Market Update – August 2023

An Update On The Markets, Economic Changes, and Political Variables

Market Performance

It has been a relatively volatile month within a strong year-to-date run for the stock market. The last two weeks have seen a number of economic data releases, earnings releases, and political events with varying levels of potential influence on both stocks and bonds. The final reports of earnings seasons posted for the 2nd quarter, PMI data showed prospective economic activity that was weaker than expected, the latest job report came in under expectation, and Fed Chair Jerome Powell gave his highly anticipated address from Jackson Hole.

As we reach the end of the month, the S&P 500’s month-to-date return stands at, having clawed back some of the losses from a volatile first four weeks. Our overall market outlook remains positive but with an acknowledgement of potential risks. While these risks to the economic and market environment exist in a variety of hypothetical forms such as geopolitical tensions, unexpected inflation, and the lagged effects of monetary tightening, the fundamentals of this economy remain strong, and the corporate world continues to execute above expectation. The remainder of this newsletter will further dive into our assessment of the economic and market backdrop, and what we’ll be continuing to watch for moving forward.

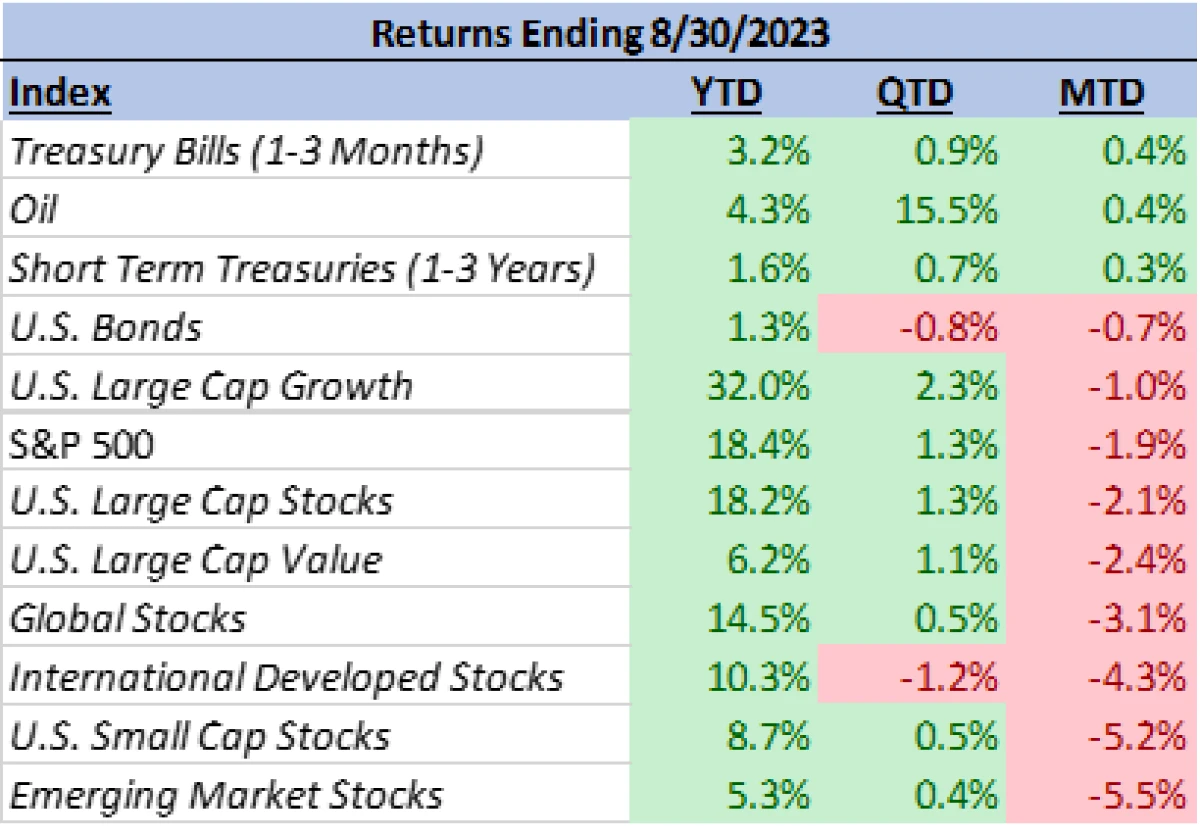

The market’s performance during the first several weeks of August included an understandable and reasonable “pull-back”. From 1928-2021, a decline in stocks of at least 5% occurred in 95% of those years. What was less straightforward was making sense of what sectors did well and which ones performed poorly. The leaders on the month have been energy (1.12%) and healthcare (0.41%), while the biggest laggards are utilities (-5.75%), materials (-3.41%) consumer staples (-3.30%). Growth (-1%) has barely edged value (-2.4%) as an asset class, but the sector differentiation doesn’t tell a clear story. Our reasoning would be that a combination of the recovery in oil prices this quarter, a pause among the highest performers, and earnings assessments have driven the dispersion.

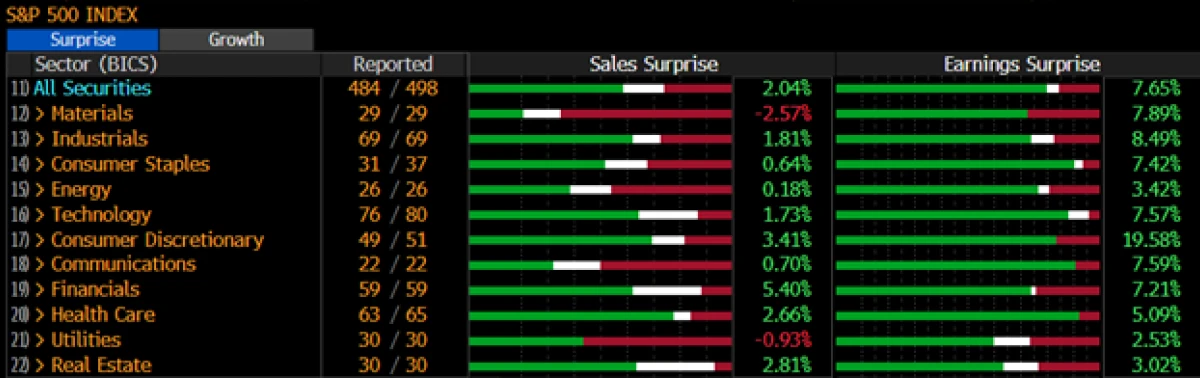

The two worst overall performers this month have been materials and utilities, and, as we will discuss further along in this update, these two sectors were the only two reporting negative sales surprises over the Q2 earnings season. Rising expectations for U.S. interest rates have also led to higher yields (seen in the decline of U.S. Bonds) and an increase in the strength in the dollar. Alongside the dollar strength, the overall relatively “risk-off” appetite for investors this month can also be seen in the underperformance of small cap stocks (-5.2%), international stocks (-4.3%), and emerging market equities (-5.5%). As often happens when investors experience volatility, treasury bills have led the month with 0.4% return.

Economy

Last week, S&P Global’s flash Purchasing Managers Index (PMI) data, considered a leading indicator for economic activity, was released with both manufacturing and services data pointing to a decline. However, important to note is that other pieces of the economy are pointing to continued resiliency and, in some cases, even acceleration. A collection of factors including a strong labor market, willing consumers, and growing nonresidential fixed investment spending (partly attributable to the continued “AI boom”) have kept the economic engine running. The end of July saw GDP surprise the experts with a 2.4% increase in the second quarter, beating estimates.

Despite the latest PMI reports, some indicators are pointing to even further upside surprises ahead on the economic activity front. The Federal Reserve Bank of Atlanta’s “GDPNow” forecasting model, which (although not an official estimate) is a running estimate of real GDP growth based on data for the current measured quarter, is projecting a shockingly strong number of 5.9% real GDP growth in Q3. This estimate by the model is a far cry higher than that of private sector economist forecasts which average 2.1% year-over-year.

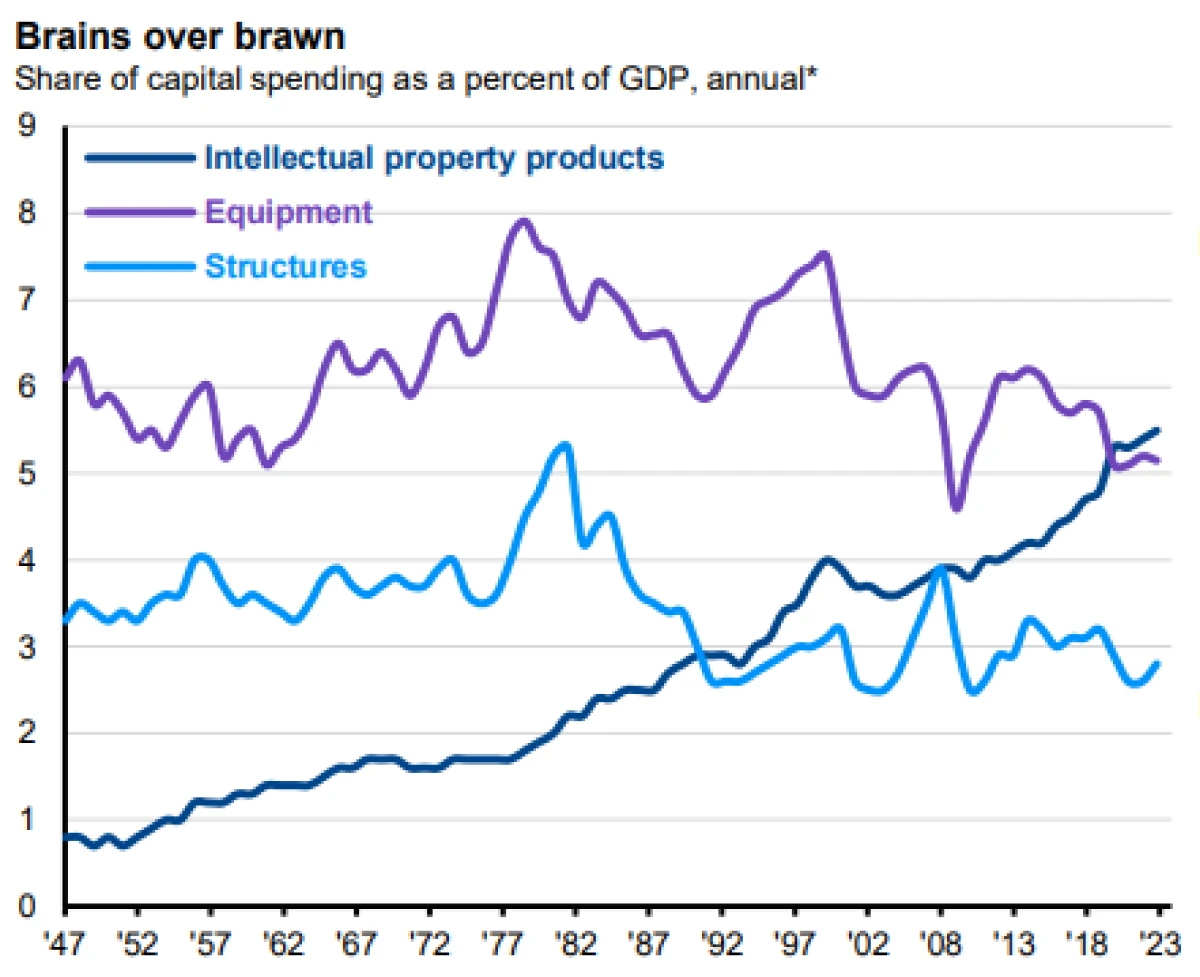

Per J.P. Morgan Asset Management, one such explanation for the economy’s surprising strength is that there has been a trend in the share of capital spending away from physical investments (equipment and structures) towards intellectual property products. This school of thought theorizes that this type of spending is less sensitive to interest rates and as that share of spending increases, the economy becomes less sensitive to interest rates as well.

While no one wants to see the economy stall, the market has for the past 2 years, been hyper focused on the duality of inflation and rates. For most of this year, the results of falling inflation and economic stability have resulted in a stock market rallying back from the previous year’s losses. The inflation component in particular has been a welcome development; the latest inflation report in July showed a year-over-year number for CPI of 3.2% compared to last year’s CPI growth of 8.5% in July which just so happened to be the month after which the inflation metric peaked (9.1% in June). While 3.2% is still above the Fed’s desired inflation rate of 2%, it is a number that shows how much progress has been made over the year. As impressive as the inflation rates year-to-date deacceleration has been, perhaps more stunning has been the continued strength of the labor market that has seemed to defy the traditional economic thought of there being an inverse relationship between inflation and unemployment. While interest rates have risen and inflation has lessened in pace, the unemployment rate (as of July) has remained the same as a year ago at 3.5%; the rate continues to be at the lowest levels in over 50 years.

This isn’t to say that the economy is invulnerable to setbacks. Monetary policy is known to operate in “lags”, and the bulk of the tightening from the Fed has not potentially been felt. And while July’s CPI report remains much lower than earlier in the year, it was also the first increase in the number (3.2% vs June’s 3%) since inflation fell from the high last year. Countering the discouragement regarding July’s CPI uptick though is that when removing food and energy (more cyclically sensitive pieces of the equation) from the data, “core” CPI continued to decline. On a month-over-month basis it will be important to pay attention to Augusts’ core number, set to be released the second week of September.

Although the “headline” data (containing food and energy prices) is projected to accelerate once more, the core number is set to remain steady at 0.2%. The increase in energy prices that were once helping lower inflation have picked back up, and while these impacts are certainly felt by consumers, they are often volatile and are heavily dictated by supply and demand impacts outside the Fed’s control. The Federal Reserve will likely be more focused on the core inflation data that better exemplifies the structural trends of inflation. This week has also seen a pair of softer data releases in the form of a below expectation ADP jobs growth number for August and a pullback in U.S. Consumer Confidence. The ADP report in particular showed a significant slowdown in job creation at 177,000 added in August versus 371,000 added in July. This is among the first signs we’ve seen of the Federal Reserve’s tightening perhaps having impacted the labor market.

Federal Reserve

The Federal Reserve’s annual trip to Jackson Hole, Wyoming proved to be a much less impactful one to markets than a year ago. In the 2022 edition of the economic retreat, Jerome Powell gave what for him was a fiery address to market participants about the Fed’s steadfast commitment to fighting inflation and hiking interest rates. The result was the continuation of a deep pullback in markets to new bear market lows by October. While Powell’s speech this year was once again quite hawkish given the year-to-date success in lowering inflation, markets seemed largely tolerant of the chairman’s rhetoric. Stocks were volatile during the address but ended the day half a percent higher. Some of the key points that may have provided some interest rate related optimism were an acknowledgement of the two-sided risks (doing too little causing inflation to return but doing too much hurting economic activity) to ongoing Fed policy decisions and the progress that has already been made allowing the Fed to “proceed carefully” at upcoming meetings.

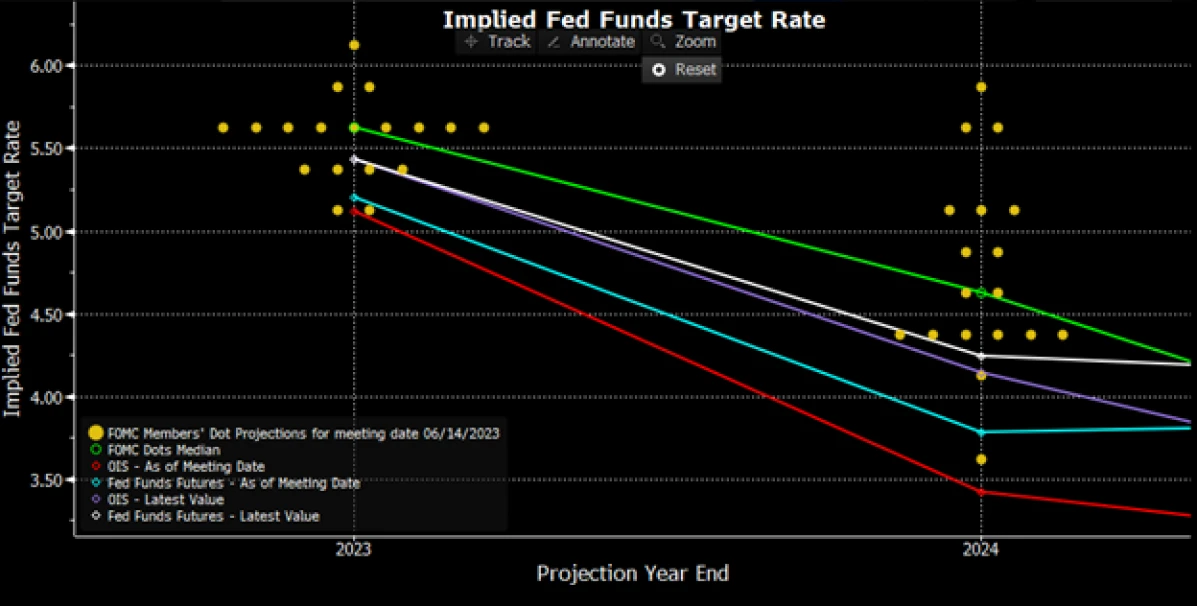

As for the upcoming meetings, three remain for the year, starting in just less than a month on September 20th. The interest rate futures market is currently pricing in a 50% chance of a hike through the end of the year, with the most probable timing of one occurring in November. Perhaps just as interesting is the pricing of interest rate probabilities next year; the same interest rate futures markets are currently pricing in multiple rate cuts by the end of 2024. Interest rate markets are also currently pricing a 2024 rate trajectory much closer to that of the Fed’s dot plot released in June. The chart below shows just how much closer the market for rates has moved relative to the Fed’s own projections; this, in our minds, is a healthy development.

Earnings Season

The story presented through Q2 earnings has been one similar to that of the economy; as in better than expected. With 484 of the S&P 500’s companies having reported, the aggregate results have been a 2.04% positive surprise in sales and a 7.65% positive surprise in earnings. In terms of sector representation, all sectors have seen a positive surprise in earnings, with consumer discretionary proving most positive at nearly 20%. Nearly all sector sales surprises were positive as well, apart from the materials (-2.57%) and utilities (-0.93%) sectors.

From a pure growth perspective, performance was more mixed and widely varied. Of note, the consumer discretionary and communications sectors produced double earnings growth of 33.30% and 14.39% respectively, while energy and materials experienced double digit losses (-51.42% and -29.25%). Consumer discretionary and financials also had double digit sales growth while the same two earnings laggards experienced a steep drop in sales. The strength in consumer discretionary earnings certainly matches the same strength we’ve seen and spoken of regarding the consumer’s resiliency in the economy. The quarterly struggles of the energy and materials sectors may be seen as a “coming back to Earth” type moment. Commodity prices, including oil, have certainly come off their prior year’s highs alongside inflation, but the past year’s earnings growth (particularly from energy) was going to be exceedingly difficult to replicate this time around. Overall, while a weakness in growth showed up in some of the more inflation and rate sensitive sectors, the totality of the corporate world’s resilience was stronger than many anticipated.

Final Thoughts and Conclusion

Our overall view of the market remains constructive. With inflation sharply down from the highs, the labor market keeping strength, and economic activity healthy, the case for a soft landing or more mild recession has seemingly grown more likely. Risks remain to this thesis in the form of the lagged effects of tighter monetary policy and the potential for stickiness in the remaining above target inflation level. Energy and food prices can also be volatile, which can temporarily bring doubt to the public’s inflation expectations and possibly bring volatility to markets. Additional less predictable risks appear in the form of geopolitical and domestic political risks. The conflict in Ukraine is ongoing with little sign of a near-term end to the situation apparent. In China, the economic environment continues to be poor and the dynamics that presents with their approach to Taiwan bears monitoring.

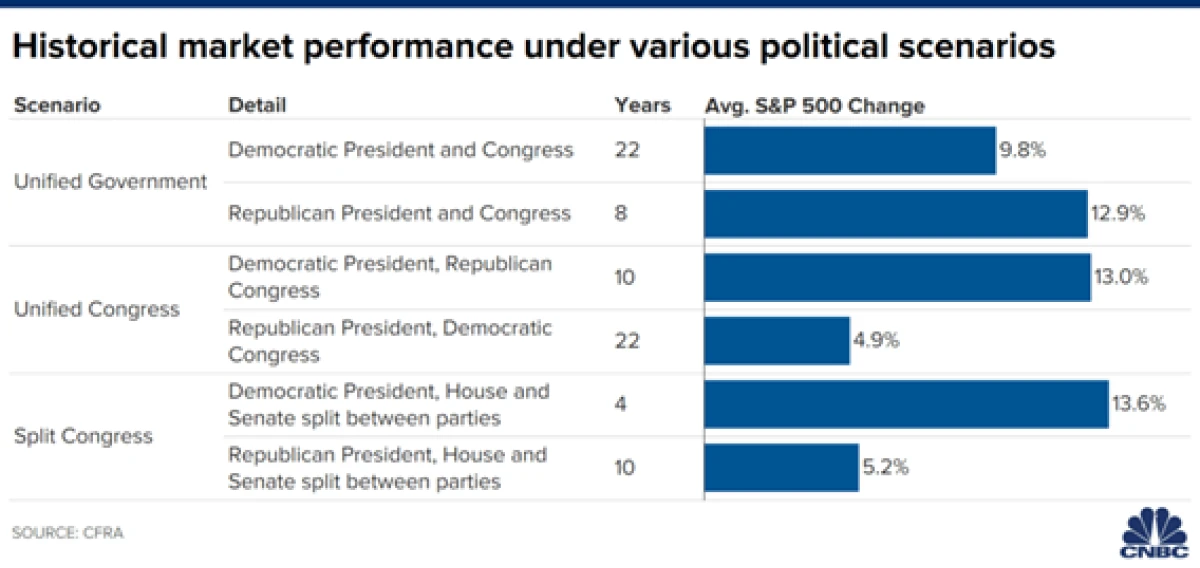

On the domestic political front, the 2024 U.S. Presidential campaign race is full speed ahead with the Republican Primary having had its first debate. Granted the election is likely to gain more and more coverage among media outlets as we get closer to 2024, we want to reiterate an important observation we’ve mentioned in the past; that the market’s performance is empirically apolitical in nature. The data has shown that whether there is a Republican or Democrat President largely does not matter. The market has on average provided positive returns in both scenarios, as well as in the various combinations of Congress.

We remain committed to diligently monitoring the financial landscape and adjusting our strategies as necessary. We will be watchful of both these threats and opportunities and will continue to manage the long-term risk and return mandates of our model portfolios accordingly.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.