Brokerage Account vs. Life Insurance as an Investment: A Guide

Understanding The Consequences of Utilizing a Life Insurance Policy as an Investment

When discussing the topic of money management, one of the most important aspects is having an efficient tax strategy for the location, execution, and the timing of the assets invested. A big problem facing individuals heading toward retirement is the lack of tax-efficient options after they have exhausted resources such as IRAs and employer sponsored plans. Even the more creative strategies, such as the Backdoor Roth IRA, eventually have a limit on contributions.

Recently, this lack of options has led investors to explore other choices such as investing in life insurance. It is important to understand that investing in cash-value life insurance may appear to have potential value on the surface, but is no substitute to proper tax mitigation within more traditional investment vehicles, such as brokerage accounts.

What is Investing in Life Insurance

This phrase is often misleading, as life insurance should not be classified as an investment, but a risk mitigation strategy. At its core, insurance is a way to offset liabilities in the event something unexpected happens that would affect an individual’s or household’s financial stability (the death of the breadwinner, for example.)

However, the insurance industry is very competitive, which has led many insurance companies to start pushing life insurance to consumers as an investment vehicle. There are many ways in which this is marketed, and we will cover the various facts and myths surrounding life insurance, and the role it plays within wealth management.

Term Life Insurance

Term Life Insurance is straightforward and generally not marketed as an investment. It has a level premium, fixed death benefit, and no cash value.

It is used for, and often marketed as, a way of providing for beneficiaries during the time in an individual’s life when he or she has the highest amount of liabilities. For example, individuals between the ages of 30 to 50 who often have a mortgage, car payments, and a family to provide for will buy term insurance in order to relieve their family of any financial burden if they pass.

Whole Life Insurance

A whole life insurance policy has a fixed or increasing death benefit with a fixed premium and cash value. This type of policy can be useful when an individual wants to pay a fixed premium to assure that their beneficiaries will receive a death benefit, regardless of when the individual passes. Unfortunately, this is often marketed as an investment vehicle due to the cash value that accumulates tax-deferred at a guaranteed rate of return.

While the cash value in a whole life policy can be useful for paying premiums or buying additional coverage to increase the death benefit, it is not an efficient use of allocating funds for tax-free growth. Opportunity cost of the market aside, withdrawing funds without causing a taxable event is only possible through taking out loans against the policy or removing contribution basis. These loans are often subject to loan rates and require repayment of principal under threat of reduction of death benefit. It is worth noting that it is also possible to take a loan on your invested assets within a brokerage account if this is a strategy that is desired.

Additionally, once the cash value grows equal to the death benefit of the policy, the policy will automatically terminate, and the entire amount of the cash value becomes fully taxable as ordinary income. Again, these attributes can be suitable for an insurance policy designed to provide a death benefit to beneficiaries, but not for the purpose of tax-efficient investing.

Variable or Indexed Universal Life Insurance (VUL/IUL)

These policies have flexible or fixed death benefits, flexible premiums, and variability of cash value dependent upon investments made within the policy. Unlike other types of policies, the cash value of VULs and IULs track investments across various markets, allowing the cash value to be invested, and subject to market volatility as well. This type of insurance is not a favorable risk mitigation strategy in comparison to other types of insurance because of this volatility in the cash value, and the poor amount of death benefit received for the premium.

This policy is often marketed as a way to invest and grow money tax-free. The idea is that the minimum amount of death benefit is paid in order to maximize the portion of premiums that are contributed towards the cash value that accumulates in the account. Essentially, it is minimizing the cost of insurance so you can put as much money as possible toward investing within the policy.

Some policies even have cash values equal to their death benefit after a certain period of time (7-10 years,) so the money could potentially be passed onto beneficiaries. However, due to the fees associated with the underlying investments and the life insurance component of the policy, a VUL will not be able to compete with the overall performance of a stock index.

It is also worth noting that while the investments grow tax-free within the policy, they are still taxed as ordinary income upon withdrawal. A VUL policy could be a good way of growing investments tax-deferred, but as previously mentioned, they are often limited in their investment capabilities and have a high cost associated with the policy.

Strategic Tax-efficient Investing in a Brokerage Account

After exhausting various tax-advantaged retirement accounts, a brokerage account, while not offering any tax advantages in and of itself, does allow for tax-efficient investing and trading. In an ordinary brokerage account, the growth of the investments is taxed as either short-term or long-term capital gains.

If these gains are realized (by selling an investment at a profit), within one year, they will be considered short-term, and will therefore be taxed as ordinary income. Any gains realized beyond a year from the original investment are taxed as long-term capital gains at either 0%, 15%, or 20% (subject to tax policy changes). Unlike the cost of insurance, there are ways of mitigating this tax over a long period of time.

Because any gains accumulated in the portfolio are only taxed when realized, investing in passive funds such as Exchange Traded Funds (ETF’s) and index funds are a good way of keeping the tax implications of investments within the control of the investor. For example, if an investor wished to participate in the upside potential of large cap markets, he or she could invest in an S&P 500 ETF to avoid having to trade in and out of positions in the short term, exposing them to ordinary income taxes.

Tax-Loss Harvesting

Another effective tax mitigating strategy is intentionally selling investments at a loss in order to offset their capital gains tax. This process is known as tax-loss harvesting.

Consider an example: If an investor buys securities at a price of $15,000 and then sells those same securities for $5,000 the next year, there would be a $10,000 capital loss associated with the account. If the investor then buys other securities at a price of $15,000 and then sells those same securities for $30,000 the next year, that will result in a $15,000 capital gain.

While an investor would have to pay taxes on the total $15,000 gain, he or she would be able to use that $10,000 capital loss in order to offset those gains. This means that the investor made a $15,000 gain in the current year and is only required to pay taxes on $5,000 of the original investment. Additionally, if the losses still exceed the gain for the given time period, the investor can even report up to $3,000 of capital losses to reduce his or her ordinary income.

Step-Up in Basis

It is also worth noting that a brokerage account is also capable of passing investments tax-free on to beneficiaries. In fact, there is a potential step up in cost basis when a beneficiary inherits the account. In other words, if the owner of a brokerage account dies, the beneficiary of the account would inherit it allowing the beneficiary the opportunity to either withdraw the current amount tax free or allow the investments to grow over time with that new cost basis.

For example, if the owner of an account originally invested $100,000 that grew to $500,000, the owner would need to pay a capital gains tax on the $400,000 growth. However, if the owner dies, and the account is inherited, then the new cost basis is $500,000. This implies that the new account owner can either withdraw the new basis of $500,000 tax free, or allow the investment to grow over time, and pay taxes on the capital gain accumulated beyond the $500,000 in the account.

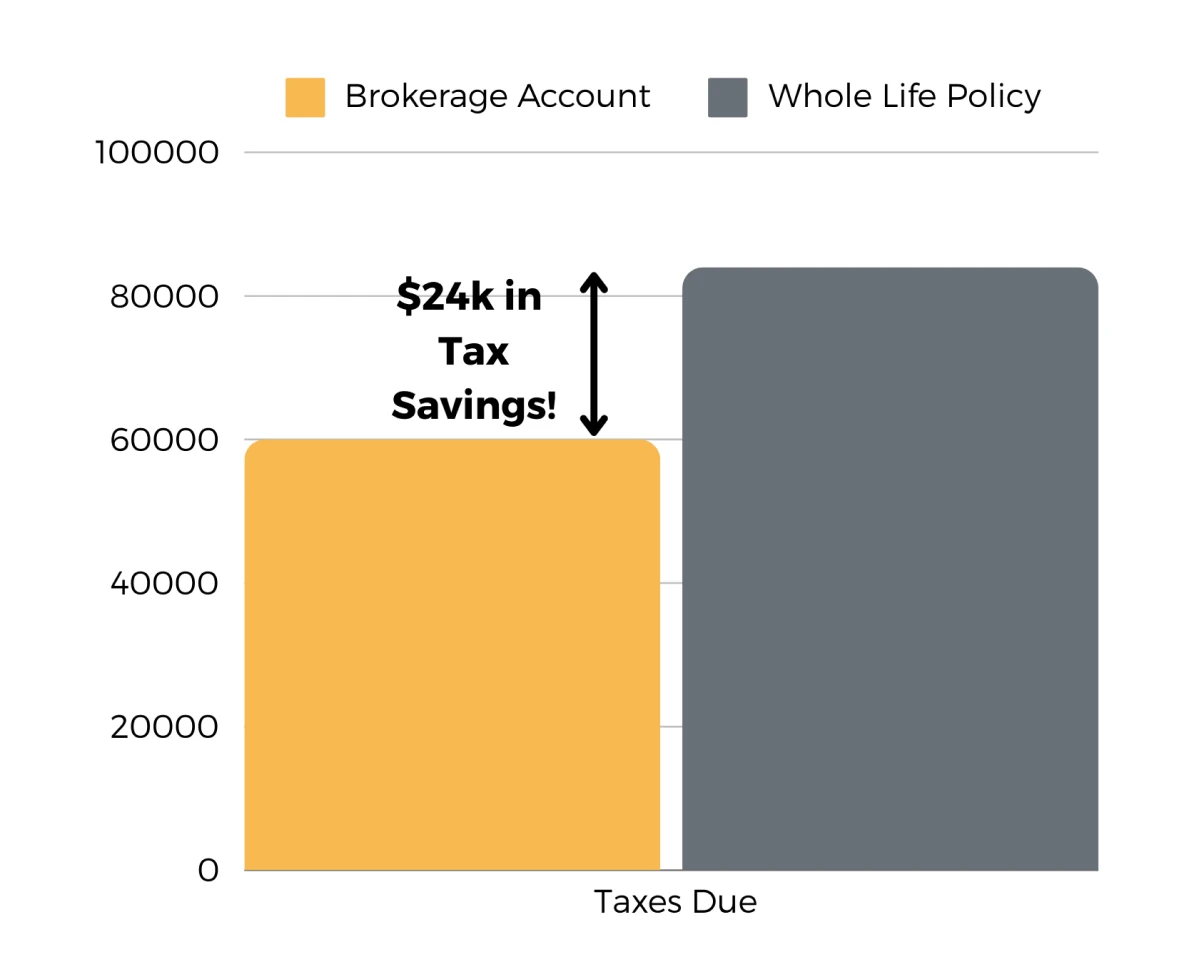

Investing in Insurance Versus Investing Strategically

Now that we have a better understanding of the pros and cons of investing in insurance and investing strategically, let us look at a demonstration of how the two perform as an investment.

Say there is an investor named John who has $350,000 he wishes to invest, seeking maximum return while remaining tax conscious. He is curious about whether he should invest in a variable universal life insurance policy, or a brokerage account. Let us compare these strategies.

VUL

John buys $350,000 worth of a VUL policy. For demonstrative purposes, let us assume the cash value grows to be $750,000. Even if he could pull out the entirety of the cash value, which is normally subject to policy minimums due to the risk of lapsing the policy, the gains he accumulated would be subject to an ordinary income tax rate.

If he is married and filing jointly, this would be an average tax rate of 21% on the $400,000 taxable gain. This would require the investor to pay $84,000 in taxes, leaving him with a total gain of $316,000.

$750,000 – $350,000 = $400,000 taxable gain

$400,000 * 21% = $84,000 tax liability

$400,000 – $84,000 = $318,000 net gain

Brokerage Account

John invests the full $350,000 into many different passive securities such as index funds and ETF’s. For demonstrative purposes, let us assume this has the same performance as the VUL, and the investments grow to be $750,000. Even without the use of tax loss harvesting, the rate at which the investment will be taxed upon withdrawal will be a long-term capital gains rate of 15% on the $400,000 gain. This would require the investor to pay $60,000 in taxes, leaving him with a total gain of $340,000.

$750,000 – $350,000 = $400,000 taxable gain

$400,000 * 15% = $60,000 tax

$400,000 – $60,000 = $340,000 net gain

Conclusion

While investing in insurance demonstrates potential in a tax-deferred investment strategy, the lack of liquidity and investment options, loan rates, and fees associated with the policy often pose a threat to the total return of the investment.

Regardless of the type of insurance policy, the main selling point of the “investment” is the tax-free growth accumulated in the cash value. However, between the cost of insurance, loan rates, and the risk of lapsing the policy, it is reasonable to believe that the cash value would not exceed the total return of a strategically allocated portfolio – particularly when considering the elimination of tax on gains when passed along to heirs.

The strategies involved in proper portfolio tax management can get complicated, however with the help of a dedicated financial advisor, there are many different options available for those seeking tax-efficient growth to improve and secure their financial future.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.