Market Update – December 2024

A Summary of Recent Market Trends, Economic Data, and Key Insights Heading into 2025

With less than two weeks remaining in December and the holidays imminently approaching, the end of the year is upon us.

As 2024’s conclusion quickly approaches, investors’ focus has already moved forward towards 2025. This has turned investor intrigue towards deciphering the potential economic and financial catalysts that will chart the market’s path forward.

The Fed’s latest announcement to reduce interest rates by a quarter point was in-line with expectations and largely priced into the market. However, forward guidance on 2025 rate cuts was revised lower, and the Fed’s projections for inflation raised slightly higher; a statement that likely led to the late day’s volatility on Wednesday.

The upcoming new year is set to begin with a foundation built around an economy that continues to grow above expected long-run trend, inflation that has declined from high levels but remains stubbornly above the 2% target, and a labor market that has loosened from historically strong tightness but has stayed at a level healthy enough for economic expansion.

This economic regime has allowed for both actual earnings delivered in 2024 and expected earnings forecasted for 2025 to sustain current equity valuations above their longer-term averages. Positive sentiment around the AI boom and U.S. economic growth exceptionalism have been powerful narratives assisting with this dynamic, leading to strong returns from the “Magnificent 7” stocks that have lifted the U.S. large cap stock indices to levels higher than would be suggested by their average constituent.

With a new Presidential administration taking office, questions over the extent to which monetary policy will maintain a dovish stance, and a geopolitical environment that remains tense, investors would be wise to balance the optimism brought from recent market performance and economic conditions with a cautious eye on fundamental valuations.

Market Summary

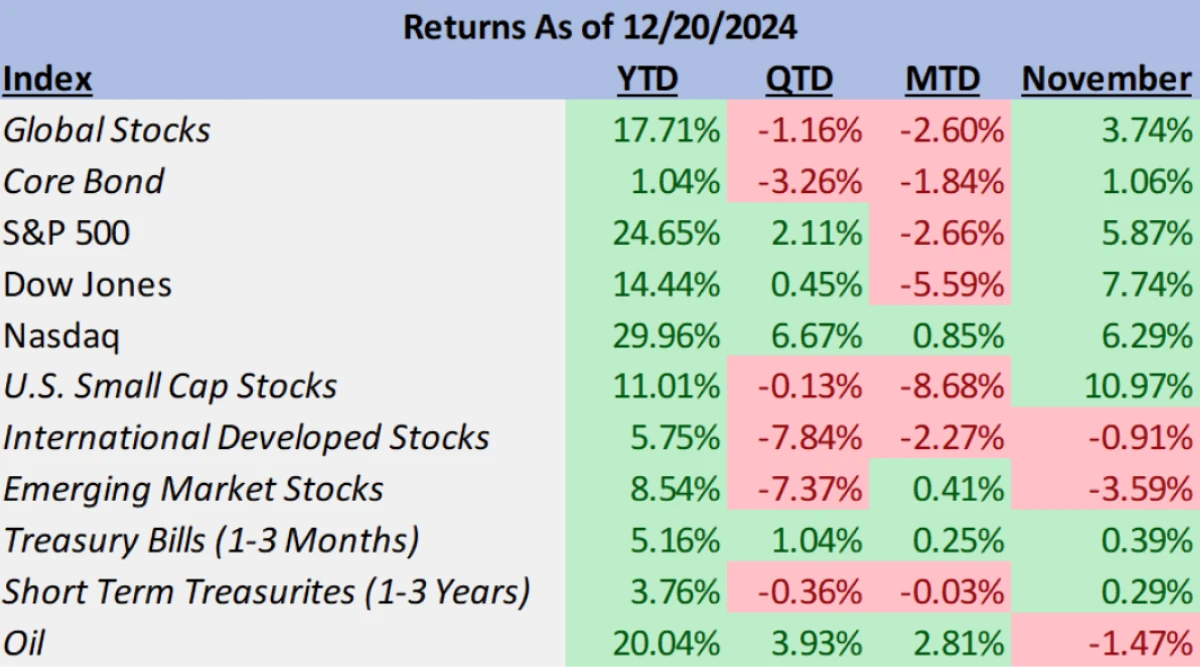

Global stocks, led by U.S. large cap equities, continued their strong year into November but have had slight setback in December. The MSCI All Country World Index (ACWI) closed Thursday up nearly 18% for the year. Despite slight outperformance of their U.S. counterpart’s month-to-date, international equities have been a laggard on the year when compared to domestic large caps partly due to lower economic growth and a strengthening dollar.

U.S. small cap stocks, continue to lag the broader global equity market year-to-date (The Russell 2000 is up 11% YTD), but had a notably strong November when they were nearly 11% higher for the month alone. The bulk of those gains have been given back in December’s recent volatility.

Return data from Bloomberg

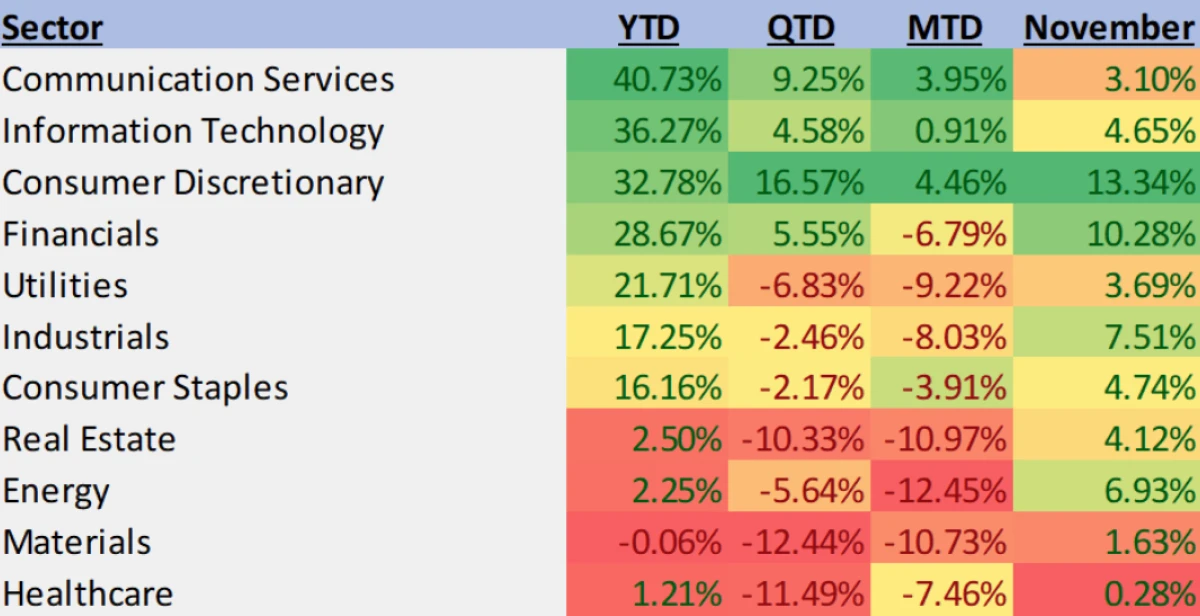

On a sector basis, the Magnificent 7’s substantial year largely contributed to those corresponding companies’ sectors’ outperformance of the broader market.

Communication services (~41%), technology (~36%), and consumer discretionary (~33%) stocks have been the biggest winners of 2024, while market leadership also emerged from a value sector in financials (~29%). Often speculated upon as potential deregulation and potential policy beneficiaries alongside small caps, financials and industrials each saw strong returns following the election in November; but each of these sectors and subgroups has also seen a significant portion of these gains given back month-to-date.

Real estate, energy, materials, and healthcare have been the biggest laggards compared to the broader market in 2024. Energy and real estate were also beneficiaries of the post-election trading activity in November, but have more than reversed off those initial gains since the start of December.

Return data from Bloomberg

Bonds remain marginally positive on the year, as the Barclays US Aggregate Bond Index has returned just over 1% for 2024. The index rallied over 1% in November but has fallen nearly twice as much over this month. Stubborn inflation, recalibration of future interest rate cut expectations, concerns over deficit spending, and resilient U.S. economic growth are all likely factors in the year’s mostly stagnant return on bonds.

Economic Update

As of December 9th, the Atlanta Fed’s GDPNow model estimate for real GDP growth for the current quarter is tracking at 3.3%. While more upcoming data remains in the pipeline, and the estimate is likely to change with those new reports, the model’s estimate is above the consensus economist forecast of 2.4% and would represent an acceleration in economic growth compared to the third quarter’s reported 2.8% rate.

Consumer spending would likely continue to be the primary driver of economic growth for Q4. Personal consumption contributed 2.37 points to the 2.8% GDP number in Q3 which along with contributions from fixed investment and government spending, offset a drag from net exports.

Retail sales for October, reported on November 15th, indicated continued strength from consumers on the surface with a 0.4% increase month-over-month which was above the forecast of 0.3%.

It is important to note as a caveat, however, that driving this beat in retail sales was renewed strength in motor vehicle related spending. When removing that contribution, retail sales ex auto and gas was actually below consensus at 0.1% vs 0.3% expected. Key insight will be provided as consumers head into the holiday spending season; a bounce back in consumption (ex auto) in other segments would be a sign of sustained strength and a positive sign for economic activity.

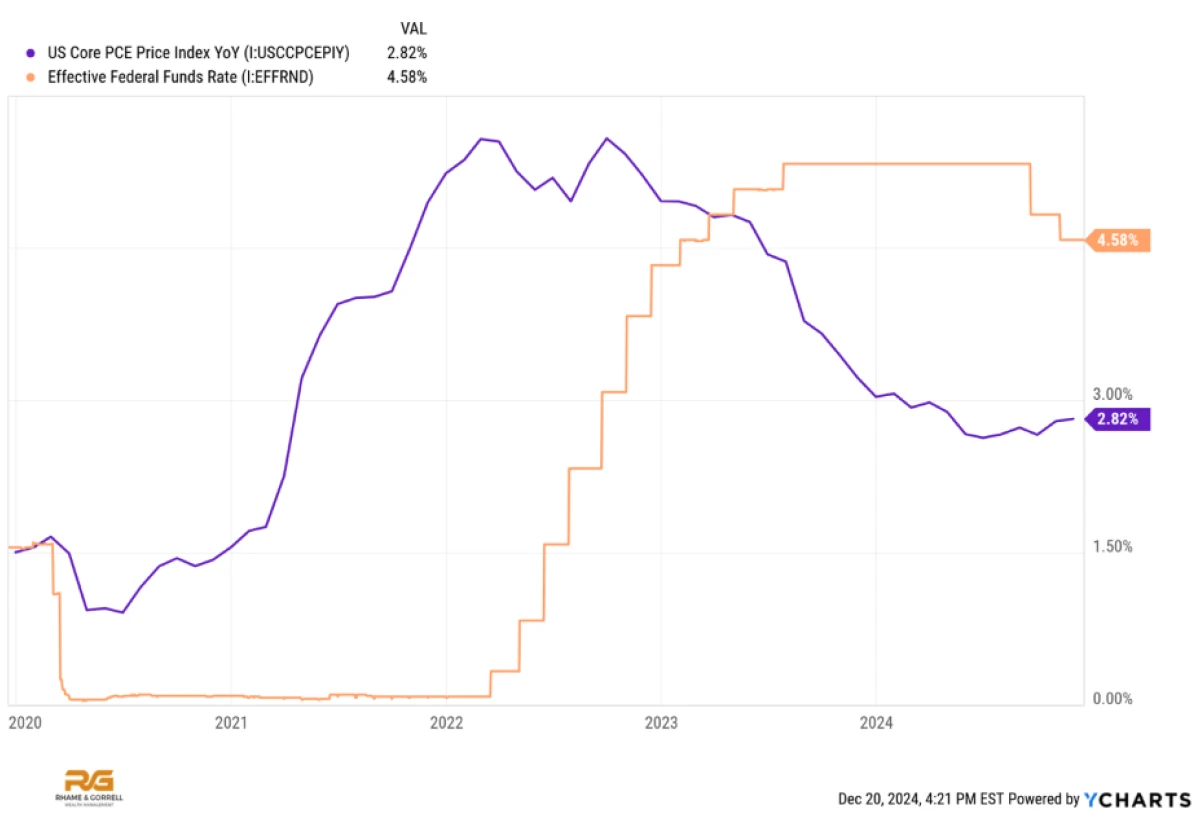

The road to the Fed’s 2% inflation target has taken a pause in recent months. After falling consistently from 5.6% to 2.7% over the course of two and a half years, the annual Core PCE (the Fed’s preferred measure of inflation) remained stubbornly above 2.6% since May and reaccelerated to 2.8% in November (matching October’s reading and up from 2.7% in September).

On a month-over-month basis, the last two readings (for October and September) both saw inflation grow 0.3%, in line with economist forecasts but annualizing higher than target. Contributing to this persistence has been the continued adverse impact of housing costs as well as a recent pickup in non-housing related services inflation. On the positive side, goods prices have been relatively stable, with nondurable goods showing a slightly disinflationary trend over the past three months.

Chart from YCHARTS

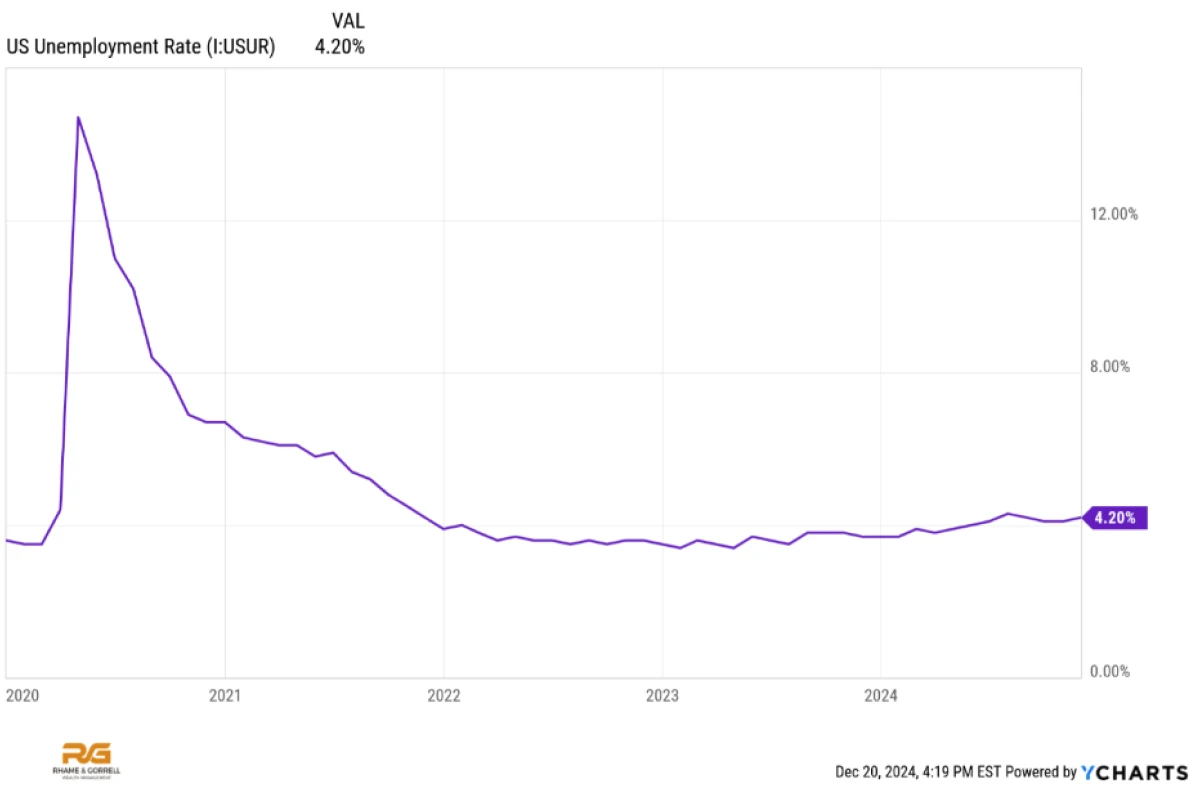

In a more welcome form of stubbornness, the labor market has also shown resiliency despite the Fed having held interest rates above the annual inflation rate (core PCE) for nearly nine months. The US unemployment rate has risen above the 4% lows (4.2% for November), but remains at a level most seasoned market followers would consider healthy and descriptive of an expanding economy.

The change in non-farm payrolls was above the survey’s estimate for November, with the economy adding 227k of those jobs. In addition, the two-month payroll net revision moved 56k jobs higher.

Chart from YCHARTS

The Fed

Following a widely anticipated 25 basis point cut to the federal funds rate that brought the target range to 4.25%-4.5%, markets experienced a sharp decline, with the Dow Jones Industrial Average falling over 1,100 points. While the rate cut itself was expected, the Fed’s updated guidance for fewer rate cuts in 2025 was a surprise to financial markets. The central bank signaled a more cautious outlook for 2025, revising expected rate cuts down to two—a notable shift from the four previously anticipated.

This adjustment reflects the Fed’s ongoing commitment to returning inflation back to its 2% target amid stronger-than-expected economic data. The Fed raised its 2024 GDP forecast from 2% to 2.5%, lowered its unemployment projection from 4.4% to 4.2%, and increased its core inflation expectation to 2.8% (up from 2.6% in September). While markets reacted with volatility, this cautious approach underscores the Fed’s prioritization of managing inflation over concerns of an economic slowdown.

With recession odds now in-line with the average long-term probability of 15% (https://www.goldmansachs.com/insights/articles/the-probability-of-a-us-recession-in-the-next-year-has-fallen-to-15-percent), the Fed’s stance reflects an economy that remains resilient, albeit one requiring careful navigation as inflation proves sticky. This balance between economic growth and inflation control will likely remain a central theme as we enter the new year.

Valuations and Earnings Expectations

Outside of unexpected inflation and the uncertainty regarding monetary and fiscal policies, one of the chief concerns for market participants is whether the current level of valuations will ultimately be justified by future earnings.

As of a December 13th report summarizing the analyst landscape by Lipper, Wall Street is currently estimating S&P 500 earnings to grow by 12.9% in 2025; this represents total aggregate earnings per share of $275.05. With a current value of 5867.07 on the S&P 500 as of Thursday’s close, this would put a forward Price-to-Earnings ratio (P/E) on the S&P 500 of just under 21.35x earnings.

While the S&P 500 has traded at higher valuations before and still seen substantial subsequent 1-year returns, the near-term return outlook (based off history) does become somewhat mixed. According to JP Morgan, the long-term average forward P/E ratio on the S&P 500 is close to 17x earnings.

For the market to continue moving higher, either the fundamental underpinnings of P/E (EPS) must grow at this level or higher, or multiples must continue to expand. Both of these market drivers are possibilities.

Conclusion

The backdrop heading into 2025 for markets is quite different than that which brought us into 2024. Valuations are higher, inflation has fallen below 3%, a new Presidential administration is set to enter office, and the Federal Reserve is now entering a “wait and see” approach off the heels of rate cuts. While these distinctions are notable, we believe an approach of careful analysis, risk management, and a focus on individuals’ personal risk tolerance and goal-oriented needs, remain an all-weather investment approach.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.