2025 Tax Code Changes: Everything You Need To Know

All the tax changes you need to know heading into 2025

2024 was marked by anticipation and speculation surrounding the U.S. tax code and its future. While no major tax changes or adjustments occurred during the year, the looming expiration of the Tax Cuts and Jobs Act (TCJA) at the end of 2025 spurred significant discussion and planning. During the recent election cycle, both political parties presented contrasting views on the post-TCJA landscape. While much of the rhetoric was aimed towards galvanizing voter support, the results of the November 5th election provide a clearer indication of what lies ahead.

With a shift in political leadership following the election, efforts to extend key provisions of the TCJA are expected to gain momentum. Originally designed with an expiration date due to its taxpayer-friendly provisions and potential impact on budget deficits, the TCJA’s future now hinges on fiscal trade-offs. Policymakers are exploring options such as adjustments to trade policies and revisions to tax credit programs to address these challenges.

The evolving landscape suggests that future tax policy will likely prioritize maintaining low tax rates for individuals. While previous analyses anticipated a potential repeal or reversion of the TCJA, current projections indicate that favorable tax provisions for taxpayers could remain in place for the foreseeable future.

This outlook creates continued opportunities for strategies such as Roth conversions at low tax rates, along with the preservation of high standard deductions and elevated estate and gift tax exclusion limits. As 2025 progresses, the RGWM team continues to monitor legislative developments closely, as any changes could impact tax planning strategies. Updates will be provided promptly to ensure alignment with new regulations.

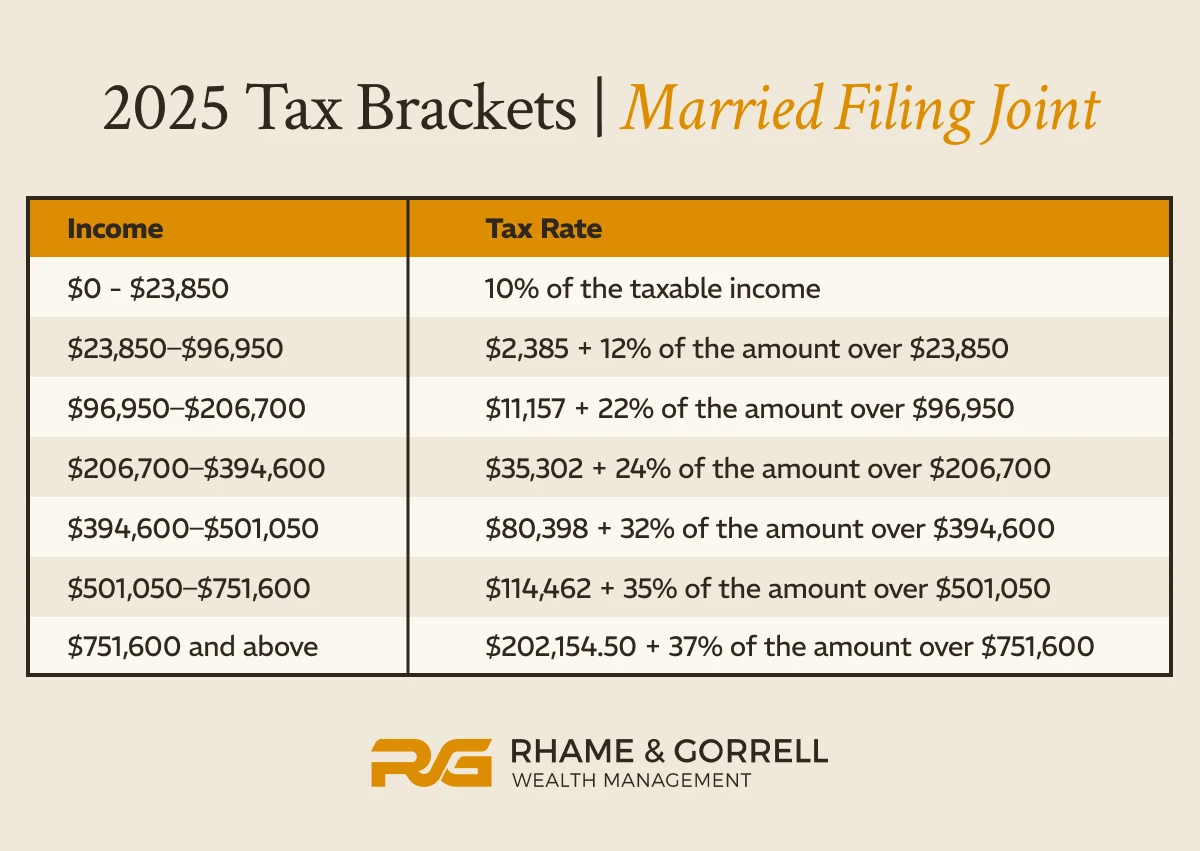

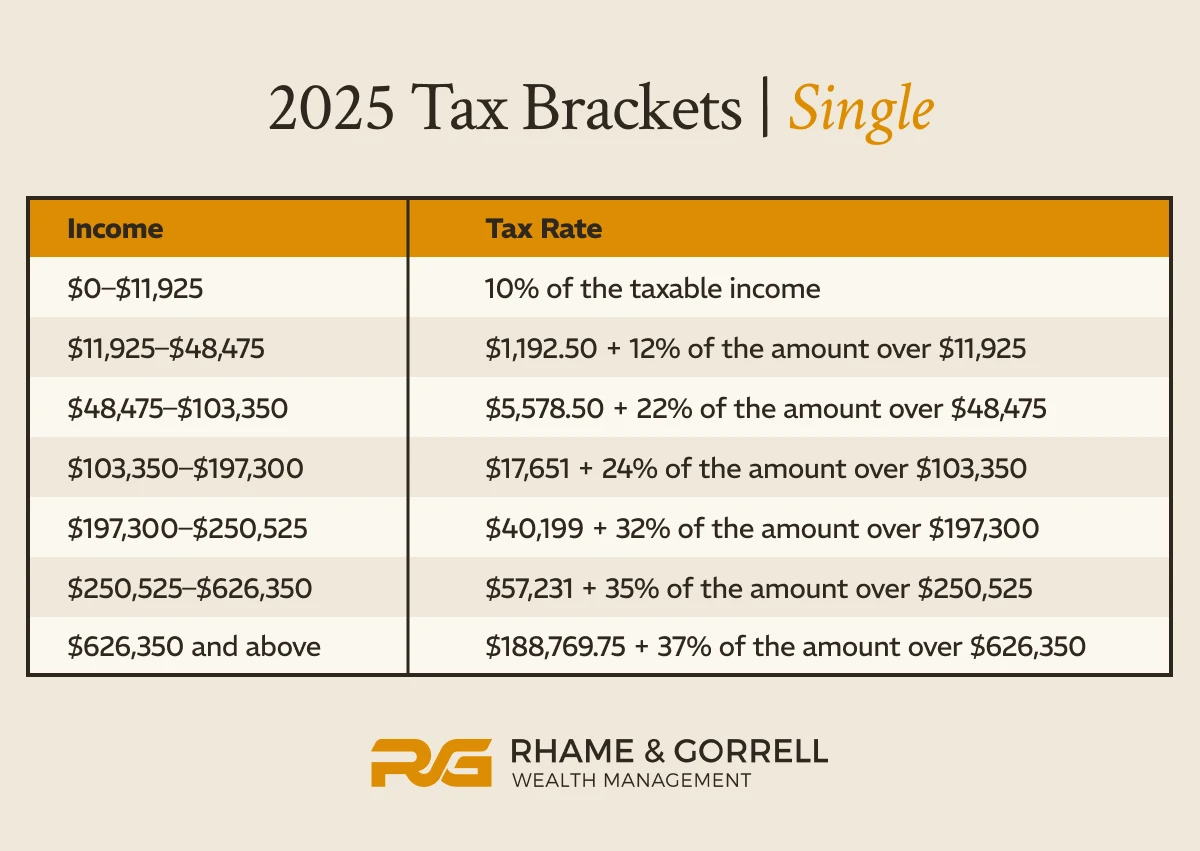

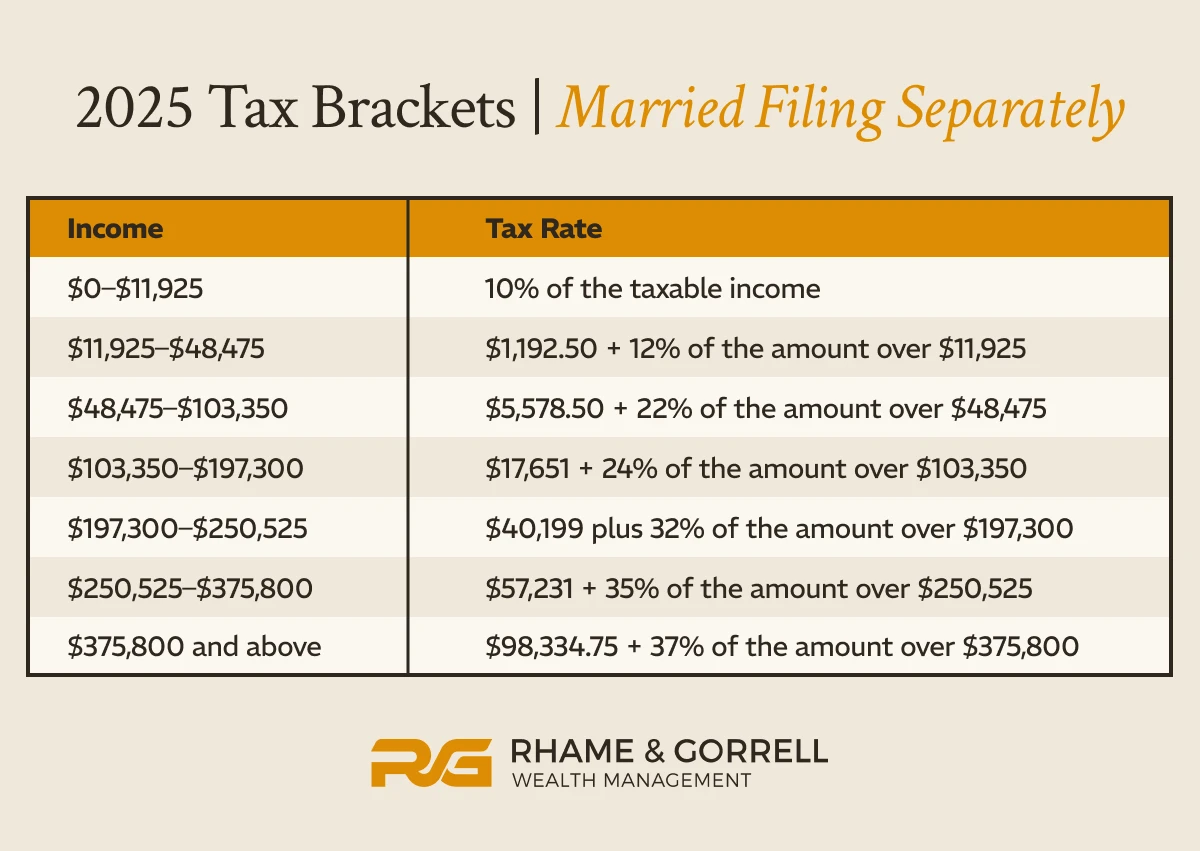

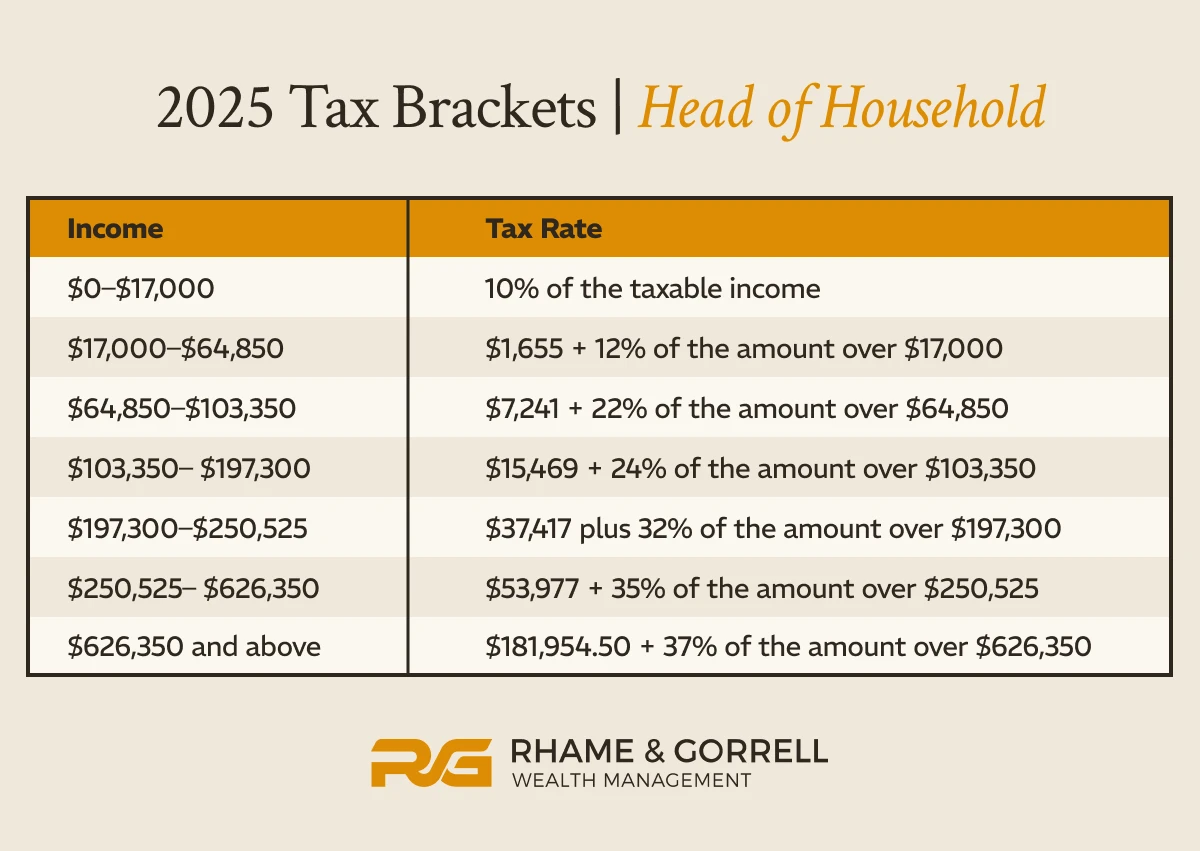

2025 Tax Brackets:

For 2025, tax brackets have increased by 2.8%, reflecting modest inflation adjustments. The Social Security Cost-of-Living Adjustment (COLA) for the year is slightly lower at 2.5%.

Married Filing Joint:

Single Filer:

Married Filing Separately:

Head of Household:

Standard Deductions:

We observe a 2.8% increase to the Standard Deduction in 2025, matching the adjustment to tax brackets. This brings the standard deduction to $15,000 for single filers and married taxpayers filing separately, $22,500 for Head of Household, and $30,000 for married couples filing jointly. Taxpayers over the age of 65 can claim an additional deduction of $2,000.

Since 2018, the elevated standard deduction has resulted in fewer taxpayers itemizing deductions, as many do not exceed these higher thresholds. However, this trend could shift if the current tax code does in fact expire at the end of 2025. Without legislative action, standard deductions could revert to pre-TCJA levels in 2026, potentially halving these amounts and creating a resurgence in itemization.

Retirement Contributions:

Retirement contributions made on a pretax basis provide an immediate reduction in taxable income, and for 2025, the IRS has made slight adjustments to contribution limits. The maximum employee/employer combined contribution limit for company-sponsored 401(k) plans has increased to $70,000, with the employee contribution limit rising to $23,500.

The catch-up contribution for individuals aged 50 and older remains unchanged at $7,500. These limits also apply to SEP IRA contributions, which continue to follow the same income and wage calculation rules: 20% of wages or self-employed income for owners and 25% for non-owner employees.

The maximum annual benefit for defined benefit plans, such as pensions, has increased to $285,000, up from $275,000 in 2024. Additionally, the compensation limit for defined contribution plans like 401(k)s has risen to $350,000, compared to $345,000 in 2024.

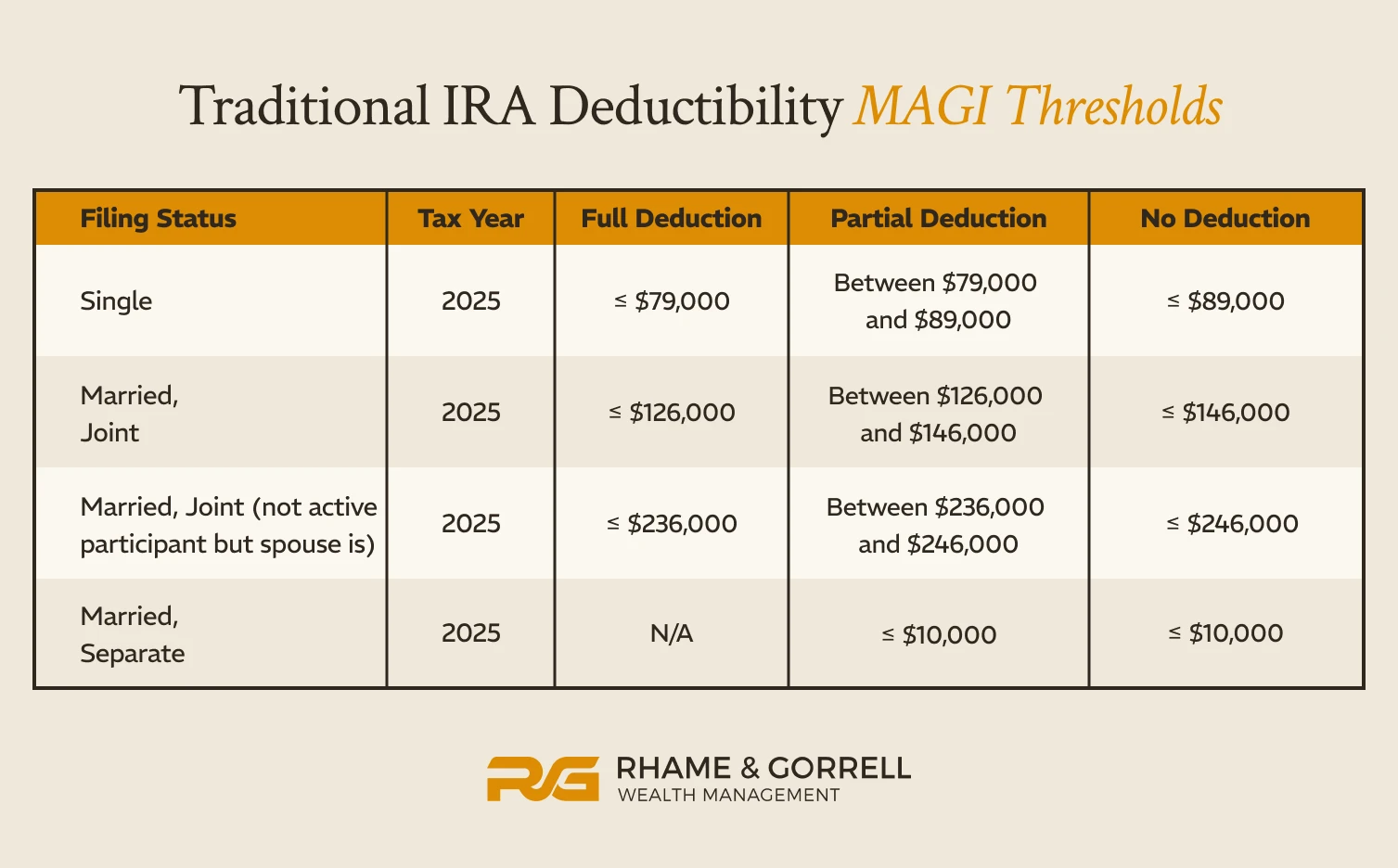

For Traditional and Roth Individual Retirement Accounts (IRAs), contribution limits will remain at $7,000, with the $1,000 catch-up contribution for those aged 50 and older also unchanged, reflecting decreased inflation over the past year. The phase-out ranges for deductible traditional IRA contributions and direct Roth IRA contributions are outlined in the tables below.

Traditional IRA Deductibility MAGI Thresholds

Roth IRA Eligibility MAGI Thresholds

SIMPLE IRA contribution limits have also increased slightly for 2025, rising from $16,000 to $16,500. Similar to Traditional IRAs, Roth IRAs, and 401(k) plans, the catch-up contribution for SIMPLE IRAs remains unchanged at $3,500 for individuals aged 50 and older.

Health Savings Accounts (HSA)

Health Savings Account (HSA) contribution limits will see modest increases for 2025. The individual contribution limit will rise from $4,150 in 2024 to $4,300, while the limit for family coverage will increase from $8,300 to $8,550. The catch-up contribution for individuals aged 55 and older remains unchanged at $1,000.

New Catch-Up Contribution Rules

Beginning in 2025, individuals aged 60 through 63 will have a new, enhanced catch-up contribution limit for 401(k) plans. Under this rule, eligible participants can contribute the greater of $10,000 or 150% of the 2024 catch-up contribution limit, adjusted for inflation. For 2025, this results in a maximum catch-up contribution of $11,250 for individuals within this age group.

Additionally, a new IRS clarification will take effect in 2026, requiring individuals earning more than $145,000 to make catch-up contributions as designated Roth contributions.

Annual Gift Exclusion Limit

In 2025, the annual gift exclusion limit will increase to $19,000, up from $18,000 in 2024. This adjustment allows individuals to gift up to $19,000 per person, per recipient ($38k as a married couple) in a single year without filing a gift tax return or reducing their lifetime exclusion amount.

Tax Cuts and Jobs Act (TCJA) Considerations

One of the most significant tax developments this year will be the fate of the Tax Cuts and Jobs Act (TCJA). Originally enacted in 2018, the TCJA made material changes to personal and corporate income tax provisions across a wide array of areas. While an extension of the TCJA before it sunsets at the end of 2025 appears to be the most likely scenario, Congress could allow certain provisions to lapse or implement substantial changes to others.

For a comprehensive overview of the TCJA’s sunset provisions and their potential impact, please refer to our detailed analysis here. This resource aims to clarify various aspects of the TCJA, enabling a better understanding of potential changes in forthcoming tax code proposals.

At Rhame & Gorrell Wealth Management, our team has extensive experience navigating the complexities of the tax code to identify strategies that benefit our clients. If you would like to explore your unique financial situation, we invite you to reach out for a complimentary financial plan review.

Our team of CPAs and CFP® professionals brings years of expertise in retirement, tax, investment, and estate planning. We are committed to providing clear, personalized guidance to help you achieve your financial goals.

HTML Resources:

2025 Tax Brackets | Married Filing Joint

| Income | Tax Rate |

| $0 - $23,850 | 10% of the taxable income |

| $23,850–$96,950 | $2,385 + 12% of the amount over $23,850 |

| $96,950–$206,700 | $11,157 + 22% of the amount over $96,950 |

| $206,700–$394,600 | $35,302 + 24% of the amount over $206,700 |

| $394,600–$501,050 | $80,398 + 32% of the amount over $394,600 |

| $501,050–$751,600 | $114,462 + 35% of the amount over $501,050 |

| $751,600 and above | $202,154.50 + 37% of the amount over $751,600 |

2025 Tax Brackets | Single Filer

| Income | Tax Rate |

| $0–$11,925 | 10% of the taxable income |

| $11,925–$48,475 | $1,192.50 + 12% of the amount over $11,925 |

| $48,475–$103,350 | $5,578.50 + 22% of the amount over $48,475 |

| $103,350–$197,300 | $17,651 + 24% of the amount over $103,350 |

| $197,300–$250,525 | $40,199 + 32% of the amount over $197,300 |

| $250,525–$626,350 | $57,231 + 35% of the amount over $250,525 |

| $626,350 and above | $188,769.75 + 37% of the amount over $626,350 |

2025 Tax Brackets | Married Filing Separately

| Income | Tax Rate |

| $0–$11,925 | 10% of the taxable income |

| $11,925–$48,475 | $1,192.50 + 12% of the amount over $11,925 |

| $48,475–$103,350 | $5,578.50 + 22% of the amount over $48,475 |

| $103,350–$197,300 | $17,651 + 24% of the amount over $103,350 |

| $197,300–$250,525 | $40,199 + 32% of the amount over $197,300 |

| $250,525–$375,800 | $57,231 + 35% of the amount over $250,525 |

| $375,800 and above | $98,334.75 + 37% of the amount over $375,800 |

2025 Tax Brackets | Head of Household

| Income | Tax Rate |

| $0–$17,000 | 10% of the taxable income |

| $17,000–$64,850 | $1,655 + 12% of the amount over $17,000 |

| $64,850–$103,350 | $7,241 + 22% of the amount over $64,850 |

| $103,350– $197,300 | $15,469 + 24% of the amount over $103,350 |

| $197,300–$250,525 | $37,417 plus 32% of the amount over $197,300 |

| $250,525– $626,350 | $53,977 + 35% of the amount over $250,525 |

| $626,350 and above | $181,954.50 + 37% of the amount over $626,350 |

Traditional IRA Deductibility MAGI Thresholds

| Filing Status | Tax Year | Full Deduction | Partial Deduction | No Deduction |

| Single | 2025 | ≤ $79,000 | Between $79,000 and $89,000 | ≤ $89,000 |

| Married, Joint | 2025 | ≤ $126,000 | Between $126,000 and $146,000 | ≤ $146,000 |

| Married, Joint (Not active participant but spouse is) | 2025 | ≤ $236,000 | Between $236,000 and $246,000 | ≤ $246,000 |

| Married, Separate | 2025 | N/A | ≤ $10,000 | ≤ $10,000 |

Roth IRA Eligibility MAGI Thresholds

| Filing Status | Tax Year | Full Contribution | Partial Contribution | No Contribution |

| Single | 2025 | ≤ $150,000 | Between $150,000 and $165,000 | ≤ $165,000 |

| Married, Joint | 2025 | ≤ $236,000 | Between $236,000 and $246,000 | ≤ $246,000 |

| Married, Separate | 2025 | N/A | ≤ $10,000 | ≤ $10,000 |

Need Some Help?

If you’d like some help from one of our CPAs or CERTIFIED FINANCIAL PLANNER (CFP®) advisors regarding this strategy and how it applies to you, the Rhame & Gorrell Wealth Management team is here to help.

Our experienced Wealth Managers facilitate our entire suite of services including financial planning, investment management, tax optimization, estate planning, and more to our valued clients.

Feel free to contact us at (832) 789-1100, [email protected], or click the button below to schedule your complimentary consultation today.

IMPORTANT DISCLOSURES:

Corporate benefits may change at any point in time. Be sure to consult with human resources and review Summary Plan Description(s) before implementing any strategy discussed herein.Rhame & Gorrell Wealth Management, LLC (“RGWM”) is an SEC registered investment adviser with its principal place of business in the State of Texas. Registration as an investment adviser is not an endorsement by securities regulators and does not imply that RGWM has attained a certain level of skill, training, or ability. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own CPA or tax professional before engaging in any transaction. The effectiveness of any of the strategies described will depend on your individual situation and should not be construed as personalized investment advice. Past performance may not be indicative of future results and does not guarantee future positive returns.

For additional information about RGWM, including fees and services, send for our Firm Disclosure Brochures as set forth on Form ADV Part 2A and Part 3 by contacting the Firm directly. You can also access our Firm Brochures at www.adviserinfo.sec.gov. Please read the disclosure brochures carefully before you invest or send money.