How to Avoid the Pro Rata Rule with Backdoor and Mega Roth Conversions

A Guide For Navigating The Tax Pitfalls Associated With Roth Conversions

Two of the most beneficial tax planning tools are Backdoor Roth IRA conversions and Mega Backdoor Roth conversions. If done correctly, they are excellent methods for moving pre-tax assets into a Roth account. The downside is that if not properly performed, you might be hit with an unwanted tax liability due to the Pro-Rata Rule. This rule requires you to consider all your IRA accounts as a single entity when calculating the tax liability for a conversion.

What is a Backdoor Roth IRA Conversion?

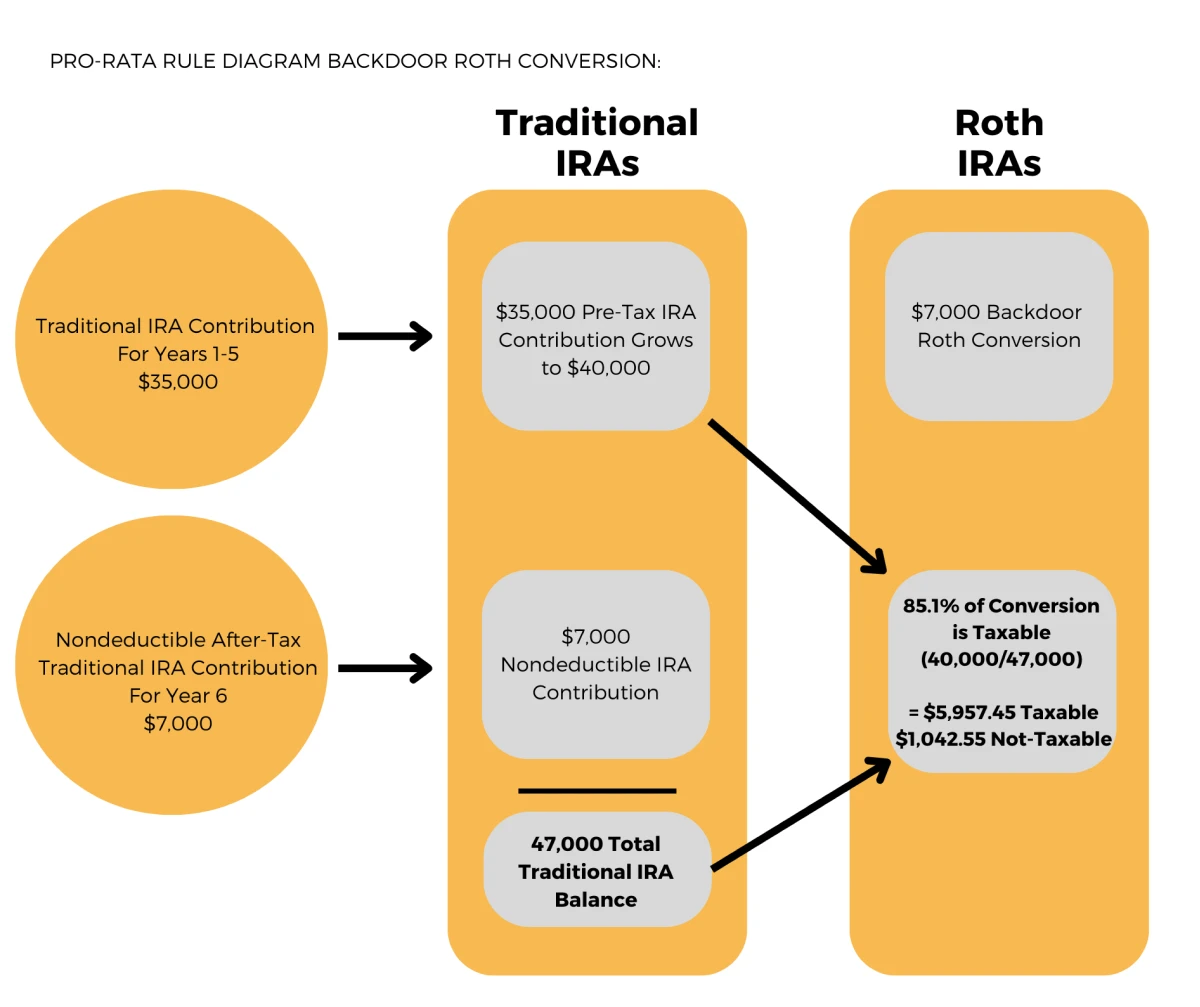

Traditional IRA contributions are either deductible (pre-tax) or non-deductible (after-tax) depending on your level of income. Backdoor Roth IRA conversions are performed by making non-deductible after-tax contributions to a Traditional IRA account and then rolling those into a Roth IRA account. If you already have tax-deductible pre-tax contributions in your Traditional IRA and try to do a Backdoor Roth conversion, you might get hit with a tax bill due to the Pro-Rata Rule. This rule requires you to consider all your IRA accounts as a single entity when calculating the tax liability for a conversion.

Example

Let’s say that Billy currently has a Traditional IRA. Over 5 years, he made tax-deductible pre-tax contributions to this account in the amount of $35,000, which grows to $40,000.

Now he is looking to take advantage of backdoor Roth conversions and makes a non-deductible after-tax contribution of $7,000 to his Traditional IRA in hopes of doing a Roth Conversion. When he Makes the Roth conversion of $7,000, some of that amount will end up being taxable since he already has deductible pre-tax contributions in the IRA.

What is a Mega Backdoor Roth Conversion?

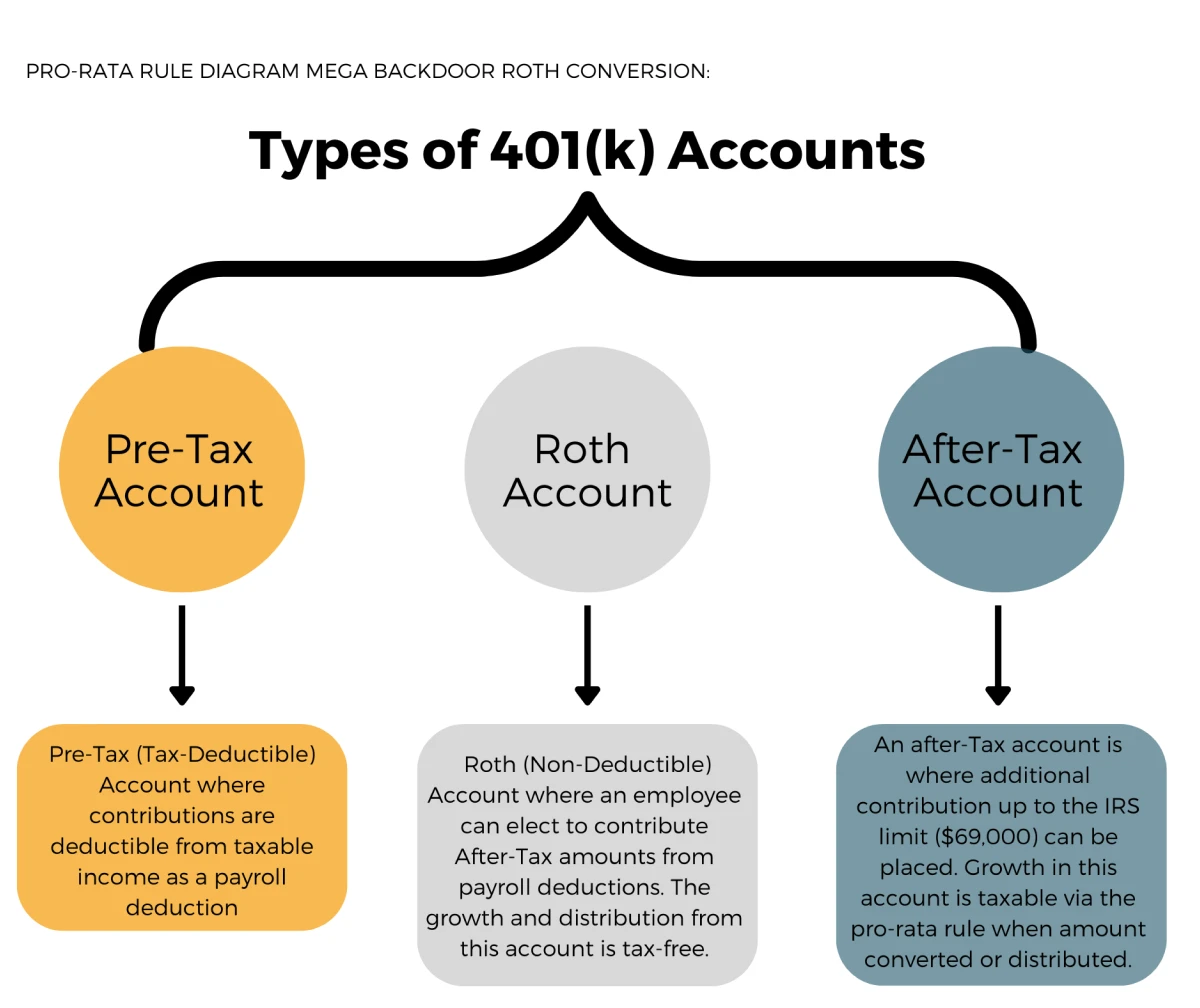

The Pro-Rata Rule can also apply within the 401(k) when trying to make a Mega Backdoor Roth conversion. This rule becomes an issue for Mega Roth conversions when there are pre-tax and after-tax dollars within the 401(k). Often when an employee has maxed out their Pre-Tax 401(k) or Roth 401(k) and still wants to put some money into their workplace retirement account, they will make a contribution to the After-Tax 401(k) bucket.

Example

Let’s say Stacy’s salary is $250,000, and she is currently maxing out her Pre-Tax 401(k) contributions at the maximum of $23,500 for 2025 (this is a 9.4% contribution from her salary). Her employer matches 100% of her contributions up to 6% of her salary for a total of $15,000.

For 2025 the IRS allows maximum annual additions in a defined contribution plan to be $70,000.

This leaves $31,500 that Stacy can still contribute to her 401(k) plan if she would like. Since she has already maxed out her salary deferrals in her Pre-Tax 401(k), she can put this money in as a contribution to the After-Tax 401(k) account.

This After-Tax account is where the Pro-Rata Rule can come into play. let’s assume Stacy puts the $31,500 in the After-Tax account and it grows to $40,500. The $9,000 of growth is viewed by the IRS as pre-tax dollars. This is an issue because now Stacy has both pre-tax dollars of $9,000 and after-tax dollars of $31,500 in the same account.

The $9,000 of pre-tax dollars will have to be realized as income when a Mega Backdoor Roth conversion is made. Therefore, it is best to make your Mega Backdoor Roth conversions yearly to ensure that the taxable gain in the After-Tax account does not grow too large.

What is the Pro-Rata Rule?

The Pro-Rata applies when a Traditional IRA or 401(k) contains both after-tax and pre-tax funds. Each dollar withdrawn or converted from the IRA or 401(k) will contain a percentage of tax-free and taxable funds relative to the proportion those funds make up the account.

The Pro-Rata Rule is used to provide a ratio that determines what amount of the conversion is taxable. This ratio is calculated based on the percentage of non-deductible after-tax dollars in Traditional IRAs, 401(k)s, SEP IRAs, and SIMPLE IRAs.

It is important to note that the pro-rata rule treats all IRAs as one IRA. This is referred to as the Aggregation Rule. Opening a new IRA account and making a nondeductible contribution does not avoid this rule.

Another common wrinkle is that even if you contribute to an after-tax 401(k) through your employer, the employer match of your funds must be placed in a non-Roth account. This means that if you try to convert your entire 401(k) account, you may owe taxes on the portion of the account from your employer’s matching contribution. The Secure Act 2.0 changed this limitation, but it is still yet to be seen in the majority of 401(k) plans.

How to Avoid the Pro-Rata Rule

In Billy’s example, he already has pre-tax dollars in his Traditional IRA account. To avoid the Pro-Rata Rule, he will first need to remove all the pre-tax money from the account. Typically, the best way to accomplish this is by rolling the pre-tax Traditional IRA balance into your current employer’s retirement plan.

When doing this, consult your current company’s employer plan to make sure they handle this transaction correctly. Once your Traditional IRA has been zeroed out, you are ready to make your backdoor Roth Conversions without having to pay taxes on the pre-tax dollars.

Mega Backdoor Roth conversions have many moving pieces and, if done incorrectly, can land you a massive tax bill. Please consult our article about Mega Backdoor Roth Strategies for more information on navigating them.

FAQs

Below, we have outlined some frequently asked questions surrounding the Pro-Rata Rule.

How does the Pro-Rata Rule apply if you have multiple IRA accounts with different custodians, and how can you efficiently consolidate these to avoid the Pro-Rata implications?

When you have multiple IRA accounts across different custodians, the Pro-Rata Rule considers the aggregate balance of all your IRAs to determine the taxable portion of a conversion. Consolidation can simplify tracking and managing these accounts but requires a careful approach to avoid unintended tax consequences.

Are there any specific record-keeping strategies or documentation that should be maintained to substantiate the segregation of pre-tax and after-tax contributions, particularly when undergoing IRS scrutiny?

To effectively maintain records for a backdoor Roth IRA conversion, you should meticulously document every contribution and conversion, noting whether contributions are pre-tax or after-tax. Preserve all relevant IRS forms, such as 1099-R and 8606, and corresponding account statements that reflect these transactions. These documents should be kept systematically for at least three years to ensure they can be readily accessed if the IRS requires verification of your tax filings and the nature of your IRA contributions and conversions.

How do rollovers from other retirement accounts (e.g., 401(k)s from previous employers) into an IRA affect the Pro-Rata Rule calculations and the strategy for Backdoor or Mega Backdoor Roth conversions?

When you roll over assets from other retirement plans, such as 401(k)s, into an IRA, these rolled-over funds are considered in the Pro-Rata calculation if they are pre-tax dollars. This can affect the tax consequences of a Backdoor Roth IRA conversions and should be planned with care to ensure that the conversion strategy is optimized and unintended tax consequences are avoided. However, the Pro-Rata Rule for Mega Backdoor Roth conversions (within the 401(k)) is not affected by IRA balances.

Prefer to watch a video on how to avoid the pro rata rule?

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.