2021 Year-End Tax Checklist

A Guide To Aid Your Tax Filing In 2021

Every year, our firm receives new clients looking for assistance with retirement planning that haven’t been getting much more from their previous advisor than a portfolio of investments. Too often, we’re starting from square one in helping them understand all of the additional elements that a comprehensive retirement plan should include. Unsurprisingly, a tax strategy is one of the most frequent and critical issues we deal with throughout that process. Failure to create a tax-efficient strategy can significantly impede your savings efforts and even delay your retirement. Our team of tax specialists includes an in-house CPA to formulate the most advanced strategies available under current tax law. As a result, we’ve helped hundreds of families to keep as much of their money out of Uncle Sam’s pocket as possible over the years.

“Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. Nobody owes a patriotic duty to pay more than the law demands.” -Judge Learned Hand

The RGWM tax philosophy is that it’s not just about what you make, it’s about what you keep. Our goal is not simply to help our clients achieve robust investment performance; we ensure that their returns are achieved in the most tax-efficient manner possible. Our proactive tax planning finds more tax-deductible items, creates tax-advantaged situations, and teaches you how to reduce taxes for greater savings in future years. In some cases, the tax savings we identify are greater than our fees, fully offsetting the cost of our services.

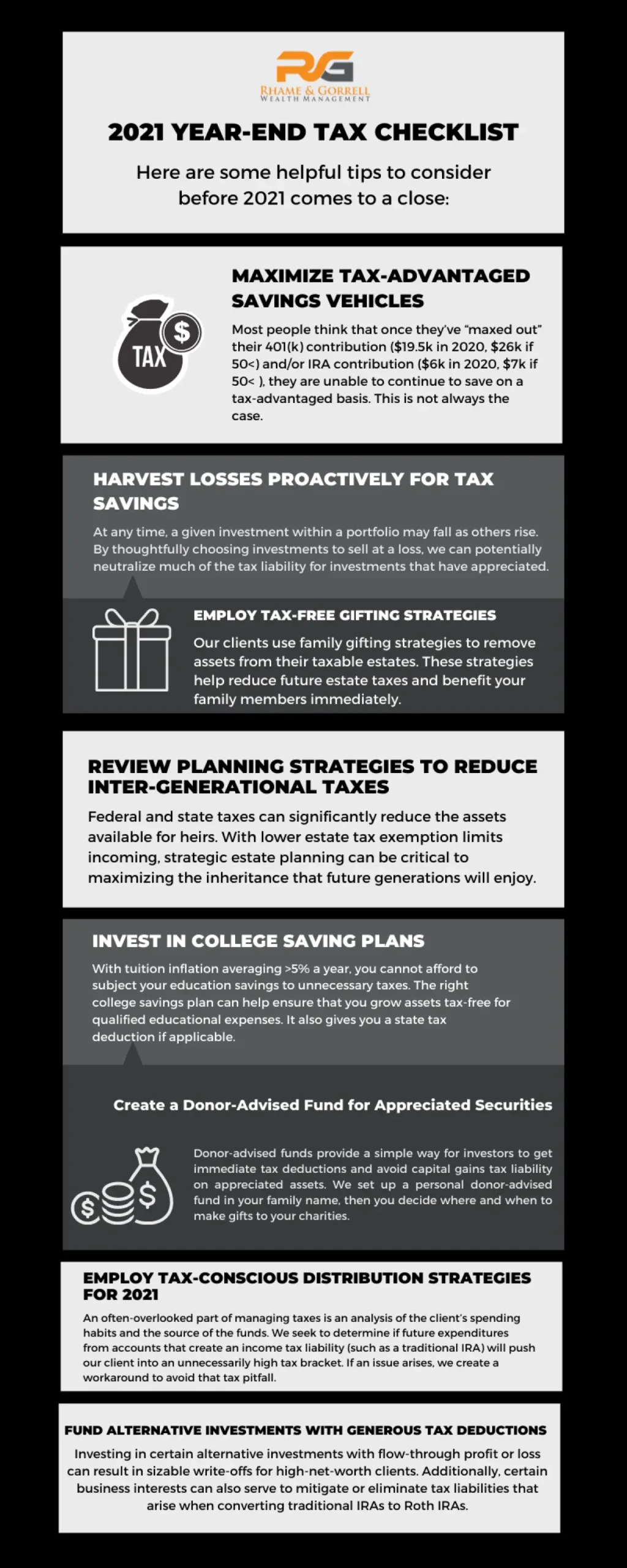

Here are some helpful tips to consider before 2021 comes to a close:

Tax Preparation

Through our in-house CPA tax planning specialist, we offer complimentary tax strategy consultations with a focus on proactive planning and deduction maximization. For new clients, our team may find overlooked deductions and recommend amending prior tax returns to claim overlooked deductions. For tax preparation, we gladly work cooperatively with your CPA or tax preparer. Alternatively, you may prefer that we coordinate your tax preparation with one of the CPAs in our network.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.