Market Recap – May 2024

A Recap of The Stock Market and Economic Conditions

“Sell in May and go away” is a popular mantra in investor circles, popularized by the Stock Trader’s Almanac regarding the best 6 months of the year for stock market returns on average. However, investors following this strategy would have missed out on a stock market bouncing back from April losses; May has seen the S&P 500 rise over 4% over the month.

While seasonality historically displays some patterns in markets (the average returns from November through April have been 7% versus 2% for May through October from 1970 to 2023), the stock market has tended to record gains throughout the year and inherently acts as a pricing mechanism for a multitude of economic, financial, geopolitical, and behavioral factors. A series of weaker labor market reports, better than expected inflation data, and resilient corporate earnings have all contributed to the positive month for equities.

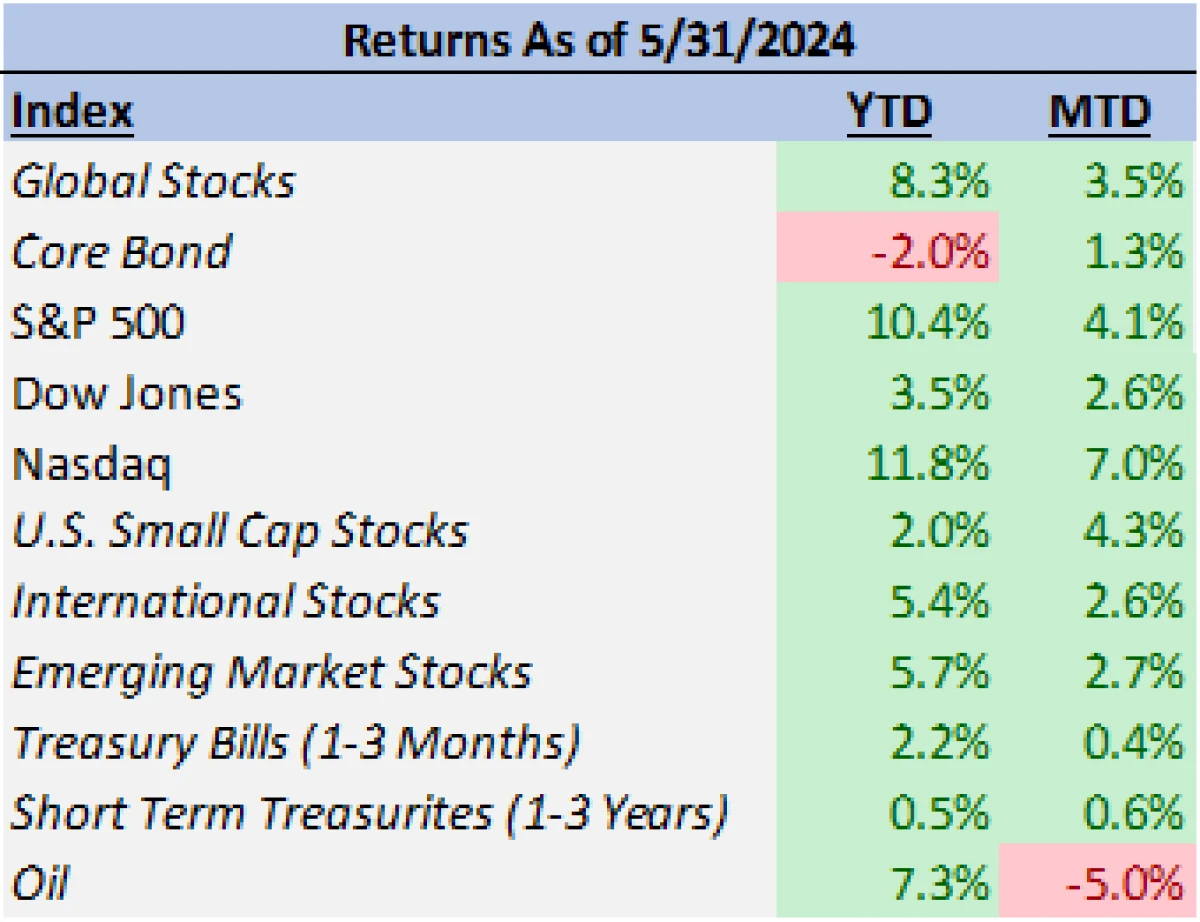

Market Summary

As mentioned in the introduction, the S&P 500 had a strong month, returning over 4%. Leading the way in the index was the technology sector which recorded double digit returns north of 10%. Utilities and communication services were also leading sectors with above market returns of 9% and 6.6% respectively. Energy stocks were the only negative detractors producing losses of -0.40%.

US large caps were not the only beneficiary of the positive month. Small cap stocks more than kept pace with slightly higher returns of 5%. International and emerging market stocks lagged their US counterparts but delivered respectable gains as well at 2.7% and 1.4% apiece.

Likely contributing to the recovery in stocks was a modest decline in bond yields. The 10-year Treasury yield ended the month at 4.5%, higher than its low of 4.3% mid-way through the month but well off the April high of 4.7%. This reduction in yields facilitated a recovery in the bond market, with the Barclays Aggregate Bond Index rising 1.3%.

Economic Data

2024 has been a year of market endurance in the face of oscillating economic narratives that seem at times to shift in their polarity week to week.

While April’s display of a much weaker than expected GDP report for Q1 and hotter than expected inflation (through CPI and PCE) stoked fears of “stagflation” and drove the stock market lower, May’s economic data has painted a more calming picture.

To start the month, the market rallied in the wake of an anxiously anticipated Federal Reserve meeting where rates were left unchanged and Chair Jerome Powell’s rhetoric calmed investor concerns over the risk of potential rate hikes. The patience of the Fed was, for the time being, validated by the month’s inflation and labor market data releases.

On the labor market front, April unemployment (released in May) saw the rate rise slightly from 3.8% to 3.9%; still remarkably low but higher than the prior month and above the expected forecast of the rate to remain static.

Perhaps more substantial were big downside misses in April’s payroll data. Change in Nonfarm payrolls (175k vs 240k exp) and change in private payrolls (167k vs 193k exp) saw misses of 65,000 and 26,000 each.

While the labor market data partly bolstered the moderating growth story framed by Q1’s GDP miss, it also acted as evidence that the Fed’s already tight interest rate policies are having an impact and may also be suggestive of cooling wage inflation to follow given the easing of the labor market.

The key to a soft landing and continued market optimism is for both sides of the equation, normalizing growth and falling inflation, to be achieved.

For that second part of the equation, May’s reports saw a reversal in the recent trend of stalled progress. Headline CPI for the month of April (released in May) arrived below expectations at 0.3% month-over-month (0.4% exp) and 3.4% year-over-year (3.4% exp). While the year-over-year figure was in-line with expectations, this was due to the effect of “rounding up” the number from 3.36%.

The core (ex food and energy) data was in-line with estimates as well at 0.3% month-over-month and 3.6% year-over-year, which importantly was a decline from the previous month’s inflation rate.

The last day of the month saw additional data calm the market’s inflation concerns, with April’s PCE (the Fed’s preferred inflation measure) mostly meeting the market’s expectations. Of particular note was April Core PCE (ex food and energy) rising less than expected at 0.2% for the month (vs 0.3% ex).

The cumulative effect of these data reports on market sentiment has been an increase in expected interest rate cuts.

The end of April saw the Fed Funds futures market imply just over one interest rate cut arriving by the end of the year; that same market is now implying closer to 1.5 cuts by year-end (with the increased probability of two cuts by December and increasing implied chances of cuts occurring in September and November).

Investor interest rate forecasts have still risen greatly from the start of the year when Fed funds futures were pricing in six cuts by year’s end.

The key to any cuts occurring this year and going forward will be a sustained decline in inflation that instills confidence in the Federal Reserve that PCE is trending towards their 2% target.

Corporate Earnings

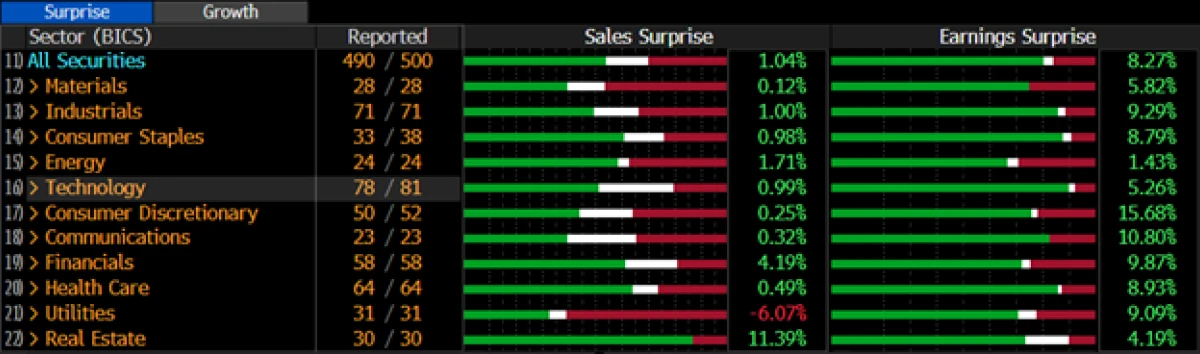

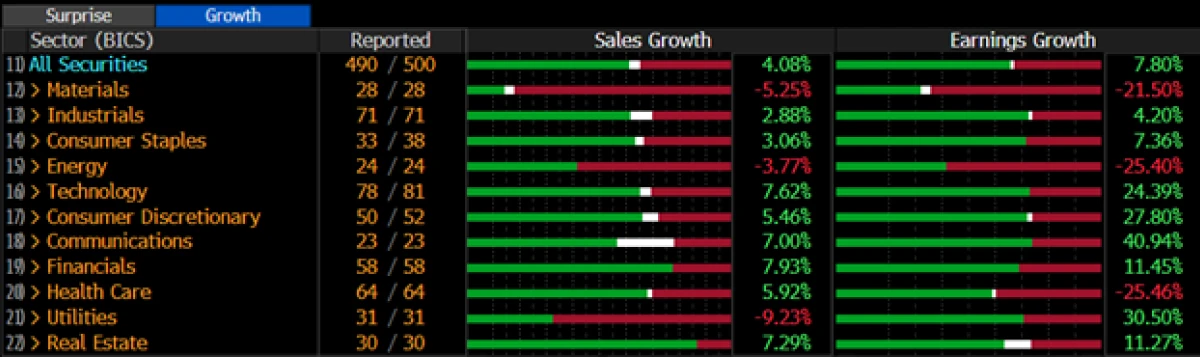

A tailwind to market returns this month has also been provided by a strong corporate earnings season. As an index, The S&P 500 (with 490 companies having reported) has seen overall sales growth of 4.08% and earnings growth of 7.8% respectively. Both of these measures have beaten expectations by 1.02% and 8.27% respectively.

The biggest absolute earnings growers on a sector level have been communications services (40.94%), utilities (30.50%), consumer discretionary (27.80%), and technology (24.39%). Real estate and financial services have also seen double digit earnings growth of 11.27% and 11.45% respectively.

Declines in earnings growth were found in health care (-25.46%), energy (-25.40%), and the materials (-21.50%) sectors. All sectors, however, have beaten the market’s expectations going into earnings season, with the consumer discretionary (15.68% surprise) and communication services (10.80%) both delivering double digit surprises.

S&P 500 Sales and Earnings Surprises by Sector (as of 5/31/2024)

Q1 S&P 500 Sales and Earnings Growth by Sector (as of 5/31/2024)

Heading into the current earnings season, much of the spotlight was on the mega caps, with particular attention being paid to the group of stocks known as the Magnificent 7 (AAPL, GOOGL, TSLA, NVDA, AMZN, MSFT, and META). These companies from the technology, communications, and consumer discretionary sectors have collectively driven much of the return in the S&P 500 year-to-date (22% for the Mag 7 versus just 4% for those in the S&P 500 outside of the group) and have traded at market multiples substantially higher than the S&P 500.

The price-to-earnings (P/E) ratio of the Magnificent 7 stands at 36.75 versus 24.42 for the S&P 500. With these high valuations and a rising level of index market cap concentration, some investors were rightly concerned that this earnings season may have hinged on a relatively few companies beating already lofty expectations centered around future prospects of an AI driven economic supercycle.

Now that the dust has settled, it can be said that the Magnificent 7 mostly delivered this season; only Tesla failed to beat the market’s expectations, missing an already pessimistic outlook for the quarter. As a collective, the index beat earnings expectations by nearly 11.5%, growing earnings by 52.53%.

Q1 Magnificent 7 Sales and Earnings Growth (as of 5/31/2024)

Q1 Magnificent 7 Sales and Earnings Surprises (as of 5/31/2024)

Going forward, the question for investors will be whether both earnings growth, and market returns, will broaden out. While the Magnificent 7 can continue to provide positive returns to investors, rising valuations and corporate execution expectations also produce a rise in risk that expectations could be less attainable. Expectations for other parts of the market remain less aggressive and valuations seemingly favorable.

Our view, is that while investors shouldn’t avoid the Magnificent 7 given their strong earnings performance and the long-term prospects of their positions in the innovation economy, favorable valuations for the market’s remaining constituents (from the rest of the large cap space as well as with small caps and international equities) warrants diversification. An inflation environment that we expect to trend towards the Fed’s target rate should lead to a reduction from the current peak level of interest rates, and this along with a weakening dollar could be the catalyst for a more broadly representative stock market rally to follow.

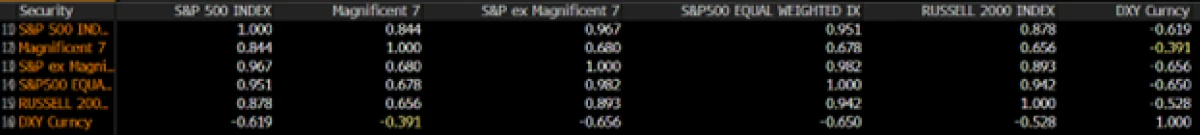

Many of these companies outside of the Magnificent 7 collective stand to benefit the most from a reduction in ongoing interest expenses and inflationary pressures. The chart below shows how various market segments (from the S&P 500, Magnificent 7, small caps via the Russell 2000, and others) have interacted on a correlation basis to the dollar’s relative strength over the past two years.

Stock Index and Dollar Spot Index Monthly Correlations (1/1/2022-5/31/2024)

While each of these stock indexes have interacted in a somewhat inverse fashion with the strength of the dollar, the Magnificent 7 has had a lower magnitude of correlation relative to these other segments. If these correlations hold going forward, a weaker dollar in the aftermath of global interest rate reductions should stand to benefit the broader equity market the most.

Conclusion

As the market moves into the final seven months of the year, we will continue to monitor the developments in the economy, corporate earnings, geopolitics, and, of course, the upcoming US Presidential election cycle.

With many moving parts and a wide range of potential scenarios, it is important to stay vigilant while also focusing on the fundamental factors that drive markets forward. With normalizing economic growth, a resilient labor market, and strong corporate earnings, we continue to believe capital markets are well positioned and a soft landing is achievable as long as inflation continues its slow descent.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.