Managing NUA and Concentrated XOM Positions

How To Effectively Manage Concentrated XOM Positions

One of the biggest challenges for investors who hold large, long-term positions is how to effectively manage exposure through different cycles – both market based and company specific. We have previously written about some of the risks of holding concentrated positions, and it is worth repeating a few key points. The most critical point to make is that a single stock is more than four times as likely to underperform a broader market average over the long term. This correlation actually increases over time, so the longer the holding period, the higher the risk of underperformance. Additionally, the higher the volatility in the stock, the larger the underperformance is likely to be. Over the last 20 years, stocks with average volatility have lagged S&P risk level returns by nearly 3% per year and stocks with higher than average volatility have underperformed by as much as 7%.

Long-term holders of ExxonMobil shares have experienced this first hand. Again, we have talked about this previously, but the numbers bear repeating. Over the past 30 years, XOM has very slightly underperformed relative to the S&P on a total return basis (including dividends and stock splits). That would seem to blow a hole in the above arguments, but let’s continue. Over the past 20 years, XOM has outperformed the S&P by 10% – somewhat more impressive but perhaps still not a compelling reason to validate the argument. However, over the last 10 years XOM has underperformed the S&P by 127% – which may be a very unpleasant surprise for long-term holders who have not looked at recent comparative data. However, the points made in the preceding paragraph shows that perhaps it should not have been that surprising, because the likelihood of underperformance increases over time.

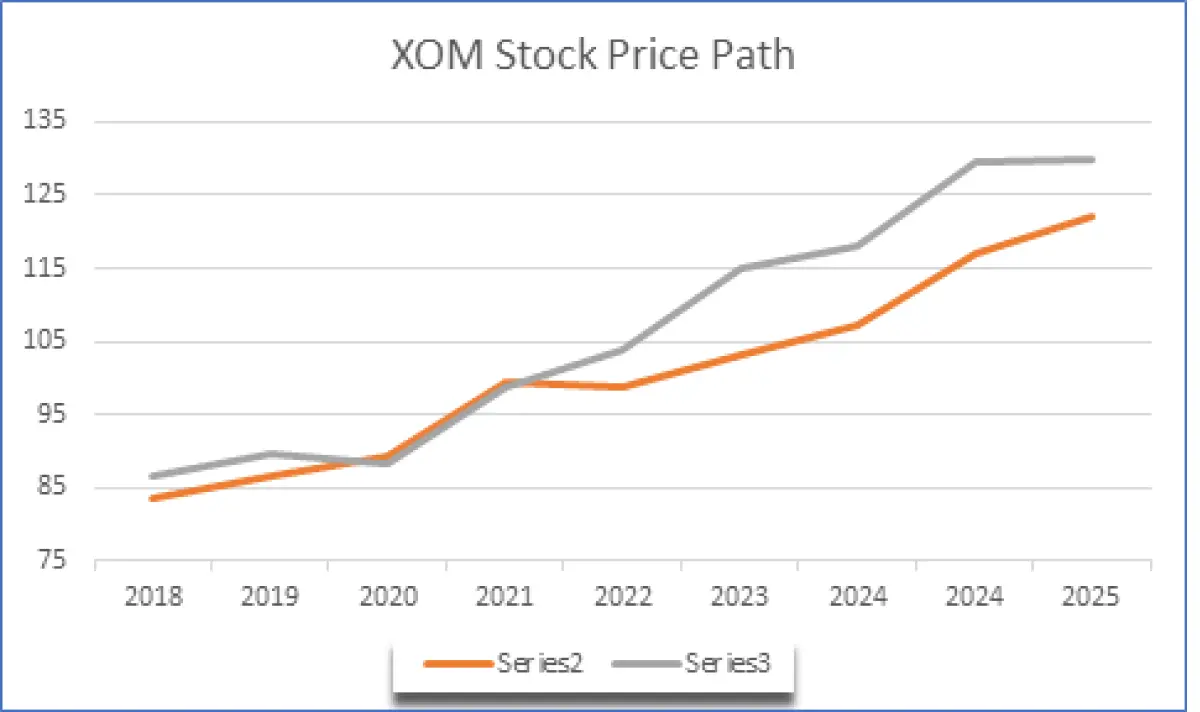

The above chart shows two different pictures – even though the long-term performance of ExxonMobil approximates S&P returns over the 30-year period, there have been significant deviations in the range of returns. However, it is clear that the longer the holding period, the worse the return was on a risk-adjusted basis. This is one reason why our investment philosophy is centered on risk and the quality of the return and not on absolute numbers.

Even given this backdrop of information, many holders of NUA stock (Net Unrealized Appreciation) do not want to sell because of the onerous tax consequences of such an action. While saving taxes should never be a reason to exit a bad investment (think Enron instead of Exxon), thankfully that is not the case with ExxonMobil. However, there are strategies that can be implemented to offset some of the embedded risk of concentrated holdings. Many of our clients use our Yield Enhancement Option Program, which can provide additional income on long-term holdings. Another way is to selectively sell stock during periods of outperformance. For NUA holders, this must be part of an overall tax strategy, but for those that hold the stock in a qualified account, this is an excellent way to reduce exposure. Of course, this brings up the biggest question of all – how does one determine the optimal price to sell shares?

In lieu of a crystal ball, we do have access to some information that may help in this regard. During the investor presentation to analysts in March of this year, ExxonMobil management revealed their long-term plans that would double production and earnings by 2025. So far, Wall Street analysts are not impressed as the recent response to earnings reports since then has shown. Valuing the long-term prospects of the company using near term metrics and assumptions has been difficult, and there is a wide range of opinions on future returns. That is the nature the short-term myopic view of Wall Street in general.

However, we would argue that those who possess the best information are current management, and as long-term holders, management is one of the most crucial factors to consider in the investment process. If you believe that the stated goals are reasonable and achievable, which we do, then it is possible to construct a potential range of earnings outcomes, growth rates and associated P/E multiples through 2025 and be able to work backwards determine a range for the equity price that would reflect a “fair value” that would mirror how the company is achieving the stated goals. Our studies incorporated these estimates to give us an idea as to where the stock stood in relation to its likely valuation in 2025, given management’s stated goals.

The focus of this study is not for clients to use as an absolute “buy” or “sell” level. It is most appropriate for the long-term holders who want to reduce exposure opportunistically. This is not a fool-proof valuation method by any means – the main purpose is not absolute but relative value, and the focus is to identify periods where the stock may be “ahead of plan” and provide a better exit point. However, the expected range of probabilities in our assumptions is manageable, given the company we are dealing with.

The takeaway for a client thinking about making a disciplined sale of shares is that this methodology can help gauge the current price on a relative scale to how far along the company is on the long-range plan. While we look at other measures to determine short-term momentum and valuation, this methodology gives a longer-term focus. As seen in the chart, a current price of $90 would encompass much of the growth projections for the next 18 months. A sale at that level represents a good risk/reward trade-off based upon this analysis, and if that is within the expected range of the stock, there is no marginal benefit from a sale at that price. Ideally, you would only make a sale if the stock is significantly above that range.

While this is a complicated topic for discussion, it is further complicated by the fact that there is no “one size fits all” answer to the diversification question. We employ some of the same methodology in our option program analytics and we would be happy to discuss in further detail on an individual basis.

If you have questions about this subject, or anything else, please do not hesitate to contact us.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.