Microsoft Stock Incentives and Compensation

Learn How to Make The Most of Your Microsoft Stock Incentives and Compensation

Microsoft employees have the ability to acquire company stock in a few different ways: in your Microsoft 401(k), your Microsoft Employee Stock Purchase Plan (ESPP), a normal brokerage account, and through stock compensation awards. Microsoft, like many tech companies, use stock incentives like Restricted Stock Units (RSUs) and an Employee Stock Purchase Plan (ESPP) as a part of your compensation and benefits at the company. Optimizing these benefits can help you make the most of your Microsoft compensation.

Based on the massive appreciation of Microsoft stock, Net Unrealized appreciation (NUA) Treatment can significantly lower your tax bill on Microsoft Stock within the 401(k). To learn more about this strategy, check out our NUA article.

Microsoft Equity Compensation

Equity compensation is common across the tech industry for a couple of reasons. First, it creates a greater alignment of interests with the company. If the company does well, your stock awards will become worth more as the price appreciates.

Secondly, stock compensation typically has vesting schedule tied to it. If an employee voluntarily leaves prior to the stock vesting, the stock is forfeited and reverts back to the company. At Microsoft, there is a slight caveat to this rule. If you reach age 55 and 15 years of service (or age 65) with the company, all stock grants greater than 1 year old will continue to vest according to their normal schedule.

Many Microsoft professionals wonder what their earnings will look like and how equity compensation will fit into their overall compensation package. The compensation structure primarily consists of a salary, annual bonus, and restricted stock units. The makeup of your total compensation as a Microsoft employee is heavily dependent upon your grade level.

Director level executives should expect a much greater percentage of their compensation to come from Microsoft stock than entry-level employees. Developing a plan for Microsoft shares accumulated in the 401(k), through RSUs and in the Microsoft ESPP, is vital for achieving a diversified portfolio of assets.

Restricted Stock Units (RSUs)

Microsoft heavily compensates employees with stock awards. These can be given for several reasons, such as hiring incentives, annual compensation, and achieving specific work-related goals. Microsoft distributes these shares primarily via Restricted Stock Units (RSUs). These RSUs are typically granted to Microsoft employees based on a vesting schedule and are the most common form of equity compensation.

A tax liability will be created in the year of vesting based on the value of the shares on the date that they vest. This amount will be included on the employee’s W-2 wages.

Typically, your employer will sell some of the shares in order to withhold taxes. This is calculated at the federal supplemental wages rate of 22% from the shares that vested. For more information about the tax considerations of RSUs, please see our article describing the taxation of Equity compensation here.

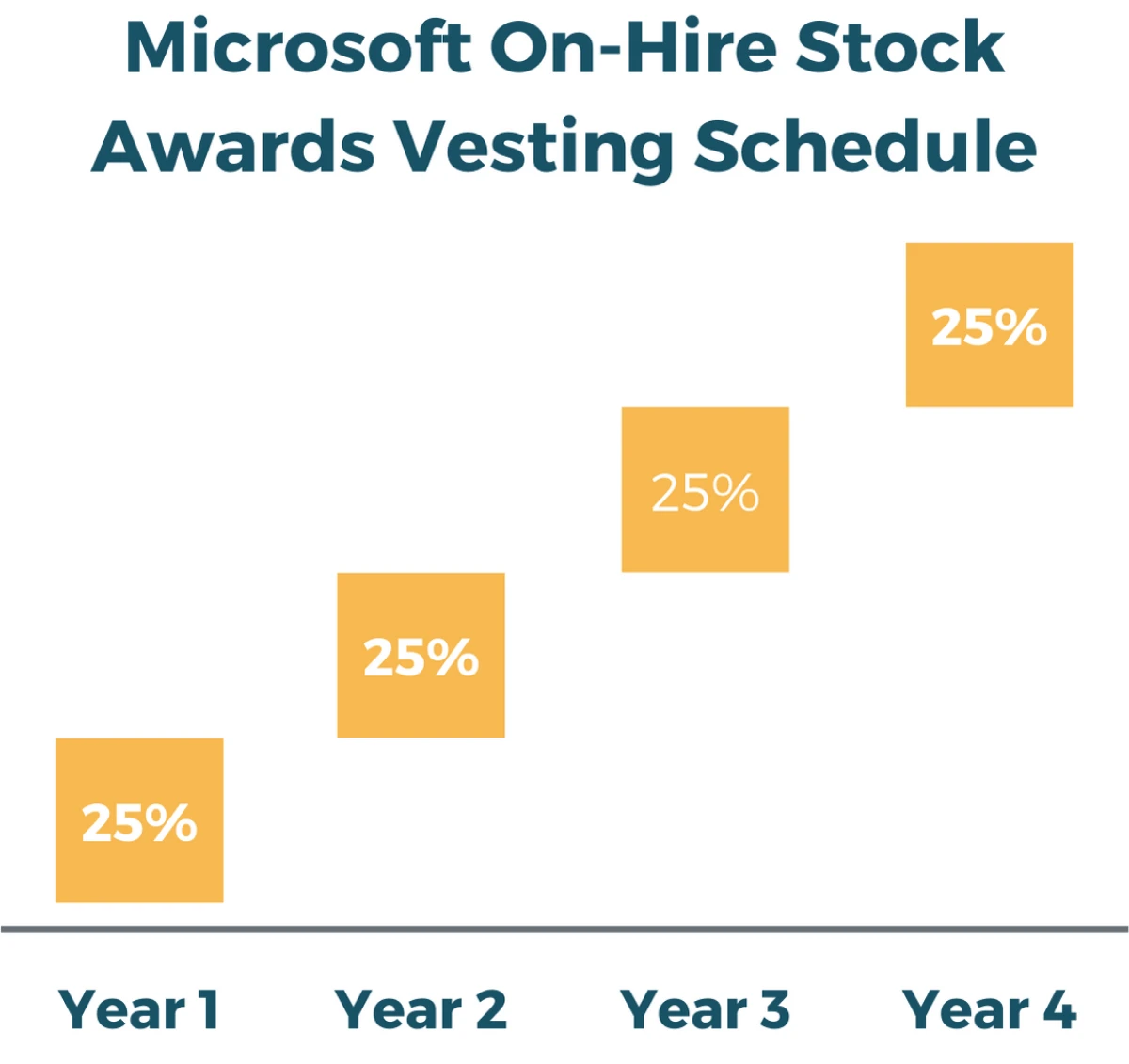

As mentioned above, RSUs can be given for several different reasons. The reason the RSU was given can determine the vesting schedule of the shares. Below is the vesting schedule for the two most common forms of RSUs that Microsoft gives: On-Hire Stock Awards and Annual Stock Awards

On-Hire Stock Awards

These RSUs typically vest 25% yearly over the first four years after being hired. The shares will vest based on your employment anniversary, not the calendar year.

- On-Hire Awards vested 25% yearly

- Vested on employment anniversary

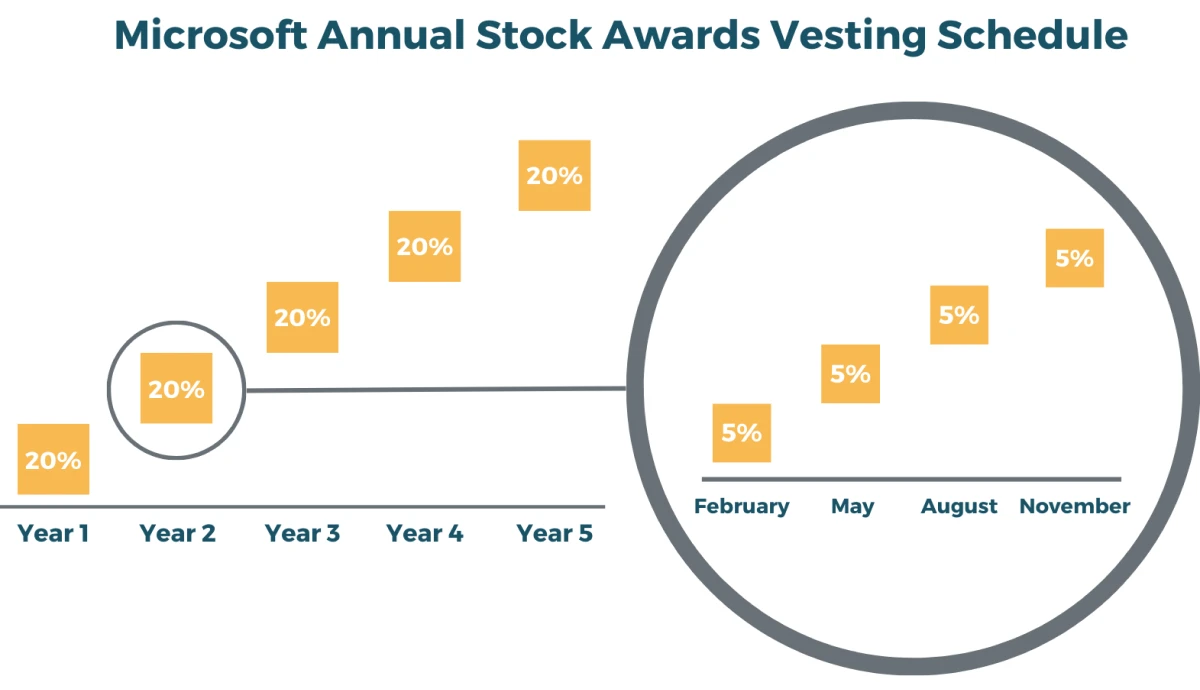

Annual Stock Awards

Microsoft employees are evaluated on a yearly basis, in August, to determine if they are eligible for additional stock awards. The vesting schedule for these stock awards is regularly 20% a year over five years, in 5% increments.

- Annual Stock Awards vested 20% each year

- Vested in 5% increments

- Increments vested in February, May, August, and November

There are also RSUs that Microsoft offers in special circumstances and to those in management positions. These RSUs can have different vesting schedules from the RSUs listed above.

Microsoft’s Employee Stock Purchase Plan (ESPP)

Like many other large corporations, Microsoft allows its employees to buy their stock at a discount through an Employee Stock Purchase Plan (ESPP). The ESPP allows Microsoft employees to set aside some of their after-tax paychecks to purchase Microsoft stock. Microsoft allows their employees to contribute up to 15% of their salary into the ESPP annually. Then, the funds will be used every quarter to purchase Microsoft stock at a 10% discount from its Fair Market Value.

As with all forms of compensation, there are inevitable tax consequences to consider with Microsoft’s ESPP. For more information about the tax considerations of ESPPs, please see our article describing the taxation of Equity compensation here.

Conclusion

Being aware of your tax implications on stock compensation is one-half the battle. Another sizeable consideration is the diversification of your portfolio. Prior to making any decisions to sell company stock, it is important to identify your basis in the shares to help mitigate any additional unwanted tax liabilities.

Although equity compensation can be very complex and hard to understand, it can create tremendous opportunities to accumulate generational wealth. It is crucial to develop a plan for the Microsoft shares received via RSUs or bought at a discount in the ESPP.

Our team is happy to help you determine the best path forward in regards to your stock compensation in order to optimize your taxes and maximize your retirement.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Rhame & Gorrell Wealth Management is not affiliated with or endorsed by Microsoft. Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealtha Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.