Using Options to Reduce XOM Stock Exposure

Strategies For Hedging Concentrated ExxonMobil Stock Positions and Generating Income

If you are a retiree or are approaching retirement as an employee of ExxonMobil, you may have accrued a substantial position in ExxonMobil shares (XOM) through the receipt of Restricted Stock Units (RSUs) or by investing in the Savings Plan.

Furthermore, if you have followed a strategy to optimize your tax savings, you may have utilized the Net Unrealized Appreciation (NUA) rule and now hold a significant amount of low-cost basis XOM shares in a taxable brokerage account. While there are potentially significant benefits to implementing this strategy in your financial planning process, a common concern for investors is how to manage risk for a significant stock position held in their portfolio.

Obvious complications exist for retirees under this scenario. When a large portion of one’s portfolio is concentrated in this single stock position, even a corporate giant like ExxonMobil represents significant risk on a sector, industry, and individual company level that a diversified portfolio protects against.

There is also the latent tax burden that these low-cost basis shares would create in the event the investor decided to liquidate the stock. This tax burden may have a negative impact on one’s financial plan.

One solution investors may choose employ in these circumstances is an option trading strategy. Strategic use of Call and Put Stock Options can provide both return enhancement and downside protection to your XOM stock portfolio. The most commonly used options strategies for individuals with the tax parameters described above are Covered Calls and Protective Puts.

It is important to note that the SEC (Securities and Exchange Commission) views options trading as equivalent to stock transactions when it comes to insider trading rules. Prior to executing your own XOM stock options strategy, ExxonMobil executives with non-public information should be fully aware of 10b-5 rules surrounding insider trading. Additionally, ExxonMobil maintains its own guidelines for certain executives making options transactions. You should carefully review your obligations if you believe you may be subject to SEC insider trading rules or ExxonMobil’s guidelines.

Option Contract Basics

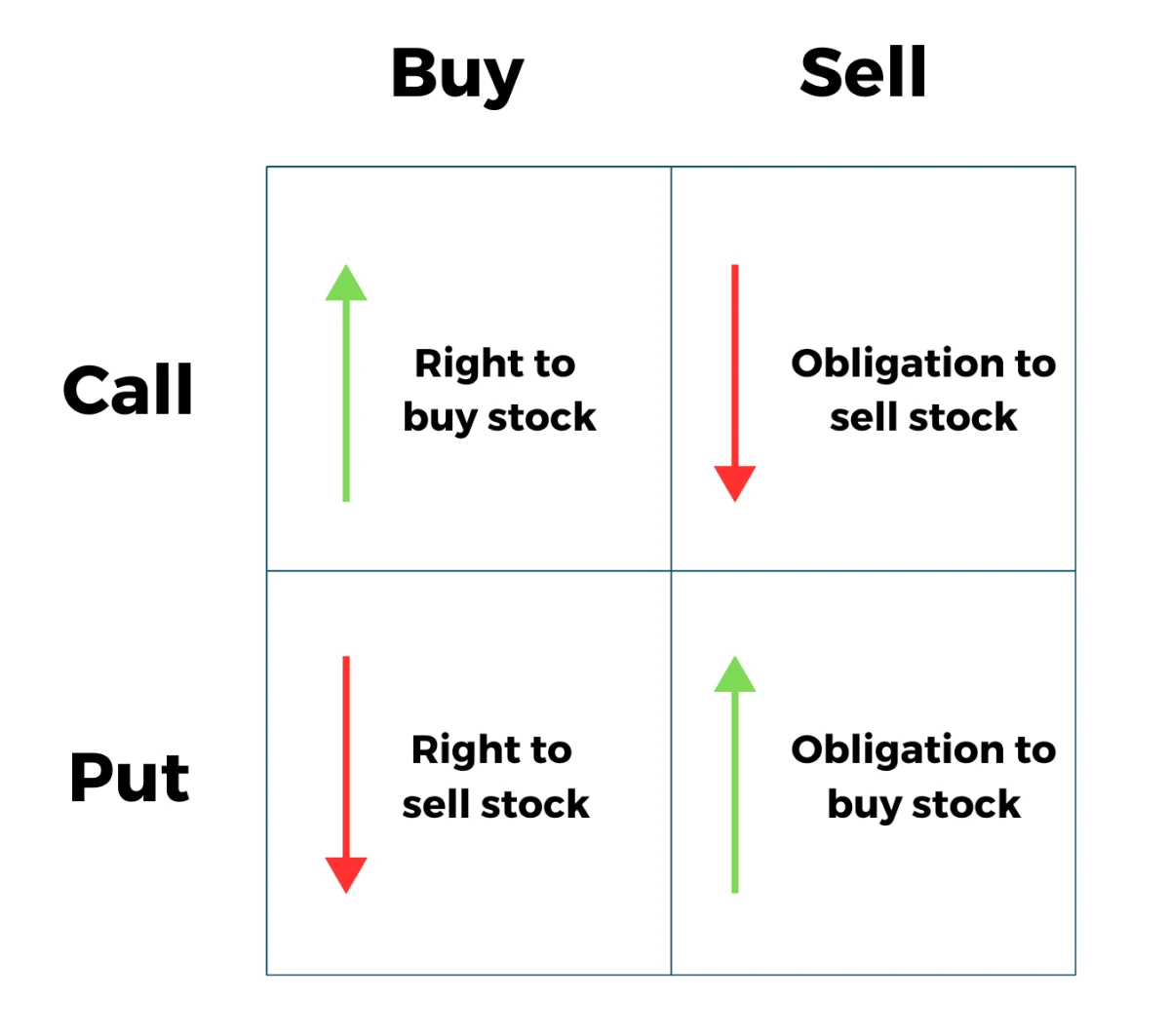

For those unfamiliar with options, an option contract is a financial instrument representing a right (or option) to either buy or sell an underlying security at a pre-determined exercise price prior to an expiration date.

An option that gives the owner the contingent right to purchase the underlying at a strike price is known as a “Call” contract. “Put” option contracts allow the owner to sell the underlying security at the contract strike price. Both option strategies pose their own utility – covered call options create opportunities for additional income from single stock exposure, and protective put options enhance an investors downside protection on singular stock risk.

Options come in a few varieties as it pertains to the manner of their execution before the expiration dates. The two most common are European and American style options. European style options are only executable on the expiration date itself, while American style options are executable all through and up to the expiration date. Nearly all US stock investors will exclusively deal in American style options for single stock contracts.

Example

As we introduced, call option contracts give the owner a right to purchase the underlying stock if the stock reaches a price higher than the contract strike price prior to contract expiration. Due to the complexity of trading vernacular, it is best that we discuss the basic components of a covered call trade using an example.

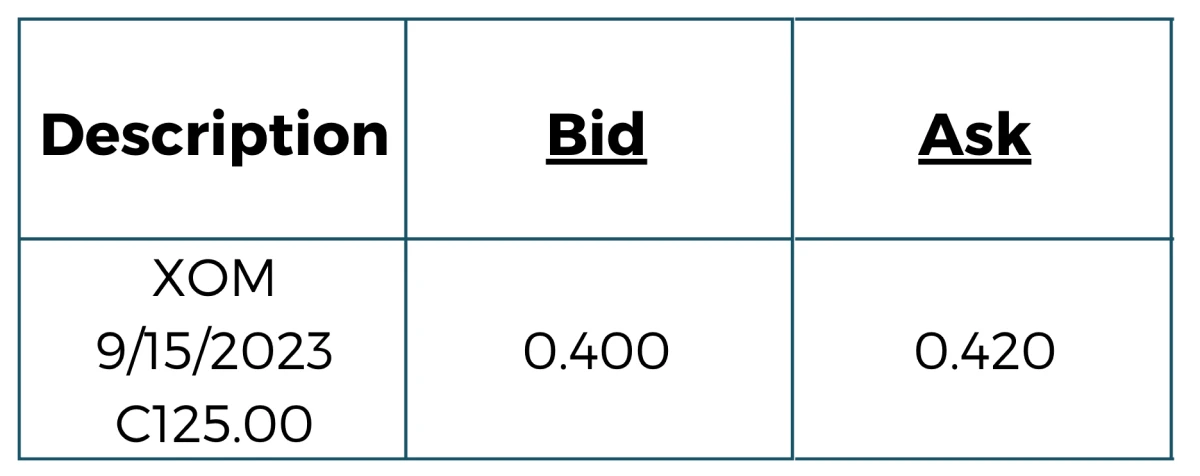

The following example will have characteristics similar to covered call trades we have done for our own clients in the past. To set the stage for this option trade, assume that the date is August 15th, 2023, and we are examining the following quote for a call option contract.

Option Elements

Underneath the description on the hypothetical quote above we see the ticker of the underlying stock (XOM being ExxonMobil stock), an expiration date (9/15/2023), the letter “C” indicating it is a call option, and the strike price (125.00). The “underlying” piece is self-explanatory, it is the asset to which the contingent call contract is connected to.

The expiration date is essentially the date before which the contract’s terms remain valid. In the above example, at the end of September 15th the contract will either have value if XOM is trading above the strike price of $125 or it will expire worthless to the owner of XOM stock is trading below the strike price.

To the right of the “description” you will see the next important component of our discussion in the “bid” and the “ask”. These terms are important to understand not only because they represent the price of the call option contract, but also because they introduce us to the concept of being the owner the call as a buyer, or the counterparty as the option “writer”. Bid and ask prices represent the two sides of the transaction from the perspective of the market.

Bid Price

The bid price represents the highest price the market is currently willing to pay for the option, while the ask price is the lowest price the market is currently willing to sell the option for.

As opposed to having a 1-to-1 relationship, stock option contracts (for both calls and puts) themselves are connected to 100-share “lots” of the underlying stock. The pricing convention of the bid and ask prices are on a per share basis of the underlying stock, but each contract represents a claim of action on 100 shares of the underlying stock.

As it pertains to the example provided, the market is willing to pay up to $0.40 per share of XOM on the call option contract while the lowest price sellers are willing to take is $0.42 per share.

What it means to be a “buyer” of a call contract is fairly simple; as we’ve explained, it is holding the right to purchase the shares of a stock if the price is above the strike price prior to contract expiration. This also means that you are taking a “long” position on the stock, as the call owner benefits from a rise in the price of XOM stock.

Ask Price

What it means to be on the “ask” side of the equation as a call option seller is much less intuitive. Inversing the meaning of the buyer’s side, this would imply the call writers are selling the right for call buyers to purchase shares of the underlying the seller at the strike price if the contract is executable by expiration.

Returning to the concepts of “bid” and “ask” prices, the ultimate price paid or received on each side of the contract is the singular price at which these two sides of market ultimately converge. Sometimes, this can be at a midpoint price as we will use in the example.

The midpoint price of the XOM Call example given would be at $0.41 per share of XOM. That $0.41 per share will be the price paid by the call option buyer and the income received by the contract seller (or “writer”). An alternative term that we will use for this price paid/received is called the “premium” which presents this concept in income terms.

Covered Call Writing

These premiums are where the utility of this strategy for individuals with highly appreciated stock (such as XOM) come into play. The primary risk for the sellers of call options is the price of the underlying stock exceeding the strike price of the contract by the date of expiration, thereby allowing the long side of the contract the ability to “call away” the stock, forcing the contract seller to deliver shares of the stock to the buyer in exchange for the lower than market, strike price.

For this strategy, the investors hold the underlying stock (XOM in this case) in the event of a contract being exercised – forcing the owner to deliver their stock to the option holder. Because the investor is holding the underlying asset, in option terms the position is “covered”. If the shares are at a significant gain and held in an after-tax account, the tax ramifications of the position being called away could be one which the option seller would wish to avoid.

Alternatively, we utilize this strategy for individuals who have a price in mind, above the current market price, that would be ideal for capturing gains. This opens the window for writing covered calls at this predetermined price and generating income at the same time.

The existence of contracts at many different strike prices (higher to lower relative to the current underlying stock price) and many different expiration dates allows for varying levels of conservatism and aggression in one’s approach to writing covered calls. Selling calls with strike prices that are closer to the current market price will result in higher valued premiums while calls with strikes that are further from being “in the money” will produce lesser premiums.

From the viewpoint of the covered call writer, selling call contracts that expire unexercised for premiums can act as a source of supplemental income beyond the dividend the stock offers. The premium received by selling the covered call is a potential enhancement on the asset’s return as an increase to the total cashflows.

This income can also be a source of downside protection by providing income regardless of an increase or decrease in the underlying asset’s value. The income generated can be used to invest in other positions in an effort to move towards a more diversified portfolio.

Purchasing a Protective Put

Conversely, purchasing a put option on your security can hedge the underlying stock through direct downside protection. As mentioned before, a put allows the owner to sell their stock at a predetermined price. In this instance, the investor will be paying the premium of the option contract for the protection on their stock.

A risk for the individual buying a put option is that the stock does not go below the strike price by the date of expiration. Although the put option was not actually exercised, the premiums paid are non-refundable and the option seller gets to keep it as income.

From the viewpoint of the individual buying protective puts, simply purchasing the put can create an ease of mind that if the underlying stock does fall below the exercise price, then the right to sell the stock at a predetermined price is available.

Conclusion

Covered calls and protective puts can be used as a powerful tool to generate additional income as a result of selling covered calls and limit downside on singular stock exposure by buying protective puts.

When executed correctly, options can add another dimension to your investment strategy to help maximize your portfolio and make your retirement goals more attainable.

If you have any questions, the Rhame & Gorrell Wealth Management team is here to help.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.