Market Update – August 22, 2022

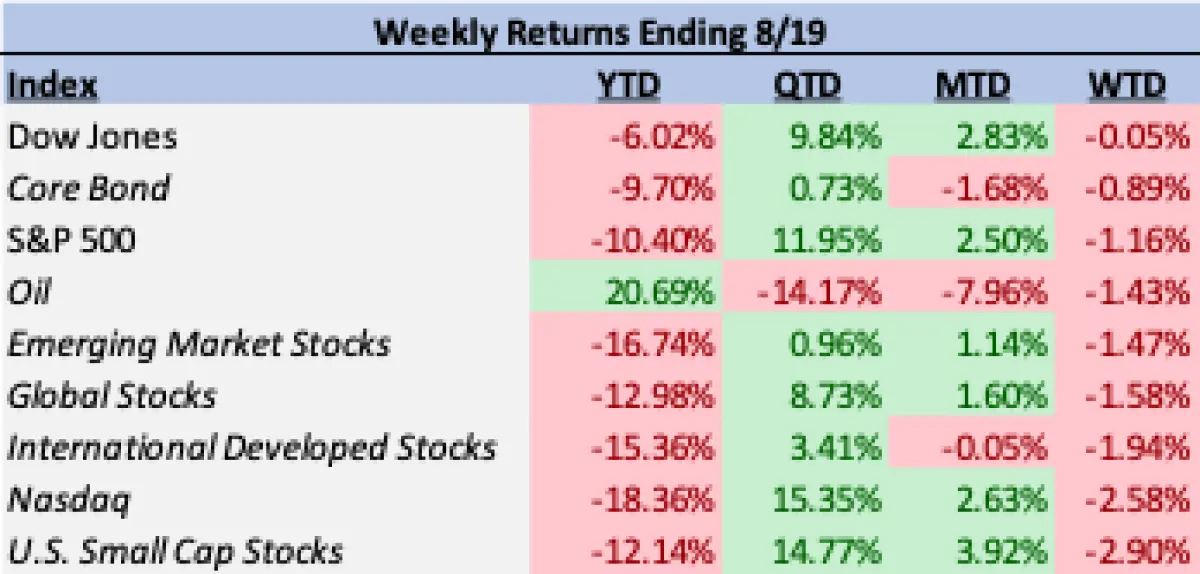

Last week saw the S&P 500 break its streak of positive weekly returns. The index ended the week with a -1.16% return. The biggest detractors in the weekly decline were the communication services and materials sectors which lost -3.28% and -2.43% on the week respectively. Positive returns for the week came from the utilities, energy, and consumer staples sectors (1.28%, 1.30%, and 1.97% respectively). The week’s decline in stocks was not limited to large cap stocks in the U.S. Small cap stocks, per the Russell 2000, experienced steeper declines with the index finishing the week down -2.90%. International developed and emerging market stocks also showed weakness relative to the S&P 500. International stocks via the MSCI ACWI ex US index were down -1.94% while emerging market stocks fell -1.47%. In addition to the decline in stocks, Barclays US Aggregate Bond Index also finished the week with a decline of -0.89% as 10-year Treasury Yields ended the week higher.

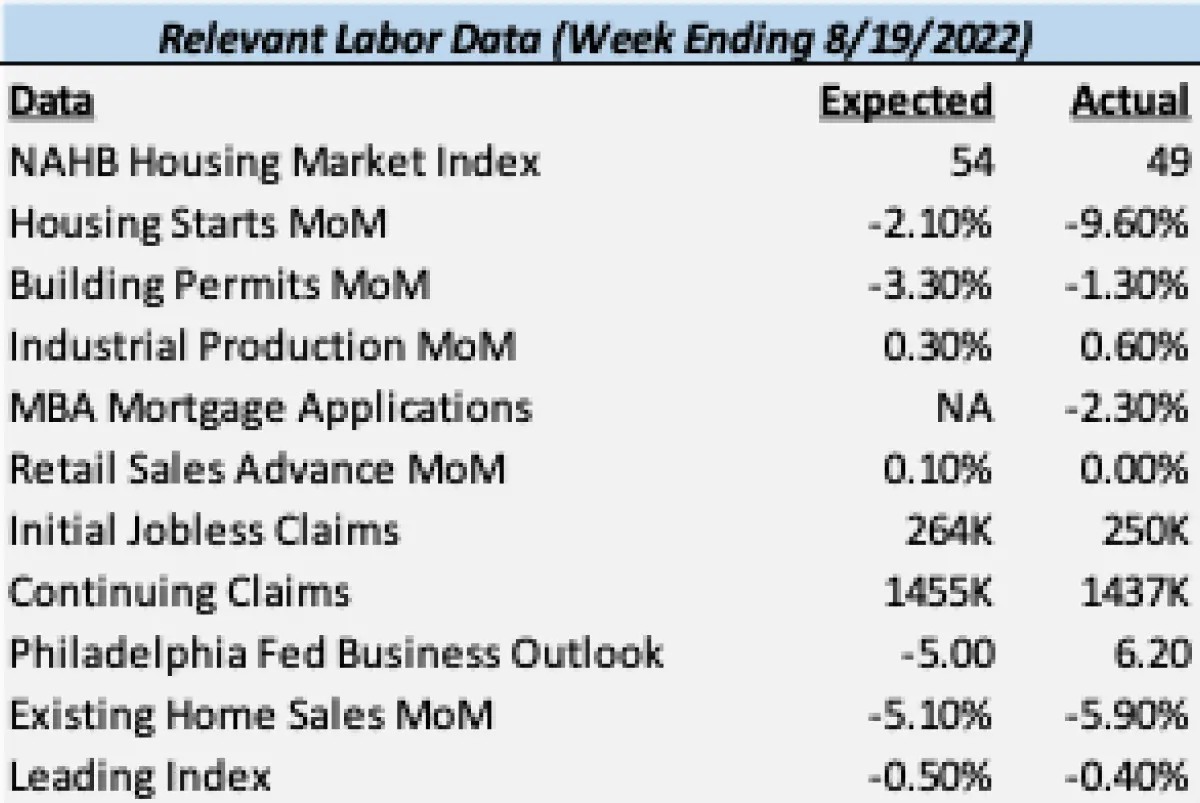

While it was a relatively quiet week as it pertained to economic data, there were still some informative releases to add context to the current market backdrop. This week’s data was particularly focused on the housing market, with the first big report of the week coming from the National Association of Home Builders (NAHB) Market Index.

The index is based on a monthly survey that asks respondents to rate market conditions and traffic of prospective buyers for the sale of new homes. Values in the index can range between 0 (worst) and 100 (best). Expectations from economists were that the index would report a value of 54, while the actual value came in at 49, placing the index on the poor end of the overall conditions’ spectrum. This negative housing data was supported by the week’s other relevant housing market releases including a worst than expected month-over-month decline in housing starts (-9.6%) and existing home sales (-5.9%). The MBA mortgage applications index also declined -2.30% on the week. With the national average 30-year fixed mortgage rate having nearly doubled to start the year, this decline in housing activity and prospective conditions shouldn’t be a surprise.

Despite the decline in housing activity indicated from the data, the week’s overall gauge for economic activity was mixed, with some data points coming in better than expected. One such surprise was the slight increase in the Philadelphia Fed’s Manufacturing Business Outlook Index. Expected to decline once more, the index came in with a small upside surprise of 6.2, indicating some short-term stabilization in manufacturing conditions. This survey was supplemented by a better than expected month-over-month pickup in industrial production of 0.60%.

These mixed results from economic releases were largely reflected in the week’s most highly anticipated event, the released “minutes” from the Federal Reserve’s July meeting. While the Fed reiterated a stance of continued restrictive monetary policy (more rate hikes and unwinding the balance sheet), they also emphasized that the pace and degree to which they further restrict monetary policy conditions would be data dependent. While these comments provide the Fed with some flexibility as it pertains to how many hikes they put in place for September and the remainder of the year, it also leaves the market in a relative guessing game as it pertains to the specific policy rate it should expect in the future. What this means for investors is a need for continued patience as the data relating to inflation and economic activity will continue to be the driving force for the market until clarity surrounding these elements is reached.

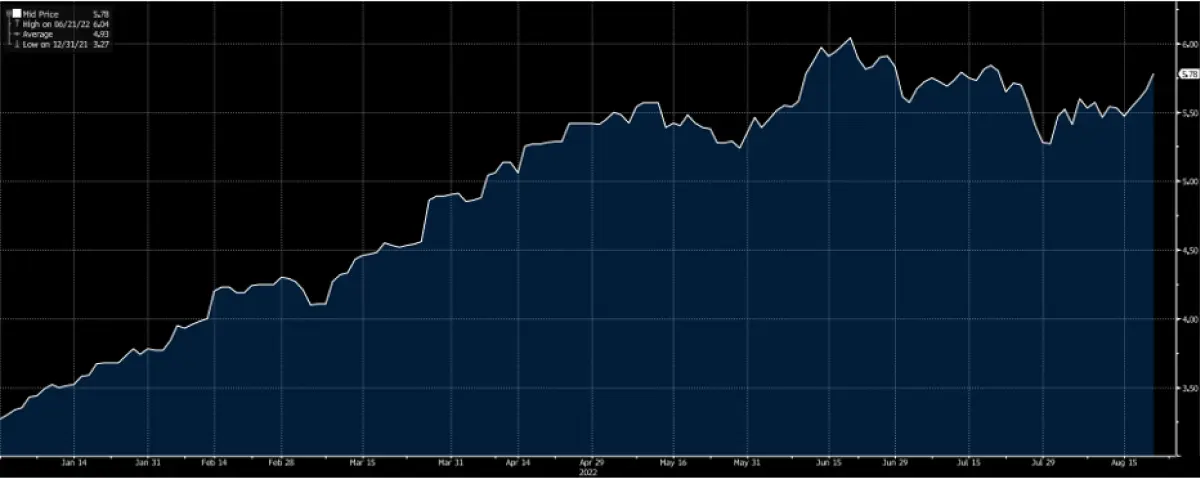

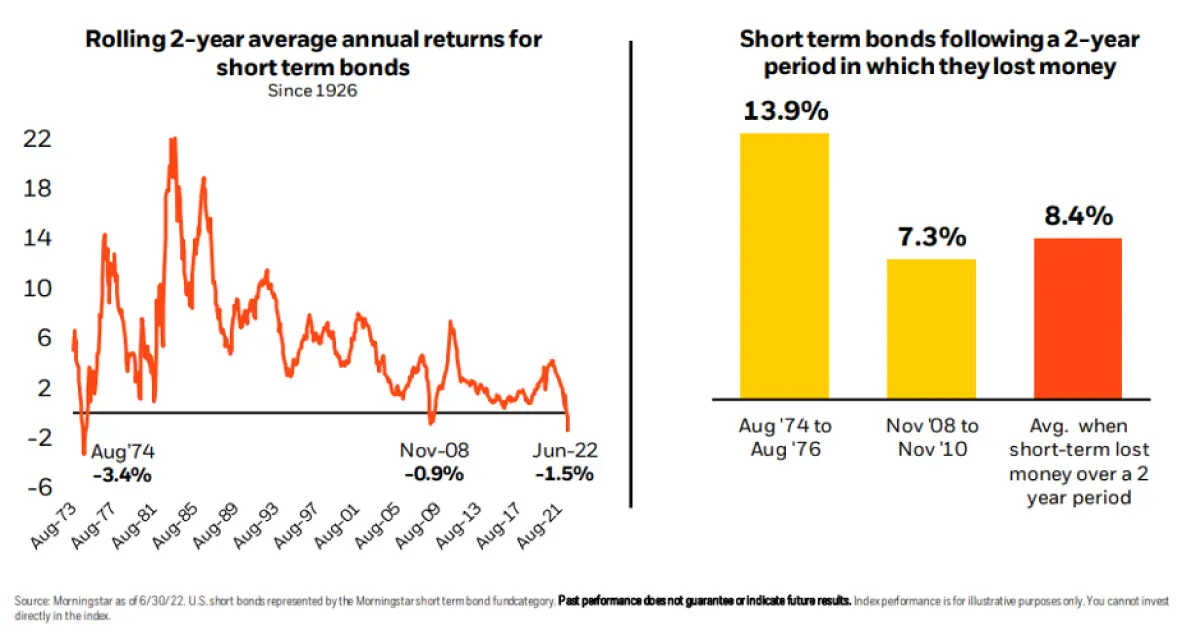

As the above would suggest, our overall view continues to be that the trajectory of the market for the remainder of the year will be primarily dictated by the path of inflation, investor sentiment regarding the Federal Reserve’s policy direction, and the general health of the underlying economy as it digests these policy actions and supply chain related factors. Geopolitical tensions will continue to be in the picture as well, with escalation or de-escalation being market narrative defining elements. For a final optimistic note, one of the more difficult pieces of the portfolio puzzle for investors this year has been the lack of protection provided through short-term bonds. The historical wisdom for portfolio management has typically pointed to bonds, especially short-term bonds, as a source of income and as a hedge on stock market volatility. For only the 15th time in the history of bonds, short-term bonds have lost investors money over the past 2-years. However, in the case of short-term bonds, history’s pessimism could be a sign for future optimism, as the average short-term bond has experienced relatively strong rolling returns the 2-years following such a decline.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.