The Stock Concentration Risk and ExxonMobil’s Correlation to Oil Prices

How Mega Backdoor Roth Conversions Can Optimize Your Tax Treatment

One of the more challenging aspects of managing an investment portfolio is to be able to identify various sources of risk – some of which are not specifically related to investment performance but can have a significant impact on a portfolio. One of these types of risk lies in having an excess concentration of an individual stock or sector. The concept of concentration risk can be applicable to an individual stock holding, and also to a particular asset class. For example, a portfolio holding a significant position in municipal bonds it is subject to rate risk – if interest rates rise, this could have a dramatic and negative effect on the value of their holdings.

A single large holding in your portfolio does present some unique challenges in overall portfolio management. One of the first things to identify is how the holding came about because that may influence the specific strategy chosen to manage the exposure. There would be a different strategy focus on stock that was acquired through exercised options as opposed to inherited stock or NUA (Net Unrealized Appreciated) shares. Stock that is received through a sale of a privately held business that later goes public might be treated differently than shares acquired through a restricted stock as part of overall compensation. Timing considerations also play a role in determining the best strategy for diversification, as well. Contractual obligations may restrict the sale the sale of securities, but not the hedging of exposure.

From a long-term investment perspective, there are reasons why concentration may not be the best option. An important consideration is that large concentrations tend to skew performance more toward single stock returns rather than broader based market returns. As you shall see in the ExxonMobil example, if you have the right single stock this can be a very positive thing for portfolio performance. However, studies have shown that over time, single stock underperformance to the broad market is more than four times as likely to occur. Given the lack of diversification, studies have shown that the expected return profile for most single stocks versus a diversified basket is characterized by a wider range of values (higher volatility) and the potential for outperformance is outweighed by the underperformance on the downside.

As a firm, we manage a number of holdings that fall into this category and ExxonMobil (XOM) is a position that many of our clients have in common. While we have said that concentration can have advantages, we also recognize the challenges in managing the total risk and return tradeoff within the portfolio. Can you have too much of a good thing? To find an answer, the first task is to determine whether or not it really is a good thing.

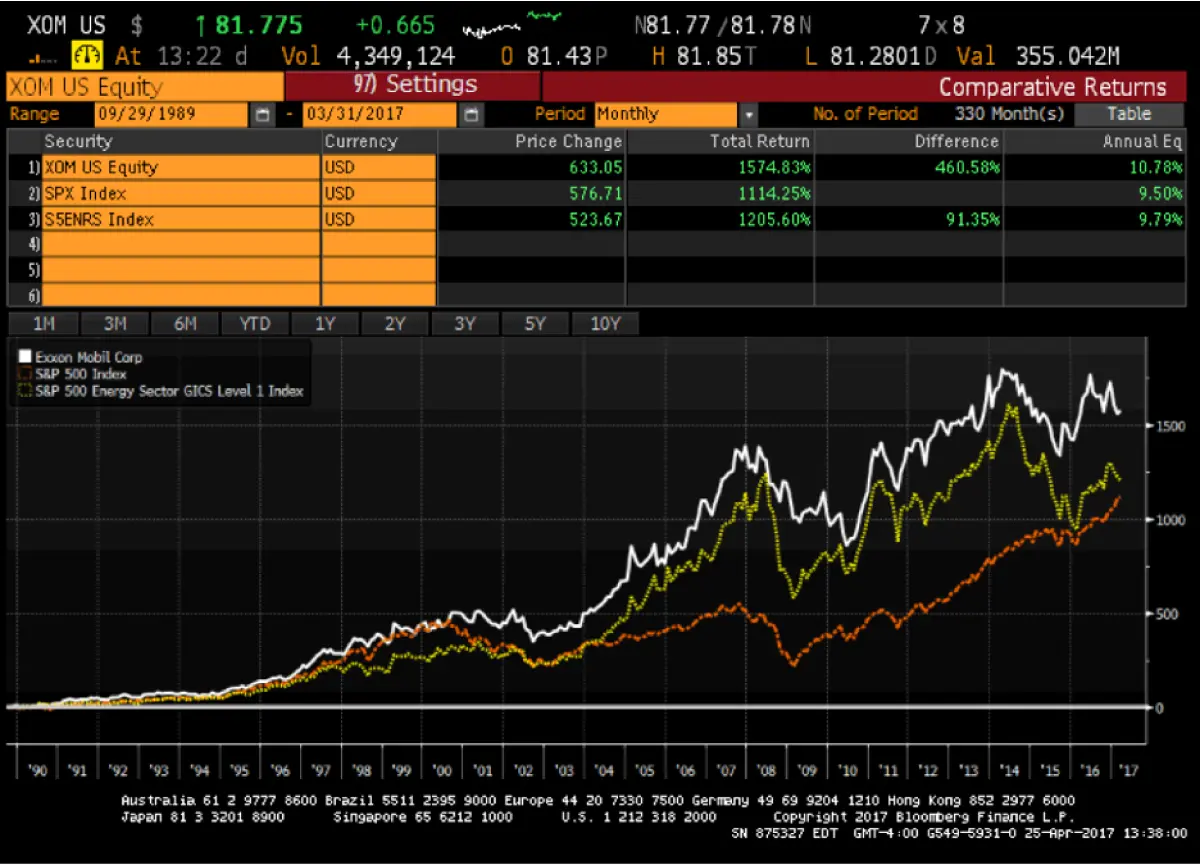

The top line of the above chart shows the performance of XOM compared to the S&P500 and the S&P Energy Index. Since 1990, the overall performance of ExxonMobil has been outstanding – compounding annually at 10.7%, and providing a total return of almost 1,600% vs the S&P (1,114%) and the S&P Energy Index (1,205%). The total return has been almost 45% more than the equity market and 33% more than the energy index. The answer seems to be obvious that it IS a good thing to have too much ExxonMobil.

However, looking at different time frames helps to deconstruct the overall risk and return of a concentrated position. Using the same analysis as above, but using 2000 as the starting point shows that XOM returned 211% over the past 17 years, which handily beat the S&P (124%) but trailed the peer group energy index (253%). While still a good investment relative to the S&P, there were clearly better alternatives in the energy space.

The last time frame analysis is taken over the most recent 5 year period. ExxonMobil showed a total return of only 13%, an average return of 2.4% which was relatively even with the energy index but significantly trailed the S&P total return of 110% (average return of 15%). Obviously, using different starting points will provide different results, but the point is that concentration risk can be both a positive and a negative depending upon the relative risk/return of the investment to the general market, and knowing where you are in that return cycle is valuable information when you are deciding on a plan of action.

One of the major considerations in managing a concentrated position is determining the amount of risk that is correlated to a specific factor or asset class. In the case of ExxonMobil, one of the primary risk factors is the exposure to oil prices. It is helpful to look at the historical correlations of XOM to oil prices to get a better picture of the potential risks in the future. One of the benefits of ExxonMobil is that the stock has provided downside protection to falling oil prices. For example, during the period 2008 – 2009 when oil prices fell from $125 to $50 – a historic drop of 60% – ExxonMobil had only a 26% correlation in terms of price. During the period 2014 – 2015 when oil prices dropped from $107 to the low of $28 – ExxonMobil stock only participated in 20% of the decline. This is a major reason for the outperformance of XOM relative to both the S&P and energy peers over the past 30 years.

However, to get an accurate picture of overall risk, the upside correlation needs to be monitored as well.

| Period | Oil Price Move | Upside Correlation |

| 1990-2005 | $20 to $60 | 100% |

| 2005-2008 | $60 to $140 | 34% |

| 2009-2011 | $50 to $125 | 18% |

Looking at the above numbers makes the obvious point that over time, ExxonMobil’s price has been less and less correlated to higher energy prices. Looking at this from an investment perspective, especially in dealing with a concentrated holding, it might make sense to look at potential alternatives, not only to diversify risk, but to balance the downside with more potential for upside capture. Obviously, these are not the only two factors to consider in making any investment decision, but we think it is helpful to bring these points to your attention so that we can begin to look at the total risk in the portfolio.

If you would like to discuss the topic of ExxonMobil concentration further, or any other concentration risk and how it specifically affects your portfolio, please give us a call to set up a time to speak or meet for an appointment.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.