The ExxonMobil Pension Plan: Understanding Your Options

An Overview Of The Intricacies Within The ExxonMobil Pension Plan

The ExxonMobil Pension is perhaps the single most significant benefit offered by the company. We routinely see ExxonMobil employees that reach retiree status accumulate a life-changing amount of money in their Pension Plan.

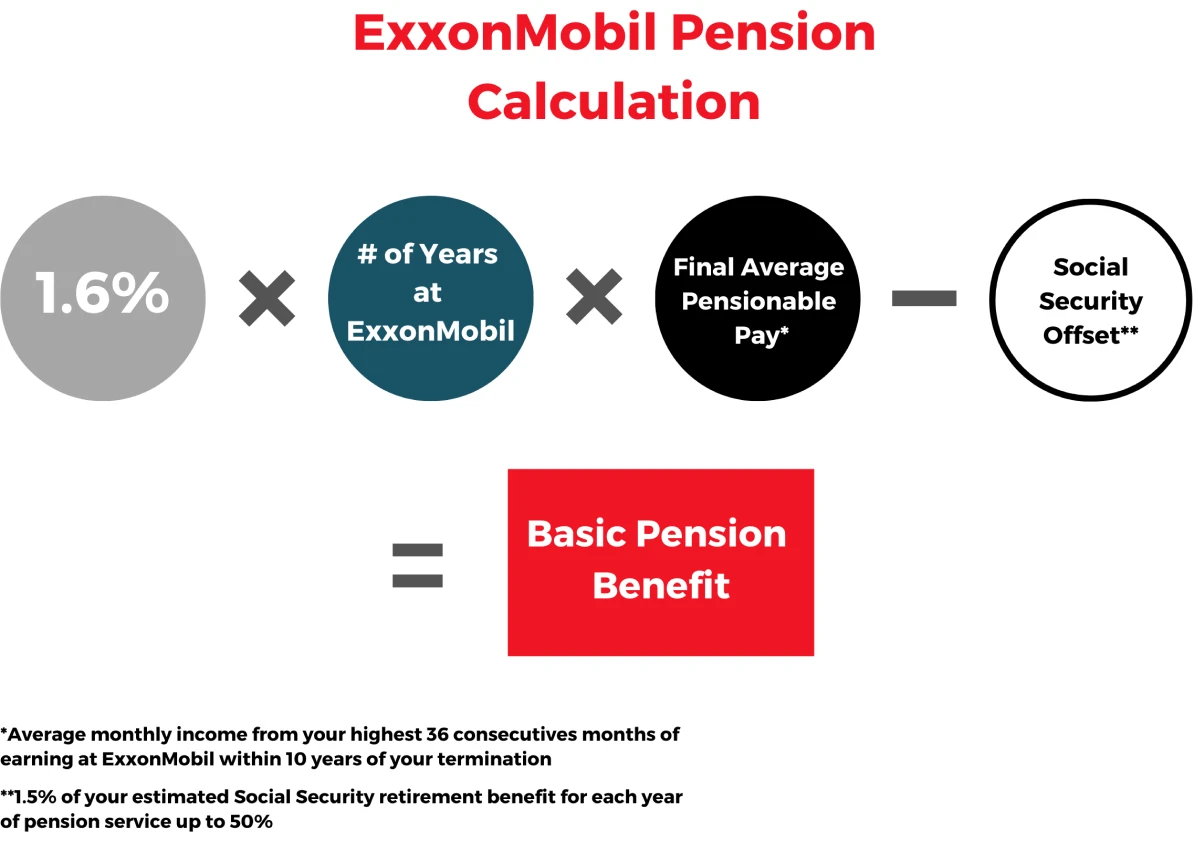

In order to make the most of the ExxonMobil Pension, it is important to understand how it works. The cornerstone of this benefit is the pension calculation which utilizes your years of service with the company and highest average pay as inputs.

The Pension formula is 1.6% x years of pensions service x average pensionable pay, as shown below:

Pension Calculation

The ExxonMobil Pension calculation is relatively intuitive. However, there are a few elements that are worth understanding further.

The first is the “Final Average Pensionable Pay.” This variable is an average of your highest consecutive 36 months of compensation at ExxonMobil. According to the IRS, this amount cannot exceed $275k for 2024.

For employees earning over $275k in compensation, ExxonMobil contributes the excess benefit to the Supplemental Pension Plan (SPP). This contribution is based on any income over $275k and utilizes a similar calculation as in the graphic above. To learn more about the ExxonMobil supplemental plans, please visit our article on the topic.

Another key piece of the calculation to pay attention to is the “Social Security Offset.” This represents part of your estimated social security benefit that is used as an offset in the pension formula. This is calculated as 1.5% of your estimated social security benefit for each year of pension service up to 50%. The offset is due to the fact that while working at ExxonMobil, the company pays half of your Social Security tax via payroll taxes.

Distribution Options

The Pension Plan has several different options for receiving the benefit at retirement. The Pension may be paid out as an annuitized stream of payments, all at once as a lump sum, or some combination of the two.

Segment Rate Effect on Lump Sum Benefit

Segment rates are a key factor in the lump sum calculation if that payout option is selected. Segment rates are used to calculate the current, or “present value”, of all the future annuity payments an employee might receive. The result of this present value calculation is the Lump Sum amount an employee is entitled to.

Segment rates are published by the IRS Pension and are directly impacted by the interest rate environment – as interest rates in the marketplace go higher, so do the segment rates. For the ExxonMobil pension, effective segment rates for each quarter are calculated by averaging the IRS rates from the 4th and 5th month prior to the beginning of the quarter.

Similar to how bond prices are affected by moves in market interest rates, the lump sum on the pension is affected by segment rates. There is a strong inverse relationship between the lump sum value on the pension and the segment rates. As rates increase, lump sum values decrease and vice versa. We like to think of this as the pension “See-Saw.”

There are 3 segment rates to pay attention to. The 1st segment rate is the rate used to discount the first 5 years of pension payments. The 2nd segment rate is the rate utilized to discount payments made in years 6-20 and the 3rd segment rate affects years 20+.

Again, the pension lump sum is the value of all future payments discounted back to present value. When interest rates rise, the annuity payments are discounted by a higher interest rate, and the present value decreases.

Summary of Pension Distribution Options

Below, we have outlined the different pension distribution options available to ExxonMobil employees and how they work. For 2024, ExxonMobil has removed two options from this list, the 20-Year Extended Period Certain and the 25% and 75% Lump Sum option.

100% Lump Sum

The entire pension benefit accumulated by the employee is all paid out at once. This option is eligible for a qualified rollover into an IRA, which would allow the participant to invest the funds as they please throughout retirement and continue to defer the taxes until funds are distributed from the IRA.

Qualified Joint and Survivor Annuity

The participant would receive a monthly benefit payment for the remainder of their and their spouses’ lives, no matter who lives longer.

5-Year Certain and Life Annuity

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within five years, then their beneficiary will receive the full monthly amount for the remainder of the five years, with no residual benefit.

10-Year Extended Period Certain

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within ten years, then their beneficiary will receive the full monthly amount for the remainder of the ten years.

15-Year Extended Period Certain

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within fifteen years, then their beneficiary will receive the full monthly amount for the remainder of the fifteen years.

25% Joint Annuity with 5-Year Certain

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within five years, then their beneficiary will receive the full monthly amount for five years. After the annuitant dies and five years have passed, then the beneficiary will receive 25% of the benefit for the remainder of their life.

50% Joint Annuity with 5-Year Certain

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within five years, then their beneficiary will receive the full monthly amount for five years. After the annuitant dies and five years have passed, then the beneficiary will receive 50% of the benefit for the remainder of their life.

75% Joint Annuity with 5-Year Certain

The participant receives a monthly benefit for the remainder of their life. If the annuitant dies within five years, then their beneficiary will receive the full monthly amount for five years. After the annuitant dies and five years have passed, then the beneficiary will receive 75% of the benefit for the remainder of their life.

100% Joint Annuity with 5-Year Certain

The participant would receive a monthly benefit payment for the remainder of their and their beneficiary’s life. If the annuitant and their primary beneficiary pass away, then the monthly benefit is paid out to their contingent beneficiary for the remainder of the five years.

Additional Options

An employee may elect to receive a 50% Lump Sum coupled with a decreased annuity payment.

Adjustments for Early Commencement

Many ExxonMobil employees are familiar with the terminology “55 and 15.” The reason this is such a common expression around the workplace is because it is the magical point where an employee reaches full retiree eligibility: 55 years of age and 15 years with the company. If you have a disability, different requirements may apply to your status as a retiree.

While the vesting period in the ExxonMobil pension is just 5 years or when you reach age 65, the 55 and 15 rule applies when it comes to receiving all available benefit options. Once you reach five years of service, you become vested in your pension benefit. This means that even if you leave the company, you are entitled to the benefit that has been accrued.

If you leave the company after reaching the vesting point but prior to retiree status, then you will be subject to terminee status. The basic pension benefit is subject to a discounted calculation if you elect to begin receiving benefits prior to:

- Age 60 as a retiree

- Age 65 as a terminee.

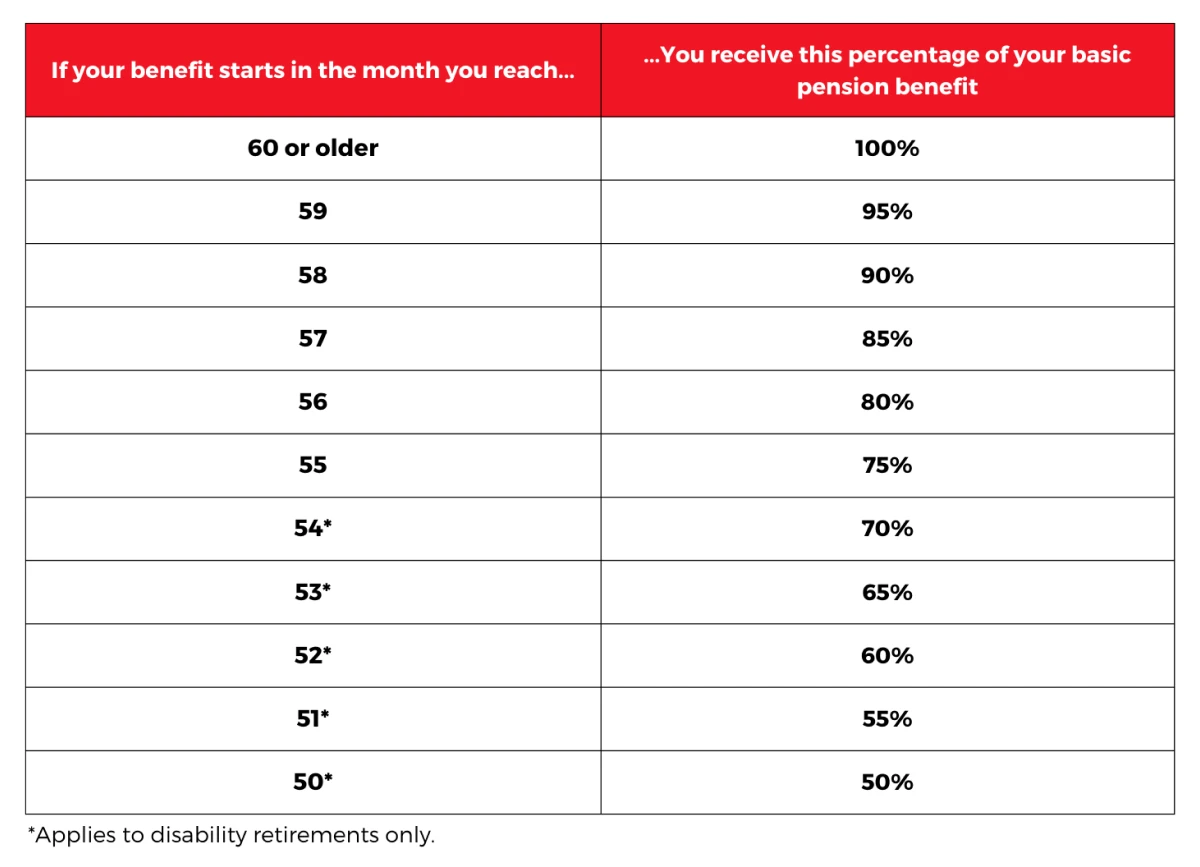

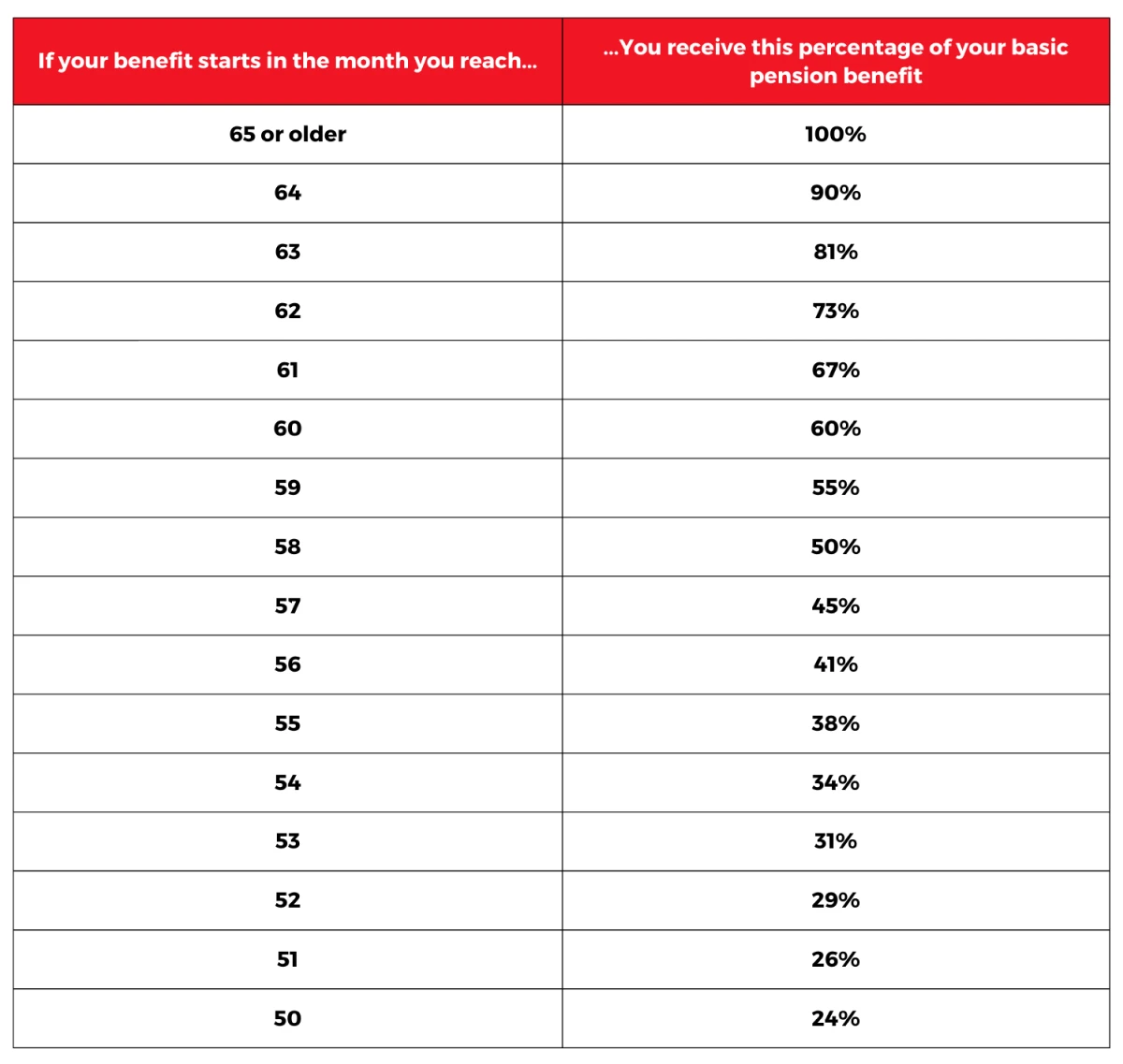

The discount is far more significant under terminee status rather than retiree status, as shown below.

Retiree Status

As a retiree that elects to receive an early benefit, your pension benefit will be adjusted by 5% per year for each year prior to 60. Your pension benefit is maxed out at age 60. Retiree status benefits are displayed in the chart below:

Terminee Status

If you terminate employment prior to retiree status, then your pension benefit will not reach its maximum potential until age 65. The reduction of terminee status benefits are portrayed below:

As you can see in the charts above, an individual that reaches the age of 55, but only has 10 years of service, will be subject to just 38% of their total benefit. If the same individual was 55 years old, but accumulated 15 years of service, then they will receive a benefit that is 75% of the total value.

Conclusion

There is immense complexity around the ExxonMobil pension benefit, and it’s critical for future retirees to have a thorough understanding of how the benefit is calculated, how and when to take benefits to optimize lifetime cash flow, and what the tax implication for the various choices might be.

The Rhame and Gorrell team has several on-staff experts to assess your personal situation and assist you in optimizing your retirement in the context of your ExxonMobil benefits. Schedule your complimentary consultation below.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.