ExxonMobil Pension Update: Q2 2024

An Update On Segment Rates And Their Effect On Your Pension Benefit

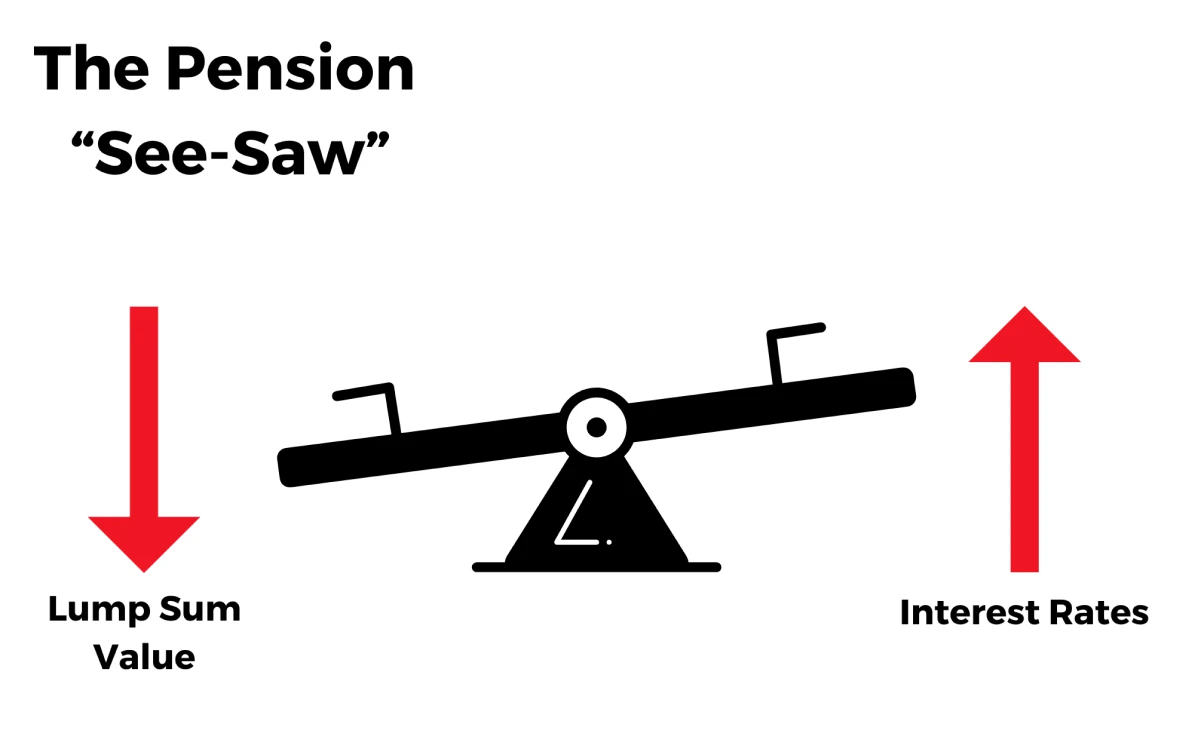

Concerns around the effect that higher rates have on the ExxonMobil Pension Plan’s lump sum values continue to be a key theme in 2024. As we highlighted in our past pension updates, higher interest rates (driven by inflation) cause a negative effect on the value of your ExxonMobil pension lump sum.

Our team has helped many ExxonMobil employees assess the impact of these rates on their retirement plans. If you’ve elected to stay with the company throughout the rate increases in 2021-23, it’s important to understand where things stand now, and what future interest rate moves might look like.

Q2 Rates Published: A Modest Decrease

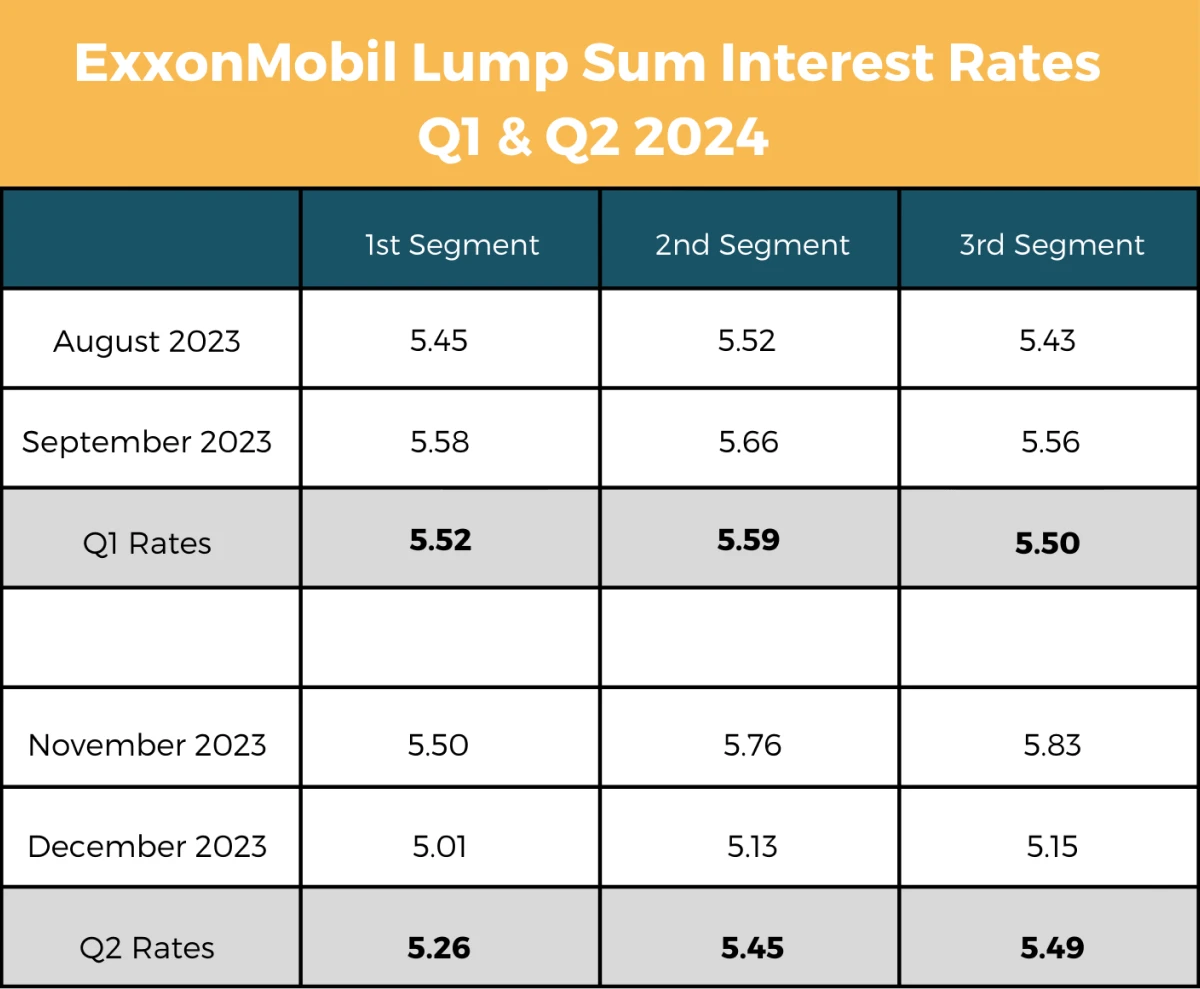

As we’ve noted previously, each quarter’s rates are calculated by averaging the rates from the 4th and 5th month PRIOR to the beginning of the quarter as published by the IRS. Therefore, the average of the November and December rates dictate the segment rates used for any individual retiring in Q2 of 2024. What did we see relative to the Q1 Rates?

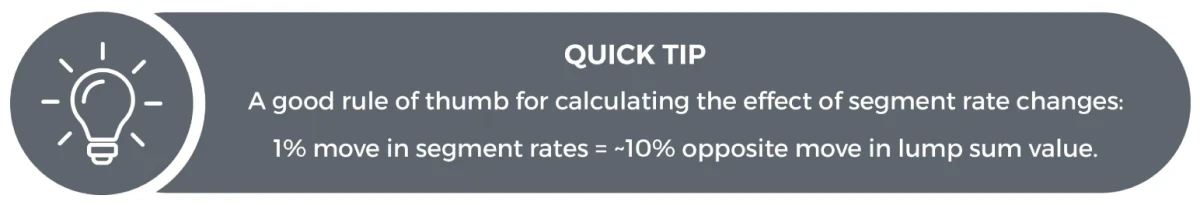

As you can see, the segment rates decreased slightly as we transition from Q1 to Q2 2024 rates. As mentioned in our article on the Pension Plan, the lump sum value of your pension is what we call the “Present Value” of all the expected future cash flows and has an inverse relationship to segment interest rates.

For individuals looking to retire soon, this downward move in the segment rates will slightly increase lump sum values for retirees with a benefit commencement date (BCD) in Q2.

Where are rates going after Q2?

After hitting a low in late 2020, interest rates have been on a steady rise as the Federal Reserve uses monetary policy to fight inflation. With respect to the ExxonMobil pension, retirees have experienced relatively stable segment rates in the ~4.5 – ~5.5% range since the 4th quarter of 2022. Rates seem to have peaked right around 6% in the October of 2023 and have modestly decreased since then.

Predominant trends in inflation data have mostly pointed to inflation in the 2.5-3.5% range for the immediate future. Despite the significant normalization from the 9-10% inflation levels seen in recent history, the Federal reserve has recently indicated a willingness to keep rates near current levels if more progress towards their stated 2% inflation target is not made.

That said, an analysis of the bond market indicates that market participants are expecting rate cuts from the Federal Reserve by the end of 2024 with more reductions in 2025. If that occurs, segment rates will almost certainly decrease commensurate with these rate cuts.

For ExxonMobil employees, this potential decline suggests a favorable environment for future pension plan lump sum values, as lower interest rates could offer strategic opportunities for retirement planning.

What does this mean for the ExxonMobil Employee planning to retire today?

Although interest rates remain elevated today, this does not mean that it’s a bad time for ExxonMobil employees wishing to retire. Elevated interest rates offer an excellent opportunity to reinvest Lump Sum payouts into low-risk bond portfolios at attractive yields. These same bond portfolios should experience material gains if yields come down as anticipated. While interest rates directly impact Lump Sum values, creating and implementing a dependable reinvestment strategy afterward is even more important.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.