Market Update – December 2023

An Update On The Markets, Interest Rates, and Economic Conditions

Last week, in a move that was largely expected by market participants, the Federal Reserve announced its decision to maintain the target federal funds rate at a range of 5.25%-5.50%. The pause was the third in a row for the FOMC following its last quarter-point hike in the July meeting.

For stocks and bonds, the decision has been an injection of fuel into a rally that has pushed markets higher after a slump from late July, bottoming at the end of October.

While investors had anticipated the pause in interest rates, it appears that the Fed’s outlook was received as a dovish surprise and a potential pivot from a policy regime of potential hiking to potential future cutting.

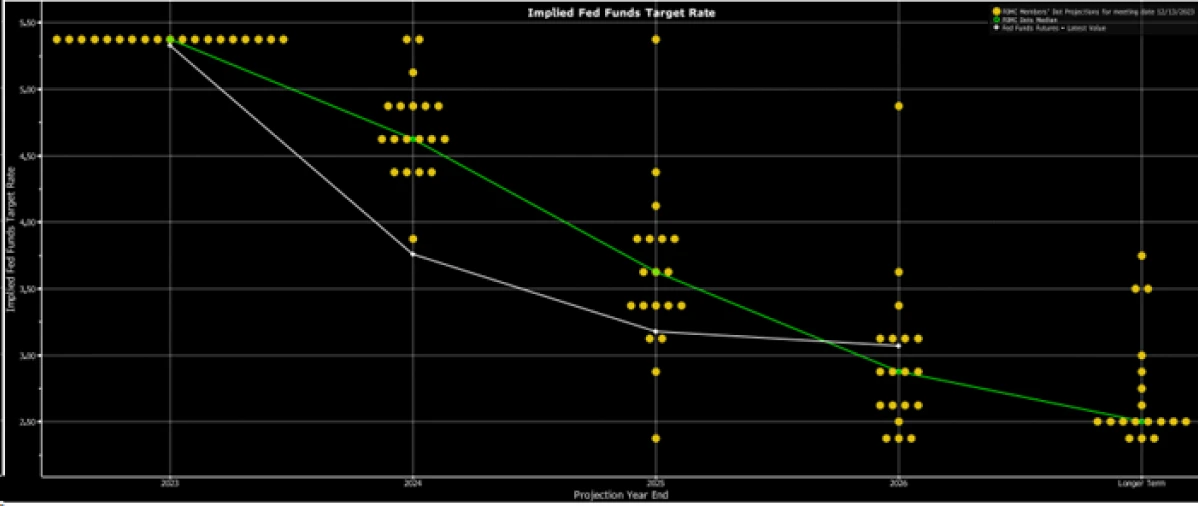

Representing the totality of this shift in outlook, was the interest rate “dot plot” released by the Fed; the median forecast among Fed officials at the September meeting showed a year-end expected Fed funds rate of 5.125% (representing somewhere between 1 to 2 quarter-point cuts) while the latest dot plot showed a median expected rate of 4.625% (between 3 and 4 quarter-point cuts).

At the time of the September meeting, fed funds futures markets (a derivatives trading market used by hedgers and rate speculators) had priced the projected rate for 2024 at 4.66%; those same futures markets as of today are forecasting a rate nearly a full point lower at 3.76%.

U.S. Treasury Yields

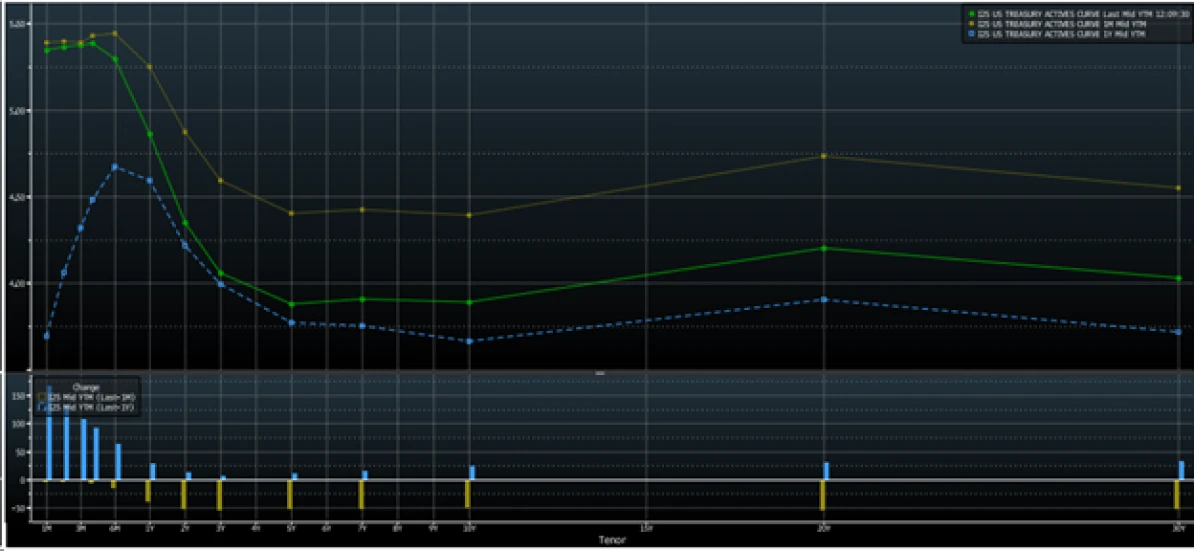

Exemplifying this recent big shift downward in expected rates are U.S. Treasury yields which have moved universally lower across the “yield curve”. As a quick synopsis, the yield curve for U.S. Treasuries is essentially the curve created when one plots the various yields for these fixed-income instruments across their various maturity groups (from 1-month treasury bills to 30-year government bonds).

Yields are inversely related to bond prices. In the chart below, the green line represents current yields, while the yellow line represents where yields were a month ago, and the blue line represents yields a year ago; all these yields being for various U.S. Treasuries.

As the image shows, yields have moved significantly lower than they were a month ago but remain higher than the previous year.

Given the many interest rate hikes put forth by the Fed over the past year, the most significant change to the curve in that time has been among those shortest-duration fixed income yields. That part of the curve is the most sensitive to current Fed policy.

The further out one goes on the curve, the more future interest rate expectations take control of the market on bonds and their corresponding yields. That is where the most significant shifts have occurred since the most recent Federal Reserve policy announcements.

Market Performance

As we’ve mentioned in previous market updates, with lower expected future interest rates comes an anticipated higher ceiling for asset valuations. These forecasted future interest rates are translated into discount rates that are used to equate opportunity costs on invested capital, which when combined with projected growth rates, provide fundamentally focused investors an estimate of assets’ intrinsic values.

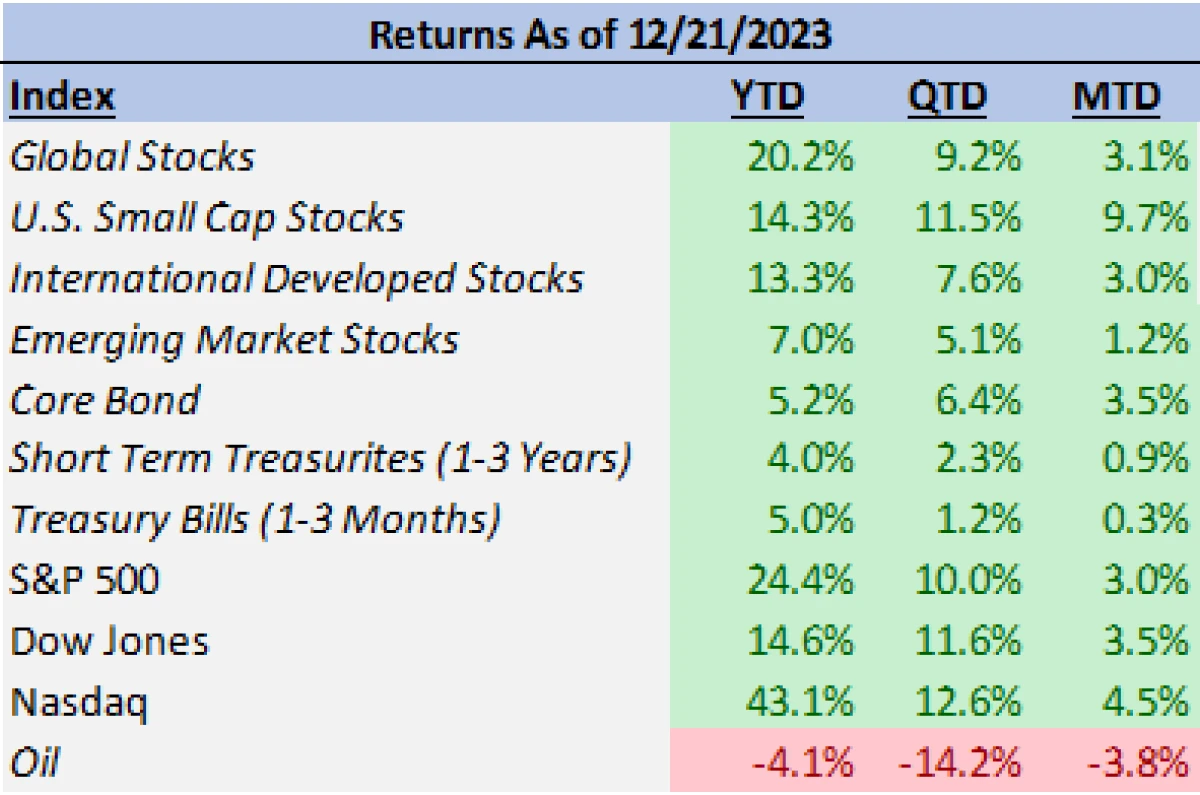

This fundamental value framework combined with the positive trend seasonality often experienced towards the end of the calendar year has been a catalyst for markets across many asset classes. Among the most encouraging aspects of this recent rally has been the breadth of quality returns. U.S. small-cap stocks for example, after having lagged behind their large-cap counterparts, have returned nearly 10% in December. Large-cap stocks, per the S&P 500, have gained 3% month-to-date with cyclical sectors such as consumer discretionary (6.49%), real estate (6.13%), and industrials (5%) leading the way in returns.

Communication services (4.26%), financials (3.47%), and materials (3.36%) have also outperformed over the month. International stocks (MSIC ACWI ex US) have also kept pace with the U.S., having also returned 3% month-to-date.

Most directly related to the recent decline in interest rates has been an increase in bond prices. Core bonds (Barclays US Aggregate Bond Index) have gained 3.5% month-to-date, a welcome development for those holding a balanced, moderate, or conservative portfolio.

Economic Conditions

Largely leading to the less hawkish Federal Reserve rate projections is an increase in evidence that the economy is slowing but not stalling. Signs of this economic deceleration were seen once again on Thursday when gross domestic product for the third quarter was revised lower to a 4.9% annualized rate of increase. This revised figure was lower than economists’ projections.

The Fed’s tightening cycle has already led to progress on the inflationary front. Last week’s Consumer Price Index (CPI) report showed the month-over-month figure report at a slightly higher than expected rate of 0.1%. While this was higher than the estimate of no change at all, the increase was still at a relatively modest pace compared to the inflationary figures consumers have experienced over the post-pandemic surge in price levels.

When looking at the CPI ex Food and Energy data, the month-over-month inflation reading was in line with analyst estimates of 0.3%. The year-over-year CPI data (both headline and ex-food and energy) were also in line with estimates at 3.1% and 4% respectively.

Much more evidential of the Fed’s progress with inflation were the Producer Price Index (PPI) reports, which often lead the CPI as it pertains to inflationary trends. PPI ex Food and Energy was reported as being flat for November as opposed to the 0.2% uptick consensus forecast by economists. PPI Final Demand also reported in at 0%.

As it pertains to the labor market, the trajectory has been less certain. After a big miss with higher-than-expected jobless claims for the week of November 11th (233k in claims versus the expected 220k), claims have come in at less than expected or in line with estimates in the weeks since.

Thursday’s latest report was a beat at 205k in claims versus the anticipated 214k. Combined with the November unemployment rate reported earlier in the month, a 3.7% rate below the expected 3.9%, there has not been a corresponding erosion in the labor market relative to inflation at this point.

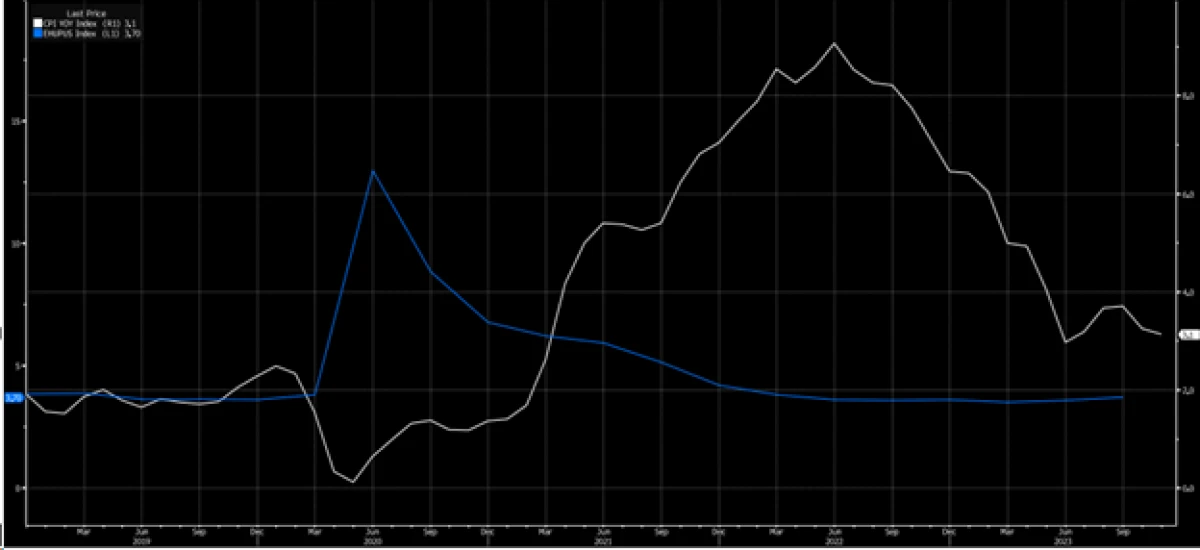

Displaying both the progress made on inflation and the thus far resiliency of the labor market is the below chart showing the Consumer Price Index (white line) and the US Unemployment Rate (blue line) over the past 5-years.

The chart covers how the two data points have responded through the turbulent economic times of the time period which included a pandemic, economic shutdown, presidential election, and inflationary crisis. In the latter years of the period, one can see the deceleration in inflation which, while having slowed in the second half of this year, has come substantially down from its highs while unemployment remains remarkably close to its lows.

As we head into the holiday season and the end of 2023, most investors’ attention will have already moved their focus towards 2024. The bulk of the economic data described above appears largely supportive of the, once thought of as unlikely, “soft landing” scenario. That being one where inflation is stymied to 2%, unemployment ticks higher but remains at a healthy level, and the economy slows to a sustainable pace but continues to grow. A moderate but shallow recession could still emerge, likely resulting in market volatility, but we believe it would be a shorter bump in the road on the way to a healthier economy and a return to long-term growth in capital markets.

2024 won’t be without its challenges, some risks already clearly recognized include the ongoing geopolitical issues in Europe, China, and the Middle East, and a Presidential election next November; all of which we will continue to watch and provide our analysis of as they develop.

While inflation has decelerated substantially in its pace of increase, the overall price level remains painfully high for many Americans, and it is likely prices in some areas will need to come down or the risk of a second surge in inflation (from a potential future round of wage increases) is possible. We will continue to be vigilant in monitoring these issues, and new ones as they inevitably emerge, from both a risk management and opportunity appraisal perspective.

The fundamentals of the economy remain strong and appear to be improving in many of the critical components and corporate execution on earnings continues to be in its totality strong, as seen through the upside surprises for the S&P 500 in aggregate last quarter. These factors lead us to be optimistic of the markets in 2024 and the longer-term horizon beyond.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.