Why ExxonMobil’s 401(k) Loan Capability is Unique – Saving Borrowers Thousands

A Guide to Understand ExxonMobil’s In-Plan Loan Capability

When an ExxonMobil employee needs funds for an unexpected financial event like medical bills or a home repair, they may explore options like a line of credit or loan to access liquidity. Too frequently, employees fail to consider one of the most advantageous sources of liquidity – a loan from your assets held within your company 401(k).

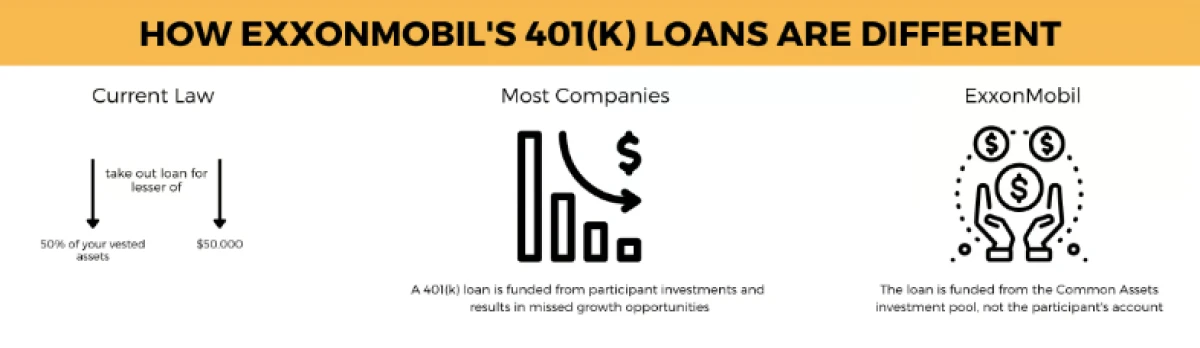

Under current law, the IRS allows employees to take a loan out for the lesser of 50% of your vested assets in the plan or $50,000. For employees of most companies, taking a loan from your 401(k) is a less-than-optimal way to access emergency funds because your investments are sold to generate the cash needed for your loan distribution. This causes the employee to miss out on the potential growth of the funds, which can add up to thousands or tens of thousands of dollars of missed gains.

Fortunately, ExxonMobil employees have access to a distinctive Savings Plan Loan feature not offered by most companies’ retirement plans. Loans from the ExxonMobil 401(k) at Voya are funded as secured loans from the Common Assets general investment pool rather than being withdrawn from the participant’s account. While this may not seem like a huge difference, funds that normally may have come from selling participants’ stock or bond investments are sourced elsewhere. On a $50,000 loan, allowing those funds to remain invested over a multi-year period could easily mean that the participant may avoid missing out on tens of thousands of dollars of growth over the loan term. This avenue is not available for employees of most other companies.

Under most circumstances, we would generally advise against taking out a 401(k) loan, as the liquidation of investment funds disrupts the main component of long-term investment returns. At ExxonMobil, the advantage afforded to employees by the loan being funded outside of the participant’s account balance creates a scenario where it could make more sense to tap into the Savings Plan for a temporary loan rather than using traditional financing measures.

The RGWM team has served thousands of ExxonMobil clients as they navigate decisions that affect their financial situations. Considering this expertise, we know that pursuing a 401(k) loan is an individualized strategy that could make sense for some individuals but not others.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by ExxonMobil. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.