Shell Provident Fund (SPF): Mega Roth Conversions

How Mega Backdoor Roth Conversions Can Optimize Your Tax Treatment

As a Shell employee, you have access to the company 401(k), also known as the Shell Provident Fund (SPF). The Shell Provident Fund provides several benefits to employees and is an excellent means of saving for retirement. This plan allows employees to contribute a portion of their income on a Pre-Tax, Roth, or After-Tax basis.

Within the SPF resides a tax strategy that can be incredibly beneficial to high-income individuals: the Mega Backdoor Roth conversion. This allows for individuals to contribute funds to the After-Tax account and subsequently convert those to the Roth account, which can grow and be distributed tax-free.

Contribution Limits for The Shell Provident Fund

Before we dive into this lucrative tax strategy, it is important to understand the different accounts within the 401(k) and their respective contribution limits.

Types of 401(k) Accounts at Shell

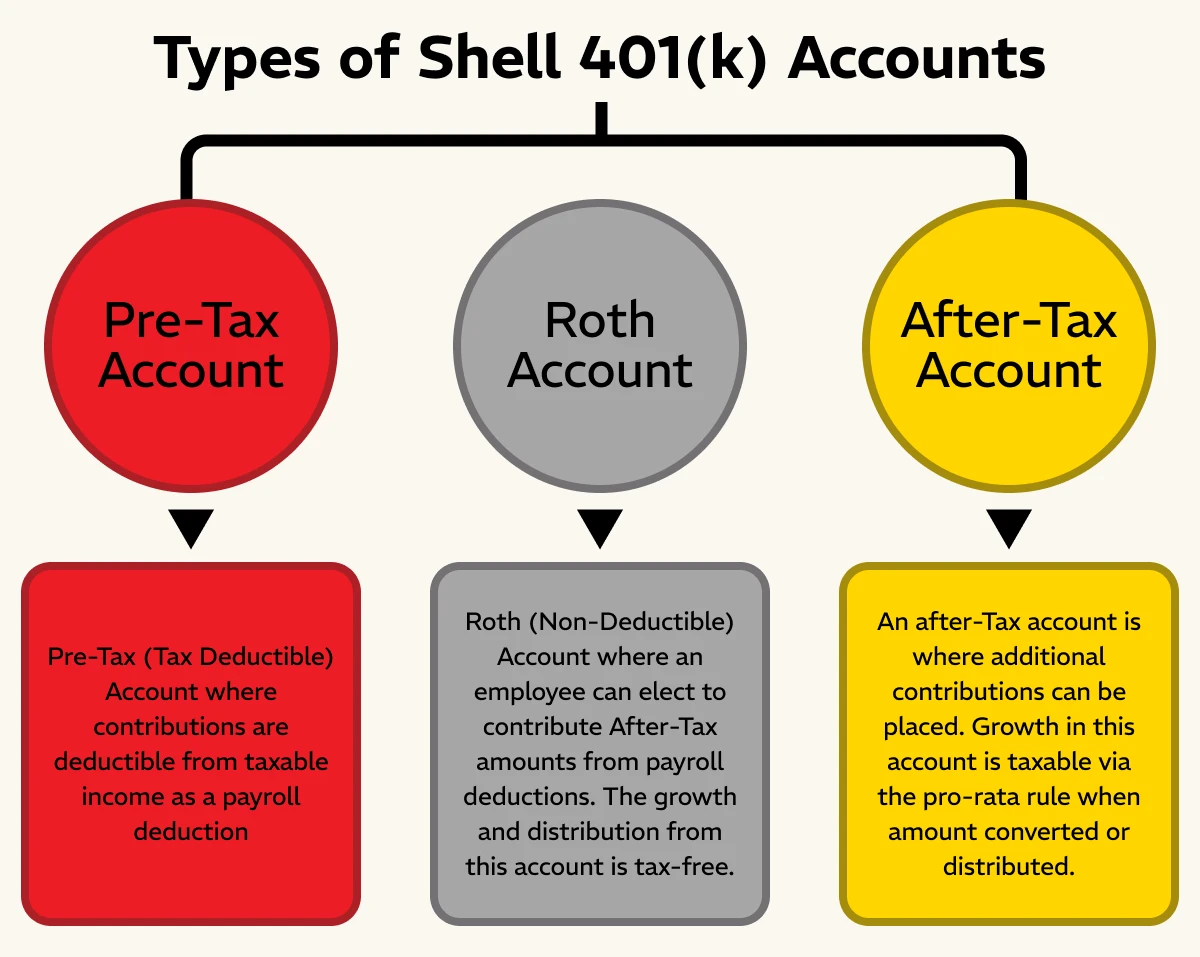

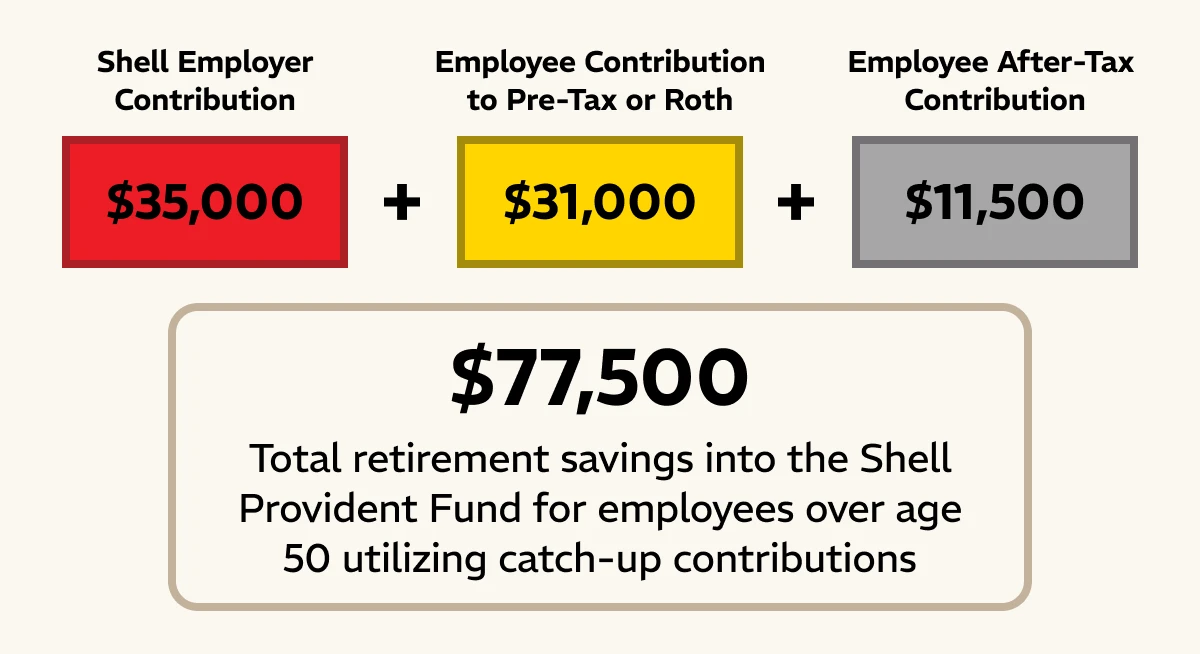

As shown in the graphic above, there are three different accounts that your deferrals can be directed to:

- Pre-Tax account

- Roth account

- After-Tax account

The Pre-Tax account is the default for contributions unless you elect otherwise. This account provides a tax deduction for contribution. However, any distributions from this account are taxed as ordinary income.

The Roth account does not provide a deduction for contributions. However, any distributions from this account in retirement are completely tax-free.

The After-Tax account contains the unpleasant effects from both the Pre-Tax and Roth accounts – there is no deduction for your contributions and any growth that occurs in this account is taxable upon distribution. The benefit of this account comes into play by utilizing the Mega Backdoor Roth strategy, where an investor converts funds from the After-Tax account to the Roth account.

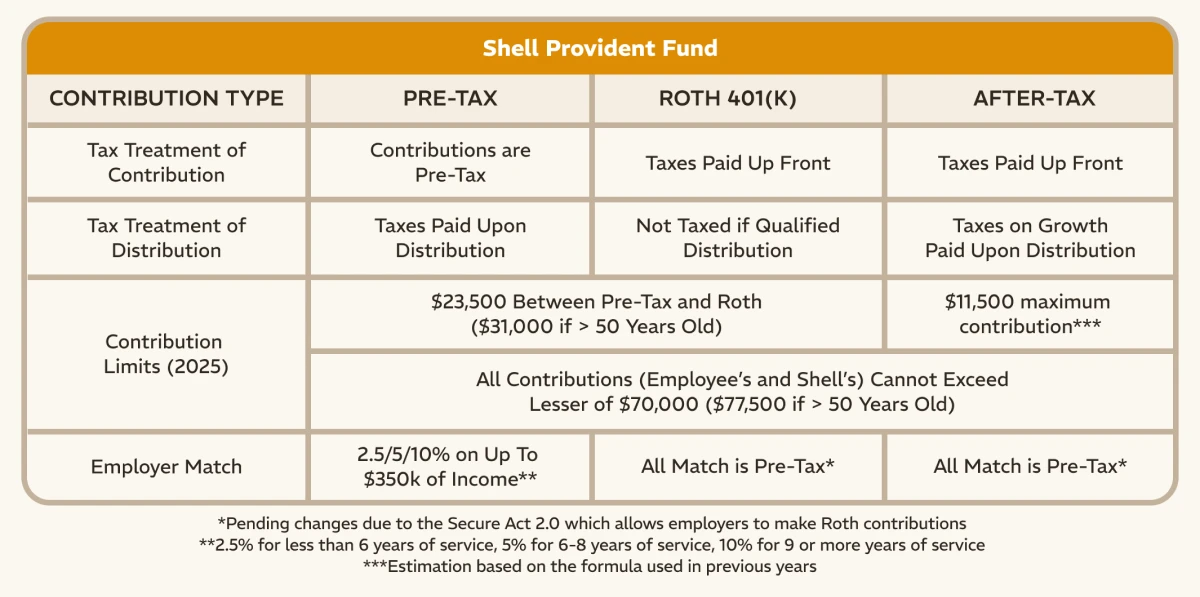

Contribution Limits

The IRS sets limits on how much employees can contribute to the Pre-Tax or Roth portion of their 401(k) plans each year. For 2025, the limit is $23,500 for employees under the age of 50. If you are 50 or older, you can make an additional catch-up contribution of $7,500, for a total of $31,000.

The Shell Provident Fund has a unique provision which limits the amount you may contribute to the After-Tax account. Rather than the IRS limit for total contributions to 401(k) accounts ($70k), there is a separate limit of $11,500. While this limits the Mega Backdoor Roth strategy in the Provident Fund, it does not eliminate it entirely.

Example

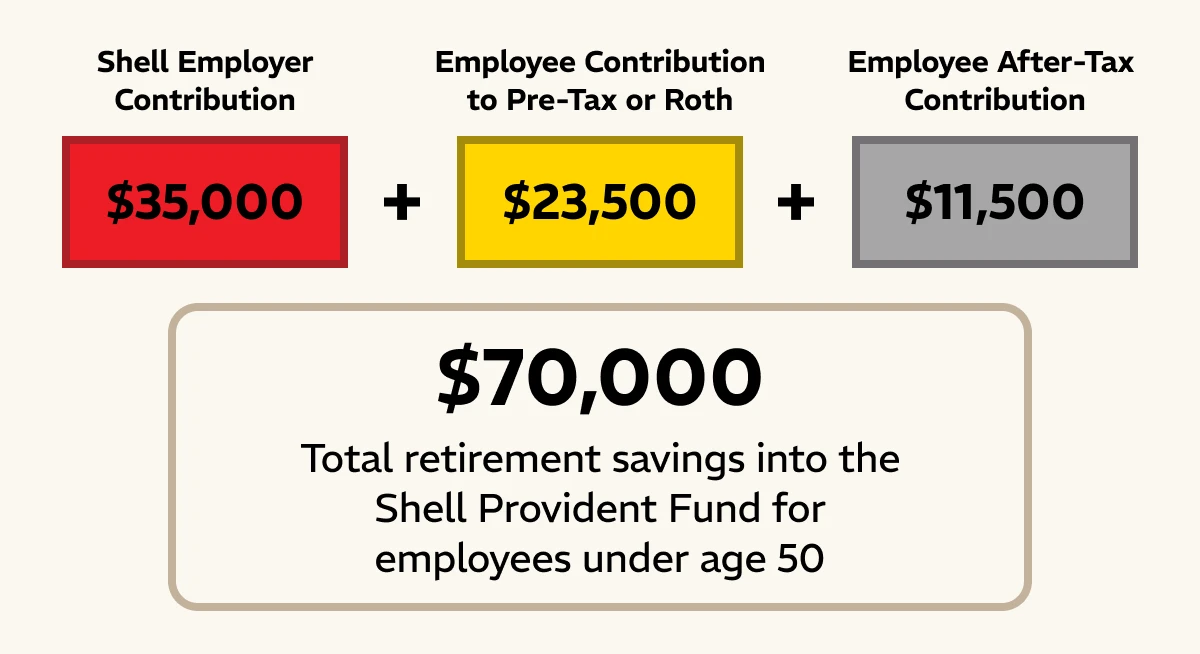

For an individual under the age of 50 who is maxing out their Shell Provident Fund, it might be a scenario similar to the one below:

For an individual over the age of 50 who is maxing out the Shell Provident Fund and using the catch-up contribution, it would look like this:

Mega Backdoor Roth Conversions

As mentioned above, the Mega Backdoor Roth strategy allows for additional Roth savings within the Shell Provident Fund. Shell employees can contribute an additional $11,500 each year to the After-Tax account and convert those dollars to the Roth account.

HERE’s HOW IT WORKS

- Max-out your Pre-Tax or Roth contributions to the SPF ($23,500 for 2025)

- Receive a 10% matching contribution

- Contribute After-Tax funds up to the limit ($11,500 for 2025)

- Convert After-Tax funds to the Roth account

Consider This Example

A Shell employee (lets call her Gretchen) has a salary of $250,000. She contributes the Pre-Tax maximum of $23,500 to the SPF for 2025 and receives a 10% match of $25,000 for a total of $48,500.

Let’s assume that Gretchen then contributes $11,500 each year to the After-Tax account in the SPF for 10 years – a total of $115,000. This money has grown from $115,000 to $175,000 over the 10 years. As long as Gretchen performed Mega Backdoor Roth conversions, this growth is completely tax-free to her.

The Pro-Rata Rule

Uncle Sam isn’t far away whenever a citizen receives a tax-advantage. He wants to get his share of this windfall! The IRS has instituted a Pro-Rata rule that mirrors the one associated with a traditional backdoor Roth IRA.

If Gretchen were to withdraw the $175k unconverted After-Tax amount from the Shell Provident Fund, she would pay ordinary income tax on the portion of the withdrawal that represents the growth ($60k). The same goes for a conversion from the After-Tax account to the Roth account. Roughly one-third ($60k/$175k) of any conversion will be taxable because that is the proportion of the value that is represented as growth.

Conversely, this strategy would be more attractive if Gretchen had completed ongoing conversions. If Gretchen were to make regular conversions before any growth occurred, these After-Tax assets would be placed into the Roth Account and compound tax-free permanently. As the chart above shows, qualified Roth withdrawals are always tax free.

In essence, Gretchen can use this strategy to permanently eliminate the tax on the growth of After-Tax assets!

The Catch

If there is one, the catch is that many people already have a current after-tax balance in their Shell Provident Fund. While this does not prohibit you from taking advantage of this strategy, the After-Tax balance can grow over time and complicate conversion strategies.

Before making conversion decisions, it’s crucial to look on your SPF statement to identify your After-Tax account balance and compare that to your contribution basis. This will give you an idea of how the Pro-Rata rule comes into play for the taxation of conversions.

Benefits of Mega Roth Conversions for Shell Employees

Tax Savings

By completing continuous conversions of your After-Tax retirement savings into the Roth account, you can save on taxes in the long run. This is especially beneficial if you expect significant growth to occur in your portfolio between now and retirement.

More Control Over Your Retirement Income

With a Roth account, there are no required minimum distributions (RMDs). This means that you have more control over your retirement income and can choose when and how much to withdraw from your account.

Flexibility in Managing Taxes

Having a mix of taxable and tax-free income in retirement can give you more flexibility in managing your taxes. This can be especially beneficial if you have other sources of income, such as a pension or rental properties.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, service@rgwealth.com, or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by Shell. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.

![[2025] Shell Provident Fund (SPF) Mega Backdoor Roth Conversion Strategy](https://i.ytimg.com/vi/eTSqhYC8hVM/hqdefault.jpg)