BP Pension Plan: Understanding the RAP

Understand the key aspects of your BP Cash Balance Pension Plan

BP employees have access to a comprehensive suite of retirement benefits. The BP Cash Balance Pension Plan, also known as the “Retirement Accumulation Plan” (RAP), is the company’s way of ensuring their employees have income after retirement. The RAP is a cash balance pension plan, which combines features from both traditional pension plans and contributory retirement accounts.

The structure of a cash balance pension provides a provides a clear view of your benefits through an individual account assigned to you. Put simply, the BP RAP account is like a savings account with guaranteed returns.

Eligibility and Vesting

BP accepts all individuals on the U.S. payroll into the RAP. Enrollment provides a BP RAP account into which the company can make contributions. However, no claim can be made on these funds until 100% vesting is achieved. Vesting occurs upon three years of service with BP. This is when the participant gains full ownership of the funds.

There are also other ways to become vested. For instance, reaching age 65 while still employed at BP results in immediate vesting, regardless of years of service. The same applies in cases of death while in active service or qualification for the company’s long-term disability plan.

BP also ensures that employees don’t lose their benefits in certain situations. Immediate vesting occurs regardless of tenure with the company if departure from BP results from:

- The sale of all or part of the employer to an unrelated entity

- The closing or cessation of operations at a facility

- The outsourcing of the employment function

- A written severance plan adopted by the company

Plan Contributions

As mentioned earlier, the RAP is a company-funded benefit provided to employees as part of BP’s retirement offerings. No portion of an employee’s salary or bonuses is contributed to the pension scheme. In essence, this retirement plan is a long-term benefit that continues to grow without impacting current income.

How the Plan Works

When BP enrolls an employee in the plan, a notional account—sometimes referred to as a current account—is created. This account allows the company to track benefit accruals. It is important to note that the funds in the notional account are not actual; they represent projected benefits rather than tangible assets.

Two structural elements define how BP contributes to the current account: pay credits and interest credits.

Pay Credits

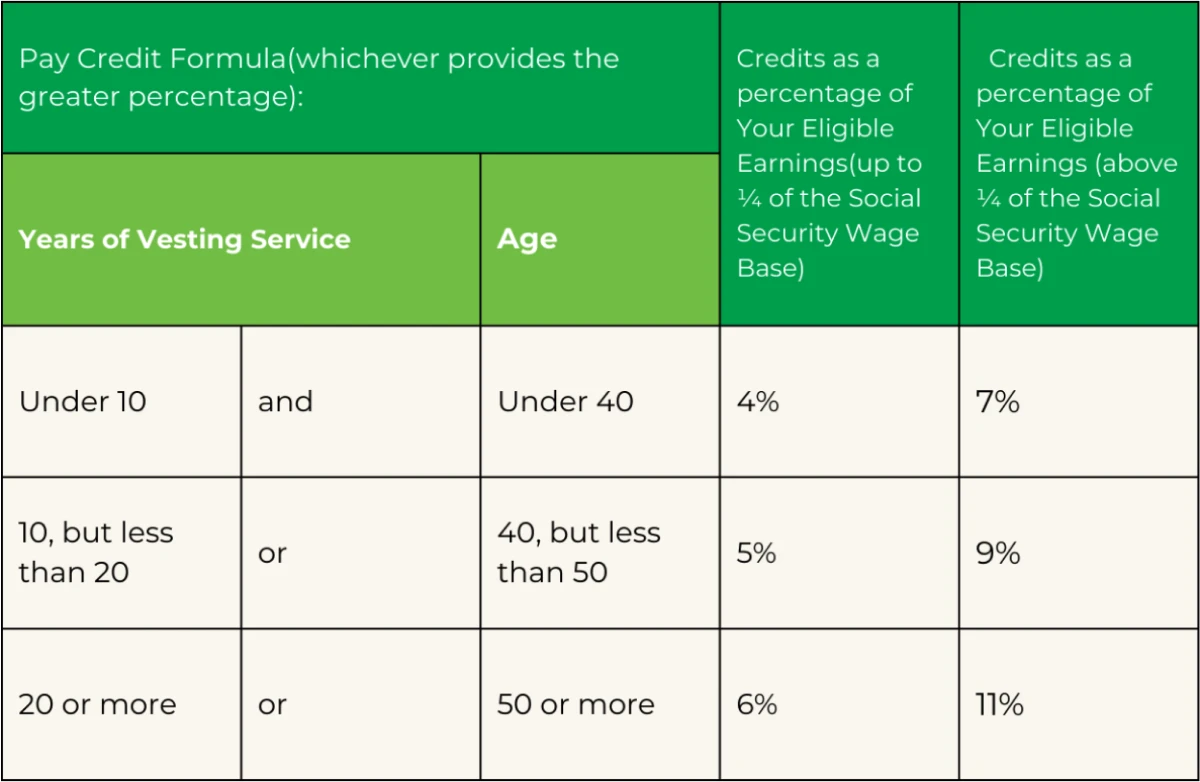

Using this formula, BP adds an amount to each employee’s current account every month. This amount is a percentage of eligible earnings, including salary, overtime, and certain bonuses. The contribution amount depends on two factors: age and length of service with the company.

Each month, a higher percentage is applied based on these factors. Eligible earnings are divided into two parts:

- For the first portion of earnings (up to a specified limit based on the Social Security Wage Base), a set percentage is applied.

- For earnings exceeding that limit, a higher percentage is used.

Example

Michael is a BP employee who is 45 years old and has been at BP for 15 years. Michael’s eligible earnings total $180,000 ($15,000/month). BP splits these earnings into two parts:

- The first part is up to a set limit (¼ of the Social Security Wage Base (SSWB), which is about $44,025 for 2025, or $3,668.75 monthly).

- The remaining amount is any earnings above that limit.

Based on Michael’s age and service (15 years and age 45), he qualifies for the mid-tier rates:

- 5% for earnings up to ¼ SSWB

- 9% for earnings above ¼ SSWB

So here’s the math:

- For the first $3,668.75: 5% of $3,668.75 = $183.44

- For the remaining $11,331.25 (which is $15,000 – $3,668.75): 9% of $11,331.25 = $1,019.81

His total monthly pay credits come to $183.44 + $1,019.81 = $1,203.25 ($14,439 annually)

BP adds this monthly credit to Michael’s retirement account, and over time, along with interest credits, the projected future value of the benefit increases.

Interest Credits

The interest credit functions as an additional component that enhances the growth of the retirement account. In addition to the pay credit, the account accrues extra value based on a pre-set interest rate.

Regular interest credits apply even if BP is not adding new pay credits. Each month, interest is added to the account, calculated as an annual rate and converted to a monthly rate. This rate is determined by taking the higher of two values:

- A market-based rate, which is the monthly average of 30-year Treasury Bond rates from four months prior.

- A minimum guaranteed rate.

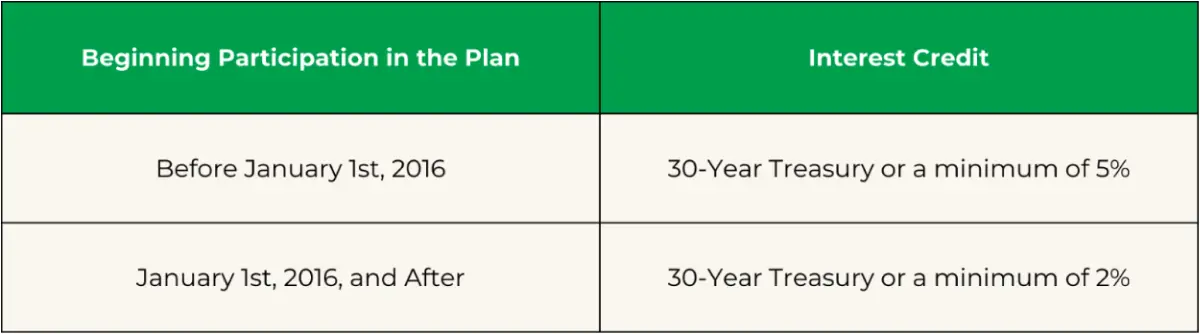

The minimum guaranteed rate depends on the year an employee joined the plan. Members who enrolled before January 1, 2016, receive a guaranteed minimum annual interest rate of 5%. Employees hired or rehired on or after January 1, 2016, receive a minimum annual rate of 2% on new pay credits. However, if an existing balance was established before rehire, that balance continues earning interest at the 5% minimum rate.

Example

Let’s revisit Michael from before. Since Michael joined BP in 2010 (as noted earlier, he has been a BP employee for 15 years), his account’s minimum interest rate is 5%. In months when the 30-year Treasury rate averages 4%, his account will still earn interest at 5%. However, if the Treasury rate rises to 6%, the accrued benefits will earn interest at that higher rate.

In contrast, an employee who joined BP in 2017 will have a 2% minimum interest rate. When Treasury rates are at 4%, the account will earn interest at 4%. However, if rates fall to 1.5%, the account will still earn 2% due to the guaranteed minimum rate.

Annuity vs. Lump Sum: Choosing the Right Distribution Option

BP employees have two primary options for receiving retirement benefits: a Lump Sum payment or an Annuity. Each option has unique advantages and drawbacks, making it essential to evaluate financial goals, tax implications, and estate planning considerations before making a decision.

Lump Sum Payment

The lump sum option provides a one-time payout of the full account balance, which can be rolled over into a qualified retirement account, such as:

- The BP Employee Savings Plan

- An Individual Retirement Account (IRA)

- Another employer’s qualified plan

Once rolled over, the lump sum continues growing tax-deferred, allowing for investment flexibility and strategic withdrawals.

Pros of a Lump Sum:

- Ability to Rollover & Reinvest for Growth – Funds can be invested across various asset classes, offering the potential for long-term appreciation.

- Can Be Passed to Future Generations – Unlike an annuity, which generally stops upon death, a lump sum can be inherited by beneficiaries, supporting generational wealth transfer.

- Control of Distributions – Provides flexibility in deciding when and how to withdraw funds based on financial needs, tax planning strategies, or market conditions.

Cons of a Lump Sum:

- Market Risk – Investment performance depends on market fluctuations and requires ongoing management.

Annuity Payment

The annuity option converts retirement benefits into a monthly income stream, which is taxable as ordinary income. The two primary annuity types are:

- Single-Life Annuity – Provides payments for the remainder of the retiree’s life, but payments stop upon death.

- Joint & Survivor Annuity – Ensures continued payments to a spouse or designated beneficiary after the retiree’s death, typically at a reduced percentage.

For those considering early retirement, withdrawing from an annuity before age 59.5 may result in a 10% early withdrawal penalty, depending on the specific distribution structure.

Pros of an Annuity:

- Steady Income Stream for Retirement – Provides predictable, guaranteed income that eliminates concerns about investment volatility.

Cons of an Annuity:

- Not Adjusted for Inflation – Fixed payments may lose purchasing power over time.

- Cannot Be Passed to Future Generations – Payments generally stop after the retiree (or, in the case of a joint annuity, the designated beneficiary) passes away.

- No Opportunity for Future Growth – Unlike a lump sum, an annuity does not allow for additional investment growth beyond its initial structure.

- Lack of Flexibility for Tax Planning – Monthly annuity payments are fully taxable as ordinary income, limiting the ability to control tax exposure by adjusting withdrawals based on income needs or tax brackets.

Which Option is Right?

Choosing between a lump sum and an annuity depends on individual financial circumstances. Those seeking growth potential, wealth transfer, and flexibility may favor a lump sum, while those prioritizing guaranteed lifetime income may prefer an annuity. Consulting a financial professional, such as our team, can help determine which option aligns best with long-term retirement goals.

Conclusion

The BP Retirement Accumulation Plan is designed to provide long-term financial security by ensuring steady growth regardless of market fluctuations. With flexible distribution options, employees can choose the path that best aligns with their retirement goals—whether prioritizing growth potential and wealth transfer through a lump sum or securing a predictable income stream with an annuity. Ultimately, BP’s RAP represents a valuable investment in retirement, offering a foundation for financial stability and future planning. For those seeking guidance on decisions within the BP RAP, our team is here to help you navigate the options and create a strategy that aligns with your long-term goals.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by BP. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.