Market Update – October 2023

An Update On The Markets, Economic Changes, and Political Variables

Market Performance

With the month of October comes the start of the final quarter for 2023. As we open the last three months of the year, the stock and bond markets enter the quarter having shown signs of weakness over August and September after what had been otherwise a strong 2023. Largely driving markets during these recent times are a combination of economic and political factors. Narratives on the economic side include uncertainty regarding the direction of interest rates as higher yields gain ground and whether growth, labor, and the financial landscape can remain healthy in such an environment for long. On the political side, concerns over stability have been at a fever pitch as Congress narrowly avoided another government shutdown when a short-term funding bill was passed effectively kicking the can down the road to November 17th. In the wake of the bill’s passage, the House of Representatives elected to oust House Speaker Kevin McCarthy, the first removal of its kind in U.S. history. As we have consistently maintained, it is important to have an investment approach to markets that considers the long-term fundamental outlook to asset classes while balancing the risk tolerance aims in one’s financial plan. Doing so allows one to more easily navigate a fully invested portfolio strategy during times of market volatility and in times of market exuberance.

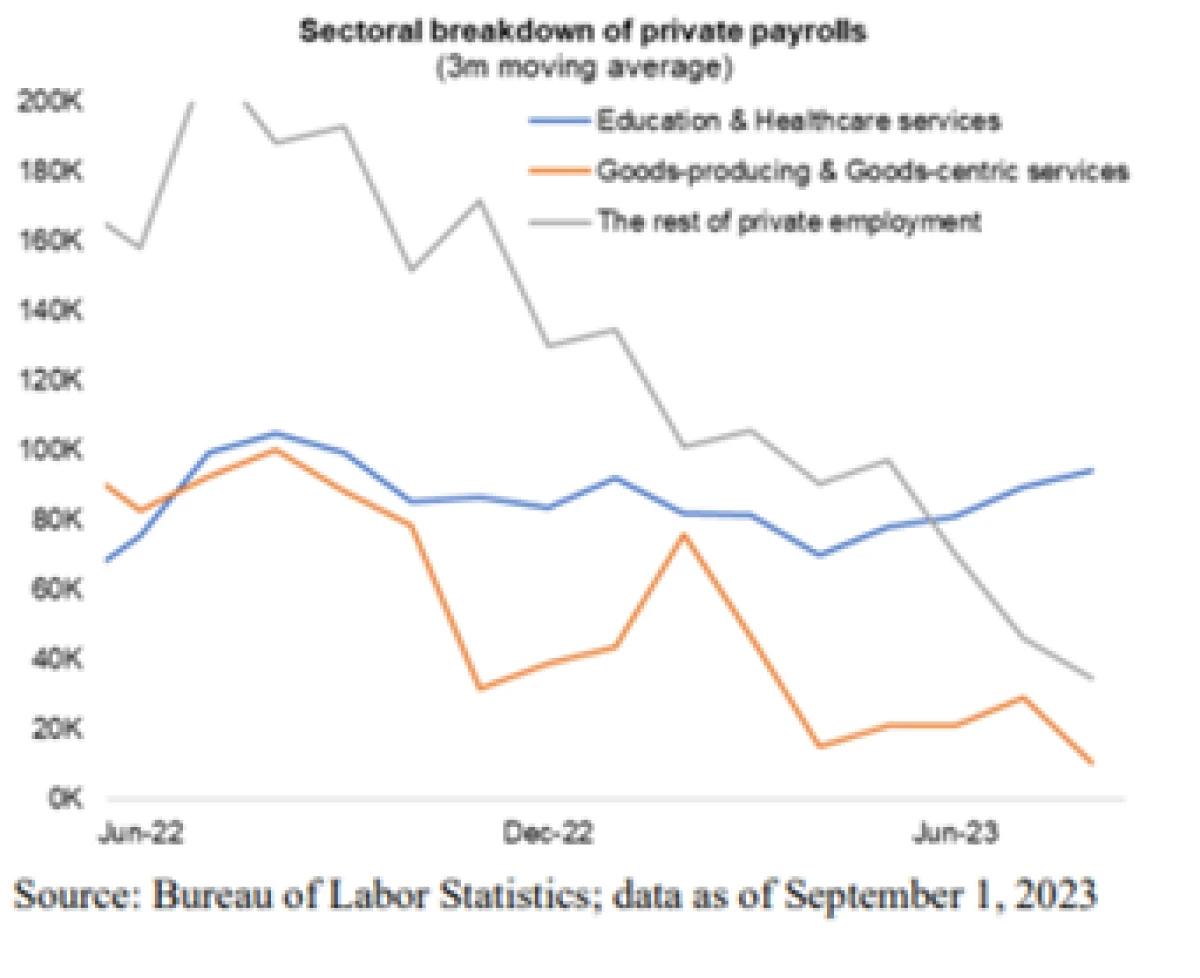

One of the major factors pushing both stock and bond prices lower is, ironically, the fact that the economy has remained strong from both a labor market and forward-looking GDP perspective. This perceived economic strength has forced market participants to adjust their outlook on Fed interest rate policy to more closely match the Fed’s own consistent stance of “higher for longer” rates. In lockstep with these adjusted forecasts have been a sudden jump higher in bond yields over the past month (the 10-year Treasury yield has risen nearly 0.70% since September 1st) and a continued correction in the stock market. Further adding to the tightening of financial conditions has been a resurgence in the price of oil, with WTI climbing from $70 at the end of June to a current price of over $87 ($93.68 at its September high). While not a part of the Fed’s preferred inflation gauge (the core PCE deflator), the rise in energy prices has added a new layer of intrigue to what appeared to be a softening of inflation expectations that could lead to future lower interest rates and a soft landing. Despite the market’s recent response to this information, there is evidence underneath the surface that the economy is beginning to feel the Fed’s policy moves. The largest contributor to inflation, shelter costs, have begun to decelerate and should continue to do so in 2024 which will act as a strong downward force on the core inflation metrics of PCE and CPI. The labor market has shown signs of moderation as well; the pace of job gains, while still resilient, has been trending lower since last year. Forward looking business surveys such as PMI measures show that sentiment is moderating which likely will further decelerate services and manufacturing businesses’ hiring plans in recent months. The 3-month moving averages for private payrolls has shown that hiring has slowed in the U.S., except in education and in healthcare services, when looking at private payrolls based on a three-month moving average as shown below.

(via BlackRock)

What this suggests to us is that the economy is truly beginning to feel the impacts of the Federal Reserve’s policies and that in the possible outcomes that exists, a soft land or mild recession continues to be the most likely set of outcomes to us in comparison to a sustained high growth high inflationary activity economy. This type of backdrop has us remain in the base case belief that we are closer to the end than the beginning of the rate hiking cycle. The Fed may hike rates again, or they very well may not; either way we see us having at least approached the end of the hiking road. Lower rates would point to lower future bond yields and a lower potential discount rate on corporate cash flows, thus supporting higher stock market valuations with an assumption of flat to stable earnings growth.

Political Variables

Of course, the biggest headline hovering over both markets and the larger political discourse in recent weeks has been the ongoing gridlocked battle over the budget, with a crescendo on Tuesday’s removal of House Speaker Kevin McCarthy from the speakership. Removing political leanings from this issue, the move to oust McCarthy was the first of its such in U.S. history and certainly a sign of this polarizing era of governance. In the days before his removal from office, the former Speaker ended his brief tenure with a temporary stop gap bill to fund the government until mid-November. It was the second time this year a shutdown was avoided. In the absence of the familiarity with McCarthy and a replacement not yet in the office, it is understandable for one to see the potential risks of an upcoming government shutdown increase. It is important to note that a government shutdown is not the same as a default on the U.S.’s debt. This significantly differentiates the current budget gridlock from the debt ceiling standoff earlier this year which has been resolved with the ceiling suspended until January 2025. What this means is that Treasury auctions will continue, interest payments will continue to be made, and Social Security and Medicare benefits would be paid, along with “essential federal workers” such as air traffic controllers and law enforcement continuing to go to work. However, a government shutdown would still mean certain non-essential federal agencies would temporarily shut down and furlough workers and key data releases (such as job and inflation reports) could be delayed. This would still be disruptive to society and there is potential for market volatility. This potential is not a guarantee though, as history has shown that economic and market impacts from shutdowns could be limited. The longest government shutdown in history was 35 days from December 2018-January 2019. The Congressional Budget Office (CBO) estimates that while the shutdown cost $11 billion and reduced real GDP by 0.3%, about $8 billion was recovered once activity resumed. As for the markets, the S&P 500 corrected sharply but only temporarily; and it is not entirely certain as to how much the correction was due to the shutdown given the other key factor at the time (similar to now) was the Federal Reserve striking a hawkish tone that rate hikes have not been finished. In January 2019, Chair Powell provided a more dovish stance suggesting a pause on the hikes and stocks rebounded in just as sharp of a fashion even before the shutdown had included. From a Federal Reserve perspective, the Fed’s stance has not provided and at the moment is not setup for a negative surprise at this time in our minds. One aspect of the market activity during the 2018-2019 shutdown that may be somewhat encouraging to those with diversified portfolios is that bond yields fell during the shutdown as investors moved to safehaven assets. This movement offset some of the volatility within balanced portfolios.

Because the impacts on markets and the economy from a potential shutdown would likely be limited, we do not believe the possibility of the event itself warrants changes in the near-term.

Looking Back To Past Market Trends

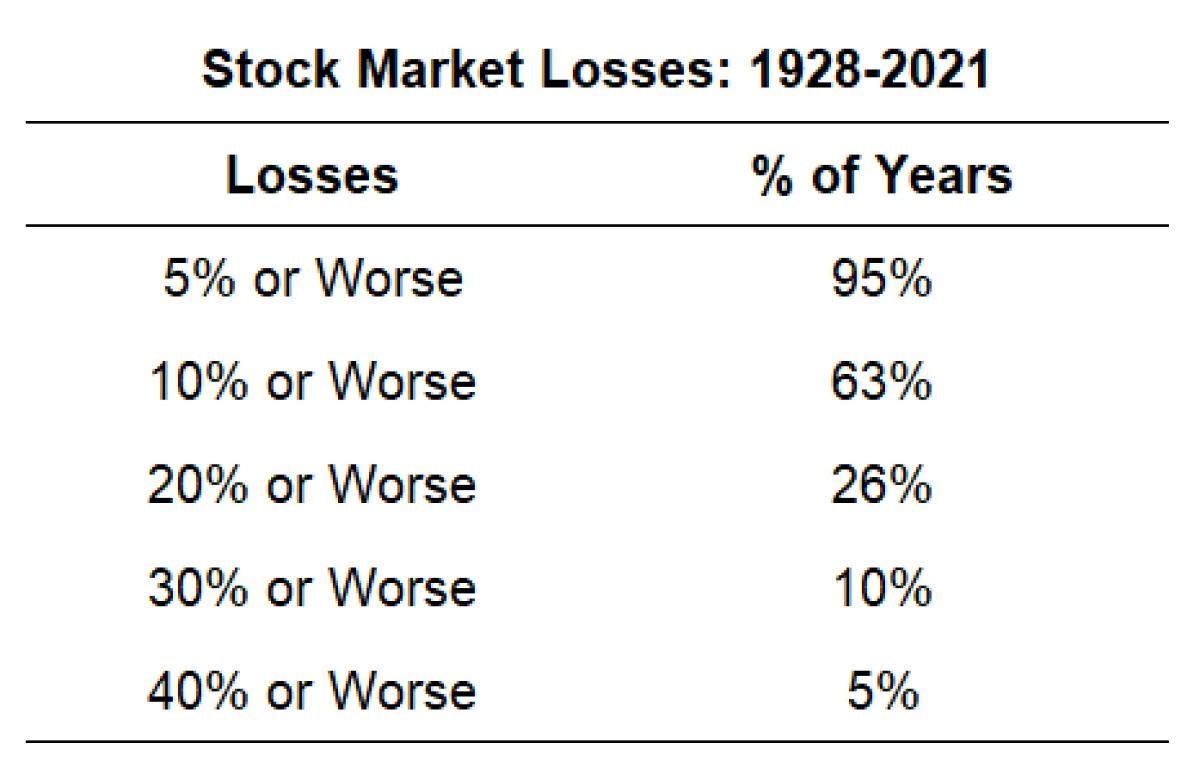

As a final note, we’d like to point out that currently the S&P 500 is only off of its recent year-to-date highs by about 7.5%. The index remains up ~11% year-to-date and has over 10% of upside left just to return to all time highs. Corrections of 5% in the stock market are extremely common in any given year; even corrections of 10% occur in more years than not since 1928.

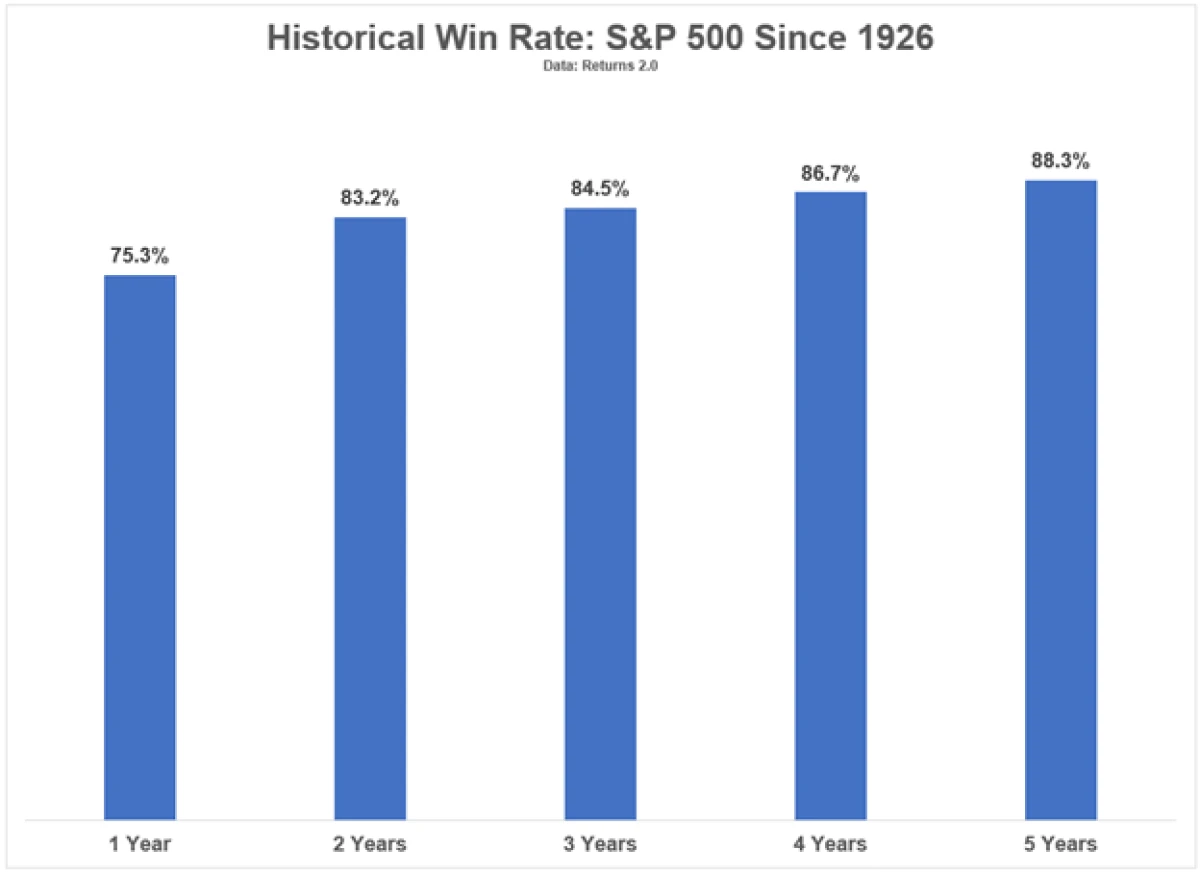

An important attribute of the stock market to keep in mind in the midst of the volatility, is that extending one’s time horizon further out will unsurprisingly increase the chances of achieving a positive outcome. The chart below shows that when evaluating the S&P 500 since 1926, investors achieved a positive return 88.3% of the time in a 5-year rolling window.

Conclusion

While the recent volatility among markets has been uncomfortable for many and could continue in the short-term given the current economic and political noisiness, we remain constructive of the longer-term investment environment due to the reasons this newsletter outlined. Those reasons in short being the limitations of the impacts from a shutdown (if there is one) and the prospects of the continued moderation of both labor market and inflationary forces. Risks remain to this thesis given the lagged effects of tighter monetary policy, the potential for stickiness in the remaining above target inflation measures, and the unpredictability of geopolitical and domestic political risks. The conflict in Ukraine is ongoing with little sign of a near-term end to the situation present. In China, the economic environment continues to be poor and the dynamics that presents with their approach to Taiwan bears monitoring.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.