How To Cut Your Tax Bill With Tax-Loss Harvesting

How You Can Cut Your Tax Bill With The Use Of Tax-Loss Harvesting

If a portfolio is adequately diversified (and in some cases, even if it’s not), not every investment is a winner every year. Fortunately, even when an investment experiences a loss, it can still be an opportunity to lower your tax liability and reposition your portfolio for the future. This is done through a strategy called tax-loss harvesting. Tax loss harvesting can be particularly useful in years that many different types of investments experience a loss.

How Does It Work?

Tax loss harvesting generally works like this: when an investment is sold at a loss, it generates what the IRS calls a Capital Loss. The proceeds from this sale are used to purchase other securities that are a fit within an investor’s portfolio asset-allocation. The losses created by the original sale are then used to offset other Capital Gains that have occurred within the portfolio.

If losses exceed gains for the year, a net Capital Loss of up to $3,000 may be used to lower ordinary income (like W-2 income from employment). If losses in a year are great enough to fully offset gains and reduce ordinary income by $3,000, excess losses may be carried forward to offset income in future years.

Example

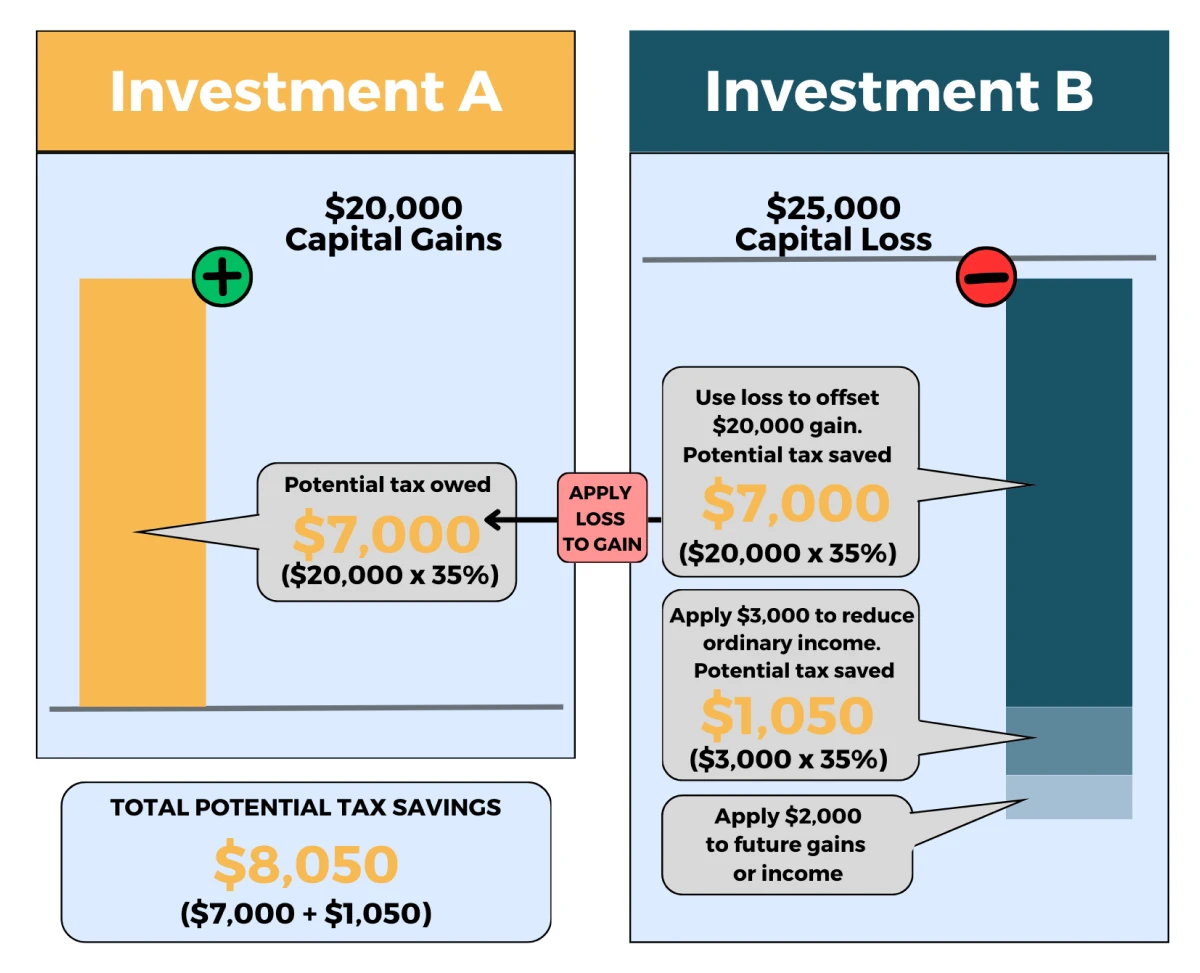

Consider this example illustrating how tax loss harvesting can lower your tax bill. Let’s say an investor has investment A that is sold in 2023 for a $20,000 short-term capital gain. The taxes owed on this transaction (assuming the investor is in the 35% tax bracket) would be $7,000 ($20,000 * 35% = $7,000).

Let’s assume that in the same year the investor also purchased investment B that is now at a loss of $25,000. While the investor could pay the taxes on investment A that was sold for a gain and hope that investment B regains its value in the future, alternatively investment B could be liquidated in the current year for tax loss harvesting and offset the taxable gain.

If harvested, the investor would realize the $25,000 loss for selling investment B. These short-term capital losses would offset the $20,000 gain from investment A. Additionally, $3,000 of the remaining $5,000 loss would be allowed to offset ordinary income and $2,000 would be carried forward to offset gains in future years.

Ideally, the proceeds from selling investment B would be placed into another investment to generate future gains. The total current year tax savings from this tax loss harvesting would be $8,050 ($3,000*35 = $1,050 + $7,000 = $8,050), and the investor would carry additional tax savings into the next tax year.

Potential Pitfalls

Despite its relative simplicity on the surface, tax loss harvesting comes with certain pitfalls investors stumble into when trying to execute the strategy. As with any seemingly beneficial tax strategy, the IRS has implemented rules and limitations that must be followed.

Wash-Sale Rules

There is a restriction against what are called “wash-sales” – transactions that involve selling an investment exclusively to generate a loss if the investor subsequently repurchases the security, or a security deemed “substantially identical”, within 31 days of the original sale. This means if an investor were to sell an investment to capture a loss only to turn around the next week and purchase the same investment, the IRS will disallow the loss and restrict the investor from the tax benefits of the loss.

There are a couple things to be aware of regarding Wash-Sale rules when developing a tax loss harvesting strategy:

- There is some grey area surrounding what the definition of “substantially identical” is. Generally speaking, there can be different investment options that consist of a similar underlying asset, but don’t run afoul of wash sale rules.

- Wash-sale rules apply across all types of investment accounts. Although tax-loss harvesting is not beneficial in IRA, Roth IRA and 401(k) accounts, you cannot generate a loss in an after-tax brokerage account and subsequently purchase the same security in another account. In this instance, the loss will be disallowed.

Long-Term vs. Short-Term Capital Gains

As noted above, there are rules regarding what type of income investment losses may offset. Long term capital losses must offset long term gains first, and likewise short-term losses offset short term gains first. Any additional net losses (long-term or short-term) may go to offsetting gains of either type.

Again, only in the case where there are enough losses created to offset all the capital gains for a tax year, up to $3,000 of the losses may then be used to offset ordinary income in that tax year and the rest of the losses are carried forward to future tax years.

Account Types

It’s important to note that tax loss harvesting is only available within taxable brokerage accounts. It’s not possible to tax loss harvest 401(k), IRA, 403(b), or other tax deferred accounts. This is because the buying and selling of investments in these types of accounts are not deemed taxable events and therefore do not create any tax benefit from selling investments at a loss. This strategy is best suited for individual or jointly held taxable brokerage accounts, trusts, etc.

Tax loss harvesting requires a thorough understanding of tax regulation and investment strategy, so we recommend that you consult a tax expert and financial planner before conducting this strategy. Rhame & Gorrell Wealth Management has deep expertise in tax loss harvesting as well as other tax and investment matters.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.