Maximizing Tax Deductions for Charitable Giving

How Do I Get the Most of My Charitable Deductions?

At this time of year, our team receives an influx of questions about the best way to minimize tax liabilities for the previous tax year as well as strategies for the future. While the IRS doesn’t offer too broad a toolkit for tax reduction, there are certain charitable strategies we encourage clients to take advantage of on an annual basis.

In this article, the RGWM team outlines factors to consider that can help you make the most of your charitable giving so you can maximize what your favorite causes receive without unintentionally lining Uncle Sam’s pocketbook.

Charitable Deductions and Your Taxes

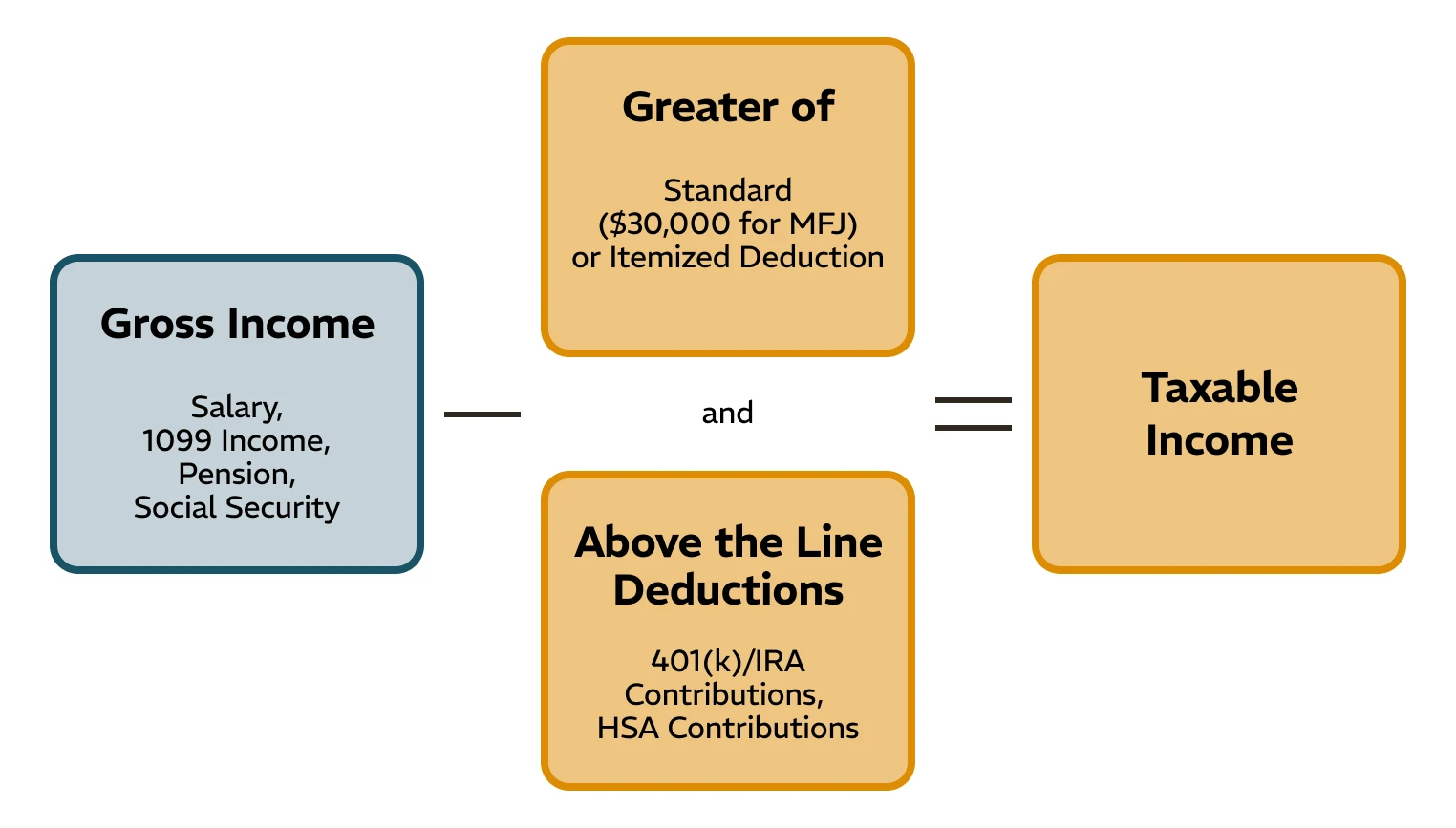

The first critical element to understand when thinking about charitable giving is that for many, these gifts don’t do much to affect taxes. Each taxpayer must decide each year between a Standard Deduction and Itemized Deductions. The visual below is an oversimplification, but helps to explain:

Therefore, if your itemized deductions don’t exceed the $30k standard deduction you already receive as a married couple ($15k for Single filers), your gift had a negligible effect on your true taxable income. In previous years, you could get a deduction for $300 of giving ($600 if married) without having to itemize. However, for 2025 this is no longer allowed and we find that many gifts are much larger, bringing deduction maximization to the forefront of tax strategy.

Deduction Lumping

If you don’t typically itemize your deductions, TIMING when you make charitable gifts as well as certain other deductible expenses can get you “over the hump” to itemize in years when you otherwise might never qualify. This strategy is called Deduction Lumping, and while it can be complex, you don’t need to be a high income individual to take advantage. Let’s look at an example:

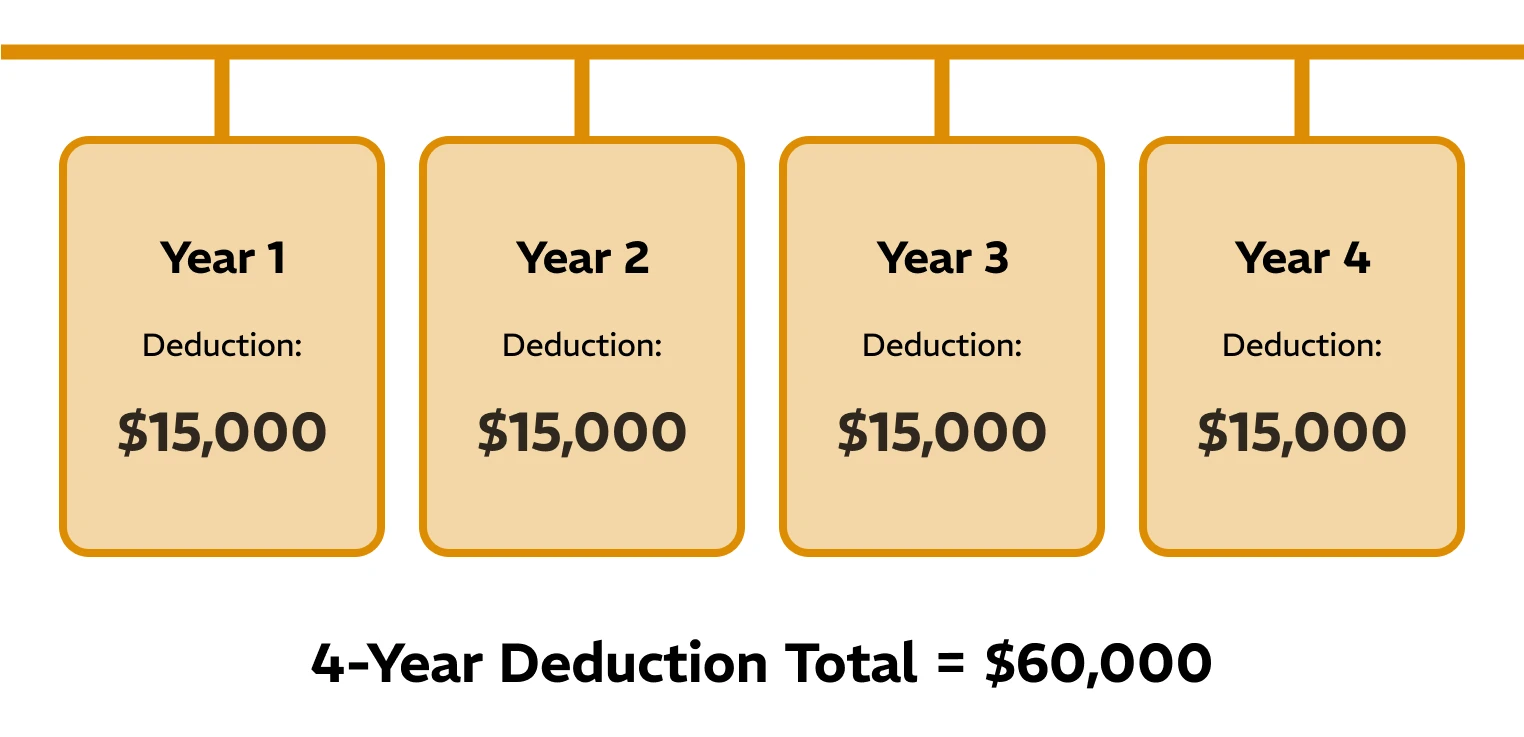

Strategy 1: Standard Deduction Every Year

Jim is a single engineer in Houston, TX. His deductible expenditures include about $4,500/year in property taxes on a small $250k house he inherited from his grandmother, $1,000/year of sales taxes and $8,000/year that he donates to his church. Under current law, Jim’s itemized deductions for State and Local taxes and Charitable Donations were $13,500/year, which is not enough to surpass the $15,000 threshold for the Standard Deduction. In essence, his itemized deductions don’t change his taxes.

Strategy 2: Significant Savings Via Deduction Lumping

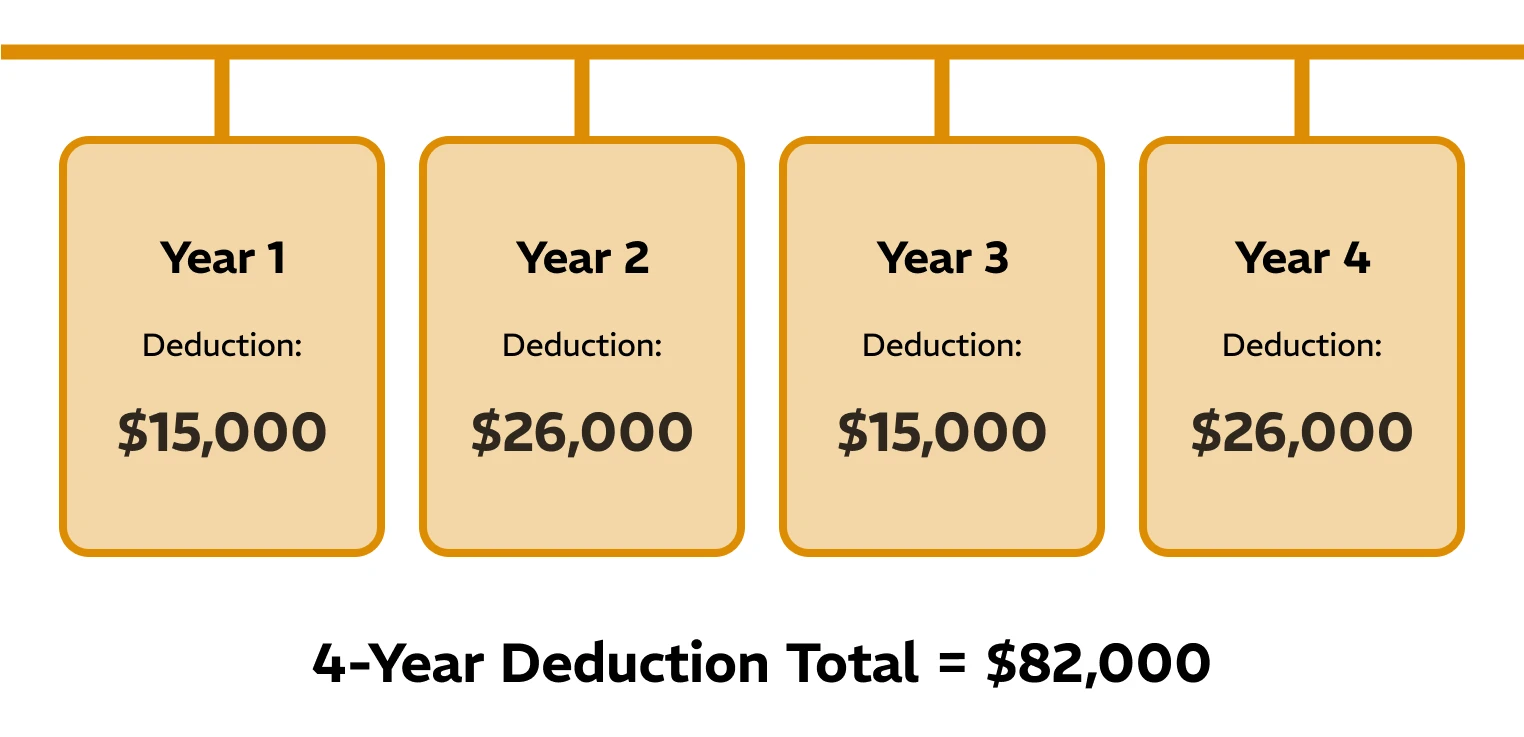

If instead Jim decided to make the following changes, his deductions look significantly different:

- Pay his property taxes for 2024 in January of 2025 (a perfectly acceptable strategy)

- Gift his 2024 tithe to the Church as a lump sum on Jan. 1 2025

- Make his 2025 gift to the church later in the year

- Pay his 2025 property taxes in December of 2025

Jim suddenly reaches a State and Local Tax deduction max of $10k for the 2025 tax year. He achieves this by paying both tax bills during the 2025 calendar year.

Additionally, he has an additional $16k charitable deduction. This gives him a total of $26k in itemized deductions – a drastic increase over the Standard Deduction of $15,000. Furthermore, he still received the standard deduction in 2024, despite his itemized deductions being negligible.

As shown by the sum totals, the deduction lumping strategy provides an additional $22,000 ($82,000-$60,000) of deductions over a 4 year period. Assuming a marginal tax rate of 24%, this strategy will save Jim $5,280.

This example is a great way to think about the timing element of various deductions. Other itemized deductions like Mortgage Interest can’t generally be shuffled around, but there are many that can.

Appreciated Assets Vs. Cash

When the offering plate is being passed around during Sunday service, do you contribute with cash or a check? Perhaps you directly transfer cash to your Church from a checking account you keep on file for convenience. Maybe you’ve even made a giving pledge to help fund a mission trip or new structure on church grounds and are wondering just how to facilitate the gift.

In many instances, directly funding

your charitable giving with cash

you’ve already paid tax on is

a tax mistake.

Before you can write a check or give cash, one must earn that money as income or sell an asset to generate the cash you’re giving. In general, gifting the asset directly is a much smarter move. Let’s consider an example of appreciated stock in an investment account.

If one purchased shares of $XYZ stock at $100 and several years later the shares are worth $200, there’s a $100 long-term capital gain that will be taxable upon the sale of the stock. Most taxpayers are subject to a 15% tax rate for long-term gains. However, this rate can be as high as 20 or 23.8% depending on income and other factors.

When liquidating the asset to give the cash to the Church (or simply giving cash that you’ve already paid a higher income tax rate on), you miss out on the tax benefit of simply donating the appreciated asset. You receive a deduction for the fair market value of the stock, and the Church as a 501(c)(3) organization doesn’t pay a capital gain tax. You just got the deduction without the underlying tax bill!

Charitable Foundations, Trusts, & Donor-Advised Funds

There are a variety of vehicles individuals can use to achieve easy and convenient gifting for the purposes of deduction lumping and capital gain avoidance. We’ll outline a few key points about each below:

Donor-Advised Fund

- 501(c)(3) organization at many popular financial firms

- Allows deduction at time of gift and avoids built-in capital gains

- Funds can be diversified and invested within your fund account post-gift and distributed to other charities over time

- Allows for non-traditional gifts like art, collectibles, etc.

Charitable Trust

- Charitable Remainder Trust: Allows charity to receive funds after your passing (you get use of a portion during your life)

- Charitable Lead Trust: Allows heir to receive funds after charity received income from funds during your life

- Partial deduction available to donor immediately

Family Charitable Organization

- Ideal for significant levels of giving

- Registered as a 501(c)(3) organization, so anyone can receive a deduction for contributing

- All the benefits of a Donor-Advised Fund, but even greater capabilities

- Can compensate employees of organization (can be family members in some cases) and have various administrative and travel expenses

- Generally higher level of scrutiny by IRS, but offers greater flexibility

All of the above charitable vehicles can be fantastic avenues to accomplish your charitable goals, but each is best suited for different scenarios.

For simple gifting strategies, a Donor-Advised fund is a perfect vehicle with an extremely low administrative burden. For more complex or higher value gifts, a donor may wish to consider a trust or family organization to fully take advantage of what the law allows.

In many cases, Deduction Lumping and donating appreciated assets go together perfectly as part of a comprehensive gifting strategy. Optimizing these deductions can amount to thousands of dollars of annual tax savings.

Prefer to watch a video on how to maximize charitable contributions?

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.