Market Update – November 2023

An Update On The Markets, Economic Conditions, and Geopolitical Factors

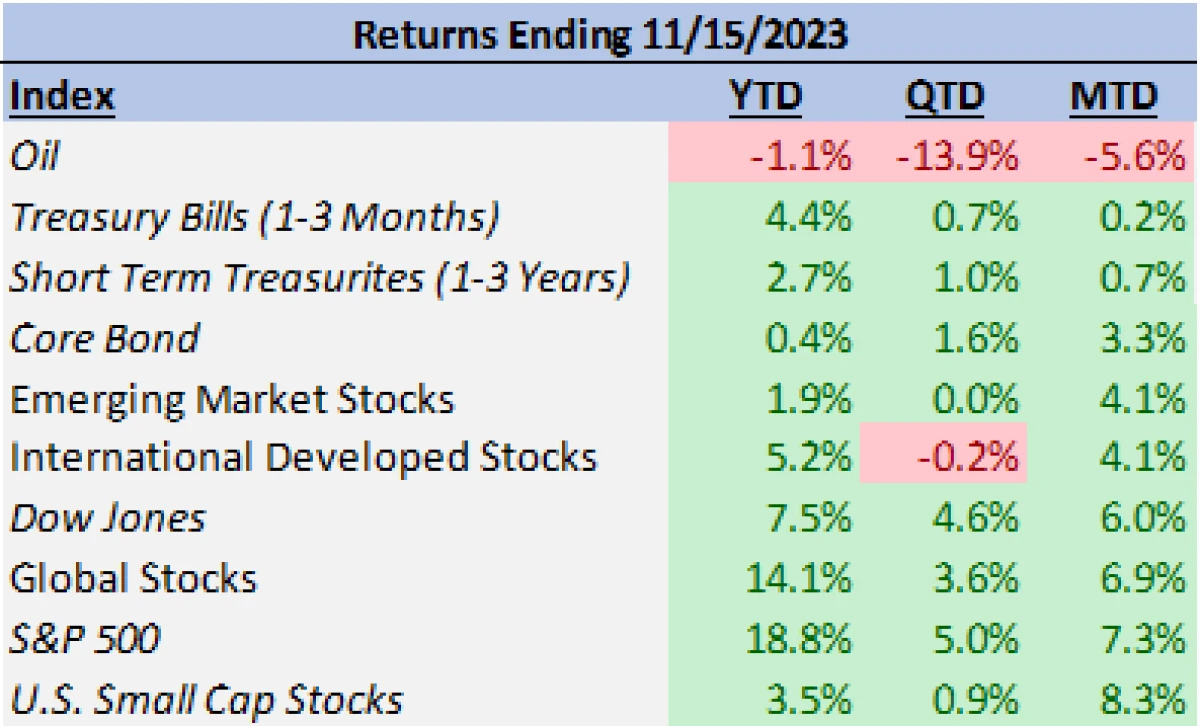

Market Performance

Investors in the stock market have experienced the full spectrum of the market over the last two months. Just in the S&P 500 alone, the index’s member stocks rose 2% for the month before reversing course to a near 4% monthly decline; a decline that put the index over 10% below its year-to-date highs set at the end of July.

As if on a turn of the page on a calendar, November brought a complete reversal with it, the S&P 500 has seen over an 8% rise and has recaptured its October losses and more. The popular U.S. large company stock market measure is still off 2% from the July high watermark, but a combination of recent Federal Reserve rhetoric, cooling inflation data, and lower bond yields positions a favorable backdrop as stocks head into a traditionally favorable seasonal period.

Adding to the overall loosening of financial conditions for the month was a decline in oil prices (-5.6%). Lower expected interest rates and lower oil prices pushed forward a welcome appreciation in asset class prices beyond just the S&P 500.

Bonds across the curve have produced positive returns month-to-date, with core bonds (represented by the Barclays Aggregate Bond Index) moving into positive territory for the year (0.4% YTD).

While the high beta technology centric growth companies representing the Nasdaq have led the rally with nearly 10% month-to-date, small cap stocks (Russell 2000) have outperformed their large cap counterparts with an 8.3% month-to-date return. Domestic stocks have continued to outpace foreign stocks with international developed equities and emerging market equities returning 4.1% each so far this month.

On a sector basis, technology and consumer discretionary stocks have led (11.41% and 8.6% respectively month-to-date), but high returns have also been produced in the real estate, communication services, financial, and industrial sectors (8.60%, 8.44%, 6.99%, and 6.53%). The biggest positive sector laggards were in the traditionally defensive places such as healthcare and utilities (2.65% and 3.26%). Energy has been the only negative sector month-to-date at -1.27%.

With such a strong November in the market standing in such stark contrast to the latter half of October, investors would be fully justified in asking if this rally in stocks is sustainable. In addressing this question, the logical place to look to is what catalysts drove this rally. While stocks started to rally prior to the Fed’s November interest rate decision, the decision to keep rates the same along with both preceding and proceeding economic data would seem to be the most logical immediate force.

As we have discussed in prior newsletters, stock valuations are a function of earnings and prices. A driving force behind how investors evaluate the appropriate prices to pay for assets are interest rates, which when tied to savings act as a de facto riskless alternative to investing in risky assets such as stocks.

This decision to invest in the risky asset or save in the risk-free asset (cash) is essentially an opportunity cost, and as rates move higher or lower so does this opportunity cost to the risk taking investor. When interest rates decrease, investors are willing to pay a higher price for the potential future returns of stocks leading to an expansion of multiples and an increase in values. This is why market participants have seemingly paid such strong attention to the Fed’s decisions and rhetoric.

Economic Conditions and Fed Policy

Not much changed in the Federal Reserve’s written statement compared to the one issued in September, but the post decision presser seemed to lay the groundwork for the surrounding economic data to push the rally forward. Chairman Jerome Powell said that no decision had been made for its December meeting and reiterated that getting inflation down to its 2% target had “a long way to go”, but he also acknowledged that the risks of doing too much versus not enough regarding inflation had become “more balanced”.

Economic releases over the past month have reinforced this notion and have led investors to believe that the interest rate hiking cycle has come to an end. While the inflation related data has improved throughout the year, the labor market data has recently suggested that the Fed’s actions are being felt. Change in nonfarm payrolls for October came in far below expectation with 30,000 less jobs added than analysts expected; manufacturing payrolls actually decreased by 35,000. The unemployment rate, while still historically low, came in above expectations at 3.9%.

The headlines that have pushed markets higher this week are on the inflation side of the equation. The Consumer Price Index (CPI) was flat at month-over-month while the core (ex-food and energy month-over-month) CPI figure was 0.2% for the month equating to a 2.4% annualized pace of increase.

Both data points were below economist estimates and while the 2.4% annualized rate is still above the 2% target it represents a very encouraging move in the right direction. CPI year-over-year was at 3.2% and 4% for the headline and core numbers respectively, once again coming in softer than expected.

On Wednesday, the inflation news was perhaps even more positive for the market and general populace alike. The Producer Price Index (PPI) ex food and energy was flat month-over-month while the headline number saw a surprising month-over-month decline of -0.5%.

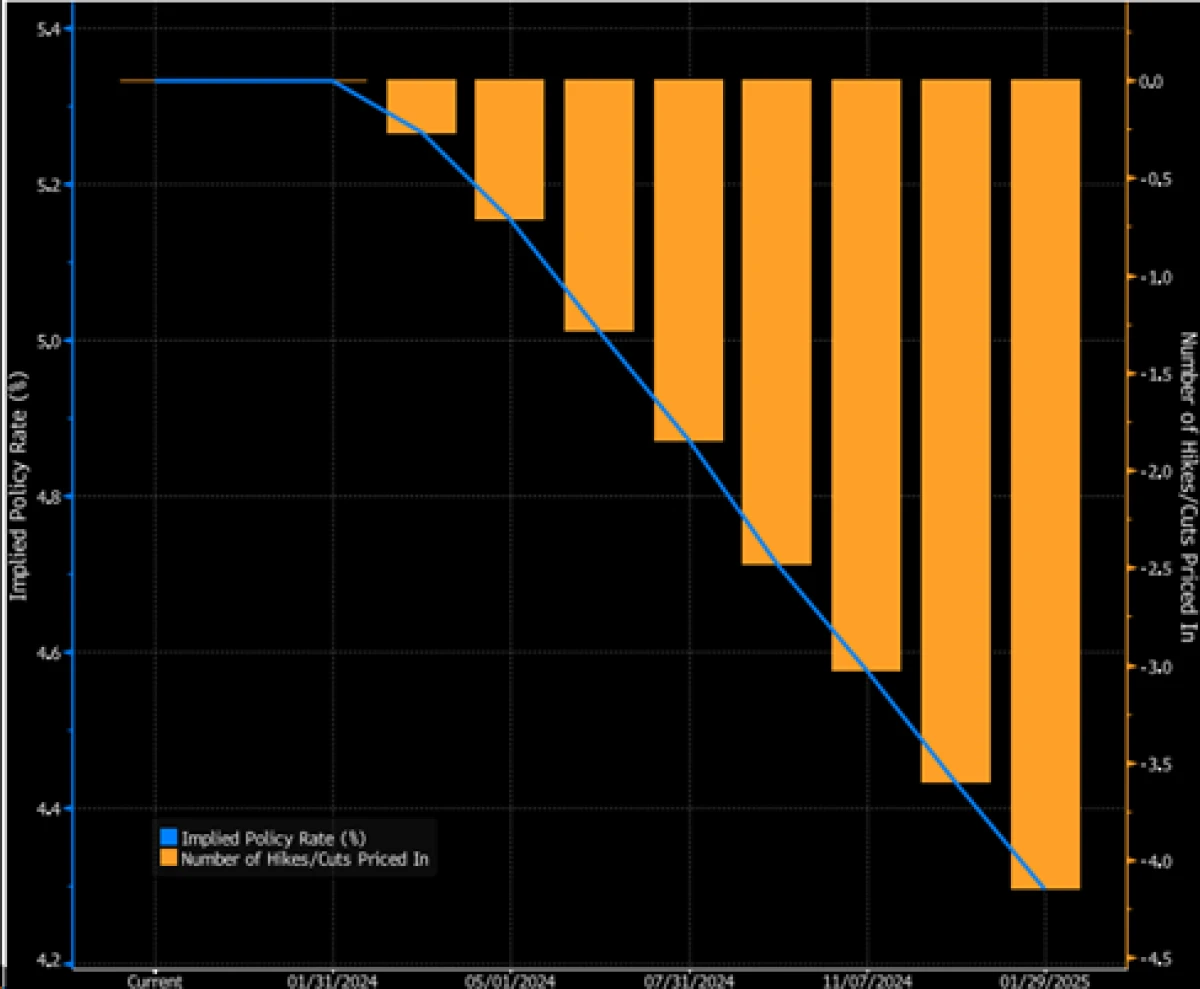

When putting all this information together, it strongly suggests to us that the Federal Reserve’s policy hikes over the past nearly year and a half are providing the intended impact. The interest rates futures market agrees as it now prices no more rate hikes and now is pricing the prospect for future rate cuts by the early summer in 2024.

In an environment of slowing inflation and a less tight but still healthy labor market, investors have been given a reason for optimism as we head into the final stretch of the year.

Beyond the discussed economic developments, seasonality has also been mentioned recently as November has on average since 1950 been the strongest month of the year for stocks, returning an average of 1.7%.

There are, as always, still risks on the horizon.

The market’s current declaration of Fed victory over inflation could be premature as the prevailing sentiment from analysts and economists has been that the move from 3.7% on Core PCE to 2% will be harder than the path getting to the current number.

From an economic activity perspective, the consensus economist estimated probability of recession within the next 12-months has gone up to 55%. While economic activity has remained resilient in 2023 (2.4% and 2.9% year-over-year for Q2 and Q3) the expectation is that the economy is likely to slow going forward.

With more of the pressure from the Fed’s tightening cycle yet to be felt, a moderate recession with a modest increase in unemployment and a corresponding decline in earnings would not be a shocking outcome. How stocks would respond in such a scenario is somewhat uncertain, as investors would need to digest the dichotomy of a decline in earnings alongside a likely cut in interest rates that would accompany a recession.

Given the room the interest rate hikes have given the Fed, overall health of the economy, and the overall improved positioning of the financial system post-Great Financial Crisis, our base case would not be for a deep long-lasting recession.

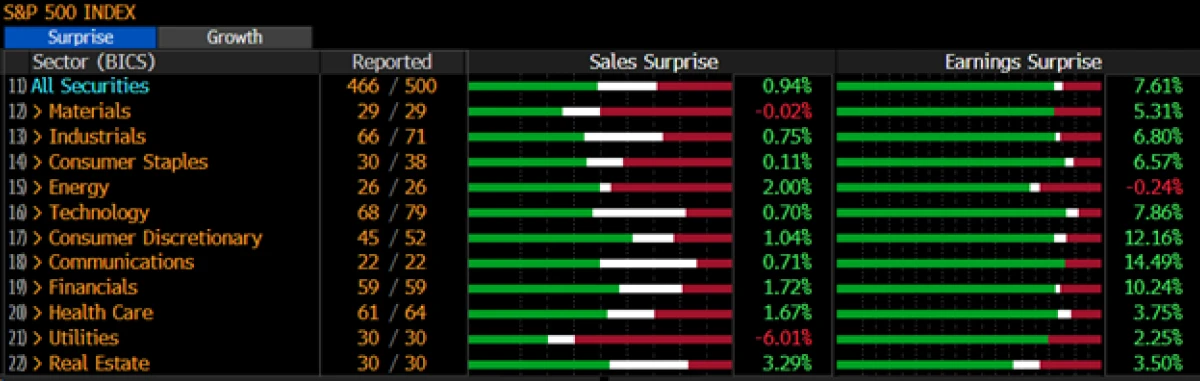

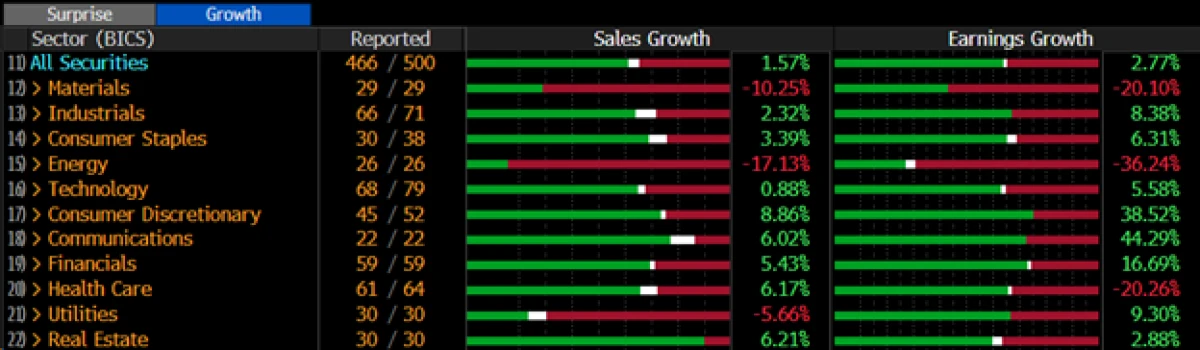

Corporate earnings for their part have remained resilient, with the S&P 500 having surprised to the upside by 7.61% in the third quarter so far with 466/500 companies having reported. The absolute growth numbers were more varied and mixed with materials, energy, and health care posting substantial declines in earnings, but overall the market has seen modest growth in sales and earnings.

Geopolitical Factors

Geopolitical risk remains high, which will continue to be important to closely watch. Both the conflicts between Israel and Hamas and Ukraine with Russia are ongoing but still mostly contained to their current participants. The U.S. has made its support for Israel well known through the mobilization of its forces in the region and has conducted limited airstrikes on Iran-backed targets in Syria. Our hope is that these measures act as a proof of concept that continues to dissuade an expansion of Hezbollah insurgent actions in the region.

Conclusion

While these risks discussed are present and important to take note of, the recent shift in the market’s interest rate expectations, positive moves in inflation, and the resiliency of corporate earnings have optimistically positioned the market into the year’s close. Increased yield levels on high quality bond instruments can assist in both producing income and acting as a counterbalance to stock market volatility when it occurs.

Long-term, we continue to remain positive on the growth prospects for the global equity market. We will continue to utilize the available asset classes in a risk-tolerance conscious framework to navigate the market environment towards our clients’ financial plan goals.

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.