ExxonMobil Pension Update: Q4 2022

Concerns around the effect that higher rates have on the ExxonMobil Pension Plan’s lump-sum values continue to be a key theme throughout 2022. As we highlighted in our pension updates in February and April, higher interest rates (driven by inflation) cause a negative effect on the value of your ExxonMobil pension. We’ve helped many ExxonMobil employees assess the negative impact of these rates on their retirement plans and, where appropriate, recommended an earlier retirement date to avoid pension losses. If you’ve elected to stay with the company, it’s important to understand where things stand now, and what future interest rate moves might look like. Will rates go higher? Will your lump sum go lower? We discuss more below.

Q4 Rates Published: Another Significant Rate Increase

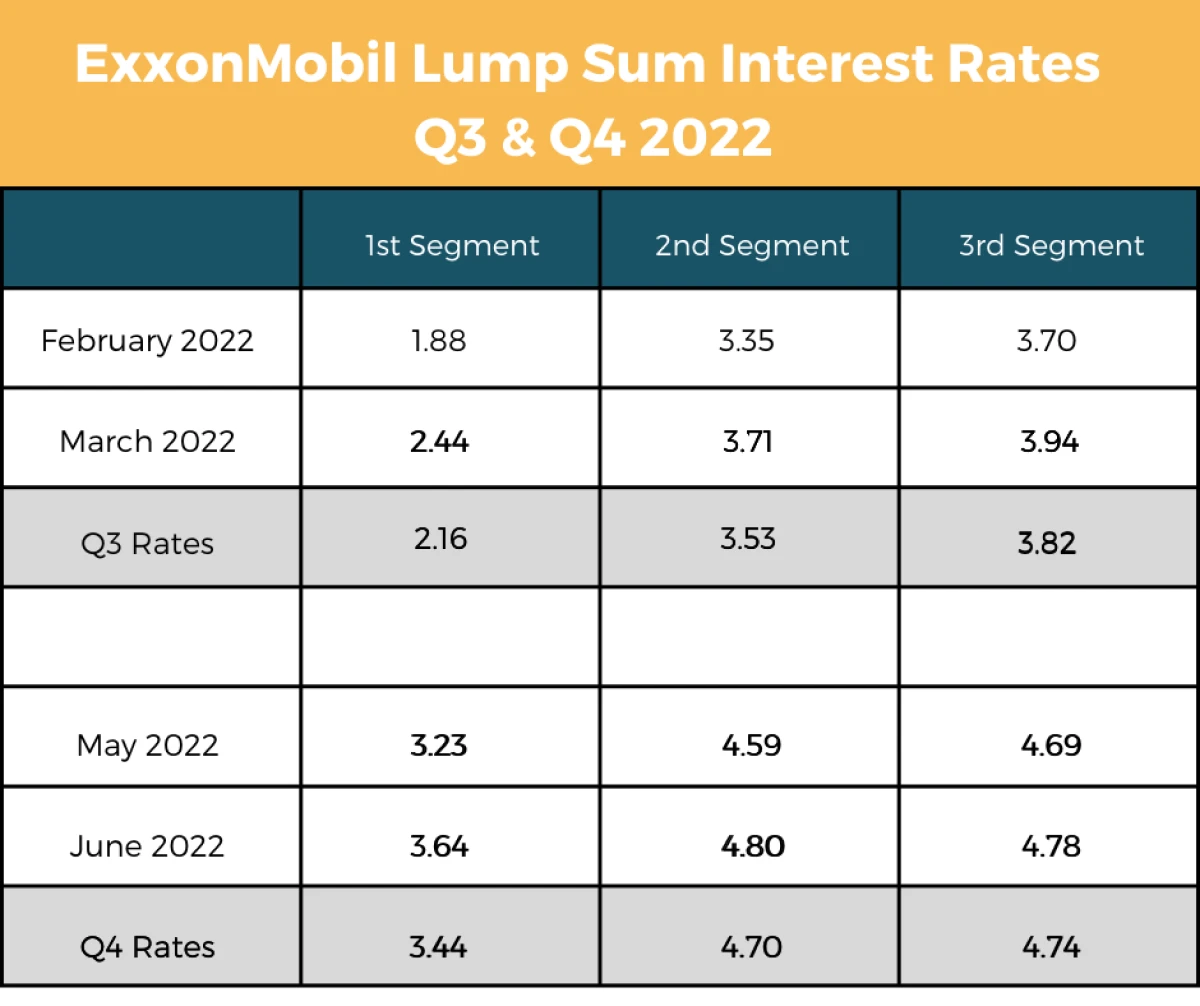

As we’ve noted previously, each quarter’s rates are calculated by averaging the rates from the 4th and 5th month PRIOR to the beginning of the quarter as published by the IRS here. Therefore, the average of the May and June rates dictate the segment rates used for any individual retiring in Q4 of 2022.

As you can see, interest rates made an even more significant jump from Q3 to Q4, as occurred the prior quarter.

So far this year, rates have responded abruptly to a higher inflation environment, as we predicted before the increases began. See the figure below for a simplified explanation of the relationship between interest rates and your lump-sum value:

If you wish to avoid the substantial decrease associated with retiring in Q4 rather than Q3, It’s critical to begin the planning process as quickly as possible. Contact our team here to schedule a no-obligation planning appointment.

Where are rates going after Q4?

Despite the significant rate increase so far this year, market interest rates are displaying only a slight tendency higher going forward, with investors’ expectations of interest rates actually falling at some point next year. Should this occur, lump sums may recover a portion of the 2022 decline.

Historically, when the Federal Reserve hikes interest rates to decelerate the economy and control inflation, there comes a point where economic activity tapers off due to the monetary policy implemented.

Subsequently, the Fed tends to “pivot” and reduce rates to begin tilting back towards an “accommodative” policy. If this cycle is consistent with history, lower rates could appear in the medium term and provide an opportunity for those near retirement to once again optimize their lump sum value when separating from employment.

The Rhame & Gorrell Team is pleased to provide complimentary retirement planning sessions geared towards helping you make the best of your pension. We will help you assess your ideal retirement date, given the fluctuating situation with the pension, so that you enter retirement in the most advantageous financial position.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.