Make The Most Of Net Unrealized Appreciation (NUA)

A Strategy to Substantially Reduce Taxes When Owning Company Stock in Your 401(k)

As modifications to the tax code become more prevalent, maximizing after-tax wealth through every avenue afforded to taxpayers is critical to retirement planning.

For many individuals, diligent savings through a 401(k) plan allows them to build ownership in their company’s stock and take advantage of special tax treatment on the shares.

Some individuals may remember investing in their company’s stock over decades of gains and stock splits. Even after the turmoil in 2008, employees may have substantial gains in company stock and a very low cost basis. Once withdrawn from the plan, taxes on these assets during retirement can be staggering with marginal tax brackets as high as 37% and the potential to increase in the future.

A little known rule in the Internal Revenue Code (IRC) may offer tax advantages on a distribution of highly appreciated company stock. The appreciation above the price that you paid for your stock within qualified plans like a 401(k) is known as Net Unrealized Appreciation or NUA.

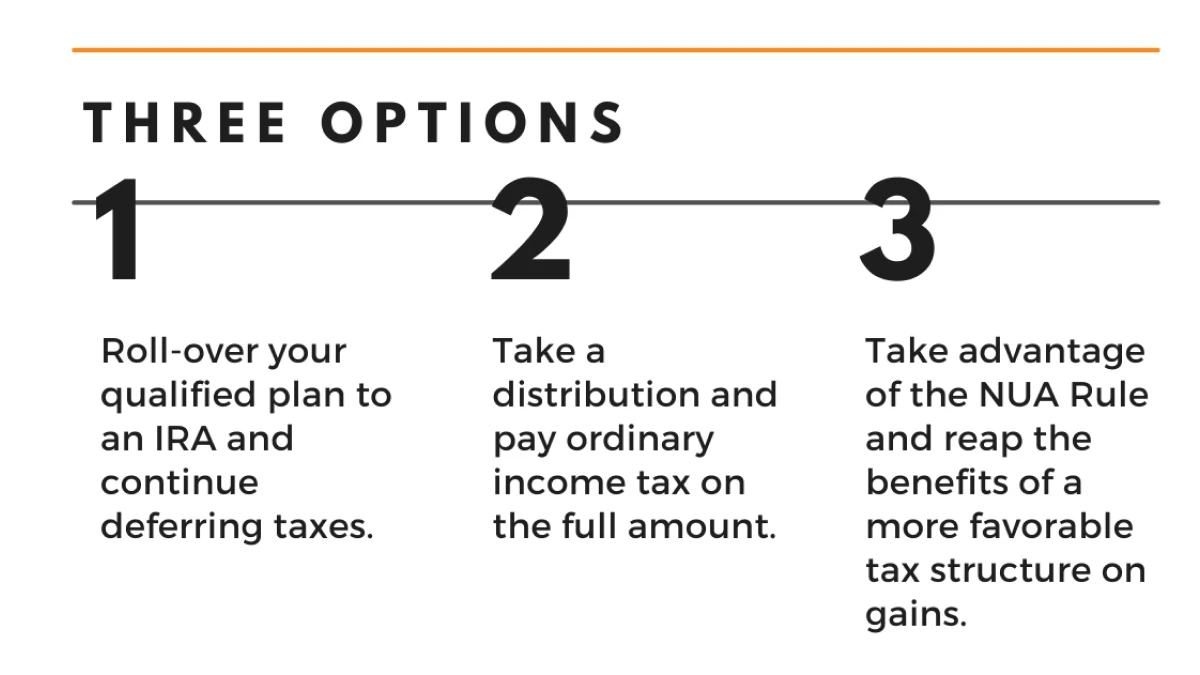

WHEN AN EMPLOYEE QUALIFIES FOR A DISTRIBUTION THEY HAVE 3 OPTIONS

How Does the Net Unrealized Appreciation Rule Work?

First, an employee must be eligible for a distribution from their qualified plan; generally at retirement or age 59.5. The employee takes a “lump-sum” distribution from the plan, distributing all assets from the plan during a 1 year period. The portion of the plan that is made up of mutual funds and other investments can be rolled into an IRA for further tax deferral. The highly appreciated company stock is then transferred to a non-retirement account.

The tax benefit comes when you transfer the company stock from a tax-deferred account to a taxable account. At this time you apply the NUA Rule and incur an ordinary income tax liability on only the cost basis of your stock.

The appreciated value of the stock above its basis is not taxed at the higher ordinary income rate but at the lower long-term capital gains rate, typically 15% but in some instances as low as 0%. This could mean a potential savings of >20%.

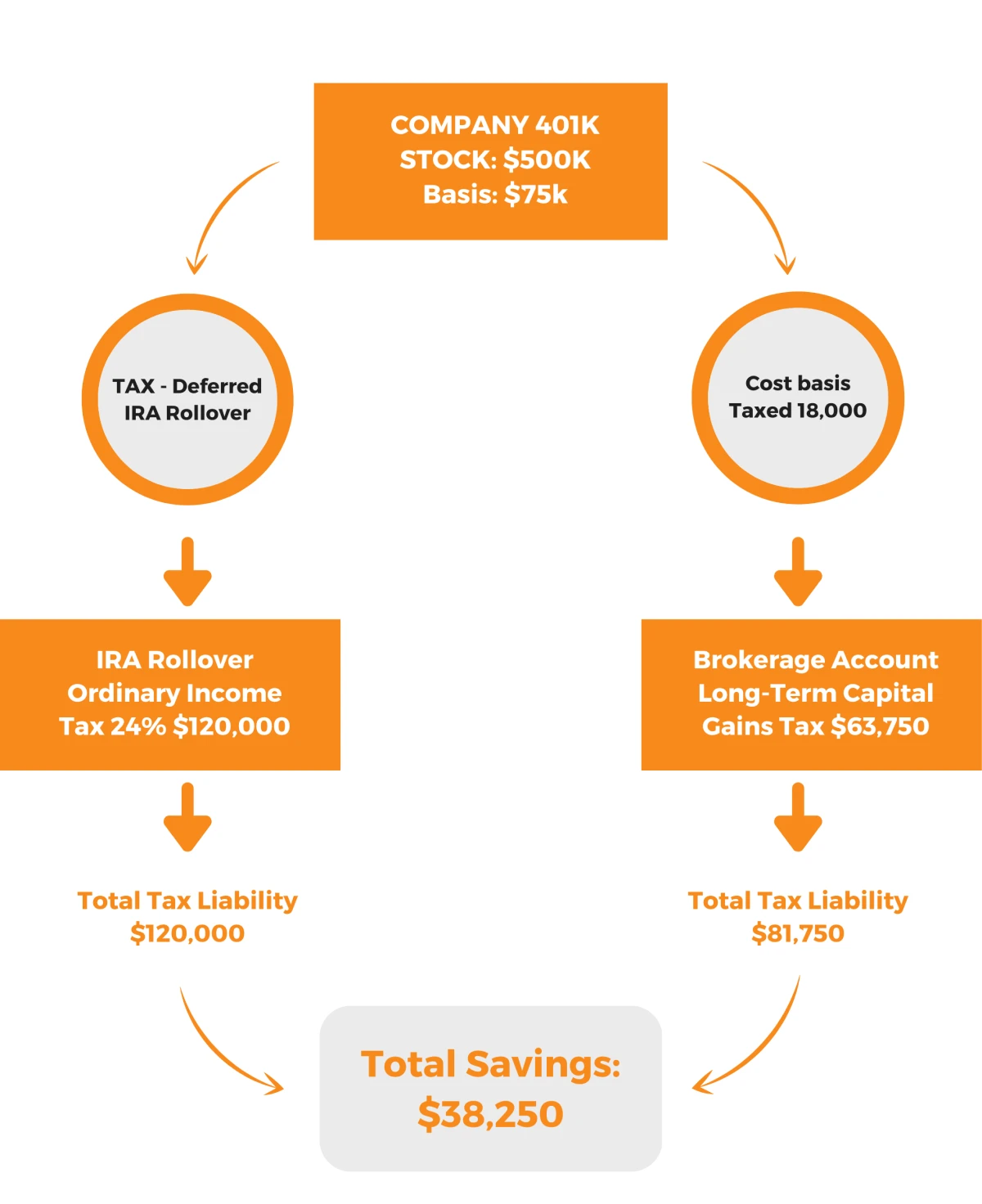

Let’s look at an example:

We will assume the value of the stock within an account is $500,000. The price paid for this stock is $75,000.

If one rolled the entire amount to an IRA they will owe nothing in taxes presently. Over time, if they were in the 24% federal tax bracket they would pay $120,000 in taxes for distributions.

If one were to take advantage of the NUA Rule, they will pay ordinary income tax on the cost basis at the time of distribution. This totals $18,000 in tax today. The tax on the Net Unrealized Appreciation would be 15% of the gain, or $63,750. Your total tax liability is $81,750.

In this example, the NUA Rule saved nearly $40k on the tax bill

A few things to keep in mind:

- Employees taking a distribution prior to age 59.5 may be subject to a 10% penalty.

- NUA makes more sense when employees have a low-cost basis.

- It is important to take advantage of the NUA Rule prior to a rollover. Once you roll retirement assets into an IRA, it is too late to take advantage of the potential savings.

- To qualify, you must be eligible for a Lump-sum distribution of your entire qualified account.

- Stock shares must transfer “in-kind” to a taxable account, this means that the shares must not sell but must move from your qualified account into your new taxable account.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.