Health Savings Accounts (HSAs): How Do They Work?

Get The Most Out Of Health Savings Accounts

As the global population continues to grow and individuals live longer average lifespans than ever, the typical expenditure for healthcare costs has skyrocketed over the past several decades. Healthcare costs can be one of the most significant expenses during retirement; various statistical studies have indicated that the average married couple reaching age 65 in 2023 will spend more than $300,000 on healthcare during their retirement years.

Health Savings Accounts (HSAs) are one of the most overlooked tax-advantaged vehicles for individuals to save money for healthcare costs. The triple tax advantage HSAs offer is unlike any other savings method available under current tax law.

What is a Health Savings Account?

An HSA allows individuals to set aside pre-tax money for qualified medical expenses. These qualified expenses include a wide array of medical costs, including Medicare Part B Premiums, which can total between $4,000 and $13,500 for a married couple in 2023. Deductibles, copayments, coinsurance, and much more fall under the qualified medical expense definition.

As long as funds within an HSA are withdrawn to pay for qualified medical expenses, all the funds plus any interest on the funds that has accrued in the HSA are tax free. As a result, the investor puts funds in on a pre-tax basis, but receives the funds back tax free.

Any withdrawals not used for qualified medical expenses will be taxed as ordinary income and assessed with an additional 20% penalty. However, upon reaching age 65 HSA funds withdrawn for non-qualified expenses will only be taxed at ordinary income rates with no penalty. Some individuals choose to view this as an “extra IRA”, of sorts.

How to Contribute

In order to contribute to an HSA, you must be enrolled in a High Deductible Health Plan (HDHP). This generally means that your deductible – the amount an individual must pay out of pocket before covered expenses are borne by the insurance company – is a bit higher than some other plans. A medical plan qualifies as an HDHP for 2023 if the deductible is at least $1,500 for an individual or $3,000 for a family.

In 2023, employees can contribute up to $3,850 into their HAS, while those with family coverage can contribute up to $7,750. For 2024, individuals under a high deductible health plan (HDHP) will have an HSA contribution limit of $4,150. The HSA contribution limit for family coverage will be $8,300.

Similar to an IRA, HSAs also have a $1,000 catch up contribution for participants over the age of 55. This means a married couple over the age of 55 can contribute $9,750 for 2023 and $10,300 for 2024.

Benefits of an HSA

HSAs have numerous benefits which we will explore below:

Triple Tax Benefit

An HSA is the only type of account that allows a tax deduction when contributions are made, deferral of the growth in the account and tax-free distributions. This is what is referred to as the “triple tax advantage.” If you are enrolled in a HDHP through your employer, contributions can be made much like 401(k) contributions.

If this is not offered through your employer, contributions can be made with personal funds and a tax-deduction can be claimed on your tax return. To make it even better, there are no income limitations associated with making a deductible contribution to an HSA.

Ability to Invest the Funds

To maximize the benefits of using an HSA account, it is important to invest the funds. According to Employee Benefit Research Institute (EBRI), only 12 percent of people with an HSA invest the funds in something other than cash.

Many HSA Administrators require a minimum balance prior to investing an account, but once sufficient funds have been accumulated, contributions can be placed into various investment options provided by the custodian of the HSA. By investing HSA funds, investors are able to take advantage of the tax deferral on the growth as well as tax-free treatment for qualified expenses.

Example

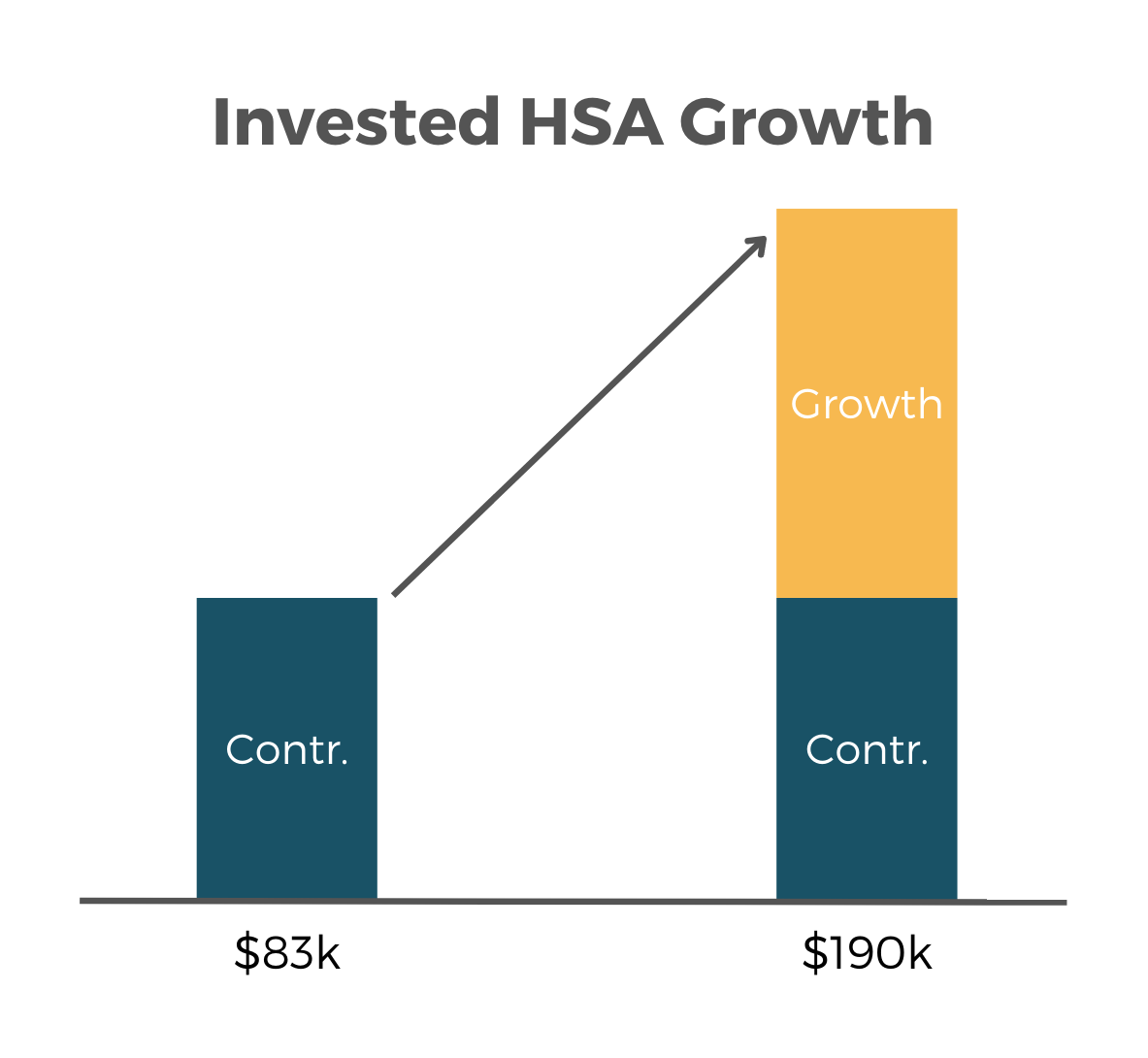

Let’s say we have a single individual named Josh. Josh is 30 years old and enrolled in a High Deductible Health Plan through his employer. If Josh decides that he is going to max out his HSA for the next 20 years, he will accumulate contributions of $83,000. If the funds are placed into an investment making an average of 8% over the 20 years, Josh will accumulate nearly $190,000 in his HSA.

Flexibility

One way to think of an HSA is like an emergency fund for medical expenses. When one actually uses HSA funds is heavily dependent on that person’s specific needs. Individuals have the flexibility to choose to withdrawal as much or as little as needed for medical expenses. If one encounters unexpected medical expenses and needs additional funds, an HSA is generally an excellent repository from which to withdraw these funds.

If one is fortunate enough to avoid significant medical expenses until the age of 65, HSA assets can be withdrawn for any reason without penalty after the age 65 milestone.

FAQs

Below are some frequently asked questions surrounding HSAs.

What happens to unused HSA funds at the end of the year?

One of the most attractive features of HSAs is that unused funds at the end of the year do not expire; instead, they roll over into the next year. This contrasts with Flexible Spending Accounts (FSAs), where there’s often a use-it-or-lose-it policy, making HSAs a more flexible option for long-term health care savings. This rollover feature allows account holders to accumulate funds over time, which can be particularly beneficial for future medical expenses or even healthcare costs during retirement.

Can HSA funds be used for non-medical expenses, and if so, what are the tax implications?

While it is possible to use HSA funds for non-medical expenses, such withdrawals come with significant tax implications. Before reaching age 65, withdrawals for non-qualified expenses are not only taxed as income but also incur a 20% penalty. After age 65, the penalty for non-medical withdrawals disappears, but the amount withdrawn still counts as taxable income. This flexibility after reaching retirement age makes HSAs a potentially useful tool for broader financial planning, albeit with tax considerations for non-medical use.

How does one choose investments within an HSA, and are there any restrictions on the types of investments allowed?

The investment options and process can vary significantly between different HSA administrators. Most HSAs offer a range of investment choices, similar to those found in retirement accounts, including mutual funds, stocks, bonds, and ETFs. However, the specifics—such as minimum balance requirements to start investing, available investment options, and fees—depend on the HSA provider.

It’s essential for individuals to review their HSA’s investment options and consider how they align with their overall investment strategy and risk tolerance. While investing HSA funds can significantly increase their long-term growth potential, it’s important to carefully consider the choices and possibly consult with a financial advisor to ensure they meet your healthcare and financial goals.

Conclusion

In summary, the Health Savings Account provides a unique opportunity to save for healthcare expenses while enjoying a triple tax advantage. By understanding the benefits, contributing to the maximum limit, investing wisely, and leveraging the flexibility offered, individuals can maximize their HSA savings and add another dimension to a well-rounded retirement plan.

The RGWM team is happy to assist investors in taking full advantage of this often-underutilized savings vehicle to alleviate the burden of healthcare costs and promote long-term financial stability.

Need Some Help?

If you’d like some help from a CPA or CERTIFIED FINANCIAL PLANNER (CFP®) professional regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers can help you review your financial, estate, and tax situation to come up with a custom strategy going forward.

Feel free to contact us at (832) 789-1100, [email protected], or click one of the buttons below to ask a question or schedule your complimentary strategy session today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.