Traditional IRA vs. Roth IRA

Understand The Differences Between Individual Retirement Accounts

What is an IRA?

IRA stands for Individual Retirement Account. This is a retirement account that is held solely by one individual that allows them to save money for retirement in a tax-advantaged way. Once funds are in an IRA they may be used to invest in stocks, bonds, mutual funds, annuities, Exchange-traded funds (ETFs), unit investment trusts (UITs), and real estate. There are multiple types of IRA accounts such as Traditional IRAs, Rollover IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, Spousal IRAs, and Self-Directed IRAs. The two most popular IRA accounts are Traditional IRAs and Roth IRAs. This is due to the tax-advantaged status of these two types of accounts.

In order to contribute to an IRA, an individual must have earned income that is greater than or equal to the amount contributed to the IRA in a given year. If you are a non-working spouse who makes little or no income annually you are still able to have an IRA through a Spousal IRA. For more information regarding Spousal IRAs, please see our article discussing this topic in depth.

IRAs are meant for retirement savings and therefore the IRS has put penalties on the early withdrawal of these funds. If you pull money from your IRA prior to 59 ½ the funds will automatically be included in your ordinary income and will be subject to a 10% penalty (there are a couple of exceptions to this rule).

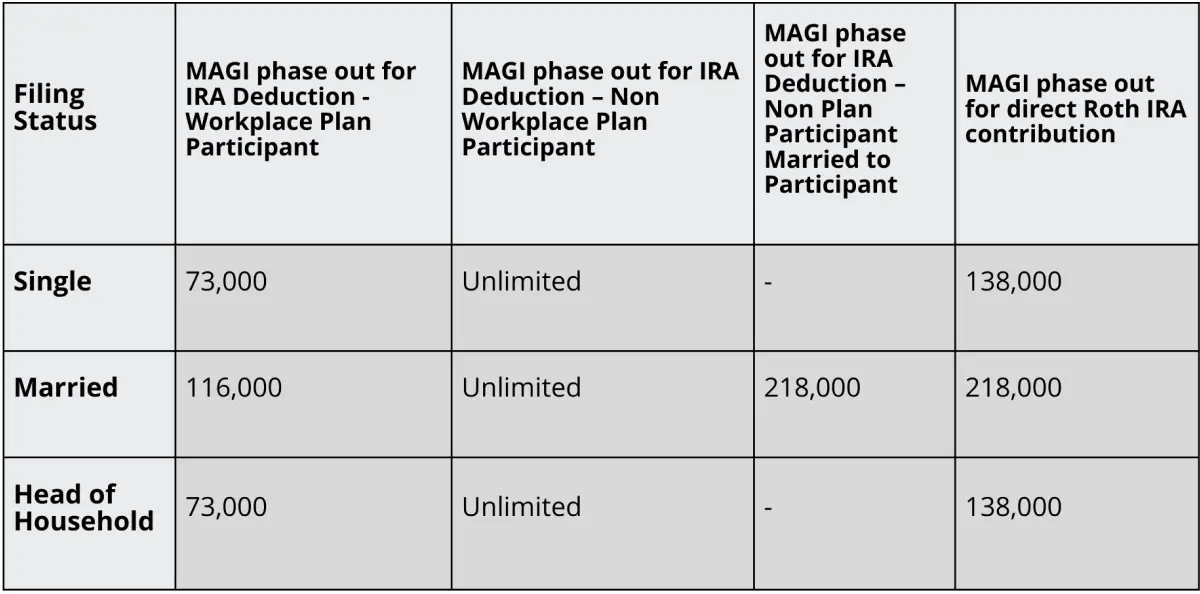

There are also income limitations for contributions and deductions for each type of IRA. These phase-outs will be discussed in detail below.

What is a Traditional IRA?

A Traditional IRA is a retirement savings account where an individual contributes pre-tax dollars to the account. The individual gets a deduction on their tax return for contributing these pre-tax dollars to the IRA in the year the contribution is made. These pre-tax dollars are then able to grow in the IRA tax-deferred until they are eventually pulled out. When distributions are made from a Traditional IRA, they are taxed at the individual’s ordinary income tax rates. The current yearly contribution limit for Traditional IRAs is $6,500 ($7,500 if you are 50 and older).

The tax-deductibility of Traditional IRAs is subject to certain income limits. If an individual or their spouse participates in a workplace retirement plan (i.e., a company 401(k) or 403(b) plan) this can affect the tax deductibility of a Traditional IRA contribution based on their level of income.

Advantages

Money contributed to a Traditional IRA can be taken as a tax deduction in the year that the contribution is made. Also, gains are not realized until funds are distributed from the account.

Disadvantages

Traditional IRAs are subject to required minimum distributions (RMDs) when you turn 73 (SECURE Act 2.0 will make this age 74 in 2030, and 75 in 2033). These RMDs force the owner of the IRA to take a distribution from their IRA every year. This amount is calculated based on the age of the IRA owner and the value of the IRA on December 31 of the previous year.

In addition to this, every dollar withdrawn will be taxable at ordinary income rates. If you make good investment decisions and the money in your Traditional IRA grows substantially, this can leave you with a sizable tax bill in retirement.

What is a Roth IRA?

A Roth IRA is a retirement savings account where an individual contributes after-tax dollars to the account. The individual does not get any tax deduction on their tax return in the year the contribution is made. These after-tax dollars are then able to grow tax-free and are not taxed when they are pulled out of the account. The current yearly contribution limit for Roth IRAs is $6,500 ($7,500 if you are 50 and older). Another feature of a Roth IRA is that you can take your cost basis out of a Roth IRA prior to 59 ½ without penalty. However, earnings cannot be withdrawn prior to 59 ½ or else you will face taxes and penalties.

Because the Roth IRA is seen as a more advantageous account to invest in, the IRS has put restrictions on who may contribute to a Roth IRA. If you file an MFJ tax return and make over $228,000 in 2023 ($153,000 for single filers), you are unable to contribute to a Roth IRA account. Currently, there is a way for individuals who make over these income limits to still get money into their Roth IRA accounts. This is known as a Backdoor Roth Conversion. For more information, please see our article on the Backdoor Roth IRA and its benefits.

Advantages

Roth IRAs allow for individuals to put money into a retirement account that can grow tax-free. This means that no matter if your earnings on the account are $1,000 or $1,000,000 there will be no tax when the money is pulled out of the account.

Disadvantages

Roth IRA accounts have income limits that try to keep high-income earners from taking advantage of it. While there is currently a loophole that allows income earners over the limit to still get their annual contribution amounts into a Roth account, it is uncertain if the IRS will try to close this loophole in the future.

Traditional vs. Roth IRA Illustrations

The key issue in determining if you would like to contribute to a Traditional or a Roth IRA is taxes.

Taxation of Traditional IRAs

With a Traditional IRA, you receive a tax deduction in the year the contribution is made and taxed when the funds are withdrawn. Let us use a scenario to illustrate this. Say Bob age 40 contributed $6,500 to a Traditional IRA and is normally in the 22% tax bracket. The year he makes the contribution he will be allowed to take a tax deduction of $6,500 on his return saving him $1,430 ($6,500*22%) on his tax return that year.

Then, when Bob retires the IRA is worth $10,000 ($6,500 Bob put in and $3,500 of gains). Whenever he pulls out any portion of the $12,000, it will be taxable to him as ordinary income. Say he pulls all $10,000 out of the IRA in a year when he is in the 10% tax bracket (he is in a lower bracket now that he is retired). That $10,000 distribution will be taxed at Bob’s ordinary income rate and create a $1,000 ($10,000*10%) tax liability. Therefore, by contributing to a Traditional IRA Bob was able to have his $6,500 of contributions turn into $10,000 and save $430 in net taxes.

Taxation of Roth IRAs

With a Roth IRA, you do not receive a tax deduction when you contribute to it but are able to pull the funds tax-free in retirement. The best way to illustrate this is with an example.

Say Sally has the same set of circumstances as Bob, but she contributes to a Roth IRA instead of a Traditional IRA. The year she contributes the $6,500 to the Roth IRA, she will not get a tax deduction and must pay $1,430 in taxes on the funds. Then, when she is in retirement, pulls all $10,000 in one year. She will not have to pay any taxes on the funds pulled. In this example, she would have been better off contributing to a Traditional IRA and paying $1,000 of taxes (see Bob example above), rather than $1,430.

The Roth IRA makes more sense if we change the scenario slightly Say both of their IRA accounts had grown to $20,000 instead of $10,000. Bob would then have to pay $2,000 in taxes on the withdrawal of the full amount ($15,000*10%) whereas Sally would withdraw these funds tax-free. In this scenario, it would be more tax advantageous to put the money into the Roth IRA and save $570 in taxes ($2,000-$1,430).

Considerations for Traditional vs. Roth IRA

The scenarios above help illustrate the considerations for determining whether to contribute to a Traditional or Roth IRA. It is usually more tax advantageous for younger people and those in lower tax brackets to contribute to a Roth IRA. These individuals will have more time for their funds to grow tax-free and will not save as much from tax-deductible element of the Traditional IRA.

On the flip side, it is more tax advantageous for people nearing retirement or those who are in higher tax brackets to contribute to a Traditional IRA. Traditional IRAs are more advantageous for these high earners as they will receive the highest benefit from the tax-deductibility. In many cases these individuals will be in a lower tax bracket during retirement and would be best off taking the deduction when contributing to the account.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.