Understanding the 83(b) Election and Restricted Stock

How The 83(b) Election Can Effect The Taxation of Restricted Company Stock

Section 83(b) of the Internal Revenue Code (IRC) allows recipients of stock awards to potentially lower their tax burden by paying taxes on the total fair market value (FMV) of the award when it is issued instead of when it is sold.

The 83(b) election must be made within 30 days of receiving restricted stock and can substantially reduce the associated tax liability. Making the this election can be beneficial for the recipient of restricted stock, as it allows them to recognize the full economic value of the stock at the time of vesting, rather than when it is actually sold.

Companies can award their employees with various forms of equity compensation. One of the most common forms is Restricted Stock. There are two variations of restricted shares; Restricted Stock Awards (RSA) and Restricted Stock Units (RSU).

This article will discuss RSAs and the beneficial 83(b) election that can be made on them. For more information on RSUs and how they work, please see Tax Insights on ISOs, RSUs, and NQSOs: A Complete Guide.

Restricted Stock Awards

Like RSUs, RSAs have a specified number of shares given to the employee, laid out by a vesting schedule. With RSUs, these shares are outlined at the grant date but are not actually issued until the shares vest. This differs from an RSA where at the grant date, the shares are issued and held in escrow until they are vested to the employee.

This means that all the shares issued under an RSA are considered issued and outstanding at the grant date as opposed to the vesting date. These issued and outstanding shares under an RSA also allow the employee to have voting rights even before vesting. RSAs also allow the shares to receive dividends before they vest.

Vesting Schedule

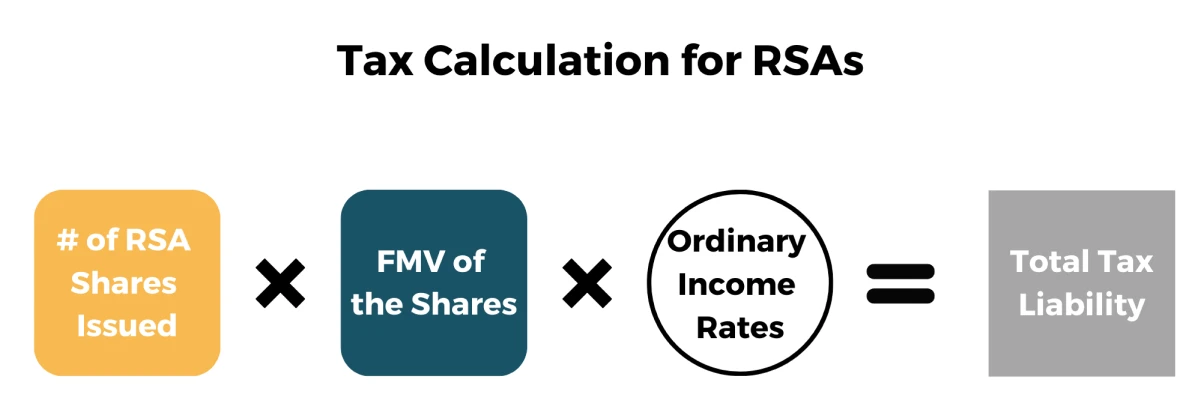

The vesting schedule of RSAs is the same as RSUs. The shares are given to the employee based on achieving specific work milestones whether time or performance based. These RSA shares, like RSUs, are taxed when they vest, and the tax is calculated based on the shares received multiplied by the Fair Market Value (FMV) of the shares on the vesting date. This amount is taxed as ordinary income.

Because of this most employees that have RSAs must immediately sell some of their vested shares to pay the tax bill. The holding period for capital gains consideration of the shares starts at the vesting date and must be held a year from this date to qualify for these preferential tax rates. RSAs also have a tax election that is not offered to RSU recipients.

Restricted Stock and The 83(b)

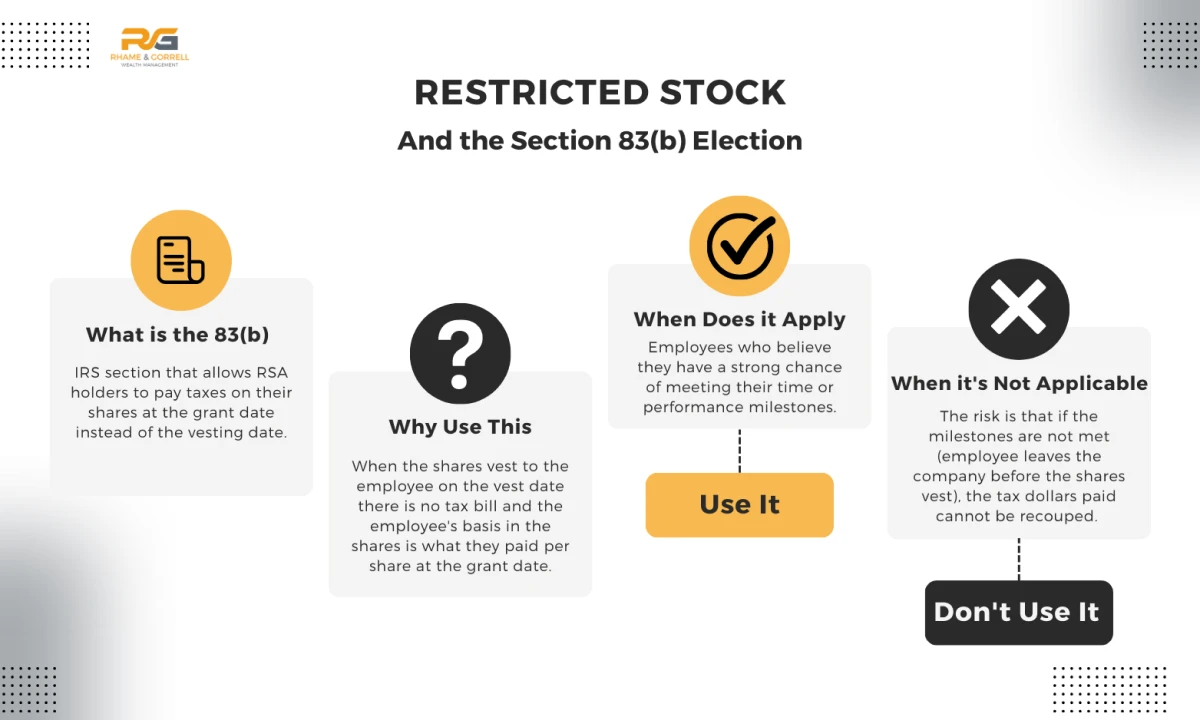

Section 83(b) election is an Internal Revenue Code section created by the IRS to allow RSA holders to pay taxes on their shares at the grant date instead of the vesting date. The employee must send this election form to the IRS no more than 30 days past the grant date of the RSA. The completed 83(b) IRS form should also be sent to the employer.

This election should be made by employees who believe they have a strong chance of meeting their time or performance milestones and believe the company’s stock will appreciate over their vesting schedule. The section 83(b) election works by taxing the FMV of all the RSA shares at the grant date. This means that the employee is paying taxes on shares they have not physically received yet. This can be viewed as a pre-payment of taxes.

Then, when the shares vest to the employee on the vest date, there is no tax bill and the employee’s basis in the shares is what they paid per share at the grant date. This does not change the holding period calculation for long-term capital gains as the vested shares must still be held for a year before receiving the preferential capital gains rates.

Example

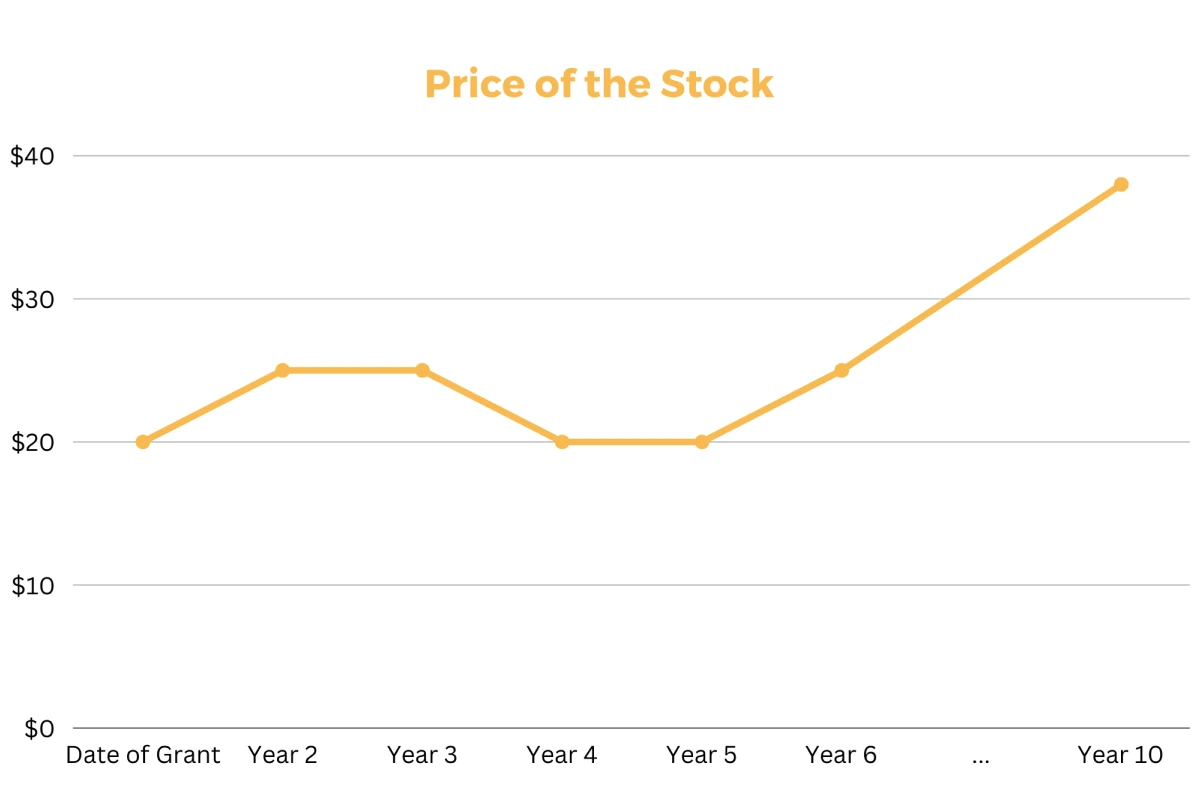

Let’s say that an individual named Pat has been working for a company for the past 5 years. As an added benefit, Pat’s company offers him a restricted stock award of 5,000 shares that will vest 20% every year starting the second year after the award was granted.

Pat’s company stock is $20 on the date of the grant, $25 in years 2 and 3, $20 in years 4 and 5, $25 in year 6, and $38 at the point of sale in year 10.

Assumptions

For this example, we need to make a few assumptions:

- Pat is in the 32% tax bracket while working

- Pat will be in the 22% tax bracket when retired

- Pat will stay with the company long enough to receive the full award

- Pat will elect within 30 days to utilize section 83(b)

Illustration

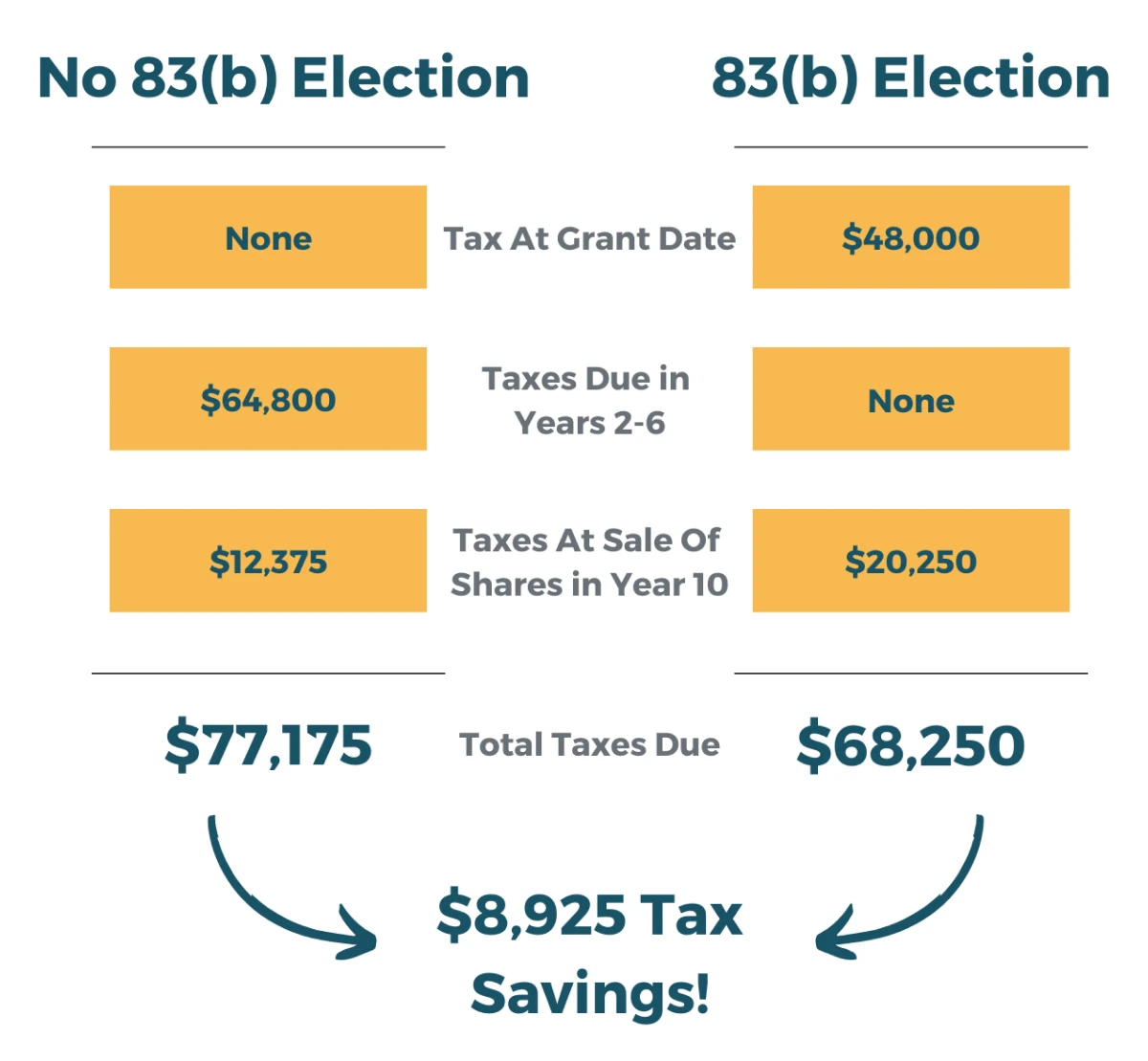

Over this 10-year period, Pat will be able to save $8,925 in taxes by making the 83(b) election and paying the ordinary income taxes on the shares up front. For the full tax calculation, please see the disclosures below.

Conclusion

As with everything, the IRS does not give any tax benefits without the risk of potential downsides. With the 83(b) election, the risk is that if the milestones are not met (i.e., the employee leaves the company before the shares vest) the tax dollars paid on the grant date cannot be recouped by the employee. The IRS does not allow an overpayment claim of taxes for the 83(b) election.

Along with this risk, the company’s share price could also decrease by the time the shares vest. If the employee had waited to pay the tax until the vest date, a lower amount would have been reported on their income. This is why it is essential to talk with your financial advisor, walk through the potential scenarios, and see if the section 83(b) election is the right choice for you.

FAQs

Below are some frequently asked questions surrounding the 83(b) election.

What happens if the stock value decreases after making an 83(b) election?

When an individual makes an 83(b) election and the stock value decreases afterward, the election’s initial tax implications are locked in; the taxpayer cannot adjust for the decrease in stock value.

This means if you pay taxes on the fair market value of the stock at the time of the election and the stock’s value decreases, you do not get a refund or a tax credit for having paid taxes on a higher value. This scenario underscores the risk associated with making an 83(b) election: if the stock’s value decreases, you may end up paying more in taxes than the stock is worth when it vests or if you sell it at a lower value.

Can the 83(b) election be revoked or amended once it is filed?

Regarding the possibility of revoking or amending an 83(b) election once it is filed, the simple answer is no. Once the election is made and filed with the IRS, it is final and cannot be changed. This permanence requires careful consideration and possibly consultation with a tax professional before making the election. The irrevocable nature of the decision means it’s critical to weigh the potential benefits against the risks, considering both the likelihood of the stock’s appreciation and your own financial situation and tax implications.

How does the 83(b) election affect state taxes?

The impact of the 83(b) election on state taxes varies by jurisdiction, as state tax laws differ significantly. While some states align closely with federal tax regulations, others have distinct rules and may not recognize the 83(b) election in the same way.

Therefore, it’s essential to investigate the specific tax laws of your state or consult with a tax advisor who is knowledgeable about local regulations. The election’s effect on state taxes could influence the overall financial benefit of making an 83(b) election, depending on where you live and the state’s tax treatment of restricted stock and capital gains.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, service@rgwealth.com, or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.