Not a Good Week for the Market

This week concluded was the worst in 2 years for the Dow Jones and S&P. After a very impressive start to 2018, investors are now faced with trying to decide if 2018 market performance will look more like January or if the concerns of the last week are signaling the end of the 9-year bull market.

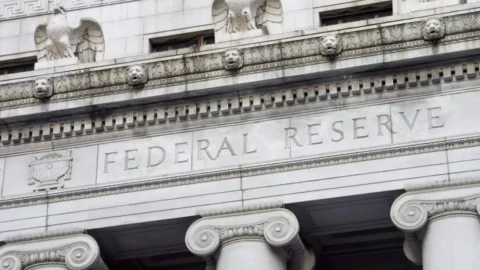

One of the key issues that markets are reacting to is the rise in bond yields. The 10 year is now trading at 2.85% and will likely head higher in the short-term. The equity markets are concerned that the Fed is now behind the curve and that there may be four rate hikes this year rather than three. The prospect of higher yields, and the potential rise of inflationary pressure are at the root of the market behavior this week.

We want to caution our clients not to react too quickly to these sentiments for the following reasons:

- Interest rate increases are not inherently bad things. The key is WHY rates are rising. If rates are moving higher in anticipation of future growth in the economy, then this is a counterbalancing force and part of the normal economic cycle. If rates are moving higher because of incipient inflation, then it is more likely to be an issue for market performance. Right now, we feel that the over-riding factor behind the rise in interest rates has to do with growth, not inflation. For a fuller discussion of this, see our recently released 2018 outlook.

- It is always useful be able to place market events in historical perspective. First off, this selloff has come on the heels of a very big January and it is important to not let the most recent events color your longer term thought patterns. YTD, the markets are still up strongly and the same conditions are present today that prompted the rise at the beginning of the year.

- It is worthwhile to note that there is usually a significant period of equity outperformance AFTER interest rates have started to rise. Typically, there is about an 18 to 24-month lag between the onset of an interest rate rise, usually characterized by an inverted yield curve, and the equity market peak. The average return for this period has been over 35%!

- A knee-jerk reaction to go to cash may miss significant performance in equities. While our crystal ball remains elusive, the indicators that we rely on to look at the relative risk for bonds vs equities are still largely on the side of equity risk. In fact, if you look at many of the underlying factors that are driving the equity market performance, they are more consistent with mid-cycle economic stages rather than late stage.

- Rising rates are not necessarily bad for bonds either. One of the key components, as mentioned earlier, is what is the root cause of the rate rise. However, looking at Fed behavior during these cycles is equally important in order to understand where to be positioned. Equity and bond markets tend to underperform significantly when policy is not clearly communicated or there is some exogenous event at play. Periods like 1994 when Greenspan surprised the market and raised rates or 1998 when we had the Asian and Russian debt crisis were both times when markets reacted very negatively to rate rises that were not communicated. That is NOT the case today. The Fed has been transparent and if rates are increased more quickly than was previously signaled, it will more likely be because of growth concerns and not inflationary pressures and markets have been very aware of where the Fed has been signaling.

While nobody likes to be slapped around by the markets, it is important to understand why you are being slapped. In 2007 and 2008, markets were telling you to wake up – today Mr. Market is most likely telling you to slow down.

As always, if you would like further discussion please contact our Investment team.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.