund in Artisan International Value mutual fund (APHKX) and 50% in the Acadian All Country World ex US Value collective investment trust.

- International Large Cap Growth Fund: this fund invests in a diversified portfolio of stocks in countries outside the US and primarily focuses on long-term growth objectives of the companies it invests in.

Other

- Real Estate Index Fund: allows access to investment in REITs. Aiming to provide a high level of income and a moderate level of capital appreciation over time.

Developing a portfolio that is consistent with your familial goals while remaining efficient from a tax perspective can tremendously increase your after-tax wealth throughout your career. It is very important to not only consider the risk in the portfolio but also how your familial assets are invested across different account types. The Oxy Retirement Plan is a tax-deferred account, which would warrant different investments from a tax perspective than an after-tax brokerage account.

Distribution Options

A few different options are available for your Oxy Retirement Plan balance when you retire or separate from the company. If your vested account balance is greater than $5,000, you may elect to have your balance paid out to you as an annuitized stream of payments, a full lump sum or a combination of the two.

- Total Lump Sum Payout: You may rollover the full balance into an IRA or qualified retirement plan.

- Partial Cash Distribution: You may request a distribution of a specific dollar amount from your vested balance. This can be rolled over to an IRA or qualified retirement plan.

- Immediate Straight Life Annuity: Provides a fixed monthly payment for your lifetime.

- Immediate Joint & Survivor Annuity: Provides a fixed monthly payment for life. At your death, your beneficiary will receive the percentage of the annuity that you elected (50%, 75%, or 100%).

- Immediate 10-year Term Certain & Continuous Annuity: Provides a fixed monthly payment for your life with a guarantee of at least 120 months being paid to you or your beneficiary.

- Total Deferral: Payments from the plan may be deferred until your Required Minimum Distribution (RMD) age.

If your balance is less than $5,000, you will have the option to roll over the balance into a new retirement plan or it will be rolled over into an IRA.

Conclusion

In summary, the Oxy Retirement Plan is a standout benefit for employees, offering an excess benefit to employees beyond the traditional 401(k) option. Unlike many other plans that depend on both employer and employee contributions, this plan guarantees contributions from the company alone, providing a significant additional source of retirement savings. With a range of investment options and the flexibility to choose how these funds are managed, employees can tailor their savings strategy to match their personal financial goals and risk tolerance. For Oxy employees, this means a clearer path to a secure and prosperous retirement, making it easier to focus on what matters most both now and in the future.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by Occidental Petroleum Corporation. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.