Tax Insights on ISOs, RSUs, and NQSOs: A Complete Guide

Understanding The Impact of Equity Compensation on Your Taxes

Stock compensation plans of various types are a common method of compensation for valued employees of successful companies. Generally, these plans come in the form of Restricted Stock or Restricted Stock Units (RSUs), Incentive Stock Options, Non-Qualified Stock Options, or Employee Stock Purchase Plans. Receiving these corporate benefits is excellent for wealth accumulation, but it’s essential to understand how taxes are generated from these sources of income.

Definitions

There are a number of terms pertaining to stock compensation that are important to know in order to understand the taxation. We will outline these below.

Grant Date

The date on which a company issues equity compensation to an employee

Vesting Date

The date on which an employee may legally exercise their stock options or on which they receive their restricted stock

Exercise Date

The date on which an employee exercises stock options to purchase company stock

Vesting Schedule

A schedule by which an employee receives their equity compensation

Offering Period

The length of time after the grant date in which a stock option holder may exercise their options

Restricted Stock & Restricted Stock Units (RSUs)

Restricted Stock and RSUs are one of the most common forms of equity compensation for employees. They are largely similar, but do have a few key differences.

Employees are granted shares or units of stock that are on “Restriction” for a period of time. As long as the conditions for vesting are met, the employee receives the stock on a pre-determined vesting date. This vesting date is also when the employee realizes income from receipt of the shares.

While employers usually withhold for taxes on the income accrued to the employee at the vesting event, they typically do not adequately withhold, which can lead to an unexpected tax bill come tax time. The market value of the shares determines the taxable income on the vesting date. Usually, the employer will immediately sell a portion of the shares upon vesting to cover the tax bill they create.

It is important to note that for post-vesting gains on Restricted Stock or RSU shares to qualify for taxation at the preferential capital gains tax rate, they must be held for one year after the vesting date.

Additionally, dividends paid by Restricted Stock during the restriction period are eligible for qualified dividend tax treatment, but RSU dividends paid are technically classified as “dividend equivalents” before vesting and are taxed as ordinary income. Finally, the complex 83(b) election outlined later in this article is only available for Restricted Stock, not RSUs.

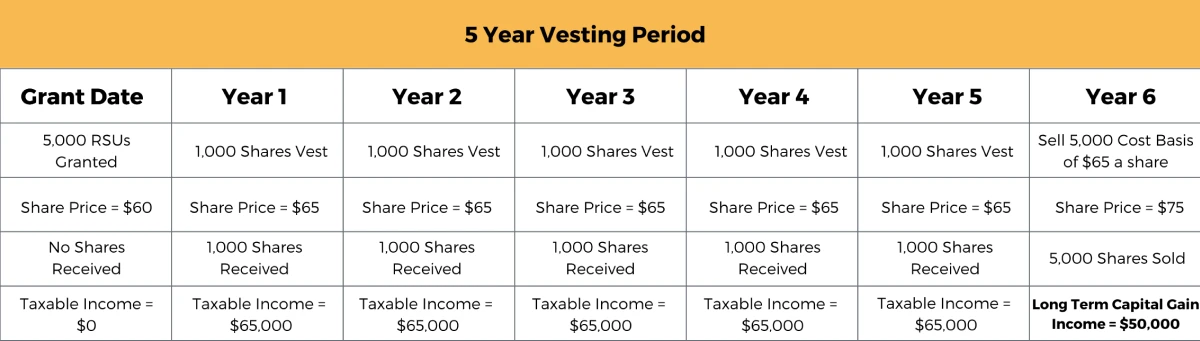

Example: How Restricted Stock & RSUs Are Taxed

Let’s say that Julian is granted 5,000 RSUs that vest at a rate of 20% annually, and the market price at the grant date is $60 a share. The stock price the next year is $65. This means that in the first year of the stock vesting, Julian will show and be taxed on a $65,000 vesting event (1,000 Shares x $65 vest price). This amount will be shown on his W-2 box 1 wage.

Let’s say the stock price stays at $65 for the remaining vesting schedule. This means that for five years in a row, Julian will show an additional $65,000 of income on his W-2 but not actually receive cash for the income (this is why many people immediately sell some shares to cover the tax liability and diversify the stock grant).

If in year six Julian sells all 5,000 of the shares when the share price is $75 a share, he will recognize a $50,000 long-term capital gain (Cost Basis of 5,000*$65 = $325,000 sell price of 5,000*$75 = $375,000). Please see Exhibit 1 below for a visualization of this example.

As previously mentioned, there are a couple of key differences Between RSUs and Restricted Stock, sometimes also known as Restricted Stock Awards (RSAs). RSAs are eligible for the 83(b) election, which is a tax planning tool that allows a Restricted Stock recipient to set their cost basis and holding period at the grant price and date. This election realizes the taxable income at grant, not vesting, and can be an excellent strategy.

However, there are a few pitfalls to be aware of prior to making the 83(b) election. For more information regarding Restricted Stock, RSAs, and the 83(b) election, please see Understanding the 83(b) Election and Restricted Stock.

Incentive Stock Options (ISOs) & Non-Qualified Stock Options (NQSOs):

Stock option compensation for employees tends to be more complex in nature. There are two primary types of option compensation: ISO and NQSO. The difference comes down to the tax treatment of the stock at exercise of the option and subsequent liquidation of the stock.

ISO Tax Treatment

An ISO is a right an employer gives an employee to buy stock in the company at a later date for a price equal to or more than the stock’s market value at the time of the initial agreement.

ISOs have a required vesting period of two years and a holding period for the stock purchased of more than one year before they can be sold at the preferential capital gains tax rates. If an ISO is not held for more than a year past the exercise date and two years from the grant date, the net benefit to the employee from the stock option will be subject to ordinary income tax rates.

It is important to note that ISOs terminate three months after employment with a company ends, so if an investor were to leave a company, the ISOs would potentially need to be exercised quickly. Unlike NQSOs, there is no tax when the options are granted or exercised with ISOs. Tax is only realized when the stock is sold – and if the conditions are met, only at capital gains tax rates.

There is also an Alternative Minimum Tax (AMT) implication to consider with ISOs. In the year the ISO is exercised, there will be a gain created for AMT. This gain will be the difference between the stock price at the grant date and the price at the exercise date. This AMT number is only taxable to certain highly-compensated individuals who are subject to the AMT – investors who are subject to normal ordinary income tax won’t be affected.

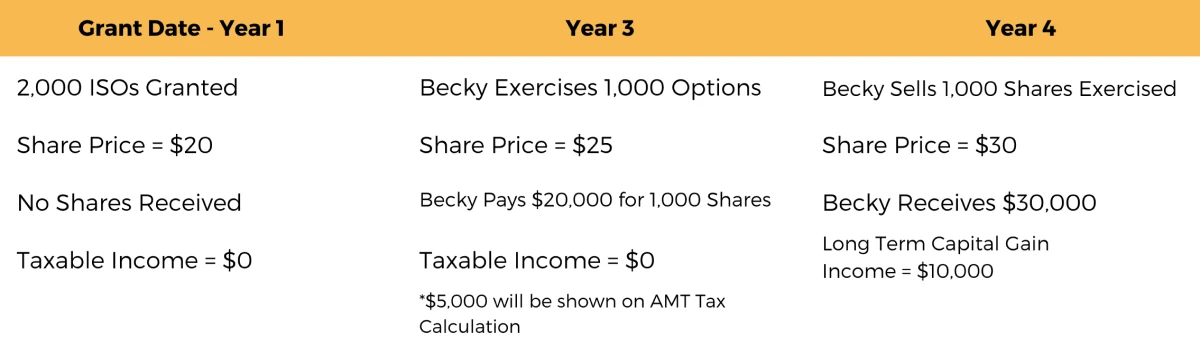

Example: How ISOs Are Taxed

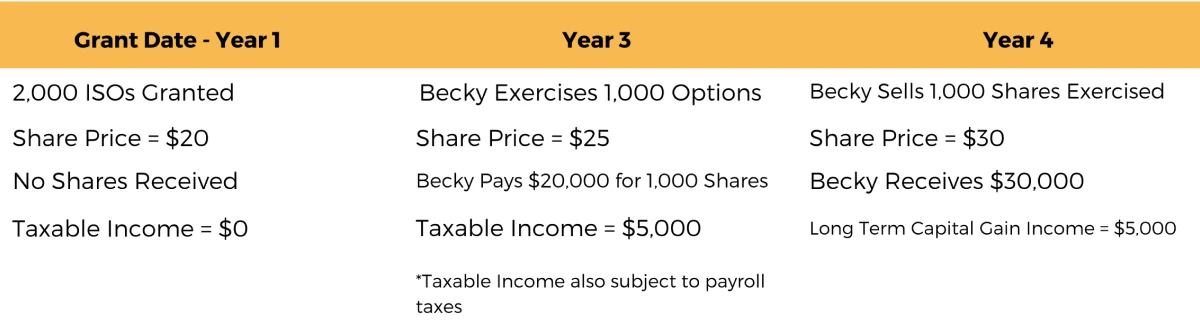

Let’s say Becky is granted an ISO to purchase 2,000 shares of her company’s stock at the current market price of $20. The option vests two years after the ISO was granted to Becky when her company’s stock price has risen to $25 a share.

Becky then exercises 1,000 of the stock options and purchases 1,000 shares of the stock for $20,000 (1,000*20).

That year on Becky’s tax return she will need to show a $5,000 gain for AMT purposes (1,000*25 = 25,000 minus 1,000*20 = 20,000). After Becky has held the stock for a year, she sells it when the price is $30 a share, and she will show a long-term capital gain of $10,000 (1,000*$30 = $30,000 minus 1,000*$20 = $20,000).

This is the most tax-efficient way for Becky to exercise her options. If Becky were to sell the shares before she held them for one year after exercising her options, then the $10,000 will be counted as ordinary income to her and taxed at a higher tax rate.

Please see exhibit 2 below for a visualization of this example.

NQSO Tax Treatment

Non-Qualified Stock Options (NQSOs) are a more common form of compensation than ISOs. Additionally, the tax implication of this compensation is far less complex. NQSOs, like ISOs, give an employee the right to purchase a set number of shares within a designated timeframe at a predetermined price. Like ISOs, the predetermined price must be the same as or greater than the market price on the grant date of the NQSOs.

The difference in taxation between ISOs and NQSOs comes into play when the stock options are exercised. The difference between the exercise price of the option and the current price of the stock is known as the “Bargain Element”, which is fully taxable as ordinary income and subject to payroll taxes for both the employee and employer.

Example: How NQSOs Are Taxed

Let’s revisit Becky’s example and assume that instead of her options being qualified ISOs, they were NQSOs. This means that at the grant date, ISOs and NQSOs look identical.

Then, in year 3 when Becky exercises 1,000 shares for $20 a share when the market price is $25 a share, she will have to pay taxes on the $5,000 appreciation (1,000*$25 = $25,000 minus 1,000*$20 = $20,000). This $5,000 appreciation will be shown on Becky’s W-2. Please see exhibit 3 below for a visualization of this example.

Employee Stock Purchase Plans (ESPPs)

ESPPs are taxed similarly to ISOs. The IRS mandates that no more than $25,000 of discounted stock may be purchased annually, and the employer can only give a maximum of 15% discount on the stock.

They have the same holding period requirements as ISOs in that they must be held for at least a year after being exercised and 2 years after the grant date (offering date) to qualify for the preferential capital gains tax rates. Otherwise, the “Bargain Element”, or discount that the employee received, is taxed as ordinary income.

Phantom Stock and Stock Appreciation Rights (STARs)

Another intangible form of equity-based compensation is Phantom Stock or Stock Appreciation Rights. Unlike Restricted Stock or Stock Options, neither of these options result in the employee owning the stock – they simply receive a cash value tied to the stock price. In the case of Phantom Stock, the employee receives the cash value of the “Phantom Shares” rather than the shares of stock.

Similarly for STARs, the employee receives cash when they exercise the “appreciation right” for the difference between the stock price at exercise and the strike price listed on the STAR when granted to the employee. The net cash value for both of these plans is taxed as ordinary income when delivered to the employee.

Both of these equity compensation options have certain advantages. For the employee, they simply receive cash value rather than having to purchase or sell stock post-transaction. For the employer, these methods still incentivize the employee to pursue strong company performance, since the stock value appreciating increases the value of the Phantom Shares and STARs. However, the company does not have to utilize treasury stock or authorize real shares of stock to be distributed, which makes administration of these plans somewhat easier.

FAQs

Below are some frequently asked questions surrounding the taxation of stock compensation.

How does the Alternative Minimum Tax (AMT) affect the exercise of Incentive Stock Options (ISOs)?

The AMT is a parallel tax system designed to ensure that individuals who benefit from certain tax advantages pay at least a minimum amount of tax. When exercising ISOs, the difference between the exercise price and the fair market value of the stock at the time of exercise (the “spread”) is considered a preference item for AMT purposes.

This means that even though this income may not be taxed under the regular tax system until the shares are sold, it could trigger the AMT, leading to a potentially significant tax liability in the year of exercise. Careful planning around the timing of ISO exercises and the sale of the acquired stock can help manage AMT exposure, such as exercising earlier in the year to monitor the stock’s value and potentially selling some shares to cover the AMT liability.

Can Non-Qualified Stock Options (NQSOs) be converted into ISOs to take advantage of more favorable tax treatment?

Converting NQSOs into ISOs is not straightforward due to the distinct tax rules governing each type of option. NQSOs are taxed as ordinary income at the time of exercise, whereas ISOs offer the potential for taxation at the lower long-term capital gains rate, provided certain holding period requirements are met.

The IRS has strict rules about what constitutes an ISO, including a $100,000 limit on the value of options that can vest in any one year and that the option holder must be an employee of the company (not a consultant or board member) and must exercise the ISOs within three months of leaving the company.

Given these strict requirements, converting NQSOs into ISOs is generally not possible once the options have been granted. However, companies can design their equity compensation plans to offer ISOs instead of NQSOs within these rules.

What are the specific tax planning strategies to minimize taxes on Restricted Stock Units (RSUs) upon vesting?

For RSUs, tax planning strategies to minimize the impact at vesting focus on understanding the timing of income recognition and the applicable tax rates. Since RSUs are taxed as ordinary income at the time they vest, one strategy might involve deferring income into years where you expect to be in a lower tax bracket, if your plan allows for this.

Another strategy could involve donating a portion of the vested shares to charity, which could provide a charitable deduction and avoid the capital gains tax that would be due upon sale.

Additionally, selling the vested shares in a year when you have capital losses could offset the capital gains from the sale of RSUs, thereby reducing your overall tax liability. It’s important to work with a tax professional or financial planner to navigate these strategies effectively, as the best approach will depend on your specific financial situation, other income sources, and long-term financial goals.

Conclusion

Although the list above covers many commonly used equity compensation programs, there are even more exotic options available for employers to use. Successfully navigating the complex tax and financial planning implications of these plans is critical to retirement planning. These are the types of plans where mistakes can amount to significant differences in after-tax wealth creation for employees.

Our expert team of CFP and CPA professionals is standing by to assist with these matters and to answer your questions. Schedule your complimentary consultation with the RGWM team today via the link below.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.