ExxonMobil Retirement: Maximizing Your Benefits

A Guide For Maximizing Your ExxonMobil Retirement Benefits

As an industry leader that wishes to attract top talent across all areas of the company, ExxonMobil has established a comprehensive benefits plan that includes robust retirement plans, health insurance, and several other incentives.

Although there are limited educational resources that do cover certain portions of these benefits, many employees give little or no thought to optimizing their benefits during their working career. Below we will address a few items that we believe are imperative to ensuring that you are making the most of what is offered as you prepare for retirement.

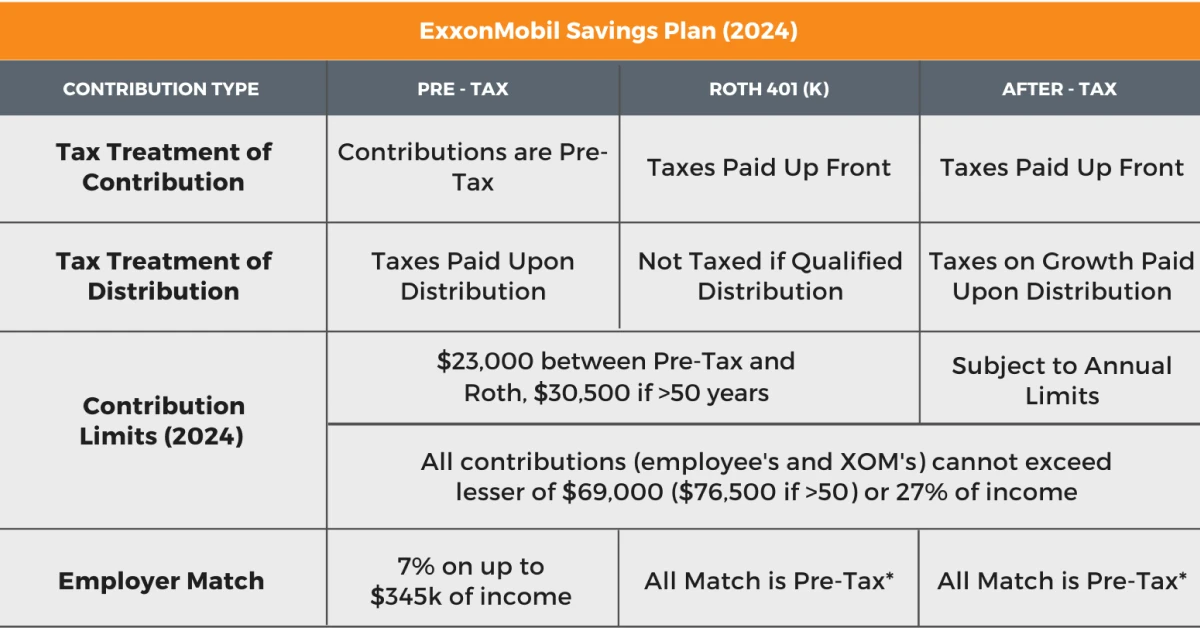

ExxonMobil Savings Plan

In simple terms, the ExxonMobil Savings Plan is a 401(k) that the company has established for employees. However, it has several unique benefits that can help optimize savings from an investment and tax perspective. The plan allows employees to defer up to 20% of their salary as a Pre-Tax and/or Roth contribution. The IRS maximum for contributions in 2024 is $23,000 for employees under the age of 50, while individuals over age 50 receive a $7,500 catch up contribution to get to $30,500 per year.

Take Advantage of the Company Match

We generally recommend that ExxonMobil employees max out their contributions into the savings plan (Pre-Tax or Roth will depend upon that individual’s unique tax circumstances). While each individual’s ability to do this will depend on their cash flow and budget, contributing at least the 6% required to receive the full 7% company match is absolutely critical.

This means that for an individual making $200,000, the company will contribute $14,000 if you contribute just $12,000 to the Savings Plan. Employees are essentially receiving an immediate 100%+ return for each dollar that they contribute.

*pending changes from Secure Act 2.0

Consider Mega-Backdoor Roth Conversions

For many ExxonMobil employees, an annual contribution of $23,000 (or $30,500 for individuals over the age of 50) is just not enough to achieve their retirement goals. Many individuals begin to explore the Backdoor Roth IRA Conversion or possibly funding brokerage accounts. These employees might not know that they are missing out on substantial tax-advantaged savings within the ExxonMobil Savings Plan.

Let’s think about an individual making $250,000 at ExxonMobil. We will assume they decide to max out their contributions of $23,000.

ExxonMobil then makes a matching contribution of $17,500 to the plan. This means that in 2024, their Savings Plan will have $40,500 of contributions. Little do they know, the IRS maximum for the combination of employee and employer 401(k) contributions in 2024 is $69,000.

The additional $28,500 can be added to the After-Tax bucket of the Savings Plan. However, leaving money in the after-tax account is not an optimal tax decision. Unlike a Pre-Tax account, you pay taxes on the contributions, and you also do not get the benefit of a Roth Account because the earnings on your contributions are taxable when the funds are withdrawn. This exact problem is solved by the Mega-Backdoor Roth Conversion strategy.

Immediately following the $28,500 contribution to the After-Tax account, we recommend completing a once-per-year Roth Conversion of the full balance. Depending on a few key factors, the subsequent Roth Conversion is a tax-free event. Now, instead of growth in the After-Tax account where someday there will be taxes due on the growth, the funds will be growing tax-free inside the Roth Conversion account at Voya.

To learn more, please refer to our ExxonMobil Mega Backdoor Roth article.

Investment Options

If you have never explored the investment options that are offered inside the Savings Plan at Voya, now may be the right time to make yourself familiar. The Savings Plan has 7 different investment options that give employees the ability to create a portfolio that benefits from exposure to assets. These include assets like Domestic Equity, International Equity, Domestic Investment-Grade Bonds, cash-equivalents, and more.

Creating a portfolio that meets your risk and return needs is important to adequate retirement preparation. Utilizing stock-oriented, more aggressive investments such as Equity Units and Extended Market Units early in your career may enhance the opportunity for more investment growth over time. As you approach retirement, it may make sense to shift towards investing in a more conservative manner.

To learn more about these investment options, please refer to our ExxonMobil Investment Options guide.

Net Unrealized Appreciation

Net Unrealized Appreciation can in some circumstances be one of the most beneficial tax strategies that ExxonMobil retirees have available. Generally, 401(k) withdrawals are taxed at ordinary income rates, which can be as high as 37% in 2024. Net Unrealized Appreciation allows retirees to take advantage of Capital Gains tax rates on their ExxonMobil stock within the Savings Plan, which are more preferential.

Net Unrealized Appreciation (NUA) is implemented during a full and final distribution from the Savings Plan. This means that the entire balance is rolled out of the 401(k) after your separation from the company. There are two types of assets that can be distributed from the Savings Plan during a rollover: Cash and ExxonMobil Stock. Net Unrealized Appreciation is a strategy that can be implemented on the ExxonMobil stock portion of your Savings Plan.

Instead of paying ordinary income taxes on the full withdrawal, you are only required to pay taxes on the cost basis of your stock. The stock would then transfer in-kind to a brokerage account.

For many employees that were around prior to the stock splits of 1997 and 2001 or during the bear market of 2020, this could be a very lucrative tax strategy for individuals with stock that carries a very low cost basis. The remainder of the growth on the stock is referred to as Net Unrealized Appreciation, which is taxed at long-term capital gains rates and could be as low as 0%.

To learn more, please refer to our ExxonMobil Net Unrealized Appreciation (NUA) article.

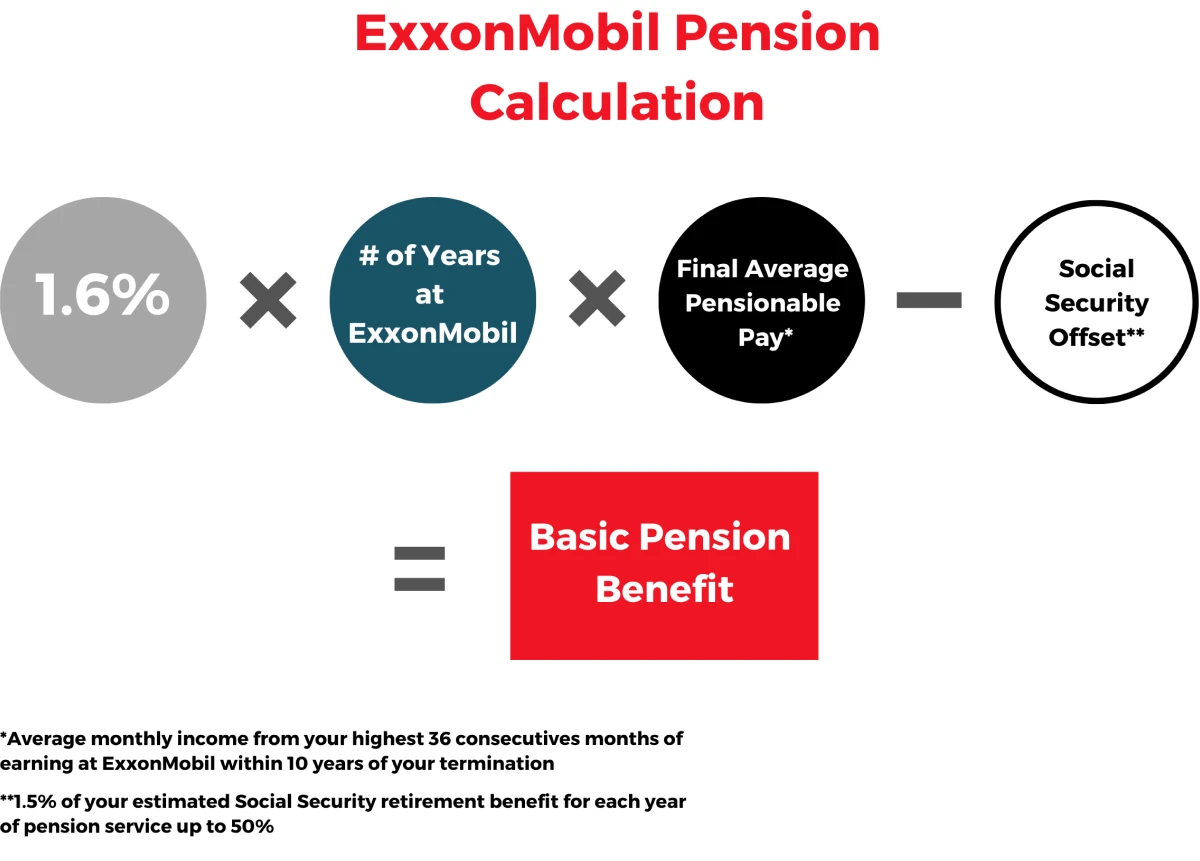

ExxonMobil Pension Plan

The ExxonMobil Pension is perhaps the single most significant benefit offered by the company. We routinely see ExxonMobil employees that reach retiree status at age 55 after 15 or more years of employment accumulate a life-changing amount of money in their Pension Plan.

The basic pension benefit is based on a monthly annuity paid to you at age 65. If an employee elects to receive the benefit prior to age 65, their benefit will be slightly reduced due to early withdrawal.

The Pension formula is 1.6% x years of pensions service x average pensionable pay, as shown below:

Distribution Options

The Pension Plan has several different options for receiving the benefit at retirement. The Pension may be paid out as an annuity structure, all at once as a lump sum, or some combination of the two. It is worth noting that for 2024, ExxonMobil has removed two of these distribution options, the 20-Year Extended Period Certain and the 25% and 75% Lump Sum option. We have listed the different options below and a description of each option.

100% Lump Sum

The entire pension benefit accumulated by the employee is all paid out at once. This option is eligible for a qualified rollover into an IRA, which would continue to defer the taxes until funds are distributed from the IRA. This option allows the participant to invest the funds as they please throughout retirement.

Qualified Joint and Survivor Annuity

The participant would receive a monthly benefit payment for the remainder of their and their spouses’ lives, no matter who lives longer.

5-Year Certain and Life Annuity

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within five years, then their beneficiary will receive the full monthly amount for the remainder of the five years, with no residual benefit.

75% Joint Annuity with 5-Year Certain

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within five years, then their beneficiary will receive the full monthly amount for five years. After the annuitant dies and five years have passed, then the beneficiary will receive 75% of the benefit for the remainder of their life.

25% Joint Annuity with 5-Year Certain

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within five years, then their beneficiary will receive the full monthly amount for five years. After the annuitant dies and five years have passed, then the beneficiary will receive 25% of the benefit for the remainder of their life.

50% Joint Annuity with 5-Year Certain

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within five years, then their beneficiary will receive the full monthly amount for five years. After the annuitant dies and five years have passed, then the beneficiary will receive 50% of the benefit for the remainder of their life.

100% Joint Annuity with 5-Year Certain

The participant would receive a monthly benefit payment for the remainder of their and their beneficiary’s life. If the annuitant and their primary beneficiary pass away, then the monthly benefit is paid out to their contingent beneficiary for the remainder of the five years.

10-Year Extended Period Certain

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within ten years, then their beneficiary will receive the full monthly amount for the remainder of the ten years.

15-Year Extended Period Certain

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within fifteen years, then their beneficiary will receive the full monthly amount for the remainder of the fifteen years.

Additional Options

An employee may elect to receive a 50% Lump Sum coupled with a decreased annuity payment.

For a closer look at this topic, please visit our ExxonMobil Pension Plan article.

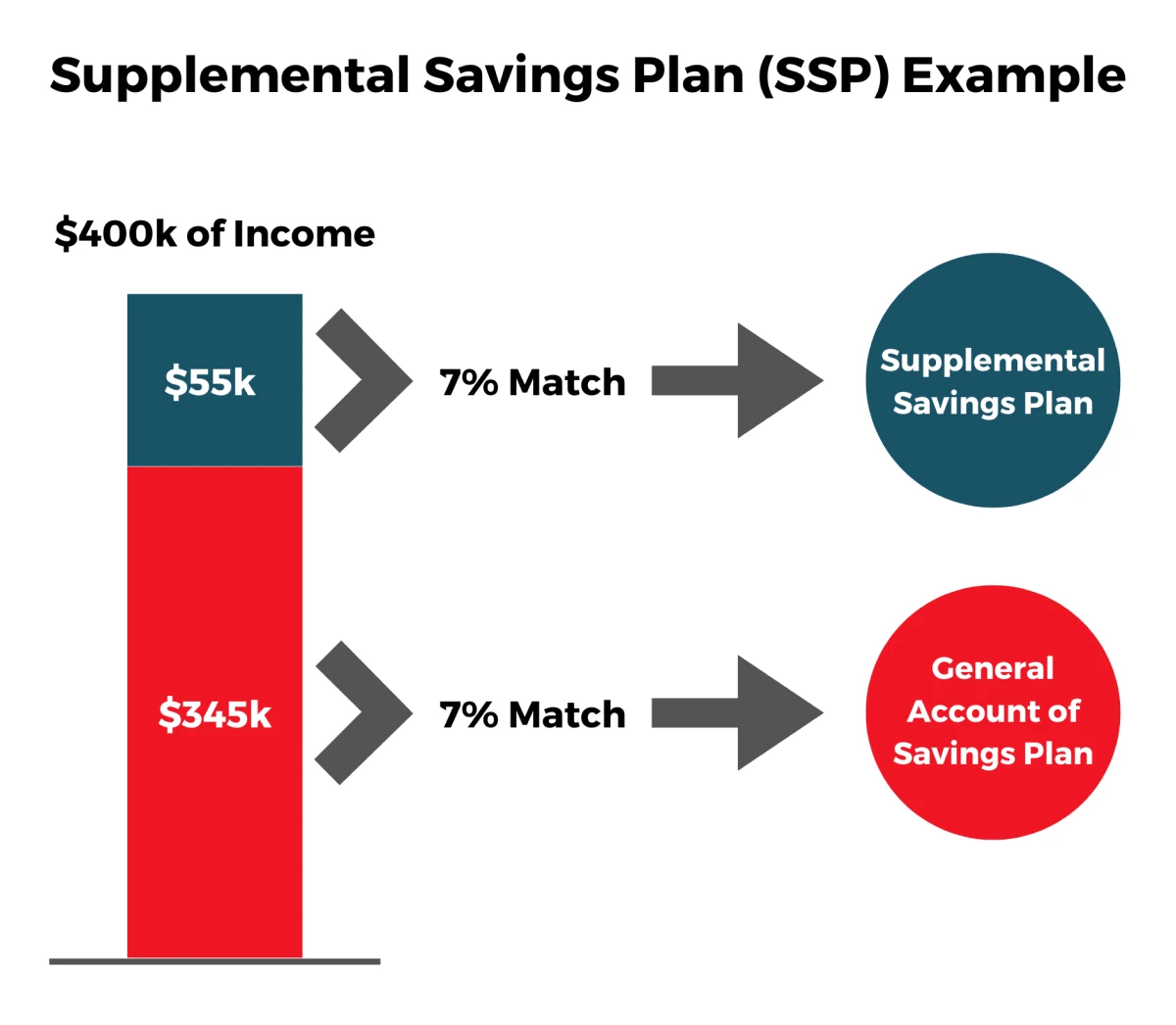

Supplemental Retirement Plans

Most ExxonMobil executives accrue retirement benefits in addition to the normal Savings Plan match and Pension Plan. These are referred to as Supplemental Plans. There are actually two Supplemental Plans – one for the Savings Plan (Supplemental Savings Plan) and another for the Pension (Supplemental Pension Plan).

These plans are considered non-qualified retirement plans (also known as deferred compensation) and are treated completely differently from a tax perspective. While the growth in the plans is deferred, the supplemental plan payments are taxable and paid out in the year of retirement. In general, the supplemental plans have been created to “true-up” executive benefits for the income earned in excess of certain IRS limits for the traditional 401(k) and pension plans.

Supplemental Savings Plan (SSP)

The IRS limits the amount of income that can be considered for a company matching contribution into any 401(k) plan ($345,000 for 2024). The Supplemental Savings Plan is designed to allow executives to continue to receive the match on the excess, but it is placed into this supplemental plan.

This means that any employee making more than $345,000 in 2024 will receive a 7% match into their Supplemental Plan for income earned above the limit. This account is credited with modest interest annually and the growth is deferred until retirement.

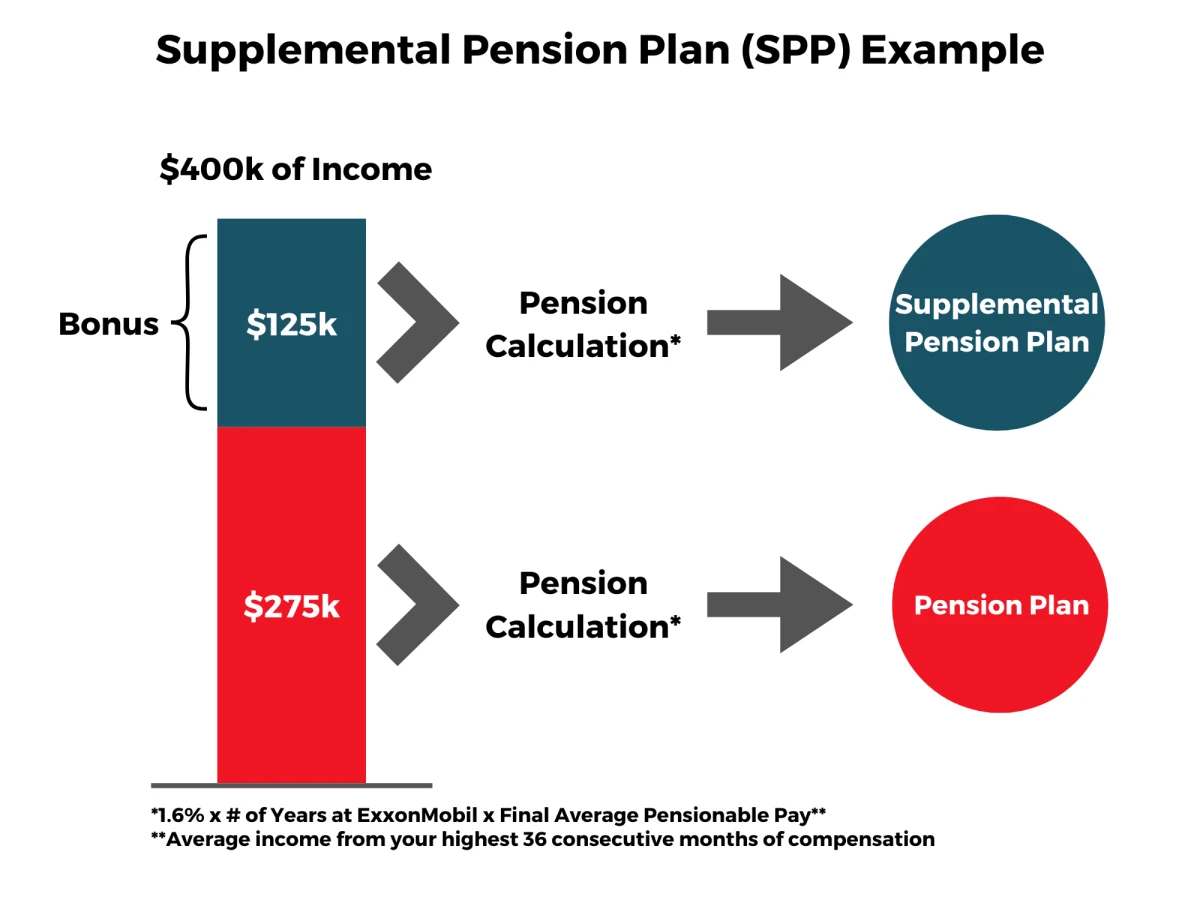

Supplemental Pension Plan (SPP)

Similarly, the Supplemental Pension Plan accumulates an individual’s pension benefit above the IRS maximum for any given year. There are two IRS limits that apply to pension plans: a compensation limit and a total benefits limit. The compensation limit is set at $275,000 for 2024 and the benefits limit moderates the maximum monthly benefit payment that one can claim during retirement.

The Supplemental Pension Plan accumulates a balance in a separate account. This excess benefit is paid out under the same lump sum calculation as the pension plan upon retirement.

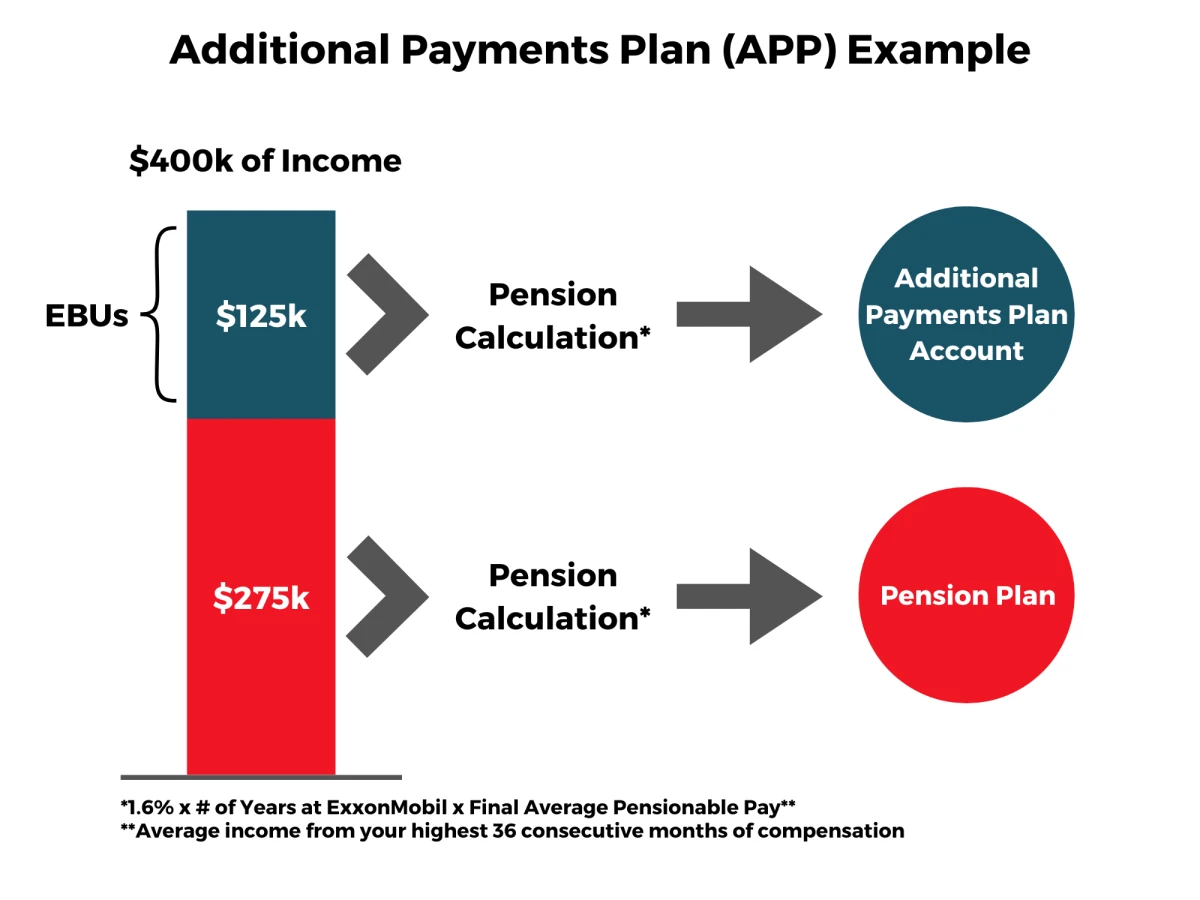

Additional Payments Plan (APP)

ExxonMobil also compensates employees with a contribution to the Additional Payments Plan account. This calculation is the same as the pension formula and based on Earnings Bonus Units (EBUs).

It is important to note that ExxonMobil discontinued the use of EBUs as a form of compensation. However, individuals who are at or near retirement might have an existing APP balance.

To learn more about these supplemental plans, please view our ExxonMobil Supplemental Plans article.

Conclusion

To attract and retain top talent, ExxonMobil has created a compensation package that is competitive with any major energy company. Considering a robust company match within the 401(k) plan, lucrative tax strategies, and a favorable pension plan, ExxonMobil employees have multiple unique opportunities that make reaching retirement substantially easier than it is for employees of many other companies.

As we’ve shown, there are substantial complexities within ExxonMobil benefits plan. Planning for retirement can be difficult without a deep understanding of your benefits and current tax code.

Our team has 30+ years of experience working with ExxonMobil employees and executives. Partnering with a team that understands the intricacies of the Savings Plan at Voya, Pension Plan, and Supplemental plans will ensure that you maximize your benefits and avoid missed opportunities. Contact the RGWM team today for your complimentary benefits strategy session.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.