How to Mitigate Reactionary Decisions in a Volatile Market Environment

The best actions you can take in a down market to set yourself up for future growth

The past year and a half have created a landscape of volatile equity markets. With continuing inflation worries, geopolitical issues, and recessionary concerns it seems that any upside in the market is quickly followed by another downturn. In times like this, it can be easy to lose sight of your goals and focus intensely on the current state of the economy. Fear can lead many people astray by selling out of the market and moving to cash at the worst possible moment. Instead of moving your portfolio to cash here are 4 ways to mitigate and take advantage of down markets

Invest According to your Risk Tolerance

An integral piece of your personal investment management is understanding your own risk tolerance. When markets are booming it is easy to invest in a risky portfolio that tends to reap big returns. Equity oriented portfolios also take the biggest hit in market downturns. As losses begin to accumulate within the portfolio, a sense of unease is often created. This type of reaction to market downturns could be a sign that you are not in the correct asset allocation. Creating a portfolio with the right mixture of equity to fixed income is crucial not only for a successful Financial Plan, but also, in many cases to maintain sanity during volatile times. While the equity portion of a portfolio allows for more growth, fixed income can act as a hedge on the volatility creating a smoother ride. A higher risk tolerance typically calls for more equity like assets, whereas a lower risk tolerance calls for additional fixed income to hedge the portfolio.

Keep Your Time Frame in Mind

It is all too common that we hear the phrase “time in the market is better than timing the market.” While this is true, understanding the time horizon for your investments is crucial to keeping your cool throughout volatile times. Whether the goals are short-term, intermediate term or long-term, each of these situations requires different asset allocations. For short-term investments, your focus should be tilted toward the investment you are receiving for your investments. For long-term investments, growth should be a much higher weighted focus. When you see your account balance tick down during market downturns, it is easy to make rushed decisions trying to help your portfolio in the short term at the expense of your long-term goals. The long-term compound return generated from growth investments can be worth the volatility. For more information, our very own David Hunter, CFA, M.E.C. was featured in a MoneyGeek article that shows the value of compound interest. We strive to have open communication with our clients to ensure they understand the time horizon for their investments and the funds are invested in the right asset allocation for their goals.

Consider Buying in Market Downturns

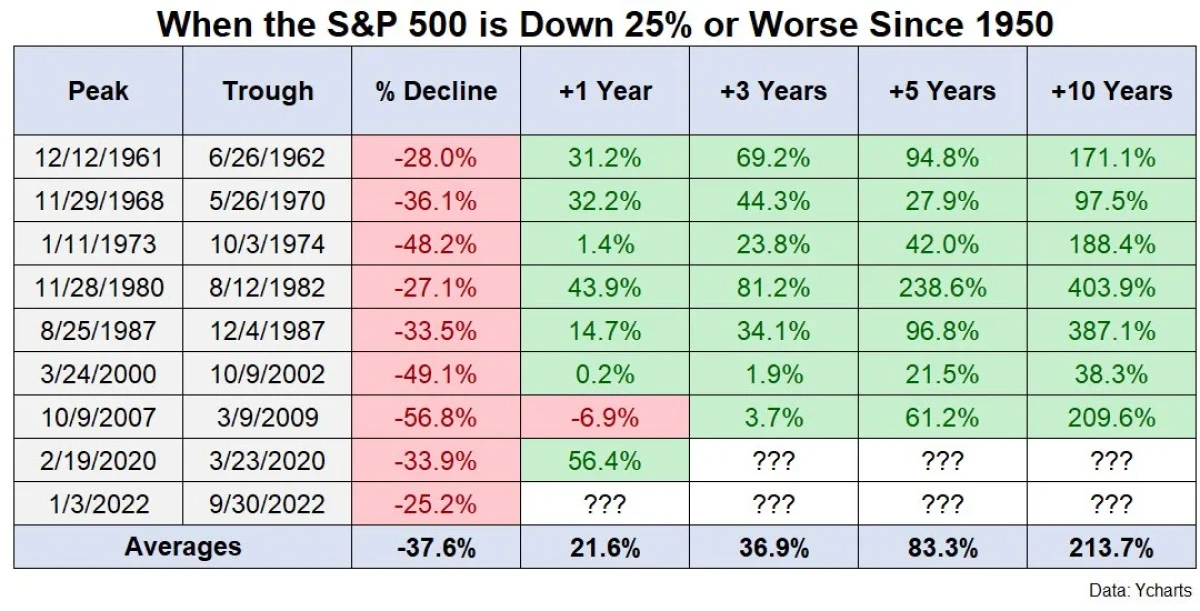

This might be counterintuitive but if there was ever a time to buy it would be when markets are down. This follows the tried and true saying of “Buy Low, Sell High”. People can have the misconception that they need to follow the prevailing market trend and if everyone is selling, they will also need to sell. History has shown that investors who are more contrarian and buy during market downturns tend to reap more returns. We cannot count the number of times we have heard clients say they will buy when “things settle down” or “once we see a turnaround”. The problem with these methods of thinking is that by the time things turnaround, it is too late to get back into the market and you have already missed out on a lot of the market rebound. This is why we strive to have a balanced approach when it comes to investment management, taking into account your holistic financial picture prior to making any investment decisions. The graphic below demonstrates this by showing that when the S&P 500 is down 25% or worse historically the years that follow see returns.

Waiting to get back into the market, creates potential to miss out on the positive markets to come. As the chart above also shows, investing when the markets are down allows for faster realization of positive returns.

Rebalance Your Portfolio

Market downturns are a great time to rebalance your portfolio. When your portfolio is rebalanced assets are bought or sold in order to change the weight of certain asset classes. This adjusts the weighting of asset classes in your overall portfolio to be more in line with your investment goals. Some natural outcomes of rebalancing a portfolio are tax loss harvesting and setting your portfolio up to capture greater upside. Rebalancing can take you out of certain risky assets and place you in assets that are more likely to reap the future gains that come when the market starts to turn positive. Here at Rhame & Gorrell we look to rebalance portfolios at least every quarter, but this tends to be more frequent if needed.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, service@rgwealth.com, or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.